- Japan

- /

- Capital Markets

- /

- TSE:8746

Not Many Are Piling Into Unbanked,Inc. (TSE:8746) Stock Yet As It Plummets 37%

Unfortunately for some shareholders, the Unbanked,Inc. (TSE:8746) share price has dived 37% in the last thirty days, prolonging recent pain. Longer-term shareholders would now have taken a real hit with the stock declining 8.0% in the last year.

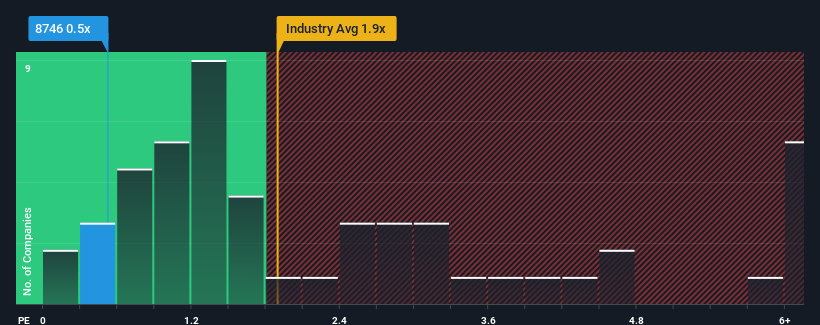

Since its price has dipped substantially, UnbankedInc may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.5x, since almost half of all companies in the Capital Markets industry in Japan have P/S ratios greater than 1.9x and even P/S higher than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for UnbankedInc

How Has UnbankedInc Performed Recently?

The revenue growth achieved at UnbankedInc over the last year would be more than acceptable for most companies. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on UnbankedInc will help you shine a light on its historical performance.How Is UnbankedInc's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like UnbankedInc's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 15% last year. The latest three year period has seen an incredible overall rise in revenue, even though the last 12 month performance was only fair. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 4.5% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that UnbankedInc's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

UnbankedInc's recently weak share price has pulled its P/S back below other Capital Markets companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of UnbankedInc revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Having said that, be aware UnbankedInc is showing 3 warning signs in our investment analysis, and 1 of those is potentially serious.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8746

Flawless balance sheet slight.

Market Insights

Community Narratives