- Japan

- /

- Energy Services

- /

- TSE:6269

Undiscovered Gems in Japan for September 2024

Reviewed by Simply Wall St

Japan’s stock markets have seen a notable rise, with the Nikkei 225 Index gaining 3.1% and the broader TOPIX Index up 2.8%, driven by a weakened yen following the U.S. Federal Reserve's recent rate cut. This positive momentum presents an opportune moment to explore some lesser-known stocks that might offer unique growth potential. In this environment, good stocks often exhibit strong fundamentals, innovative business models, and resilience in varying economic conditions—qualities that are particularly relevant given the current market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NJS | NA | 4.97% | 5.30% | ★★★★★★ |

| Ad-Sol Nissin | NA | 4.02% | 7.90% | ★★★★★★ |

| Uoriki | NA | 3.90% | 6.15% | ★★★★★★ |

| Maezawa Kasei Industries | 0.81% | 2.01% | 18.42% | ★★★★★★ |

| Mizuho MedyLtd | NA | 19.43% | 34.66% | ★★★★★★ |

| Nikko | 31.99% | 4.24% | -8.75% | ★★★★★☆ |

| AJIS | 0.69% | 0.07% | -12.44% | ★★★★★☆ |

| Pharma Foods International | 145.80% | 30.07% | 22.61% | ★★★★★☆ |

| GENOVA | 0.93% | 33.82% | 30.22% | ★★★★☆☆ |

| Nippon Sharyo | 61.34% | -1.68% | -17.07% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Tsuburaya Fields Holdings (TSE:2767)

Simply Wall St Value Rating: ★★★★★★

Overview: Tsuburaya Fields Holdings Inc. engages in content-related businesses in Japan and has a market cap of ¥149.44 billion.

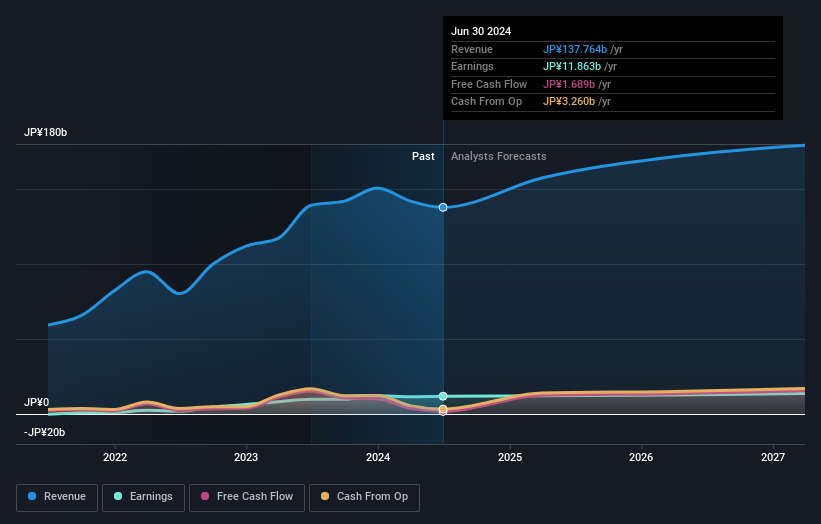

Operations: Tsuburaya Fields Holdings generates revenue primarily from its PS Business Segment, which brought in ¥120.91 billion, and its Content & Digital Business Segment, contributing ¥15.80 billion.

Tsuburaya Fields Holdings, a small cap in Japan's leisure industry, has shown impressive earnings growth of 20.9% over the past year, outpacing the industry's 8.6%. The company's debt to equity ratio has improved from 40.4% to 24.5% in five years, and it trades at a significant discount of 59.1% below its estimated fair value. With EBIT covering interest payments by an exceptional factor of 614x and high-quality non-cash earnings, it seems poised for continued stability despite recent share price volatility.

- Get an in-depth perspective on Tsuburaya Fields Holdings' performance by reading our health report here.

Evaluate Tsuburaya Fields Holdings' historical performance by accessing our past performance report.

MODEC (TSE:6269)

Simply Wall St Value Rating: ★★★★☆☆

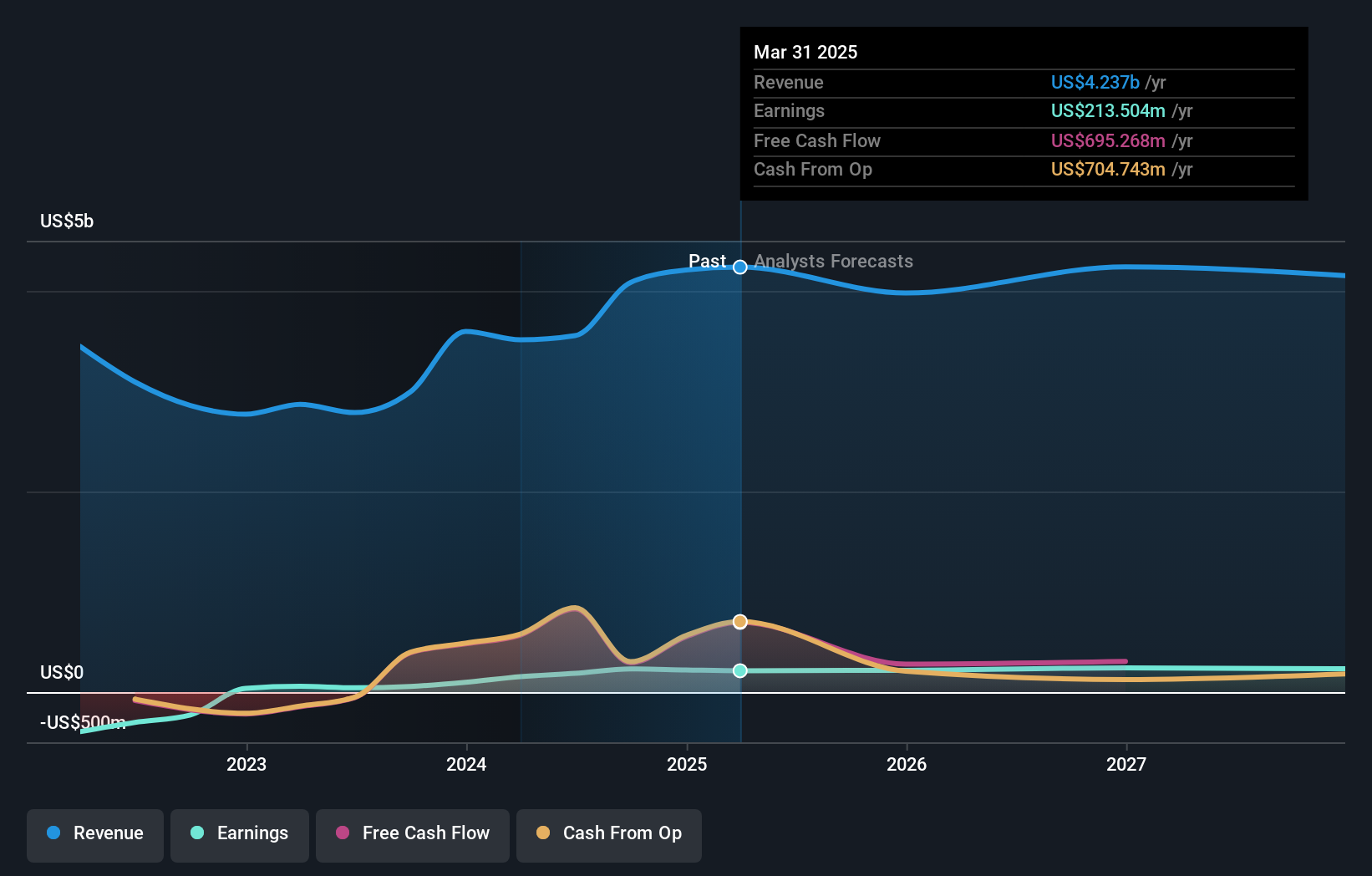

Overview: MODEC, Inc. is a general contractor specializing in the engineering, procurement, construction, and installation of floating production systems globally, with a market cap of ¥221.99 billion.

Operations: MODEC, Inc. generates revenue primarily through its engineering, procurement, construction, and installation services for floating production systems. The company's financial performance is reflected in its market cap of ¥221.99 billion.

MODEC's recent developments highlight its dynamic potential in the energy services sector. The company revised its 2024 earnings guidance, projecting revenue at US$4.3 million and operating profit at US$290,000. Earnings grew by 375.8% over the past year, significantly outpacing the industry average of 24.8%. Additionally, MODEC announced an interim dividend increase to ¥30 per share and entered a strategic alliance with Terra Drone to enhance drone inspection technology for FPSOs, aiming to triple inspection efficiency and reduce costs.

- Unlock comprehensive insights into our analysis of MODEC stock in this health report.

Explore historical data to track MODEC's performance over time in our Past section.

Financial Partners GroupLtd (TSE:7148)

Simply Wall St Value Rating: ★★★★★☆

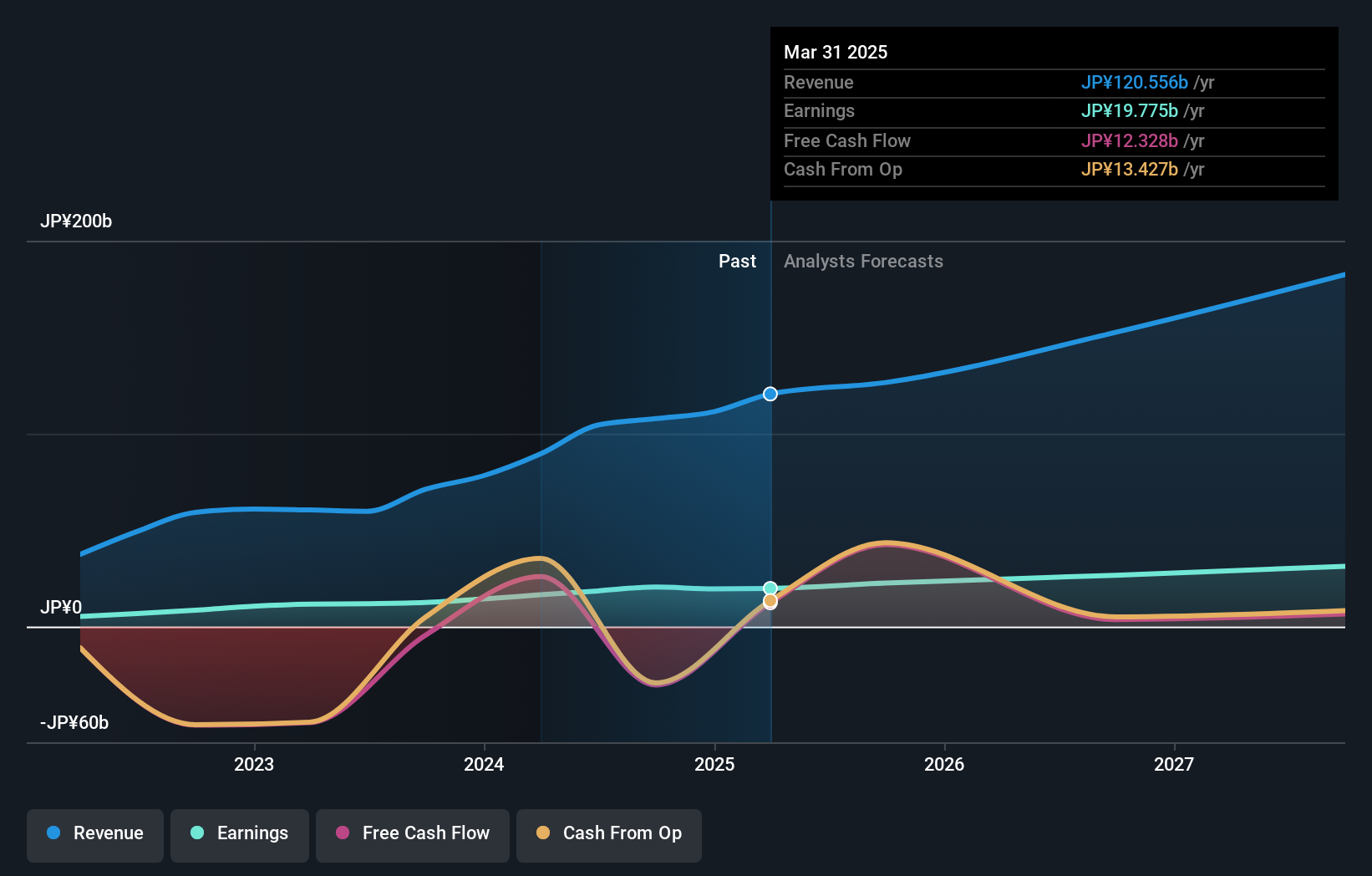

Overview: Financial Partners Group Co., Ltd., along with its subsidiaries, offers a range of financial products and services in Japan and has a market cap of ¥199.12 billion.

Operations: Financial Partners Group Co., Ltd. generates revenue through its diverse portfolio of financial products and services in Japan. The company's cost structure includes expenses related to providing these services, impacting its overall profitability.

Financial Partners Group Ltd. has shown remarkable earnings growth of 55.9% over the past year, outpacing the Diversified Financial industry’s 24.9%. The net debt to equity ratio stands at a high 228.7%, although it has improved from 309.6% five years ago. Trading at a price-to-earnings ratio of 10.8x, below the JP market average of 13.4x, FPG is considered good value among peers and industry standards while maintaining profitability without cash runway concerns.

- Click to explore a detailed breakdown of our findings in Financial Partners GroupLtd's health report.

Gain insights into Financial Partners GroupLtd's past trends and performance with our Past report.

Where To Now?

- Click through to start exploring the rest of the 748 Japanese Undiscovered Gems With Strong Fundamentals now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6269

MODEC

A general contractor, engages in the engineering, procurement, construction, and installation of floating production systems worldwide.

Outstanding track record, good value and pays a dividend.