- Japan

- /

- Electrical

- /

- TSE:5805

3 Undiscovered Gems In Japan With Strong Potential

Reviewed by Simply Wall St

In recent weeks, Japan's stock markets have experienced notable gains, with the Nikkei 225 Index rising by 3.1% and the TOPIX Index increasing by 2.8%, largely influenced by a weaker yen following the U.S. Federal Reserve's substantial rate cut. As global market sentiment shifts, small-cap stocks in Japan are drawing attention for their potential to thrive under these evolving economic conditions. Identifying promising stocks often involves looking for companies with strong fundamentals and growth prospects that can capitalize on favorable market trends. In this article, we explore three lesser-known Japanese stocks that exhibit strong potential in the current economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Toho | 69.52% | 2.84% | 55.65% | ★★★★★★ |

| Nihon Parkerizing | 0.31% | 0.86% | 4.40% | ★★★★★★ |

| KurimotoLtd | 20.73% | 3.34% | 18.64% | ★★★★★★ |

| Kanda HoldingsLtd | 30.47% | 4.35% | 18.02% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | -0.08% | 12.04% | ★★★★★★ |

| NPR-Riken | 15.31% | 10.00% | 44.55% | ★★★★★☆ |

| Innotech | 38.96% | 7.08% | 6.36% | ★★★★★☆ |

| Imuraya Group | 26.21% | 2.37% | 32.09% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 139.93% | 2.20% | -0.27% | ★★★★☆☆ |

| Toho Bank | 98.27% | 0.43% | 22.80% | ★★★★☆☆ |

We'll examine a selection from our screener results.

SWCC (TSE:5805)

Simply Wall St Value Rating: ★★★★★★

Overview: SWCC Corporation, with a market cap of ¥176.09 billion, operates in the energy systems, communication systems, and device businesses both in Japan and internationally.

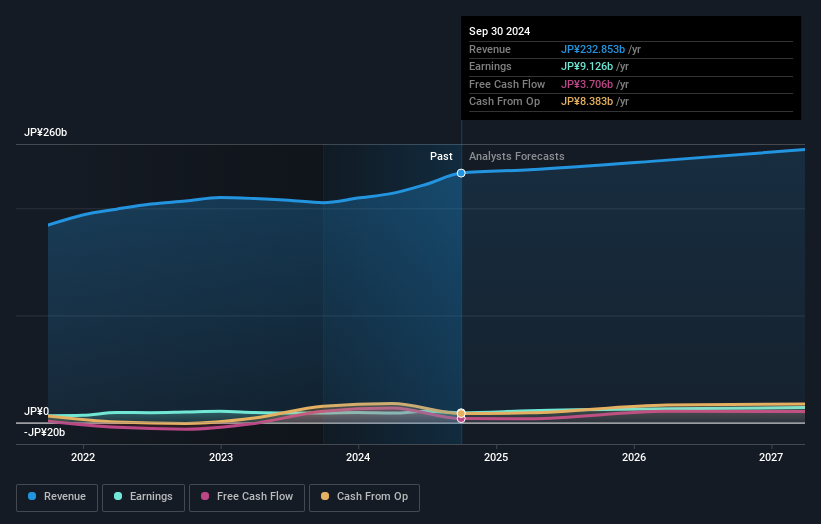

Operations: SWCC Corporation generates revenue primarily from its Energy Infrastructure Business (¥130.50 billion), Electrical Equipment/Components Business (¥100.78 billion), and Communication/Industrial Device Business (¥32.14 billion).

SWCC Corporation, a promising small cap in Japan, has shown impressive financial health. Its debt to equity ratio dropped from 125.1% to 44.5% over the past five years, reflecting prudent financial management. The company’s earnings grew by 18.3% last year, outpacing the electrical industry’s average of 17%. Additionally, SWCC's EBIT covers interest payments by an impressive 167.6 times, indicating robust profitability and stability in its operations for future growth potential.

- Click here and access our complete health analysis report to understand the dynamics of SWCC.

Explore historical data to track SWCC's performance over time in our Past section.

MODEC (TSE:6269)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MODEC, Inc. is a general contractor specializing in the engineering, procurement, construction, and installation of floating production systems globally with a market cap of ¥238.05 billion.

Operations: MODEC, Inc. generates revenue primarily from the engineering, procurement, construction, and installation of floating production systems globally. The company reported a market cap of ¥238.05 billion.

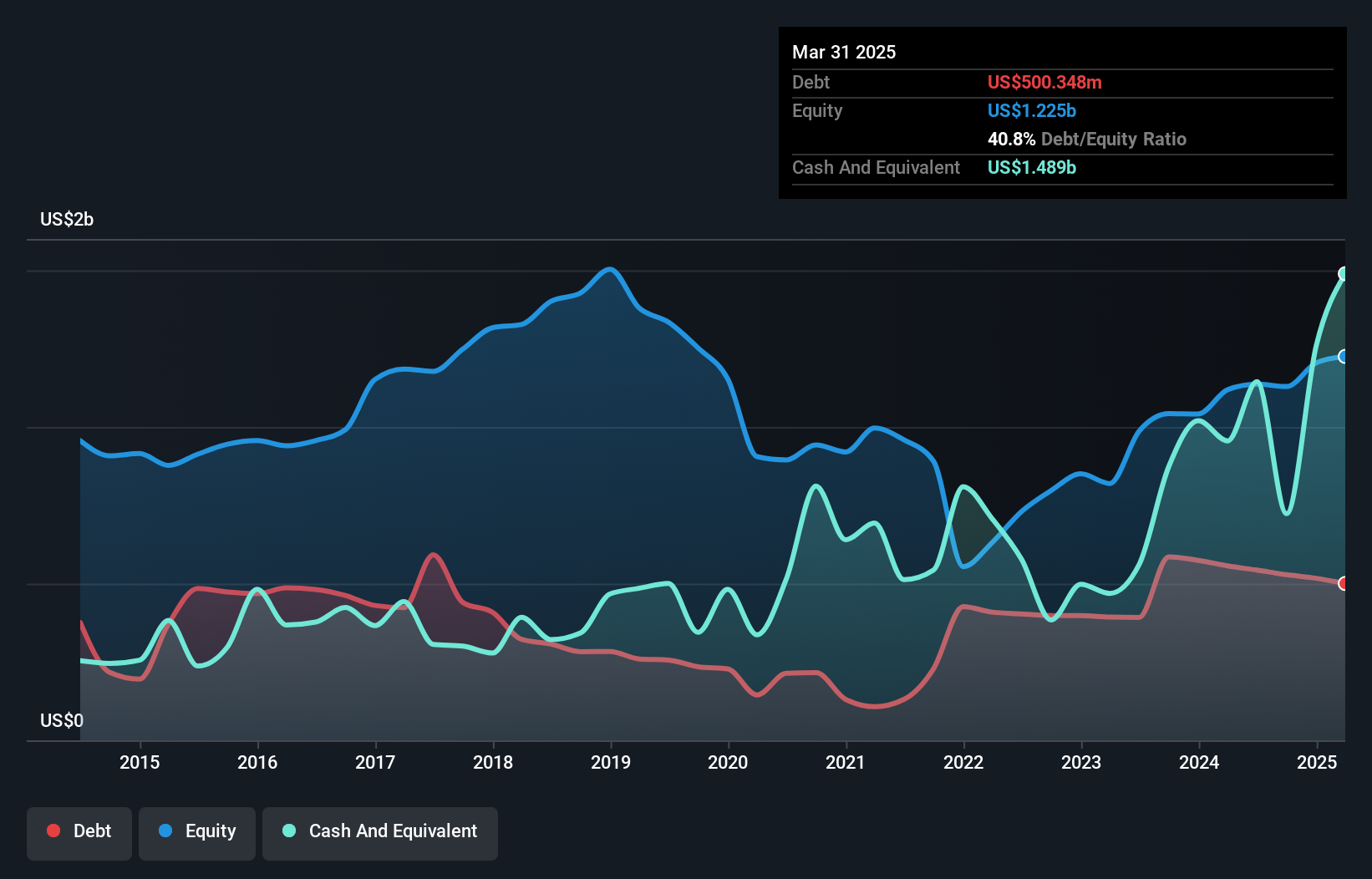

MODEC has shown impressive earnings growth of 375.8% over the past year, far outpacing the Energy Services industry average of 27.4%. The company recently increased its interim dividend from JPY 10 to JPY 30 per share, reflecting robust financial health. MODEC's debt-to-equity ratio has risen from 19.2% to 47.8% over five years, but it remains financially stable with more cash than total debt and a low price-to-earnings ratio of 7.9x compared to the JP market's 13.4x.

- Click to explore a detailed breakdown of our findings in MODEC's health report.

Understand MODEC's track record by examining our Past report.

SKY Perfect JSAT Holdings (TSE:9412)

Simply Wall St Value Rating: ★★★★★★

Overview: SKY Perfect JSAT Holdings Inc. offers satellite-based multichannel pay TV and satellite communications services mainly in Asia, with a market cap of ¥263.81 billion.

Operations: SKY Perfect JSAT Holdings Inc. generates revenue from satellite-based multichannel pay TV and satellite communications services primarily in Asia. The company has a market cap of ¥263.81 billion.

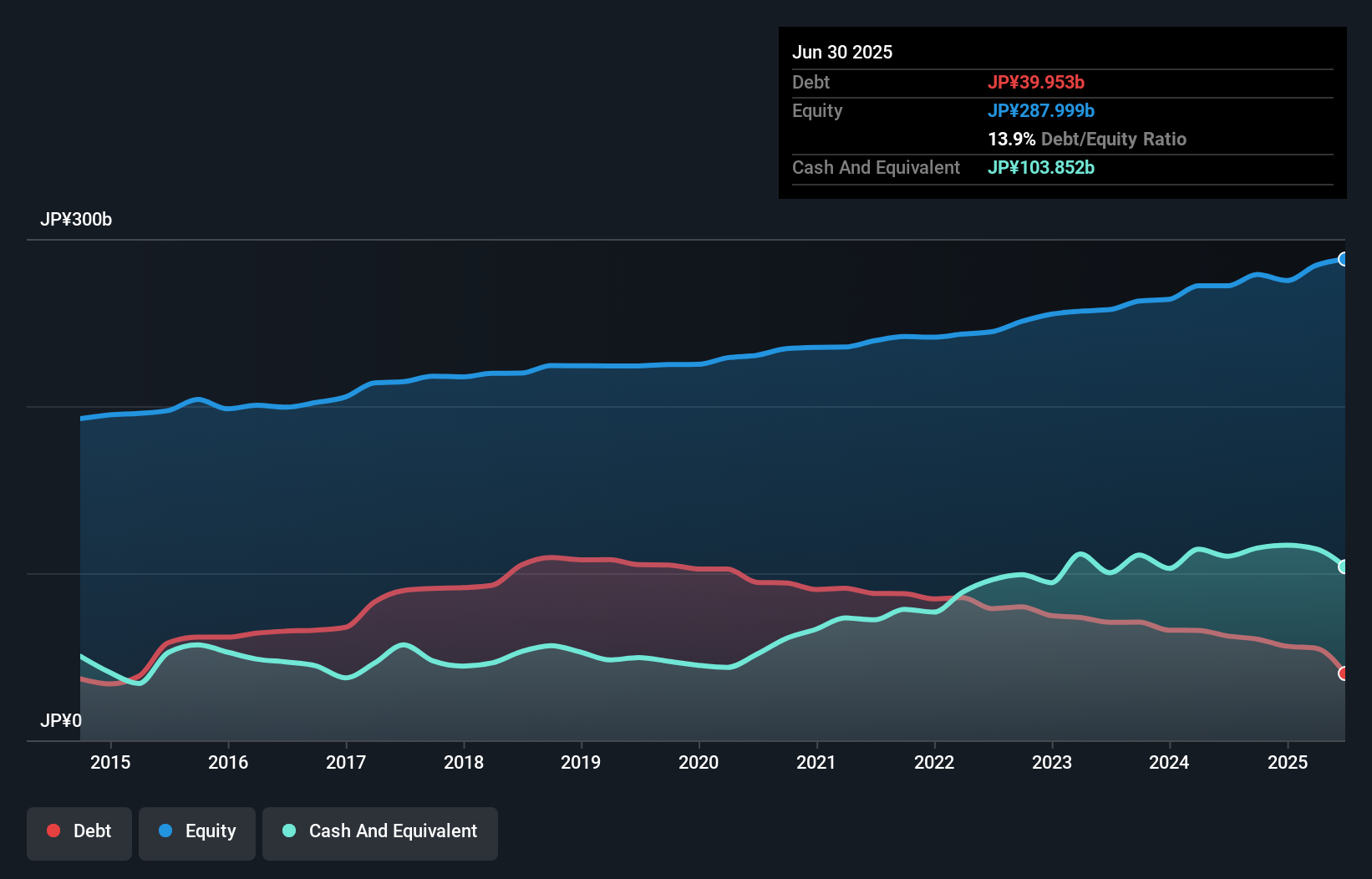

SKY Perfect JSAT Holdings has shown promising metrics, with earnings growing by 6.1% over the past year and forecasts indicating a 4.35% annual growth rate. The company trades at 50.8% below its estimated fair value, suggesting significant upside potential. Its debt to equity ratio has improved from 46.9% to 23% in five years, reflecting better financial health. Recent dividend guidance remains strong at ¥11 per share for the fiscal year ending March 31, 2025.

Next Steps

- Click this link to deep-dive into the 750 companies within our Japanese Undiscovered Gems With Strong Fundamentals screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5805

SWCC

Operates in the energy systems, communication systems, and device businesses in Japan and internationally.

Flawless balance sheet average dividend payer.