- Japan

- /

- Diversified Financial

- /

- TSE:8793

3 Prominent Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets react to recent political developments and economic indicators, U.S. stocks have been marching toward record highs, buoyed by optimism surrounding trade policies and a surge in AI-related investments. Amid this backdrop of growth, investors often turn their attention to dividend stocks, which can offer a steady income stream and potential for capital appreciation even in fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.43% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.42% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.51% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.95% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.98% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.78% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

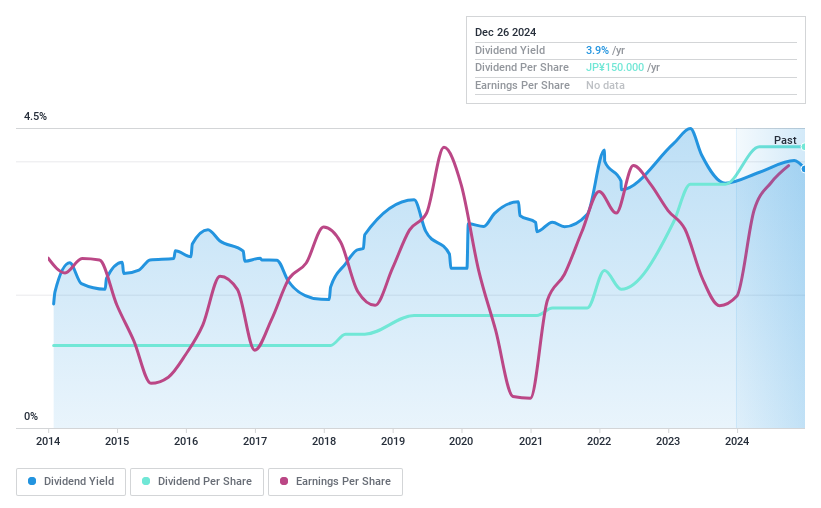

Sumitomo Mitsui Financial Group (TSE:8316)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sumitomo Mitsui Financial Group, Inc., along with its subsidiaries, offers a range of services including banking, leasing, securities, and consumer finance across various regions globally and has a market cap of approximately ¥15.13 trillion.

Operations: Sumitomo Mitsui Financial Group's revenue segments include the Global Business Unit at ¥1.35 billion, Market Business Unit at ¥602.20 million, Retail Business Unit at ¥1.34 billion, and Wholesale Business Sector at ¥879.50 million.

Dividend Yield: 3.1%

Sumitomo Mitsui Financial Group offers a reliable dividend yield of 3.08%, though it falls short of the top quartile in Japan. Its dividends have been stable and growing over the past decade, supported by a low payout ratio of 38.7%. Recent financial activities include an $800 million fixed-income offering and a share buyback program, indicating efforts to enhance shareholder returns and capital efficiency amidst strong earnings growth last year.

- Get an in-depth perspective on Sumitomo Mitsui Financial Group's performance by reading our dividend report here.

- Our valuation report unveils the possibility Sumitomo Mitsui Financial Group's shares may be trading at a discount.

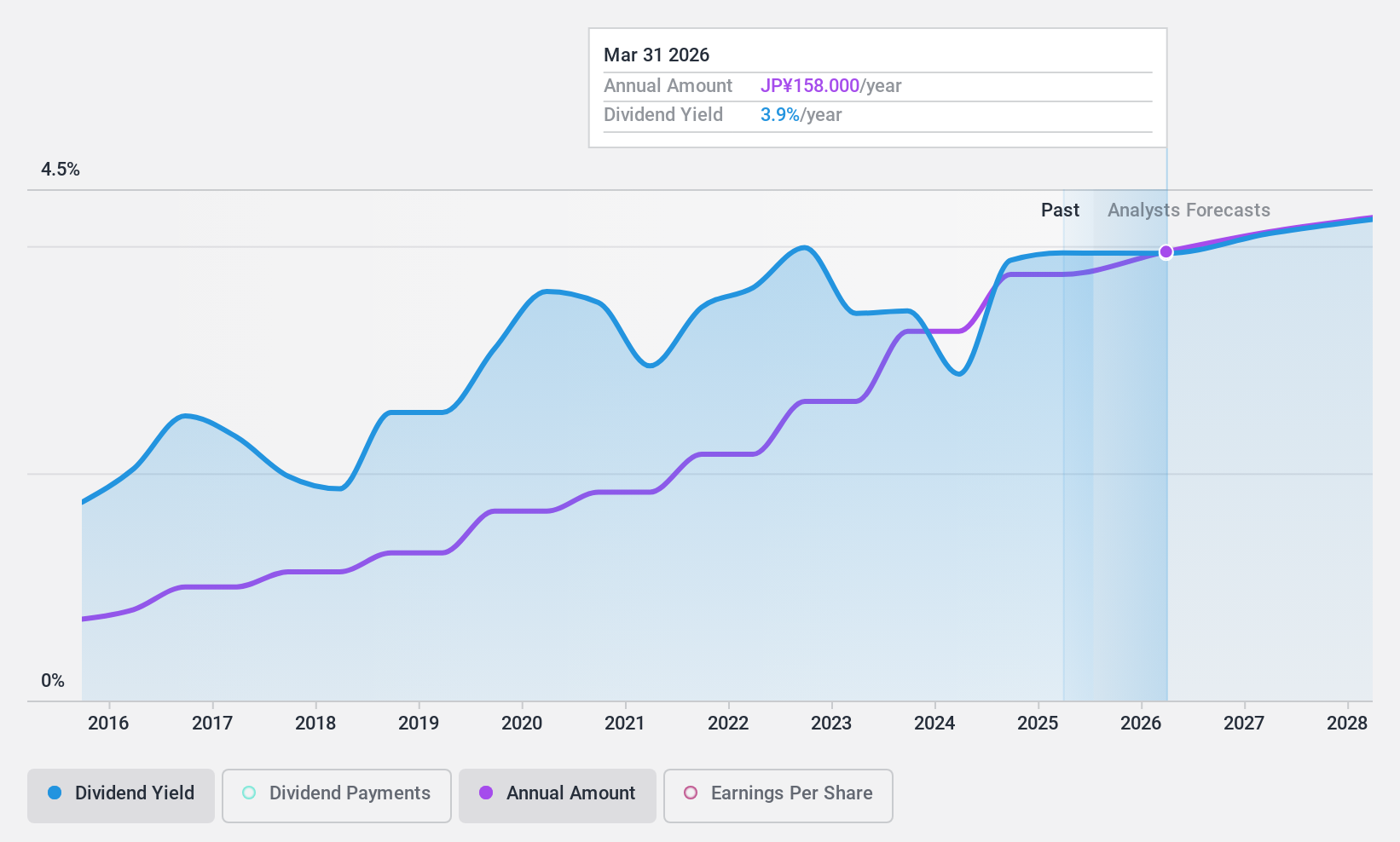

Fuyo General Lease (TSE:8424)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fuyo General Lease Co., Ltd. operates in the leasing and installment sales sector both in Japan and internationally, with a market capitalization of ¥343.53 billion.

Operations: Fuyo General Lease Co., Ltd.'s revenue is primarily derived from its Lease and Installment segment, which generated ¥596.80 billion, followed by its Financing segment with ¥43.41 billion.

Dividend Yield: 3.9%

Fuyo General Lease's dividend yield of 3.91% ranks in the top 25% of Japanese dividend payers, with stable and growing dividends over the past decade. Despite a low payout ratio of 30.1%, dividends are not covered by free cash flows, raising sustainability concerns. Recent ¥30 billion fixed-income offerings may impact future cash flow management. The stock trades at an attractive valuation, significantly below fair value estimates, although debt coverage by operating cash flow remains weak.

- Click here to discover the nuances of Fuyo General Lease with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Fuyo General Lease's share price might be too pessimistic.

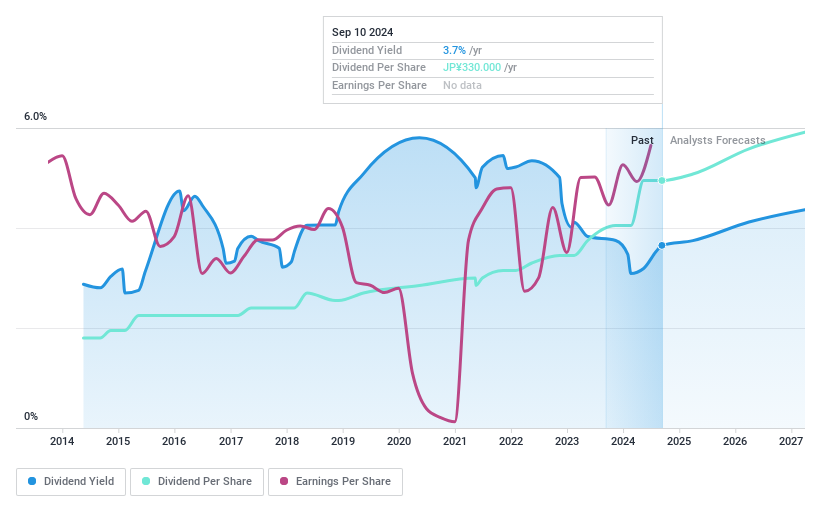

NEC Capital Solutions (TSE:8793)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NEC Capital Solutions Limited offers financial services in Japan and has a market capitalization of approximately ¥83.58 billion.

Operations: NEC Capital Solutions Limited generates revenue through its Lease Business (¥229.64 billion), Finance Business (¥9.15 billion), and Investment Business (¥11.99 billion).

Dividend Yield: 3.8%

NEC Capital Solutions offers a dividend yield of 3.82%, placing it in the top quartile among Japanese dividend payers. However, dividends are not supported by free cash flow or earnings, and past payments have been volatile. Despite this, dividends have grown over the last decade with a low payout ratio of 35.6%. The company recently issued ¥28 billion in unsecured bonds, which could affect cash flow management amid its attractive valuation below fair value estimates.

- Click here and access our complete dividend analysis report to understand the dynamics of NEC Capital Solutions.

- The valuation report we've compiled suggests that NEC Capital Solutions' current price could be quite moderate.

Summing It All Up

- Take a closer look at our Top Dividend Stocks list of 1951 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NEC Capital Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8793

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives