- Japan

- /

- Oil and Gas

- /

- TSE:5020

A Fresh Look at ENEOS Holdings (TSE:5020) Valuation Following Recent Share Momentum

Reviewed by Kshitija Bhandaru

See our latest analysis for ENEOS Holdings.

ENEOS Holdings’ strong recent momentum comes after a period of subdued performance. Its total shareholder return is now up 14.5% over the past year and more than double over five years, hinting at a recovery that is catching investor attention and may reflect shifting sentiment around valuation and growth prospects.

If you're looking for more stocks showing renewed momentum, now is a great time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares quickly rebounding and investor interest rising, the key question surfaces: Is ENEOS Holdings still trading below its true value, or has the market already accounted for much of the expected growth?

Most Popular Narrative: 2.7% Undervalued

ENEOS Holdings’ most followed narrative points to a modest undervaluation, with its fair value estimate sitting just above the last close price. This sets up a tension between analyst expectations and the current market mood, inviting a closer look at what could propel ENEOS shares higher.

Improvements in refinery unplanned capacity loss (UCL) have reduced operational disruptions, enhancing efficiency and potentially increasing net margins by minimizing unexpected downtime costs. The start of operations at the new Goi Thermal Power Plant and entry into the VPP supply-demand balancing market in the electricity business have increased operating profits significantly. This suggests future earnings growth from the energy sector.

What’s driving this valuation story? The real surprise lies in bullish projections for earnings, efficiency gains, and margin expansion, usually seen in faster-growing industries. Want to know which assumptions are fueling this price target or what could tip the scales further? The details may defy your expectations.

Result: Fair Value of ¥957 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, volatility in resource prices or unexpected swings in subsidiary contributions could quickly challenge these optimistic projections and significantly reshape the valuation outlook.

Find out about the key risks to this ENEOS Holdings narrative.

Another View: Multiples Tell a Cautious Story

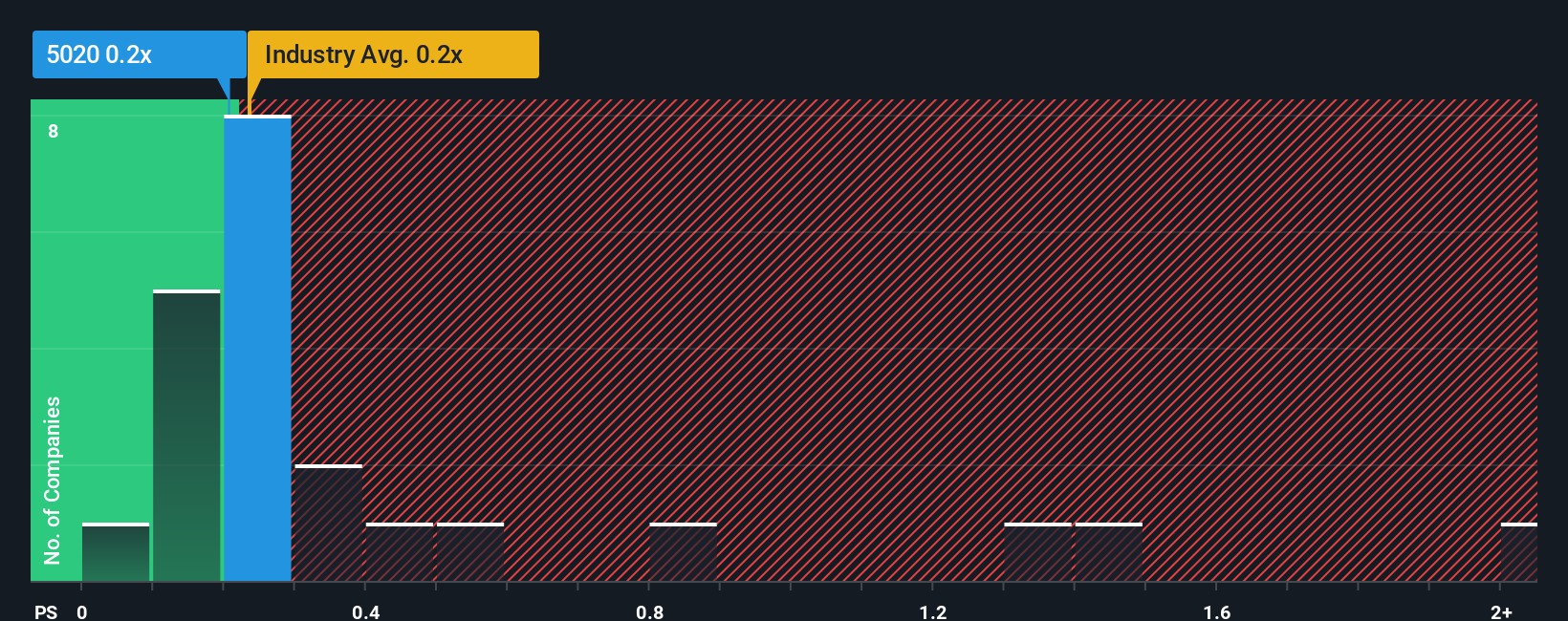

Looking at the price-to-sales ratio, ENEOS Holdings trades at 0.2x, which may appear reasonable versus peers and aligns precisely with the industry average. That said, the fair ratio estimate sits notably higher at 0.4x. This suggests the market could still be underestimating future potential or, conversely, not yet convinced by recovery. Could this gap signal hidden upside, or is it a warning sign if earnings expectations falter?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ENEOS Holdings Narrative

If you see things differently or want to dig into the details yourself, you can quickly shape your own view in just a few minutes. Do it your way

A great starting point for your ENEOS Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let your next big opportunity slip past you. Save time, avoid noise, and target high-potential stocks with unique growth stories using the Simply Wall St Screener.

- Target long-term stability and income by tapping into these 19 dividend stocks with yields > 3%, which offers strong yields above 3%.

- Take advantage of undervalued opportunities by checking out these 887 undervalued stocks based on cash flows, built on robust cash flow analysis.

- Back the future of medicine by reviewing these 32 healthcare AI stocks, at the forefront of AI-driven healthcare innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ENEOS Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5020

ENEOS Holdings

Through its subsidiaries, operates in the energy, oil and natural gas exploration and production, and metals businesses in Japan, China, Asia, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives