As global markets react to the recent U.S. Federal Reserve rate cut, Japan's stock markets have shown notable gains, with the Nikkei 225 Index rising 3.1% and the broader TOPIX Index up 2.8%. This positive momentum creates an opportune environment to explore some of Japan's lesser-known yet promising stocks. In such a dynamic market, identifying strong investment opportunities often involves looking for companies with solid fundamentals, innovative products or services, and growth potential that aligns well with current economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Toho | 69.52% | 2.84% | 55.65% | ★★★★★★ |

| Tokyo Tekko | 10.81% | 7.30% | 7.30% | ★★★★★★ |

| KurimotoLtd | 20.73% | 3.34% | 18.64% | ★★★★★★ |

| Kanda HoldingsLtd | 30.47% | 4.35% | 18.02% | ★★★★★★ |

| AOKI Holdings | 28.27% | 0.91% | 37.15% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | -0.08% | 12.04% | ★★★★★★ |

| Nippon Denko | 18.00% | 4.31% | 48.41% | ★★★★★★ |

| Icom | NA | 4.68% | 14.92% | ★★★★★★ |

| Kondotec | 11.75% | 6.85% | 2.62% | ★★★★★☆ |

| FDK | 89.57% | -0.88% | 25.34% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

C.UyemuraLtd (TSE:4966)

Simply Wall St Value Rating: ★★★★★★

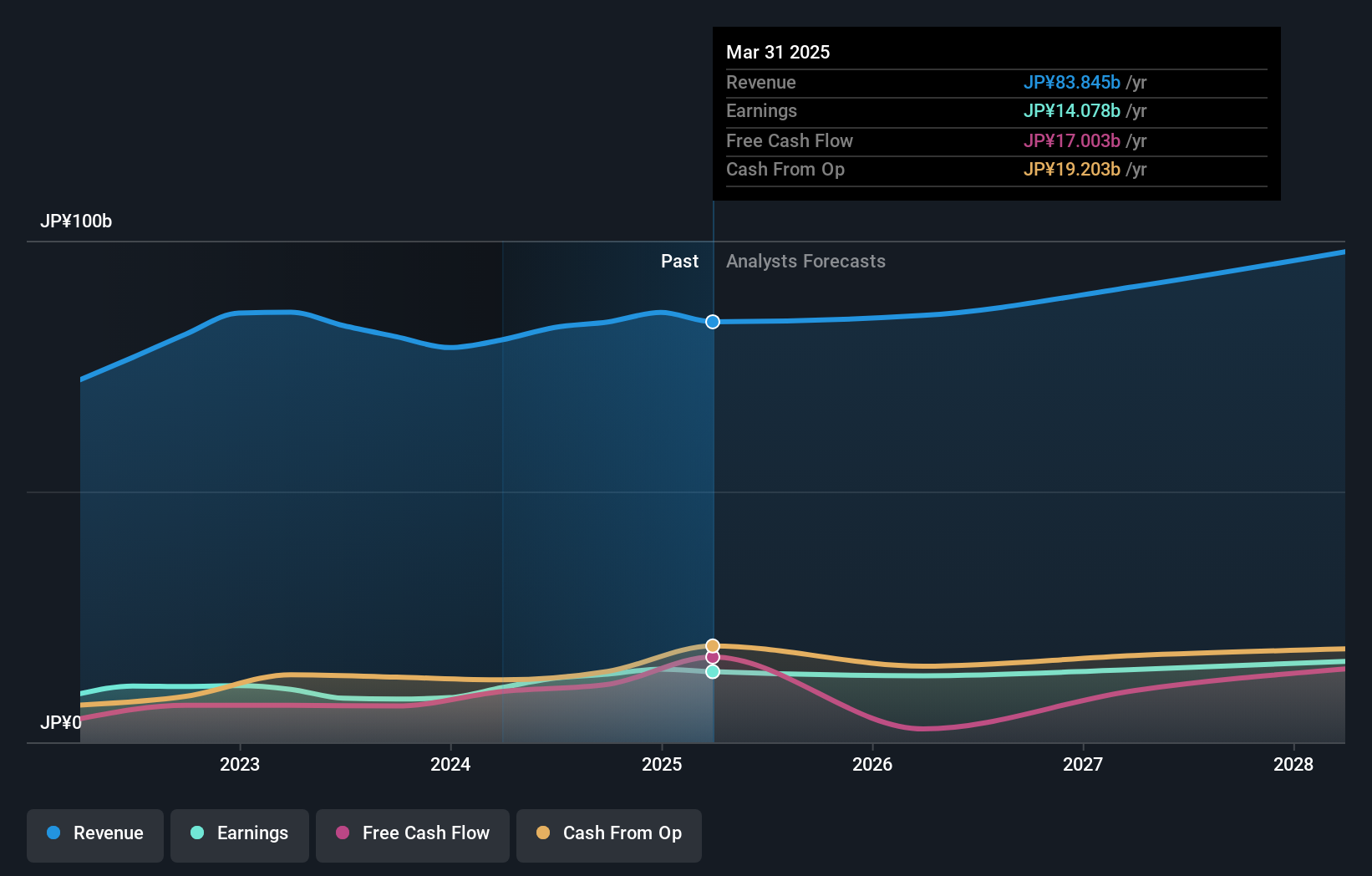

Overview: C.Uyemura & Co., Ltd. engages in the research, development, manufacturing, and sale of plating chemicals, industrial chemicals, non-ferrous metals, and other products both in Japan and internationally with a market cap of ¥183.49 billion.

Operations: C.Uyemura & Co., Ltd. generates revenue primarily from its Surface Treatment Materials Business, which contributes ¥60.58 billion, and the Surface Treatment Machinery Business, adding ¥14.53 billion. The Plating Processing segment adds another ¥4.30 billion to the revenue stream, while the Real Estate Rental Business provides ¥0.82 billion in revenue.

C. Uyemura Ltd. has seen its earnings grow 15.4% annually over the past five years, though recent growth at 3.6% lagged behind the Chemicals industry’s 13%. The company's debt-to-equity ratio improved significantly from 0.9 to 0.4 over five years, reflecting better financial health. Trading at nearly 19% below fair value, it offers a compelling investment case with high-quality earnings and robust interest coverage, making future profit growth of around 8% per year likely achievable.

- Unlock comprehensive insights into our analysis of C.UyemuraLtd stock in this health report.

Gain insights into C.UyemuraLtd's past trends and performance with our Past report.

MODEC (TSE:6269)

Simply Wall St Value Rating: ★★★★☆☆

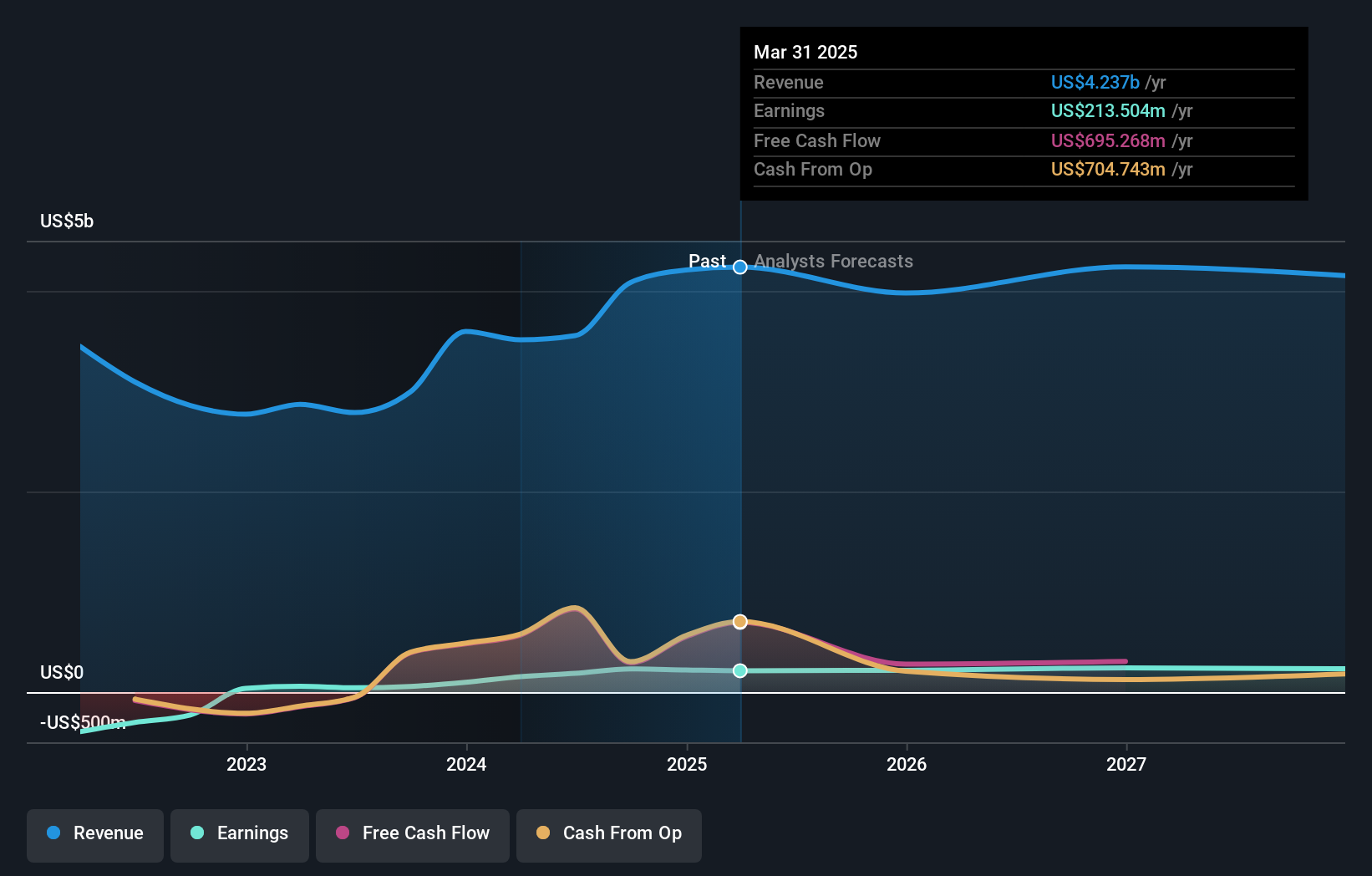

Overview: MODEC, Inc. is a general contractor specializing in the engineering, procurement, construction, and installation of floating production systems globally with a market cap of ¥224.05 billion.

Operations: The company generates revenue primarily through engineering, procurement, construction, and installation of floating production systems. It has a market cap of ¥224.05 billion.

MODEC has shown impressive earnings growth of 375.8% over the past year, outpacing the Energy Services industry’s 24.8%. The company’s price-to-earnings ratio stands at 7.4x, which is below the JP market average of 13.4x, indicating good value. Additionally, MODEC's interim dividend was increased to JPY 30 per share from JPY 10 per share for Fiscal Year 2024 due to strong half-year financial results and revised revenue guidance up to US$4.3 million from US$3.9 million.

- Navigate through the intricacies of MODEC with our comprehensive health report here.

Examine MODEC's past performance report to understand how it has performed in the past.

SKY Perfect JSAT Holdings (TSE:9412)

Simply Wall St Value Rating: ★★★★★★

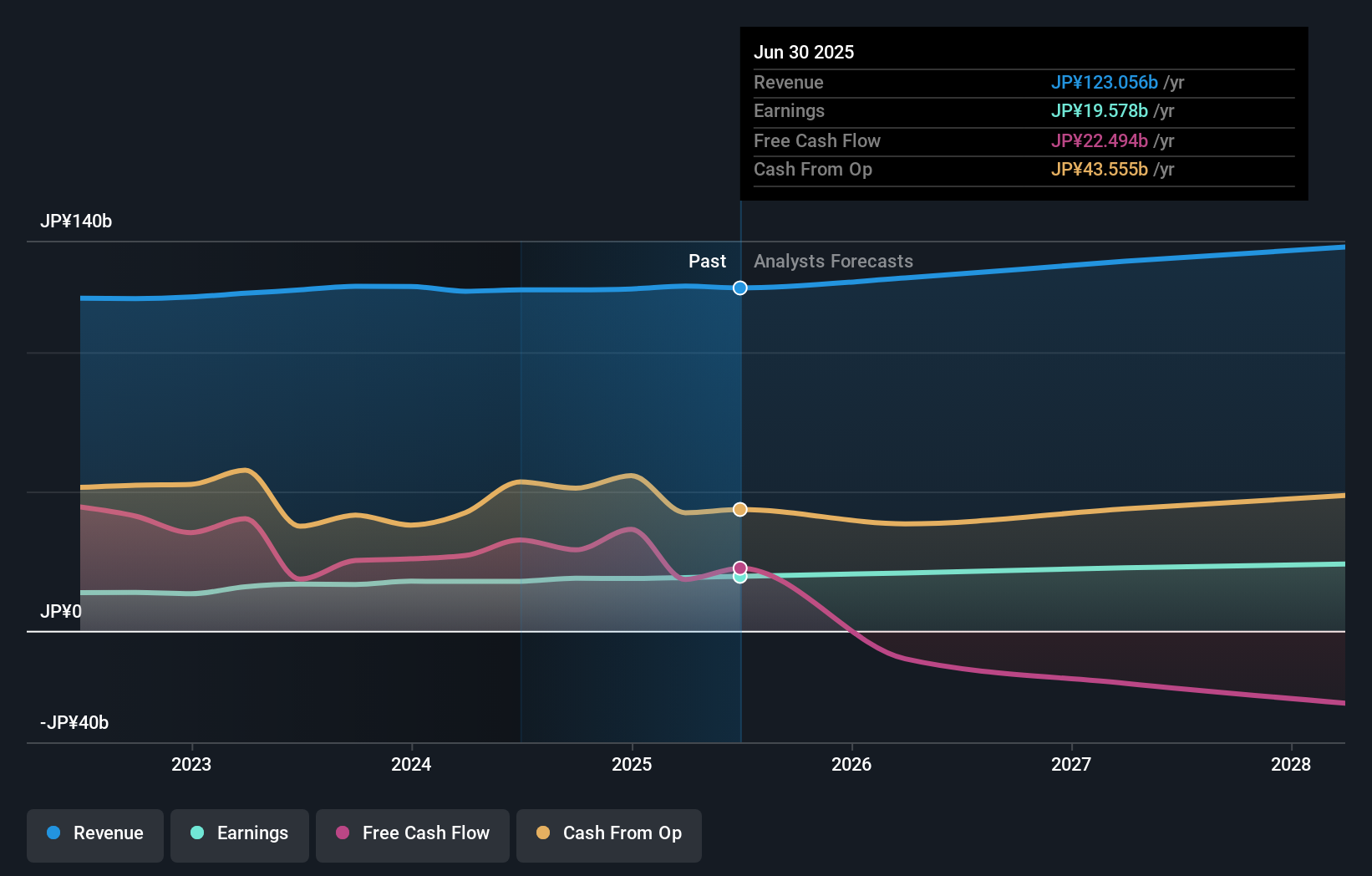

Overview: SKY Perfect JSAT Holdings Inc. offers satellite-based multichannel pay TV and satellite communications services mainly in Asia, with a market cap of ¥251.62 billion.

Operations: SKY Perfect JSAT Holdings generates revenue from satellite-based multichannel pay TV and satellite communications services primarily in Asia. The company has a market cap of ¥251.62 billion.

SKY Perfect JSAT Holdings has demonstrated solid performance, with earnings growing by 6.1% over the past year, outpacing the Media industry's 3.8%. The company is trading at 52.8% below its estimated fair value and has reduced its debt to equity ratio from 46.9% to 23% in five years. Recent dividend guidance indicates a slight increase to ¥11 per share for Q2 FY2025, reflecting stable shareholder returns amidst strong operating revenues forecasted at ¥123 billion for the fiscal year ending March 31, 2025.

Key Takeaways

- Unlock more gems! Our Japanese Undiscovered Gems With Strong Fundamentals screener has unearthed 748 more companies for you to explore.Click here to unveil our expertly curated list of 751 Japanese Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9412

SKY Perfect JSAT Holdings

Provides satellite-based multichannel pay TV and satellite communications services primarily in Asia.

Flawless balance sheet, undervalued and pays a dividend.