As global markets continue to reach record highs, driven by gains in major indices like the Dow Jones Industrial Average and S&P 500, investors are closely monitoring geopolitical developments and economic indicators. Amidst this backdrop of robust market performance, growth companies with high insider ownership are garnering attention for their potential resilience and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.9% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.6% |

| Pharma Mar (BME:PHM) | 11.8% | 56.9% |

| Medley (TSE:4480) | 34% | 31.7% |

| CD Projekt (WSE:CDR) | 29.7% | 28.6% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Alkami Technology (NasdaqGS:ALKT) | 10.9% | 98.6% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.7% | 95% |

Let's explore several standout options from the results in the screener.

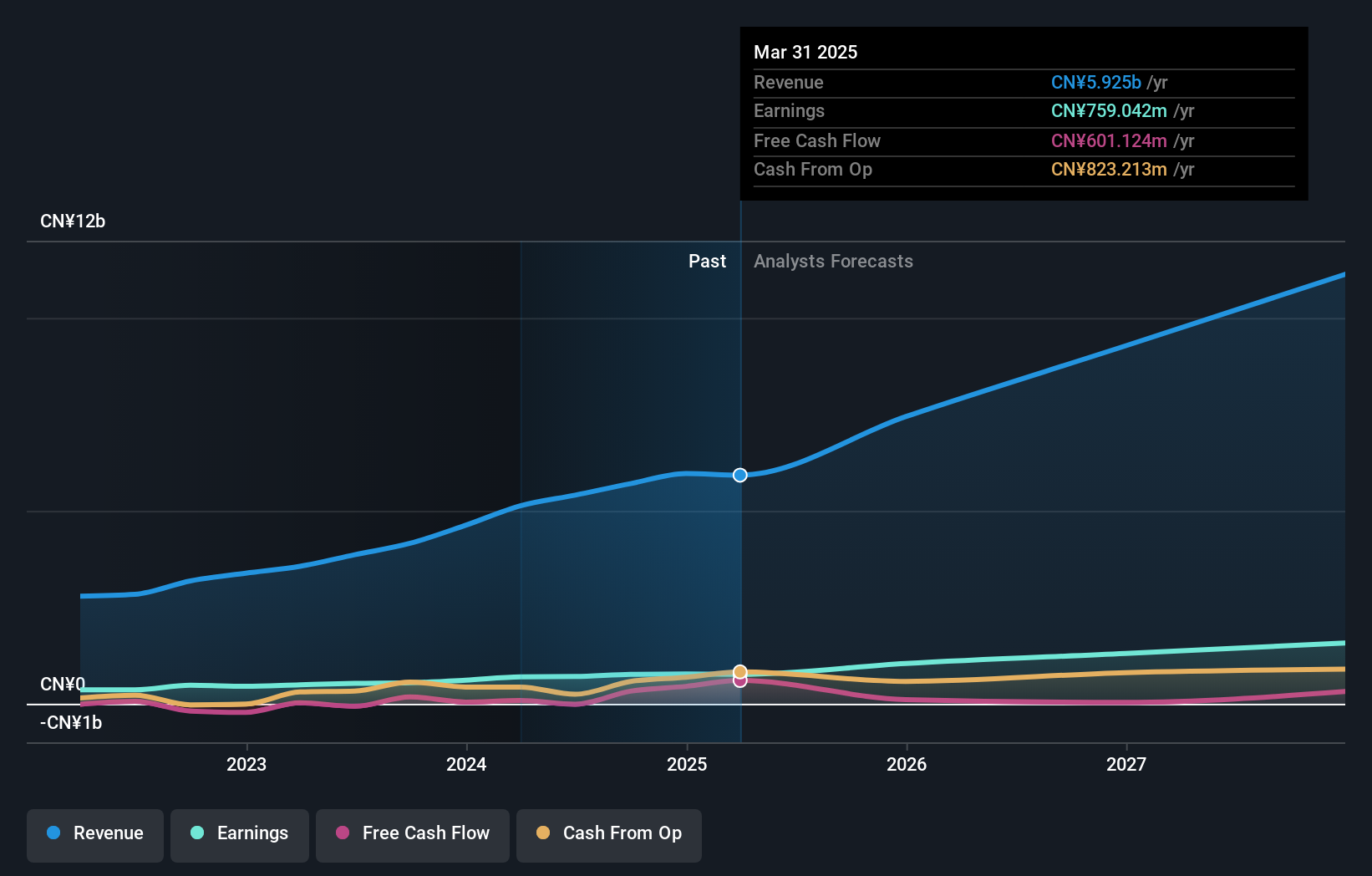

KEBODA TECHNOLOGY (SHSE:603786)

Simply Wall St Growth Rating: ★★★★★☆

Overview: KEBODA TECHNOLOGY Co., Ltd. manufactures and sells automotive electronics and related products for the automotive industry in China, with a market cap of CN¥22.74 billion.

Operations: KEBODA TECHNOLOGY Co., Ltd. generates its revenue through the production and distribution of electronic components and related products for the automotive sector in China.

Insider Ownership: 12.8%

KEBODA TECHNOLOGY demonstrates strong growth potential with a price-to-earnings ratio of 31.3x, below the CN market average. Earnings are expected to grow significantly at 26.31% annually over the next three years, surpassing market averages. Recent earnings reports show robust performance with sales reaching CNY 4.27 billion and net income rising to CNY 606.57 million for nine months ending September 2024, indicating solid revenue growth prospects at 22.4% annually compared to the broader market's 13.8%.

- Get an in-depth perspective on KEBODA TECHNOLOGY's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility KEBODA TECHNOLOGY's shares may be trading at a premium.

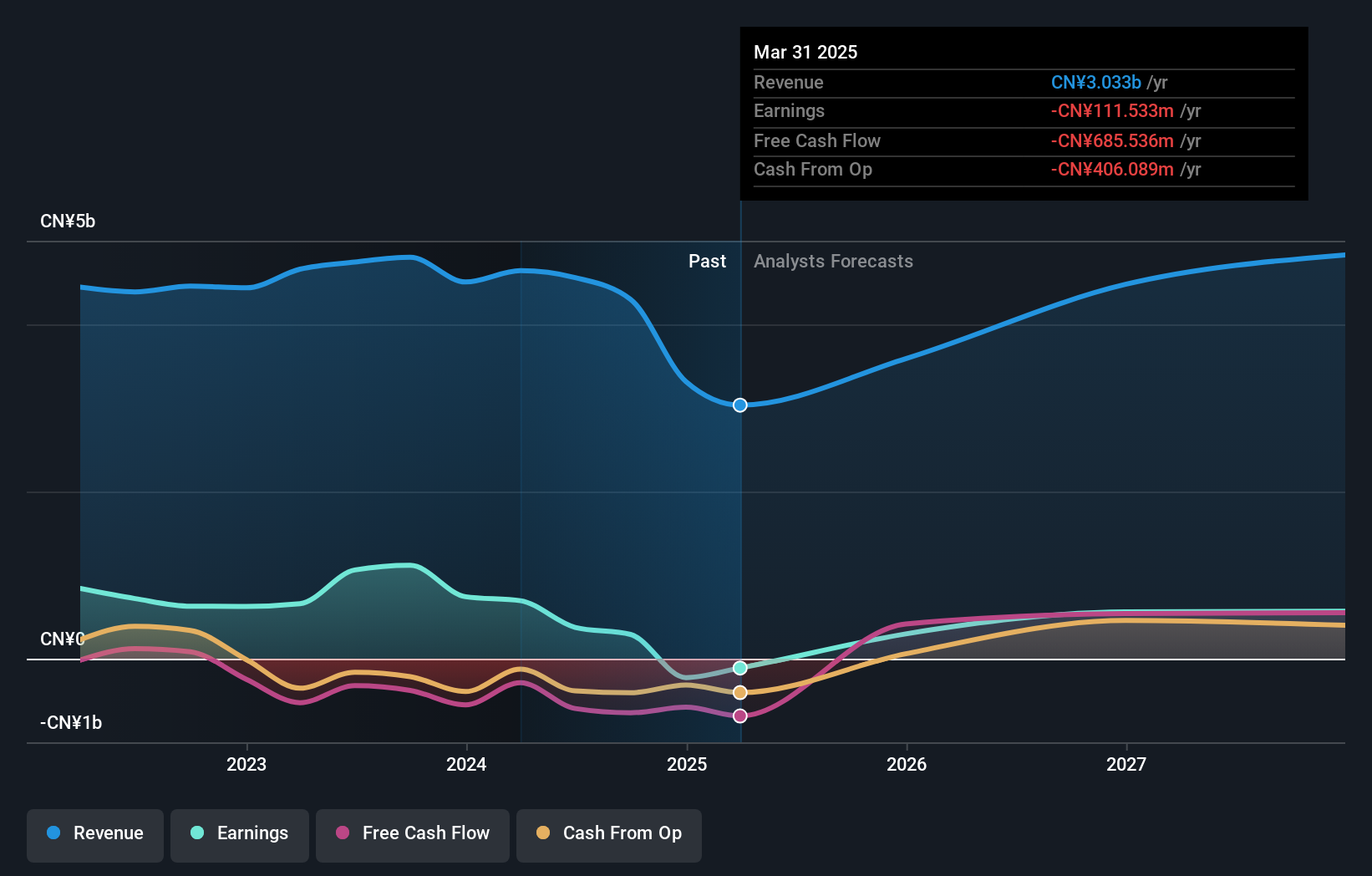

Wuhan Guide Infrared (SZSE:002414)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuhan Guide Infrared Co., Ltd. focuses on the research, development, production, and sale of infrared thermal imaging technology in Asia with a market cap of CN¥33.91 billion.

Operations: The company's revenue segments include research, development, production, and sales of infrared thermal imaging technology across Asia.

Insider Ownership: 27.2%

Wuhan Guide Infrared shows significant growth potential with revenue expected to increase by 26.3% annually, outpacing the broader Chinese market. Despite a recent drop in net income to CNY 50.21 million from CNY 285.63 million, earnings are forecasted to grow by 79.07% per year, becoming profitable within three years—an above-market growth rate. The company recently held a shareholder meeting to discuss increasing cash management funds, indicating strategic financial planning amid high insider ownership levels.

- Delve into the full analysis future growth report here for a deeper understanding of Wuhan Guide Infrared.

- Our comprehensive valuation report raises the possibility that Wuhan Guide Infrared is priced higher than what may be justified by its financials.

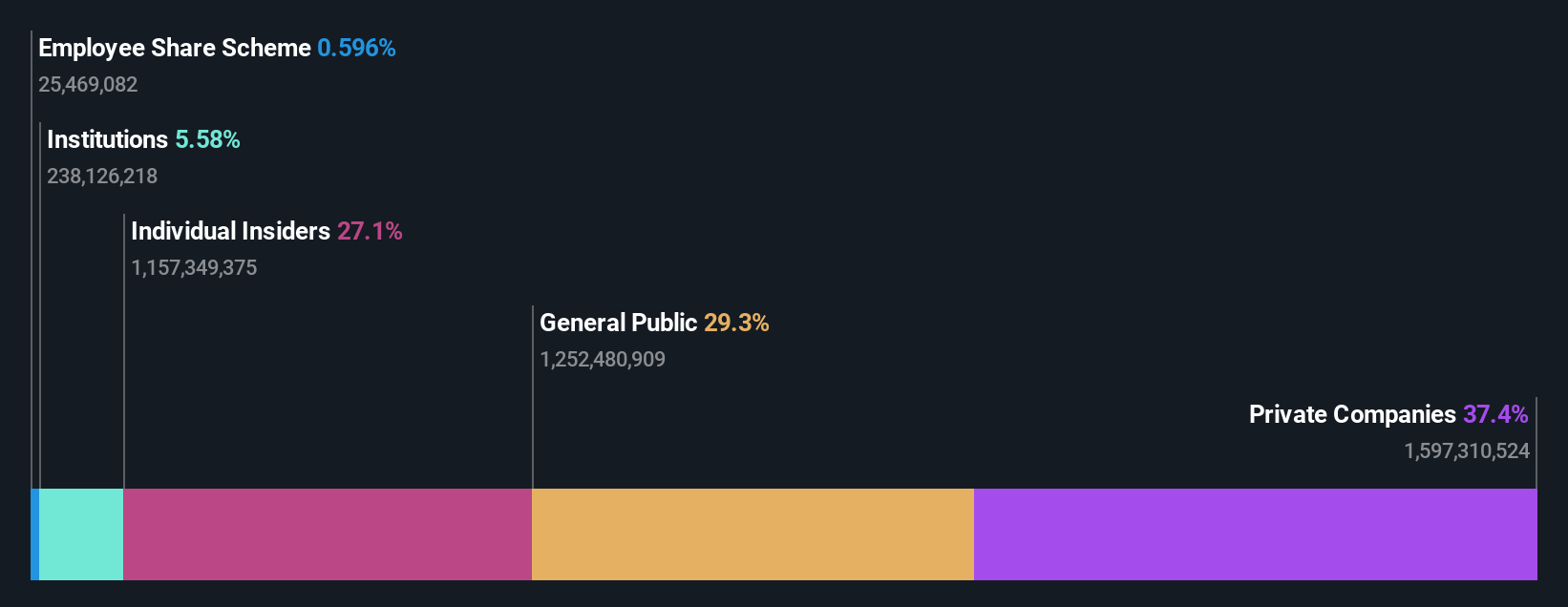

Venustech Group (SZSE:002439)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Venustech Group Inc. offers network security products, trusted security management platforms, and specialized security services globally, with a market cap of CN¥20.80 billion.

Operations: Revenue segments for Venustech Group include network security products, trusted security management platforms, and specialized security services and solutions.

Insider Ownership: 22.4%

Venustech Group's earnings are forecasted to grow significantly at 33.6% annually, surpassing the broader Chinese market's growth rate. However, recent results show a net loss of CNY 210.07 million compared to last year's net income of CNY 241.39 million, with profit margins dropping from 23.3% to 6.7%. Despite a lower-than-industry-average Price-To-Earnings ratio of 72.9x and high insider ownership, revenue growth is expected at a slower pace than desired for high-growth companies.

- Take a closer look at Venustech Group's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Venustech Group shares in the market.

Turning Ideas Into Actions

- Dive into all 1517 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002439

Venustech Group

Provides network security products, trusted security management platforms, and specialized security services and solutions worldwide.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives