- China

- /

- Electronic Equipment and Components

- /

- SZSE:002876

High Growth Tech Stocks To Watch In December 2024

Reviewed by Simply Wall St

As global markets continue to experience gains, with indices like the S&P 500 and Russell 2000 reaching record highs, investor sentiment appears buoyed by domestic policy developments and geopolitical events. In this dynamic environment, identifying high-growth tech stocks involves evaluating companies that can capitalize on technological innovation and adapt to shifting economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 32.56% | 43.21% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

Click here to see the full list of 1289 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Datalogic (BIT:DAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Datalogic S.p.A. is a global manufacturer and seller of automatic data capture and process automation products, with a market cap of €276.82 million.

Operations: Datalogic generates revenue through the production and sale of automatic data capture and process automation products globally. The company's operations focus on providing innovative solutions for various industries, contributing to its financial performance.

Datalogic, amidst a challenging tech landscape, has demonstrated resilience with a projected annual earnings growth of 23.4%, significantly outpacing the Italian market's 7%. Despite a revenue increase of only 6.5% per year, which trails behind the high-growth sector benchmark of 20%, the company's commitment to innovation is evident in its R&D expenditures. Recent financials reveal that Datalogic allocated substantial funds towards research and development, underscoring their strategy to stay competitive by enhancing technological capabilities and product offerings. Moreover, while recent earnings results showed a dip in sales from EUR 403.37 million to EUR 366.36 million year-over-year, net income rose from EUR 10.75 million to EUR 12.57 million, indicating improved operational efficiency and cost management strategies that could bolster future performance in an increasingly digital economy.

Ditto (Thailand) (SET:DITTO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ditto (Thailand) Public Company Limited focuses on distributing data and document management solutions in Thailand, with a market capitalization of THB11.24 billion.

Operations: Ditto (Thailand) Public Company Limited generates revenue primarily from three segments: Technology Engineering Services (THB1.07 billion), Data and Document Management Solutions (THB692.38 million), and Photocopiers, Printer, and Technology Products (THB475.38 million). The company is involved in the distribution of these solutions within Thailand.

Ditto (Thailand) has demonstrated robust financial performance, with a notable 27.8% annual revenue growth outstripping the Thai market's average of 6.5%. This surge is mirrored in its earnings, which have escalated by 26.8% annually, significantly ahead of the broader electronic industry's growth rate of 7.1%. The company's aggressive investment in R&D, crucial for sustaining its competitive edge and fostering innovation, is evident from recent substantial allocations that underscore its commitment to technological advancement and market leadership. These strategic investments not only fuel product development but also enhance operational efficiencies, as reflected in Ditto’s impressive earnings results for the third quarter of 2024 where net income soared to THB 138.17 million from THB 96.58 million year-over-year—an increase that speaks volumes about its potential trajectory in a rapidly evolving tech landscape.

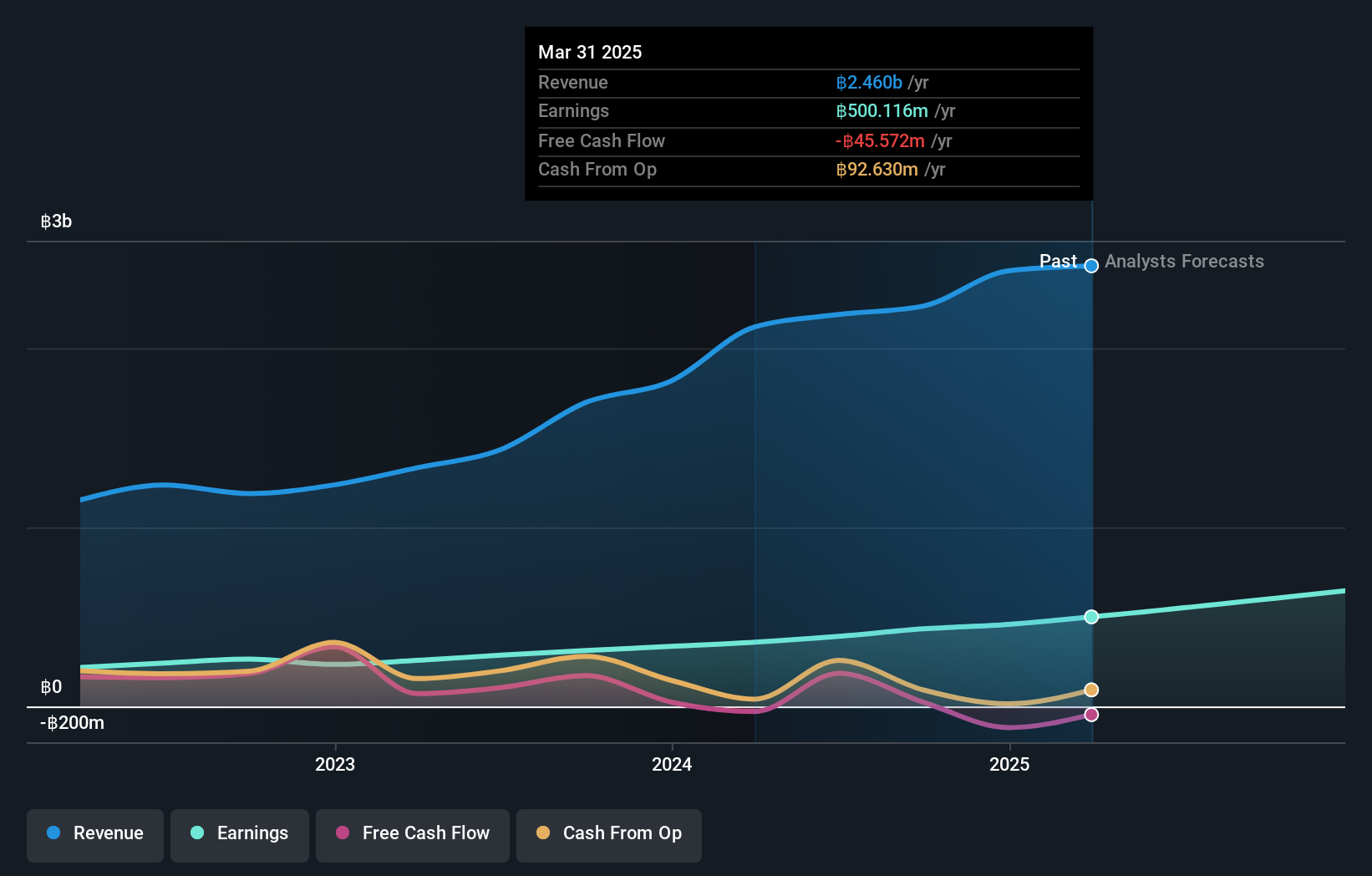

Shenzhen Sunnypol OptoelectronicsLtd (SZSE:002876)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Sunnypol Optoelectronics Co., Ltd. focuses on the production and sale of optoelectronic products, with a market capitalization of approximately CN¥4.85 billion.

Operations: Sunnypol Optoelectronics generates revenue primarily from the polarizer segment, which accounts for approximately CN¥2.39 billion. The company exhibits a focus on optoelectronic products within its business operations.

Shenzhen Sunnypol Optoelectronics has demonstrated a significant uptick in financial performance, with revenues soaring by 21.7% to CNY 1.87 billion in the nine months leading up to September 2024, compared to the previous year. This growth is underpinned by a robust R&D focus, where expenditures are not just maintaining pace but are integral to their strategic positioning within the optoelectronics sector. Despite facing challenges like a drop in net profit margins from 3.8% to 2%, the company is poised for future growth with projected annual earnings increases of 60%, significantly outpacing the broader Chinese market's forecast of 26.2%. This aggressive expansion trajectory, coupled with an innovative product pipeline fueled by sustained R&D investment, sets Sunnypol on a promising path amidst evolving technological landscapes.

Where To Now?

- Navigate through the entire inventory of 1289 High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002876

Shenzhen Sunnypol OptoelectronicsLtd

Shenzhen Sunnypol Optoelectronics Co.,Ltd.

High growth potential with mediocre balance sheet.