- Japan

- /

- Oil and Gas

- /

- TSE:8088

Iwatani (TSE:8088): Is the Current Valuation Too Low for Patient Investors?

Reviewed by Kshitija Bhandaru

Iwatani (TSE:8088) has seen its stock performance shift recently, drawing renewed attention to its underlying fundamentals. Investors are looking closer at what factors, beyond daily headlines, might be influencing the company's trajectory this month.

See our latest analysis for Iwatani.

Iwatani’s share price has been on a bit of a rollercoaster this year, with the latest close at ¥1,593 and a year-to-date decline of 10.1%. While the short-term momentum has been uneven, the bigger story is in the long run. Despite the recent 19.1% one-year total shareholder return drop, investors who held on for five years still enjoy a 70.8% total return, signaling significant value has accrued for patient shareholders even as sentiment fluctuates.

If you’re looking to see what else is capturing investor attention right now, it’s a great moment to expand your search and discover fast growing stocks with high insider ownership

But with Iwatani trading below analyst price targets and recent profit growth outpacing revenue, the real puzzle is whether the stock is trading at a bargain or if the market has already anticipated future gains.

Price-to-Earnings of 10.5x: Is it justified?

With Iwatani currently trading at a price-to-earnings (P/E) ratio of 10.5x, the stock is priced notably lower than the Japanese market average and regional industry peers. The last close of ¥1,593 positions it as apparently undervalued compared to these benchmarks.

The P/E ratio measures how much investors are willing to pay now for a company's earnings. In the oil and gas sector, this metric can signal how the market values profits, growth prospects, and sector-specific risks.

Iwatani's P/E is below the Japan market average of 14.7x and also under the Asian oil and gas industry norm of 12.9x. Compared to the estimated fair P/E of 15.6x, there is significant room for the multiple to move closer to broader valuations if future prospects are realized.

Explore the SWS fair ratio for Iwatani

Result: Price-to-Earnings of 10.5x (UNDERVALUED)

However, slowing revenue growth and a recent decline in one-year total shareholder return could signal hurdles ahead for Iwatani’s current valuation story.

Find out about the key risks to this Iwatani narrative.

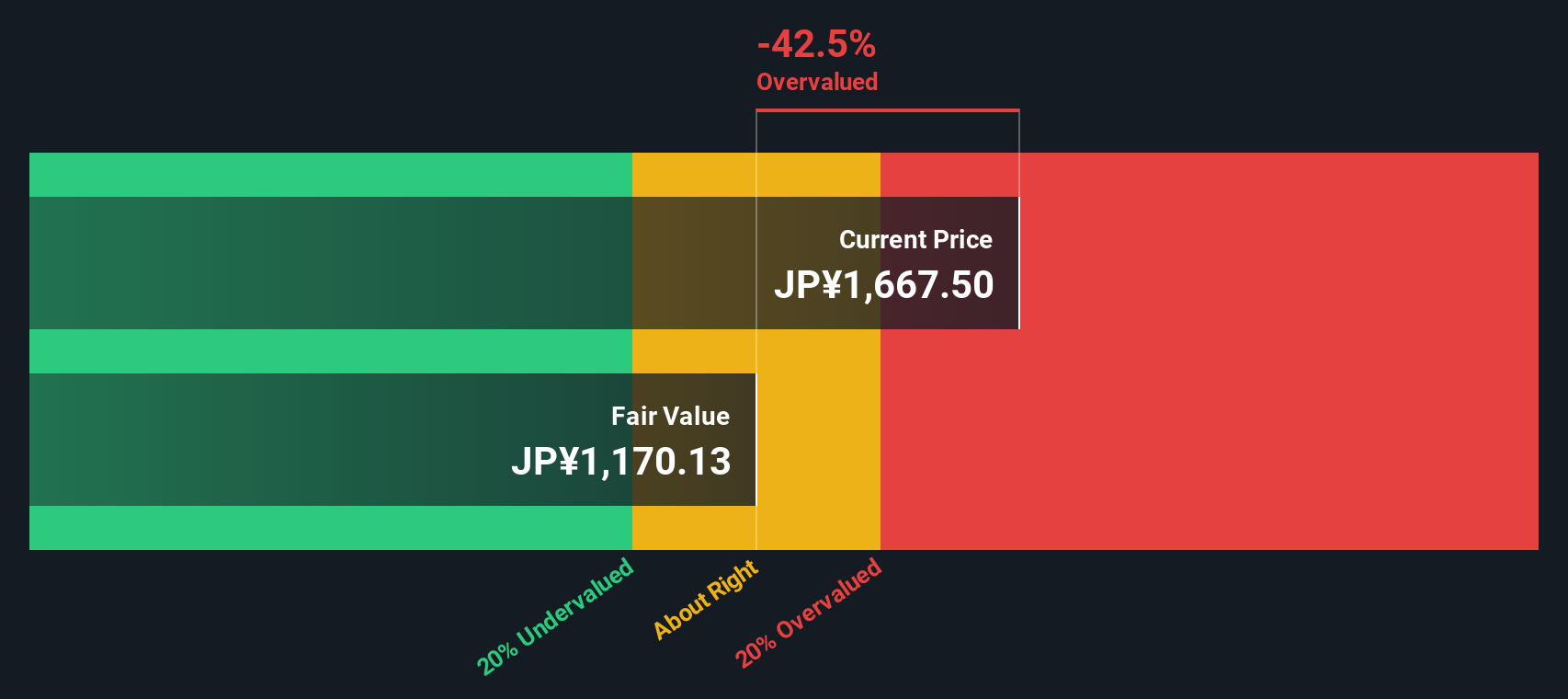

Another View: SWS DCF Model Offers a Different Perspective

While the price-to-earnings ratio paints Iwatani as potentially undervalued, the SWS DCF model tells a different story. According to the DCF calculation, Iwatani’s current share price sits above its estimated fair value of ¥1,169.62. This suggests the stock may actually be overvalued when future cash flows are considered.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Iwatani for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Iwatani Narrative

If you’d rather draw your own conclusions or take a deeper dive into the numbers, it’s quick and easy to craft your own perspective on Iwatani. Do it your way

A great starting point for your Iwatani research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't get stuck on one stock when there are powerful trends reshaping markets right now. Broaden your investing horizons and get ahead of the next big opportunity with these top picks:

- Capitalize on the artificial intelligence transformation by targeting companies accelerating growth in this dynamic sector through these 25 AI penny stocks.

- Lock in reliable income streams by checking out these 18 dividend stocks with yields > 3% offering solid yields in today’s market conditions.

- Ride the next digital wave and position yourself early with these 79 cryptocurrency and blockchain stocks leading innovation in blockchain and cryptocurrency advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8088

Iwatani

Engages in supplying gases and energy in Japan, China, Taiwan, South Korea, Singapore, Thailand, Malaysia, Indonesia, Vietnam, the United States, and Australia.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives