- Japan

- /

- Infrastructure

- /

- TSE:9303

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, with major indices like the S&P 500 reaching record highs fueled by expectations of accelerated economic growth and tax reforms, investors are closely examining their portfolios for stability and income potential. In such a dynamic environment, dividend stocks can offer a reliable source of income while potentially benefiting from favorable market conditions; these stocks often appeal to those seeking both steady returns and participation in market growth.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.51% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.83% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.88% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.57% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.37% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.15% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.36% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.37% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.90% | ★★★★★★ |

Click here to see the full list of 1946 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

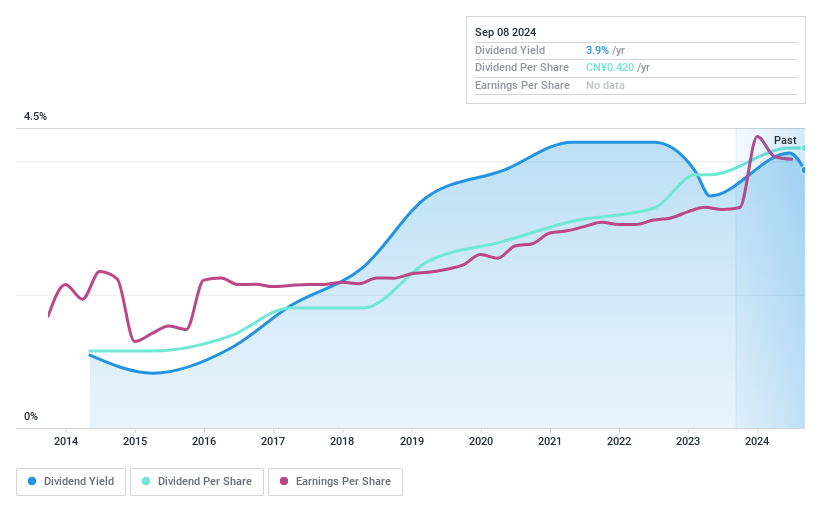

Central China Land MediaLTD (SZSE:000719)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Central China Land Media CO., LTD operates in the editing, publishing, printing, marketing, and distribution of various media products and has a market cap of CN¥11.31 billion.

Operations: Central China Land Media CO., LTD generates revenue from editing and publishing (CN¥1.50 billion), printing and reproduction (CN¥1.20 billion), marketing and distribution (CN¥2.30 billion), and material supply of books, periodicals, newspapers, electronic audio-visual products, online publications, and other media products (CN¥0.80 billion).

Dividend Yield: 3.7%

Central China Land Media LTD's dividend yield of 3.72% ranks in the top 25% of CN market payers, yet its high payout ratio (422.7%) indicates dividends are not covered by earnings, though well-covered by cash flows with a low cash payout ratio (21.6%). Despite stable and growing dividends over the past decade, declining earnings forecasts and recent net income drop to CNY 508.2 million suggest caution for sustainability amidst good relative value trading conditions.

- Click to explore a detailed breakdown of our findings in Central China Land MediaLTD's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Central China Land MediaLTD shares in the market.

Maruha Nichiro (TSE:1333)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Maruha Nichiro Corporation operates in fishing, fish farming, food processing, trading, meat products, and distribution both in Japan and internationally, with a market cap of ¥149.56 billion.

Operations: Maruha Nichiro Corporation's revenue is derived from its activities in fishing, fish farming, food processing, trading, and meat products distribution.

Dividend Yield: 3.3%

Maruha Nichiro's dividend payments have been reliable and stable over the past decade, supported by a low payout ratio of 20.7%, ensuring coverage by earnings and cash flows. Although its yield of 3.26% is below the top tier in Japan, it remains attractive due to consistent growth in dividends and earnings rising 16.8% annually over five years. The recent follow-on equity offering may impact future financial positioning but hasn't affected dividend stability yet.

- Take a closer look at Maruha Nichiro's potential here in our dividend report.

- Our expertly prepared valuation report Maruha Nichiro implies its share price may be lower than expected.

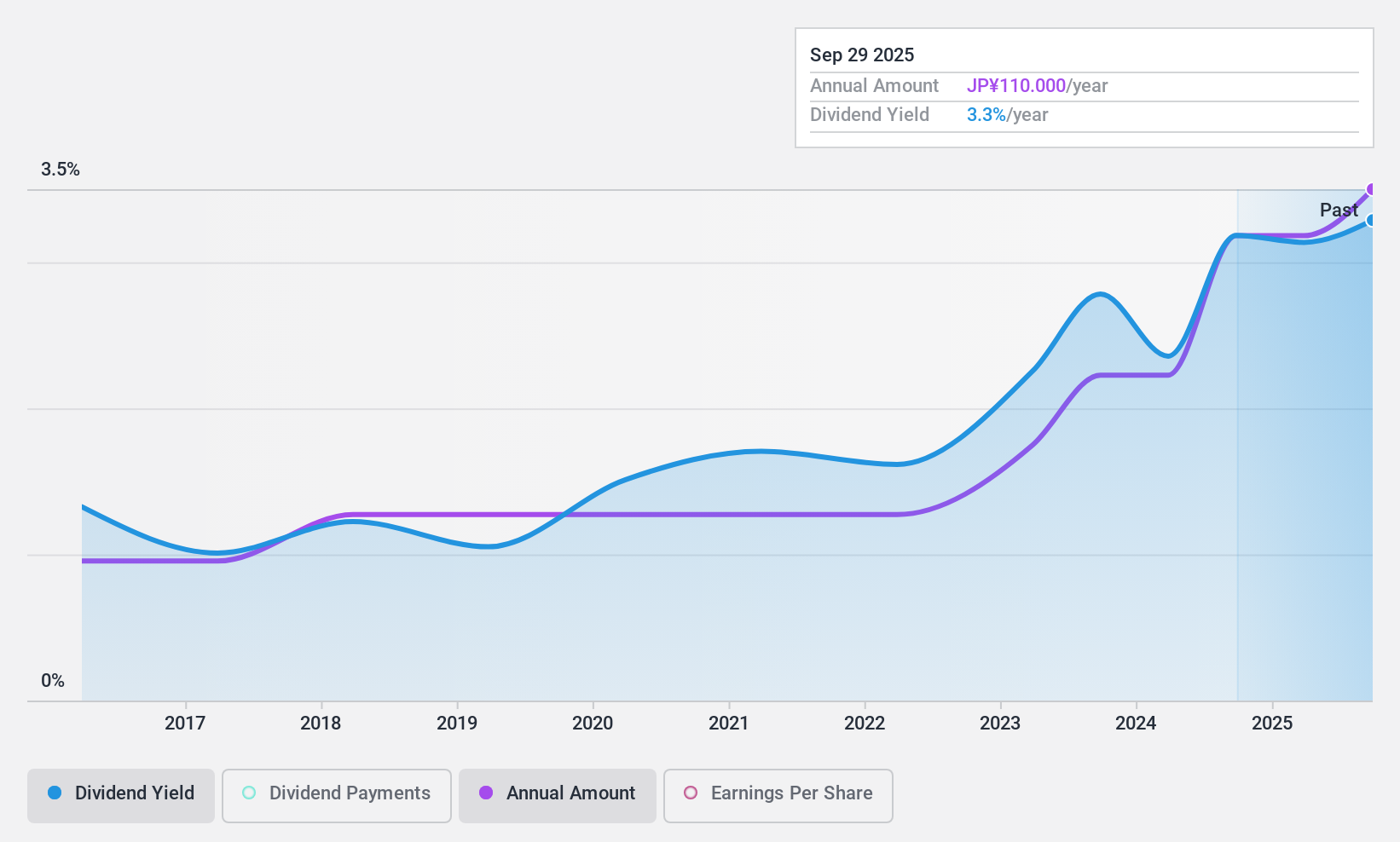

Sumitomo Warehouse (TSE:9303)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Sumitomo Warehouse Co., Ltd. offers integrated logistics services both in Japan and internationally, with a market cap of ¥213.21 billion.

Operations: The Sumitomo Warehouse Co., Ltd. generates revenue from its Logistics Business, amounting to ¥175.63 billion, and its Real Estate Business, contributing ¥11.38 billion.

Dividend Yield: 3.7%

Sumitomo Warehouse's dividends are well-covered by earnings, with a payout ratio of 32.6%, and cash flows, at 65.5%. Despite a volatile dividend history over the past decade, recent increases suggest potential stability. The current yield of 3.7% is slightly below top-tier levels in Japan. A recent share buyback program worth ¥2.5 billion aims to enhance shareholder returns and improve capital efficiency, which could positively influence future dividend reliability.

- Click here to discover the nuances of Sumitomo Warehouse with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Sumitomo Warehouse is trading beyond its estimated value.

Make It Happen

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1943 more companies for you to explore.Click here to unveil our expertly curated list of 1946 Top Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9303

Sumitomo Warehouse

Provides integrated logistics services in Japan and internationally.

Excellent balance sheet average dividend payer.