- Japan

- /

- Oil and Gas

- /

- TSE:8088

Is Iwatani's (TSE:8088) Interim Dividend a Sign of Evolving Capital Allocation Strategy?

Reviewed by Sasha Jovanovic

- Iwatani Corporation recently announced an interim dividend of ¥23.50 per share for shareholders as of September 30, 2025, marking a new step in its dividend policy for the fiscal year ending March 2026.

- The company's ability to introduce interim dividends and maintain a stable financial outlook despite mixed profitability results highlights management's focus on balancing growth investment with shareholder returns.

- We'll examine how Iwatani's introduction of its first interim dividend for the fiscal year adds a new dimension to its investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Iwatani's Investment Narrative?

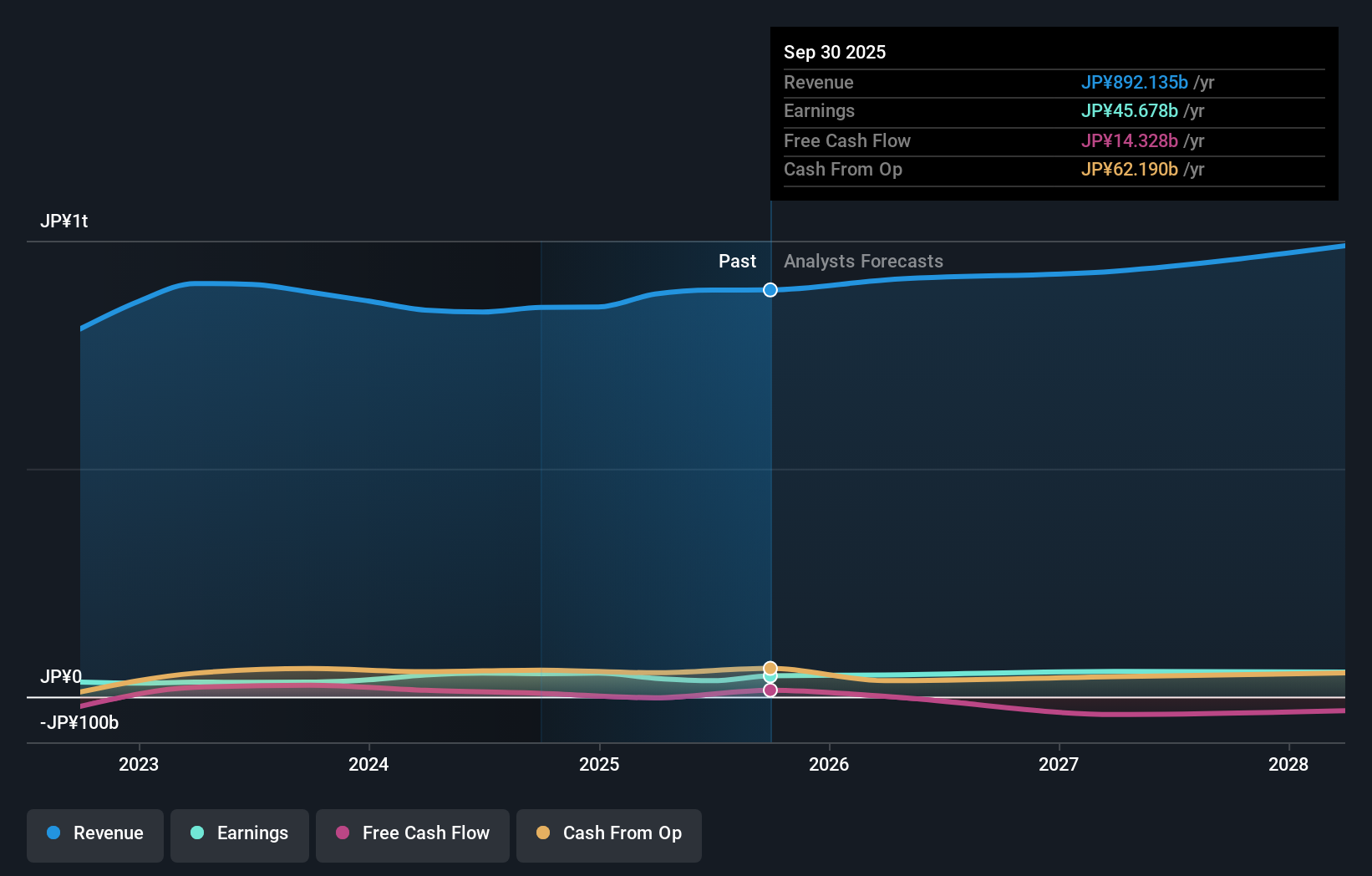

For investors considering Iwatani, the core thesis is all about confidence in the company’s ability to balance reinvestment for future growth with a commitment to returning capital to shareholders. The recent announcement of an interim dividend is a direct response to this tension, introducing a fresh element to Iwatani’s story as it aims to reinforce stability while navigating mixed profitability. As the market digests this change, many of the short-term catalysts haven’t materially shifted, with attention still keyed on earnings consistency, debt management, and the ability to convert sales growth into higher margins amid challenging market conditions. However, the new interim dividend signals management’s intent to reassure investors, which could provide some cushioning effect on perceived risks related to earnings volatility. Still, the company’s high debt levels and recent decline in net profit margins remain significant risks that bear watching, as dividend sustainability could become a concern if profitability trends do not improve.

But investors should take note of the company’s high debt position and its potential implications. Iwatani's shares are on the way up, but they could be overextended by 42%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on Iwatani - why the stock might be worth 14% less than the current price!

Build Your Own Iwatani Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Iwatani research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Iwatani research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Iwatani's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8088

Iwatani

Engages in supplying gases and energy in Japan, China, Taiwan, South Korea, Singapore, Thailand, Malaysia, Indonesia, Vietnam, the United States, and Australia.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives