- Japan

- /

- Oil and Gas

- /

- TSE:5020

ENEOS Holdings (TSE:5020) capitalizes on energy transition initiatives despite internal challenges

Reviewed by Simply Wall St

Navigate through the intricacies of ENEOS Holdings with our comprehensive report here.

Key Assets Propelling ENEOS Holdings Forward

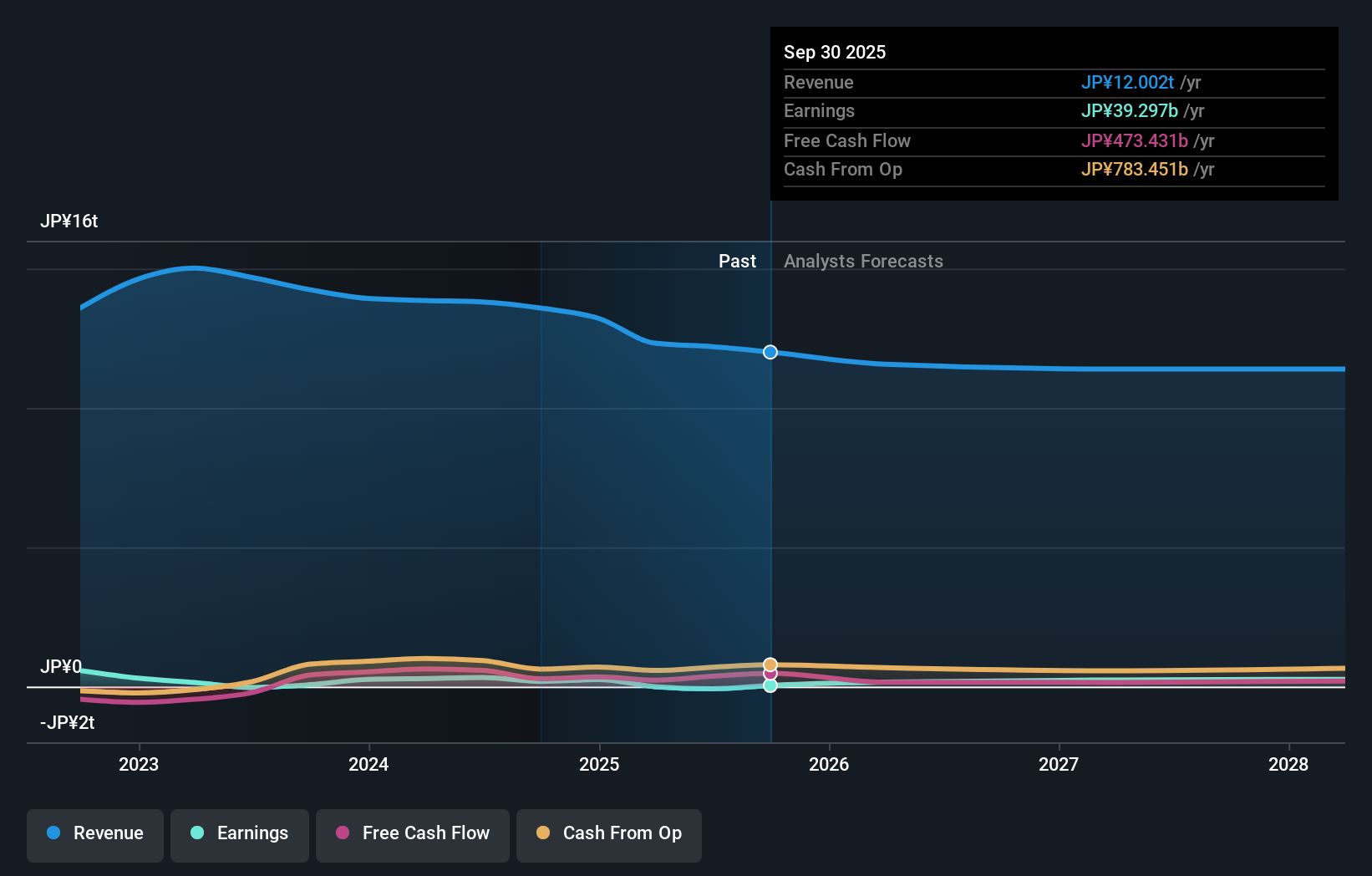

ENEOS Holdings has demonstrated remarkable earnings growth, soaring by 176.8% over the past year, significantly outpacing the Oil and Gas industry average of 7%. This surge in earnings is complemented by an improved net profit margin of 1.4%, up from 0.5% last year, showcasing the company's ability to enhance profitability. The strategic positioning of high-demand products such as SSBR and battery binders has been pivotal, aligning ENEOS with the burgeoning markets for sustainable and electric vehicle technologies. Moreover, the company's commitment to operational excellence is evident in its expansion initiatives in Indonesia and Malaysia, which leverage LNG's crucial role in the global energy transition. Furthermore, ENEOS is trading below its estimated fair value of ¥980.31, at ¥830.6, suggesting potential undervaluation despite a higher Price-To-Earnings Ratio compared to industry averages.

Internal Limitations Hindering ENEOS Holdings's Growth

ENEOS faces several internal challenges. The company's earnings growth forecast of 7.8% falls short of the broader JP market's 12.5%, indicating potential difficulties in maintaining its growth trajectory. Additionally, revenue growth is projected at a modest 0.3% annually, trailing behind the JP market's 4.2%. The Return on Equity stands at a low 7%, well below the 20% benchmark, reflecting inefficiencies in generating shareholder returns. Furthermore, a high net debt to equity ratio of 64.2% underscores financial leverage concerns, which could impact future investment capabilities. The metals segment, despite growth in semiconductor and ICT materials, experienced a 5.3 billion yen drop in operating profit, highlighting vulnerabilities in metals and recycling.

Areas for Expansion and Innovation for ENEOS Holdings

ENEOS is poised to capitalize on several promising opportunities. The company's focus on energy transition initiatives, including investments in carbon capture and storage, renewable energy, and sustainable aviation fuel, positions it well for future growth. Digital transformation efforts are underway, with progress in digital strategy aimed at driving continuous business transformation and profit improvement. The upcoming listing of JX Advanced Metals Corporation on the Tokyo Stock Exchange is expected to unlock value and attract investment, supporting business portfolio reform and enhancing shareholder returns. These initiatives, coupled with a history of stable dividend payments, could bolster investor confidence and market position.

External Factors Threatening ENEOS Holdings

External challenges loom large for ENEOS. Fluctuating crude oil prices, influenced by geopolitical tensions and economic slowdowns, pose significant risks to profitability and market stability. Regulatory pressures on fossil fuels, particularly LNG, could necessitate operational adjustments to comply with stricter environmental standards. Additionally, the renewable energy segment faces operational challenges, with flat profits due to adverse weather conditions and equipment failures. These factors underscore the need for ENEOS to navigate a complex environment of economic and regulatory pressures to sustain its growth momentum.

Conclusion

ENEOS Holdings has shown impressive earnings growth and an improved profit margin, driven by strategic product positioning and expansion in key markets, which aligns with the demand for sustainable technologies. However, internal challenges such as a lower earnings growth forecast compared to the broader JP market and financial leverage concerns could hinder sustained growth. The company's initiatives in energy transition and digital transformation present significant opportunities for future expansion, yet external pressures like fluctuating crude oil prices and regulatory demands pose risks. Despite these challenges, ENEOS's current trading price below its estimated fair value suggests potential for future appreciation, indicating that investors might find value in its strategic initiatives and continued dividend stability.

Turning Ideas Into Actions

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ENEOS Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5020

ENEOS Holdings

Through its subsidiaries, operates in the energy, oil and natural gas exploration and production, and metals businesses in Japan, China, Asia, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives