In the current landscape, global markets have been experiencing a series of gains, with major indices like the Dow Jones Industrial Average and S&P 500 reaching record highs despite geopolitical tensions and tariff announcements. As investors navigate these dynamic conditions, dividend stocks stand out as a compelling option for those seeking steady income streams amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.22% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.17% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.89% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.62% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.90% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.87% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.90% | ★★★★★★ |

Click here to see the full list of 1966 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Xinyi Glass Holdings (SEHK:868)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xinyi Glass Holdings Limited is an investment holding company that produces and sells automobile, construction, float, and other glass products for commercial and industrial applications, with a market cap of approximately HK$35.34 billion.

Operations: Xinyi Glass Holdings Limited generates revenue from its key segments, including Float Glass at HK$20.30 billion, Automobile Glass at HK$6.25 billion, and Architectural Glass at HK$3.30 billion.

Dividend Yield: 8.3%

Xinyi Glass Holdings offers an attractive dividend yield of 8.28%, placing it in the top 25% of dividend payers in Hong Kong. However, the sustainability of this dividend is questionable due to a high cash payout ratio of 162%, indicating dividends are not well covered by free cash flows. Despite a reasonable payout ratio of 48.1% from earnings, dividends have been volatile over the past decade, and earnings are forecasted to decline slightly in coming years.

- Navigate through the intricacies of Xinyi Glass Holdings with our comprehensive dividend report here.

- Our expertly prepared valuation report Xinyi Glass Holdings implies its share price may be lower than expected.

Industrial Bank (SHSE:601166)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Industrial Bank Co., Ltd. offers banking services in the People’s Republic of China, with a market capitalization of approximately CN¥374.98 billion.

Operations: Industrial Bank Co., Ltd. generates its revenue primarily from its Commercial Bank segment, which reported CN¥146.16 billion.

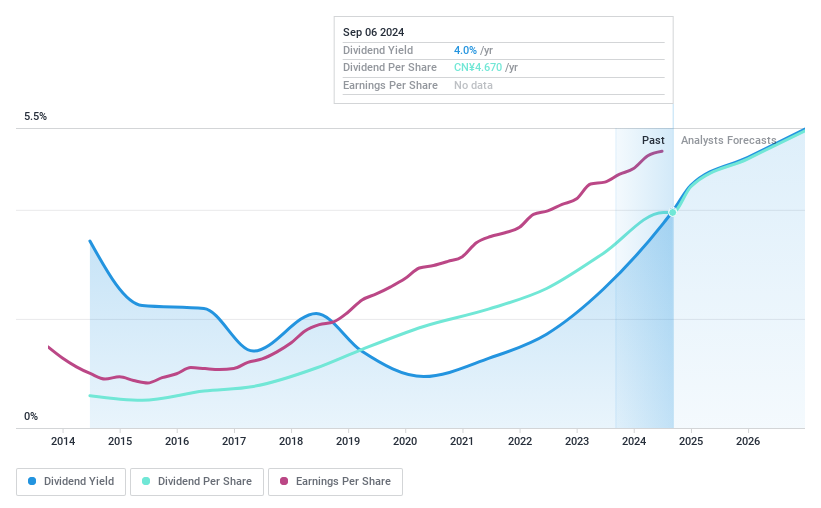

Dividend Yield: 5.7%

Industrial Bank Co., Ltd. offers a dividend yield of 5.72%, ranking it in the top 25% of CN market payers, supported by a low payout ratio of 30.5%. Despite trading at a significant discount to its estimated fair value, the bank's dividend history is marked by volatility, with annual drops exceeding 20%. Recent earnings showed a slight decline in net income to CNY 63 billion for nine months ending September 2024 compared to last year.

- Click here to discover the nuances of Industrial Bank with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Industrial Bank's share price might be too pessimistic.

Wuliangye YibinLtd (SZSE:000858)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Wuliangye Yibin Co., Ltd. manufactures and sells liquor and wine products under the Wuliangye brand in China, with a market cap of CN¥569.70 billion.

Operations: Wuliangye Yibin Co., Ltd. generates its revenue primarily from the production and sale of liquor and wine products.

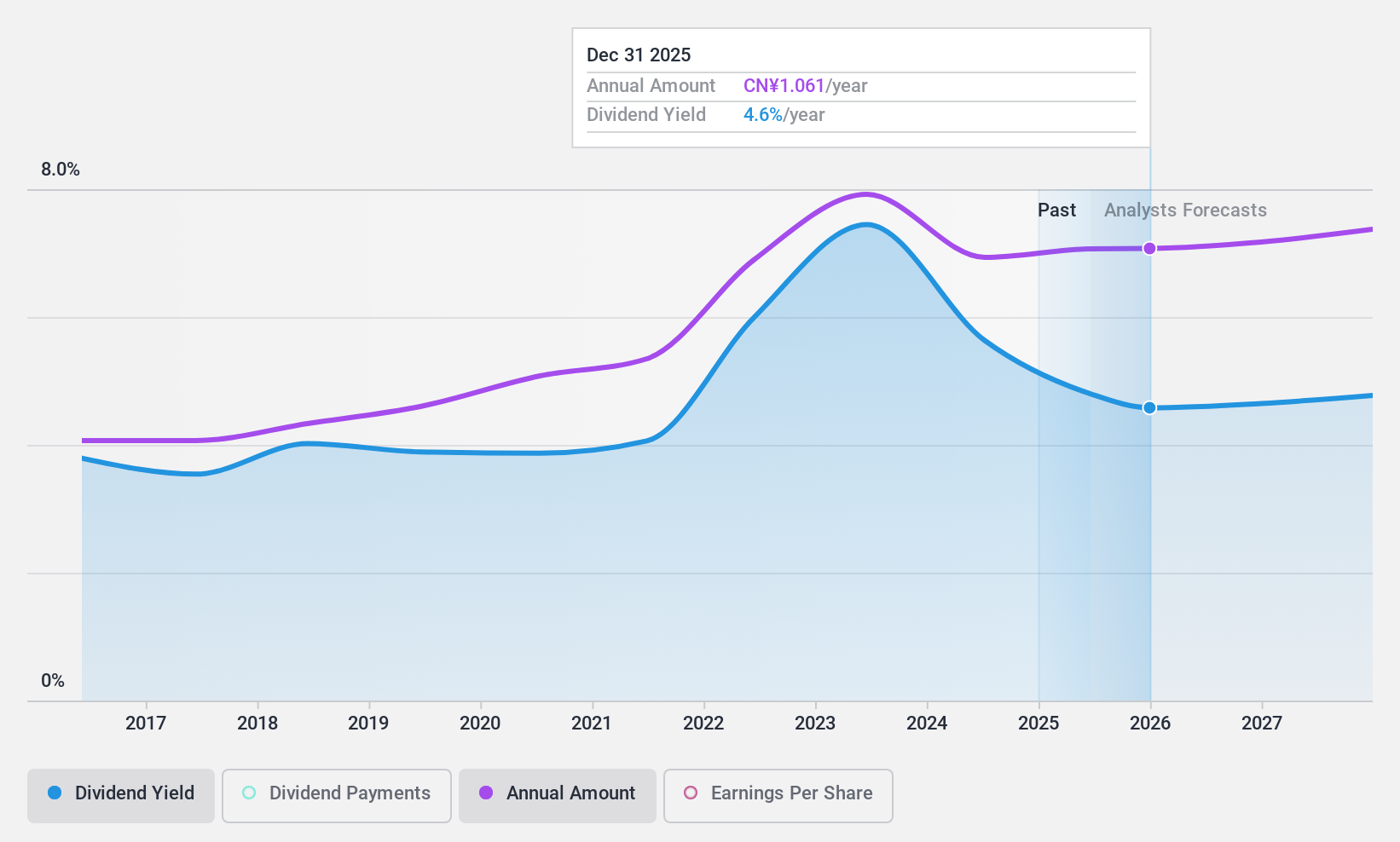

Dividend Yield: 3.2%

Wuliangye Yibin Co., Ltd. provides a stable dividend, recently affirming a cash dividend of CNY 25.76 per 10 shares for Q3 2024. With earnings of CNY 24.93 billion for the first nine months of 2024 and an earnings coverage ratio of 56.1%, its dividends are well-supported by profits and cash flows (38.6% payout). The stock offers a reliable yield of 3.17%, placing it in the top quartile among CN market dividend payers, while trading below estimated fair value.

- Unlock comprehensive insights into our analysis of Wuliangye YibinLtd stock in this dividend report.

- In light of our recent valuation report, it seems possible that Wuliangye YibinLtd is trading behind its estimated value.

Key Takeaways

- Navigate through the entire inventory of 1966 Top Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuliangye YibinLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000858

Wuliangye YibinLtd

Manufactures and sells liquor and wine products under the Wuliangye brand in China.

Flawless balance sheet 6 star dividend payer.