As global markets navigate a landscape marked by trade uncertainties and policy shifts, investors are witnessing mixed performances across major indices. With large-cap tech stocks lagging and smaller-cap indexes showing resilience, the focus on stable income sources like dividend stocks becomes increasingly relevant. In such a dynamic environment, selecting dividend stocks with strong fundamentals and consistent payout histories can offer investors potential stability amidst market volatility.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.96% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.84% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.39% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.05% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.04% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.55% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.60% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.05% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.27% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.45% | ★★★★★★ |

Click here to see the full list of 1542 stocks from our Top Global Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Star Lake BioscienceZhaoqing Guangdong (SHSE:600866)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Star Lake Bioscience Co., Inc. Zhaoqing Guangdong manufactures and sells pharmaceutical raw materials, as well as food and feed additives under the Star Lake and Yue Bao brand names in China and internationally, with a market cap of CN¥11.91 billion.

Operations: Star Lake Bioscience Co., Inc. Zhaoqing Guangdong generates revenue through its production and distribution of pharmaceutical raw materials and food and feed additives.

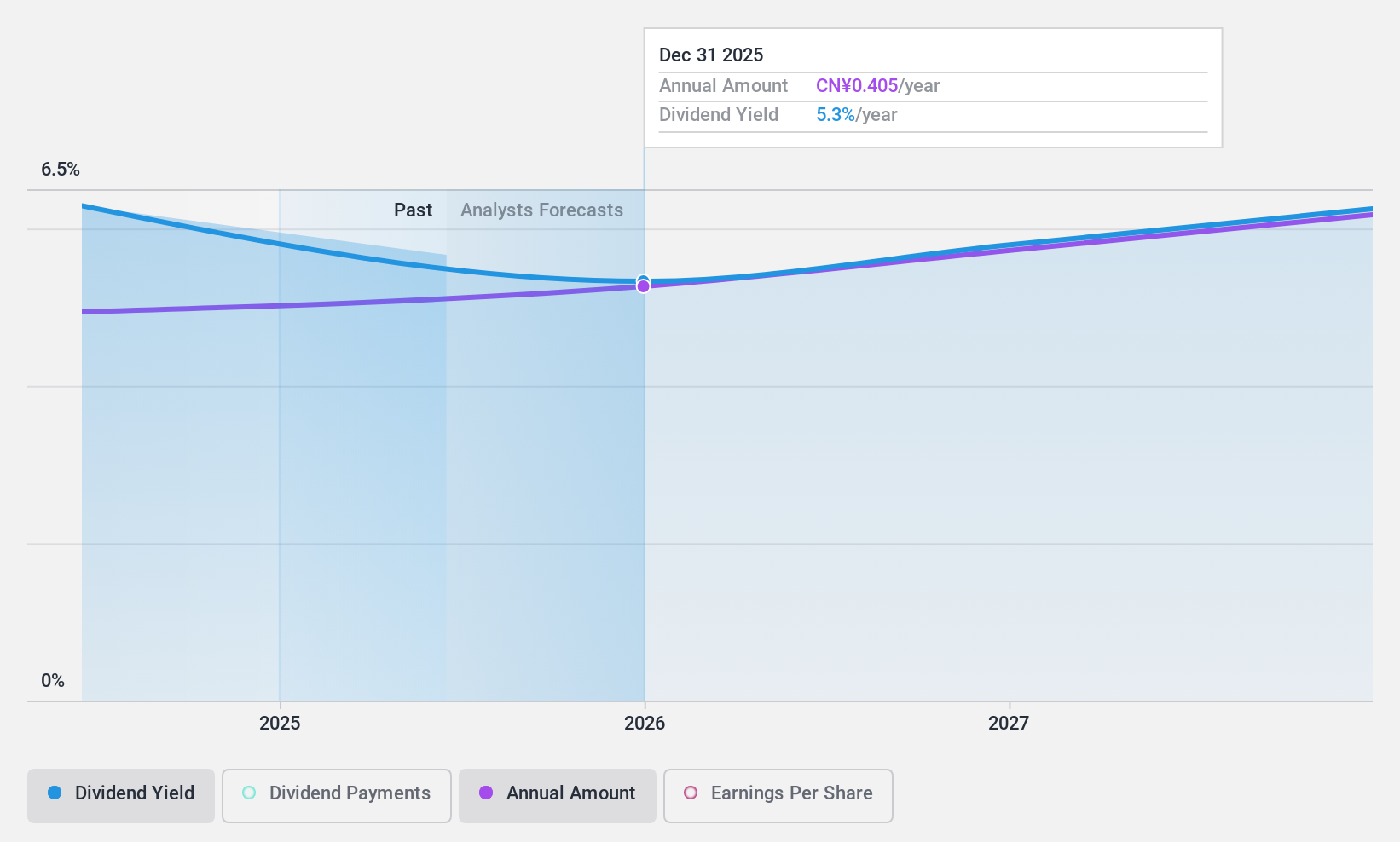

Dividend Yield: 4.8%

Star Lake Bioscience is trading at a significant discount, 72.6% below its estimated fair value, which may appeal to value-focused investors. The company offers a dividend yield of 5.3%, placing it in the top quartile of CN market payers, with dividends well-covered by earnings and cash flows (payout ratios: 72.9% and 38.3%, respectively). However, it's too early to assess the stability or growth potential of these dividends as they have just started paying them.

- Unlock comprehensive insights into our analysis of Star Lake BioscienceZhaoqing Guangdong stock in this dividend report.

- According our valuation report, there's an indication that Star Lake BioscienceZhaoqing Guangdong's share price might be on the cheaper side.

Cheng De Lolo (SZSE:000848)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cheng De Lolo Company Limited, along with its subsidiaries, manufactures and sells plant protein beverages in China, with a market cap of CN¥9.94 billion.

Operations: Cheng De Lolo Company Limited generates revenue primarily from its Vegetable Protein Beverage segment, amounting to CN¥3.08 billion.

Dividend Yield: 3.9%

Cheng De Lolo's dividend yield of 3.94% is among the top 25% in the CN market. However, its dividends have been unreliable and volatile over the past decade, with significant annual drops. The payout ratio stands at a reasonable 69%, but cash flow coverage is weak with a high cash payout ratio of 101.3%. Recent share buybacks totaling CNY 25.83 million suggest management's confidence, yet dividend sustainability remains questionable without stronger free cash flow support.

- Click to explore a detailed breakdown of our findings in Cheng De Lolo's dividend report.

- The valuation report we've compiled suggests that Cheng De Lolo's current price could be quite moderate.

MODEC (TSE:6269)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MODEC, Inc. is a general contractor specializing in the engineering, procurement, construction, and installation of floating production systems for the offshore oil and gas industries across several countries including Brazil and Mexico, with a market cap of ¥246.93 billion.

Operations: MODEC, Inc.'s revenue is primarily derived from its activities in engineering, procurement, construction, and installation of floating production systems for the offshore oil and gas sectors across various international markets.

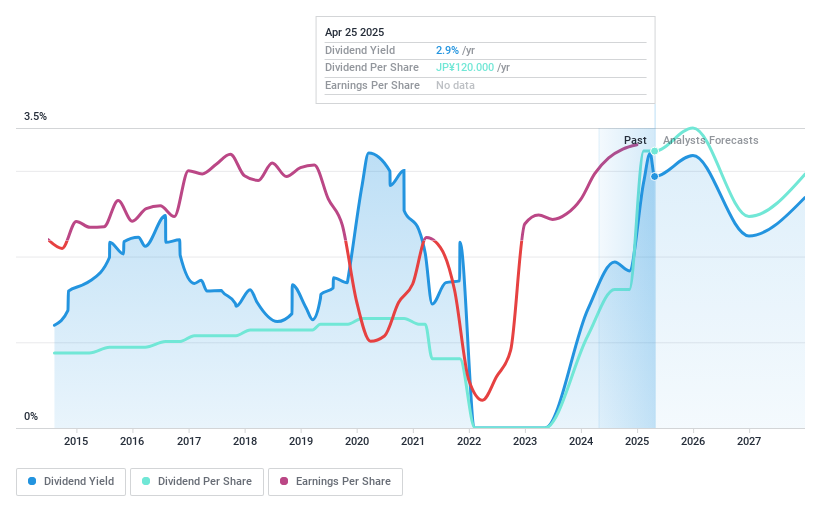

Dividend Yield: 3%

MODEC's dividend yield of 3% is below the top 25% in the JP market. Despite a recent increase to JPY 50 per share, dividends have been volatile over the past decade. However, with a low payout ratio of 15.7% and cash payout ratio of 9.4%, dividends are well covered by earnings and cash flows. Earnings grew significantly last year but are forecasted to decline by an average of 1.4% annually over three years.

- Click here and access our complete dividend analysis report to understand the dynamics of MODEC.

- Our valuation report here indicates MODEC may be undervalued.

Where To Now?

- Get an in-depth perspective on all 1542 Top Global Dividend Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000848

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives