- Japan

- /

- Industrials

- /

- TSE:7744

Undiscovered Gems in Japan Three Promising Stocks to Watch This September 2024

Reviewed by Simply Wall St

Japan’s stock markets have been on an upward trajectory, with the Nikkei 225 Index gaining 3.1% and the broader TOPIX Index up 2.8%, buoyed by a weakening yen following the U.S. Federal Reserve's recent rate cut. This favorable environment provides a fertile ground for identifying promising small-cap stocks that could offer significant growth potential. In this context, finding a good stock involves looking for companies with strong fundamentals and growth prospects that can capitalize on current market conditions. Here are three such undiscovered gems in Japan to watch this September 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ryoyu Systems | NA | 1.08% | 8.08% | ★★★★★★ |

| Togami Electric Mfg | 1.39% | 3.97% | 10.23% | ★★★★★★ |

| QuickLtd | 0.73% | 9.61% | 14.56% | ★★★★★★ |

| Nippon Denko | 18.00% | 4.31% | 48.41% | ★★★★★★ |

| Techno Smart | NA | 6.07% | -0.57% | ★★★★★★ |

| Icom | NA | 4.68% | 14.92% | ★★★★★★ |

| Yashima Denki | 2.93% | -2.38% | 13.99% | ★★★★★★ |

| YagiLtd | 32.86% | -9.57% | -0.12% | ★★★★☆☆ |

| GakkyushaLtd | 23.64% | 5.03% | 18.56% | ★★★★☆☆ |

| Toyo Kanetsu K.K | 47.92% | 2.34% | 15.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

MODEC (TSE:6269)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MODEC, Inc. is a general contractor specializing in the engineering, procurement, construction, and installation of floating production systems globally with a market cap of ¥225.07 billion.

Operations: MODEC, Inc. generates revenue primarily through the engineering, procurement, construction, and installation of floating production systems. The company operates globally with a market cap of ¥225.07 billion.

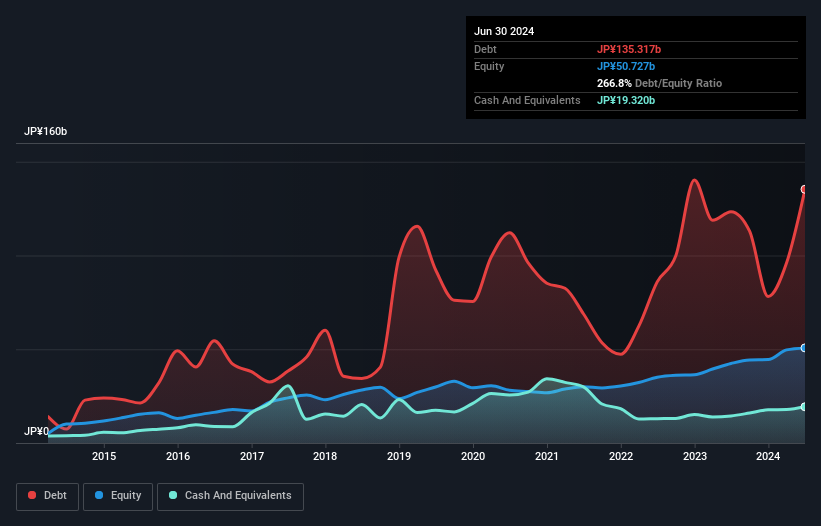

MODEC, a notable player in the energy services sector, recently raised its 2024 revenue forecast to US$4.3M and operating profit to US$290K. The company also announced an interim dividend increase from JPY 10 to JPY 30 per share. Despite earnings growth of 375.8% last year, MODEC's debt-to-equity ratio has risen from 19.2% to 47.8% over five years. Their joint R&D with Terra Drone aims to enhance inspection efficiency for offshore platforms, potentially reducing manpower needs significantly.

- Delve into the full analysis health report here for a deeper understanding of MODEC.

Gain insights into MODEC's past trends and performance with our Past report.

Financial Partners GroupLtd (TSE:7148)

Simply Wall St Value Rating: ★★★★★☆

Overview: Financial Partners Group Co., Ltd., along with its subsidiaries, offers a range of financial products and services in Japan and has a market cap of ¥198.95 billion.

Operations: Financial Partners Group Co., Ltd. generates revenue through its diverse financial products and services in Japan, with a market cap of ¥198.95 billion. The company has shown a net profit margin of 15% over the recent fiscal period, reflecting its profitability from these operations.

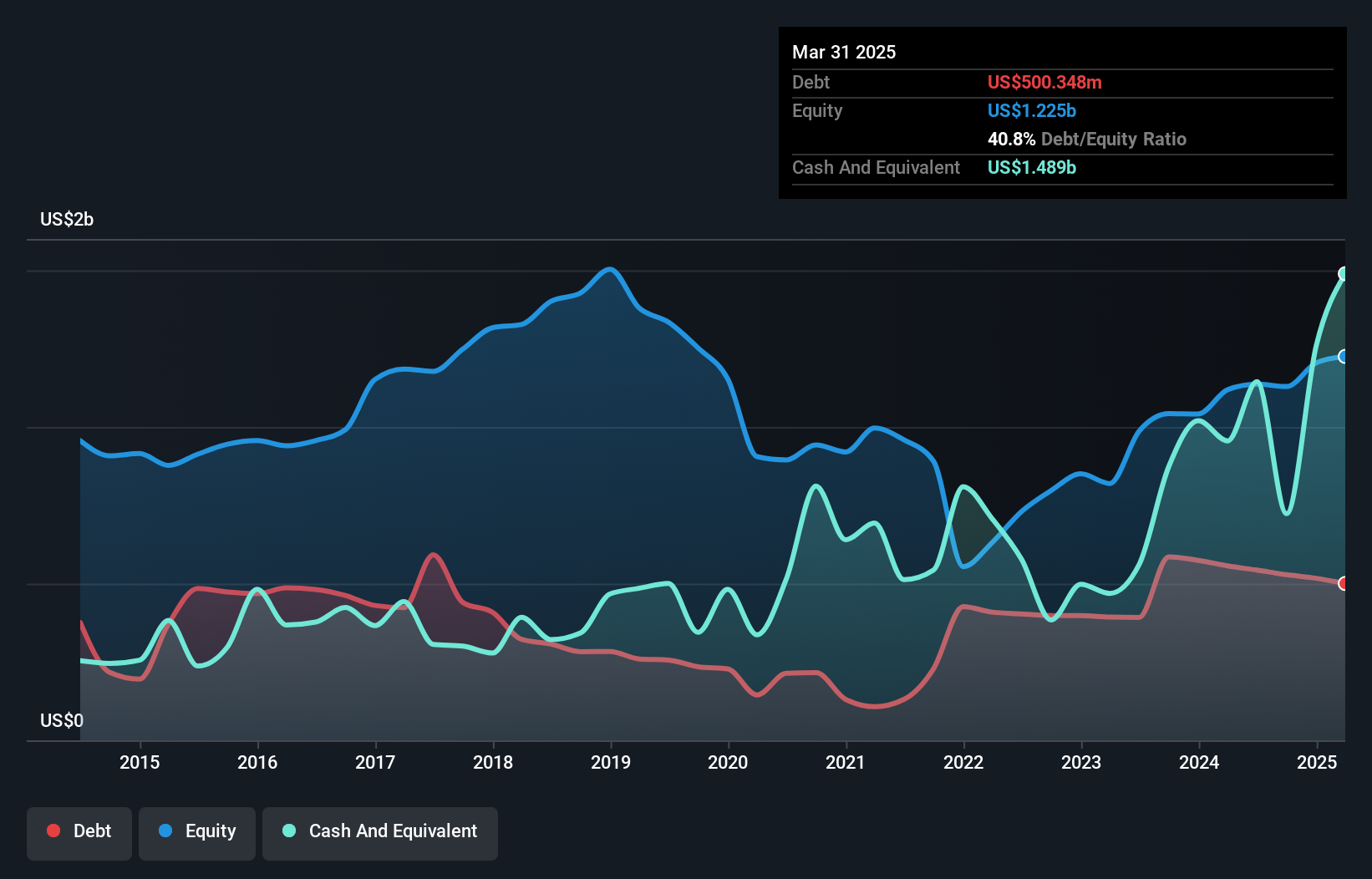

Financial Partners Group Ltd. has shown impressive financial performance, with earnings growing by 55.9% over the past year and a forecasted annual growth rate of 16.95%. The company's price-to-earnings ratio stands at 10.8x, lower than the JP market average of 13.4x, indicating good value for investors. Despite a high net debt to equity ratio of 228.7%, interest coverage is not a concern as earnings comfortably cover interest payments. Recent expansions include opening a new sales office in Imabari City and acquiring prime real estate in Fukuoka City for fractional ownership investments, highlighting strategic growth initiatives.

Noritsu Koki (TSE:7744)

Simply Wall St Value Rating: ★★★★★★

Overview: Noritsu Koki Co., Ltd. manufactures and sells audio equipment and peripheral products in Japan, with a market cap of ¥162.08 billion.

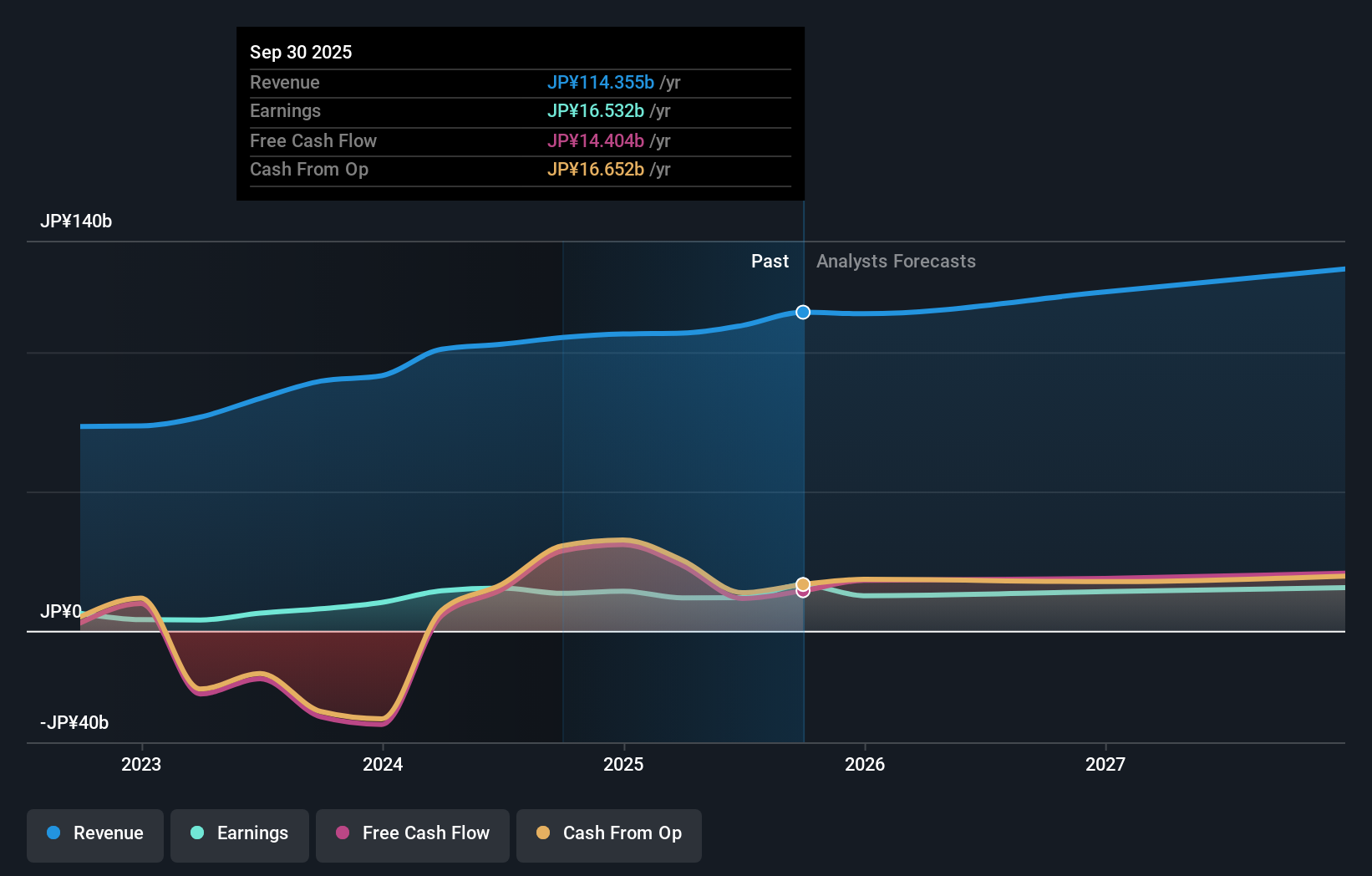

Operations: Noritsu Koki generates revenue primarily from manufacturing audio equipment and peripherals, amounting to ¥90.21 billion, and parts/materials manufacturing, contributing ¥11.82 billion.

Noritsu Koki, a lesser-known Japanese firm, has demonstrated notable financial improvements. Over the past year, earnings surged by 142%, substantially outpacing the Industrials industry average of 38%. Its debt to equity ratio impressively dropped from 44.7% to 16.4% over five years, reflecting strong financial management. Despite trading at a significant discount of 53% below its estimated fair value, the company's share price has been highly volatile recently.

- Click here to discover the nuances of Noritsu Koki with our detailed analytical health report.

Evaluate Noritsu Koki's historical performance by accessing our past performance report.

Make It Happen

- Unlock our comprehensive list of 755 Japanese Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Noritsu Koki might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7744

Noritsu Koki

Manufactures and sells audio equipment and peripheral products in Japan.

Flawless balance sheet with solid track record and pays a dividend.