- Japan

- /

- Capital Markets

- /

- TSE:8707

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets navigate through a mix of geopolitical tensions and economic indicators, U.S. stock indexes have shown resilience with broad-based gains, while European markets anticipate potential monetary easing. In this dynamic environment, dividend stocks can offer stability and income potential; they are particularly appealing when market volatility is high and interest rates are in flux.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.24% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.52% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.89% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.31% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.60% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.40% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.88% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.89% | ★★★★★★ |

Click here to see the full list of 1963 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

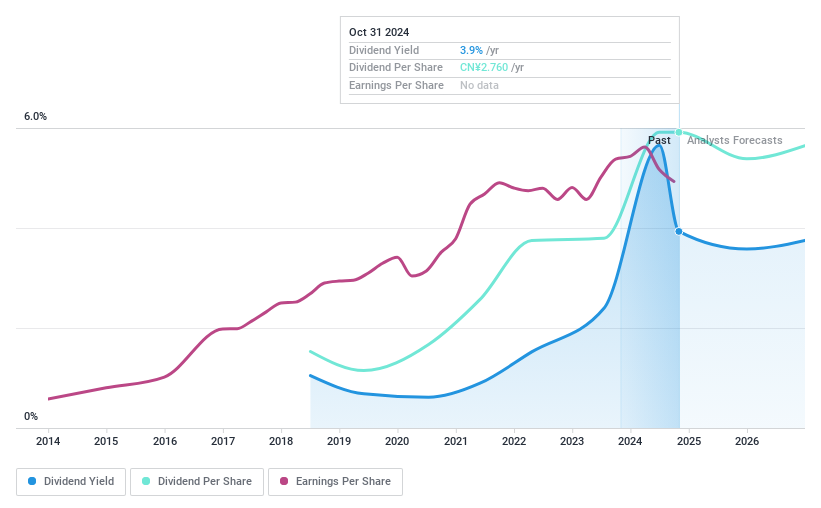

Oppein Home Group (SHSE:603833)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oppein Home Group Inc. is a cabinetry manufacturer based in Asia with a market capitalization of approximately CN¥42.77 billion.

Operations: Oppein Home Group Inc. generates its revenue primarily from Building Products, totaling CN¥20.10 billion.

Dividend Yield: 3.9%

Oppein Home Group's dividend yield of 3.91% ranks in the top 25% of CN market dividend payers, supported by a payout ratio of 61.1%, indicating coverage by earnings. However, its dividends have been volatile over the past six years and not consistently reliable or growing. Recent financials show a decline in sales to CNY 13.88 billion from CNY 16.56 billion year-over-year, with net income also decreasing slightly to CNY 2.03 billion from CNY 2.31 billion.

- Delve into the full analysis dividend report here for a deeper understanding of Oppein Home Group.

- According our valuation report, there's an indication that Oppein Home Group's share price might be on the cheaper side.

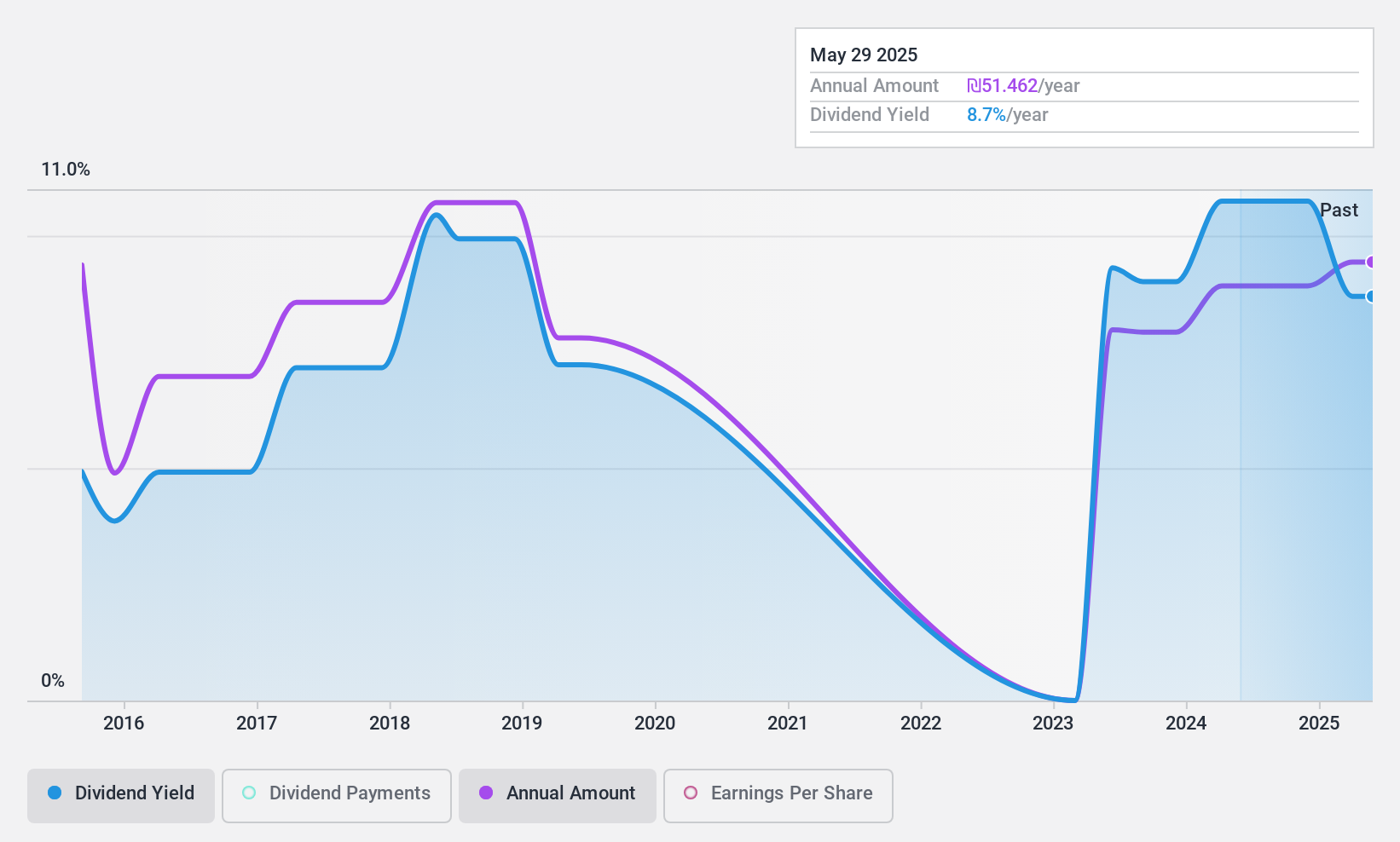

Delek Group (TASE:DLEKG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Delek Group Ltd. is an energy company involved in the exploration, development, production, and marketing of oil and gas both in Israel and internationally, with a market cap of ₪8.94 billion.

Operations: Delek Group Ltd.'s revenue primarily comes from the development and production of oil and gas assets in the North Sea, generating ₪6.45 billion, and oil and gas exploration and production in Israel and its surroundings, contributing ₪3.74 billion.

Dividend Yield: 10%

Delek Group's dividend yield of 9.98% is among the top 25% in the IL market, supported by a payout ratio of 85.4%, indicating coverage by earnings. Despite a low cash payout ratio of 24.7%, suggesting strong cash flow support, its dividend history has been volatile and unreliable over the past decade. Recent financials reveal a decline in Q3 sales to ILS 2.59 billion from ILS 3.07 billion year-over-year, with net income decreasing to ILS 403 million from ILS 547 million.

- Take a closer look at Delek Group's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Delek Group is priced lower than what may be justified by its financials.

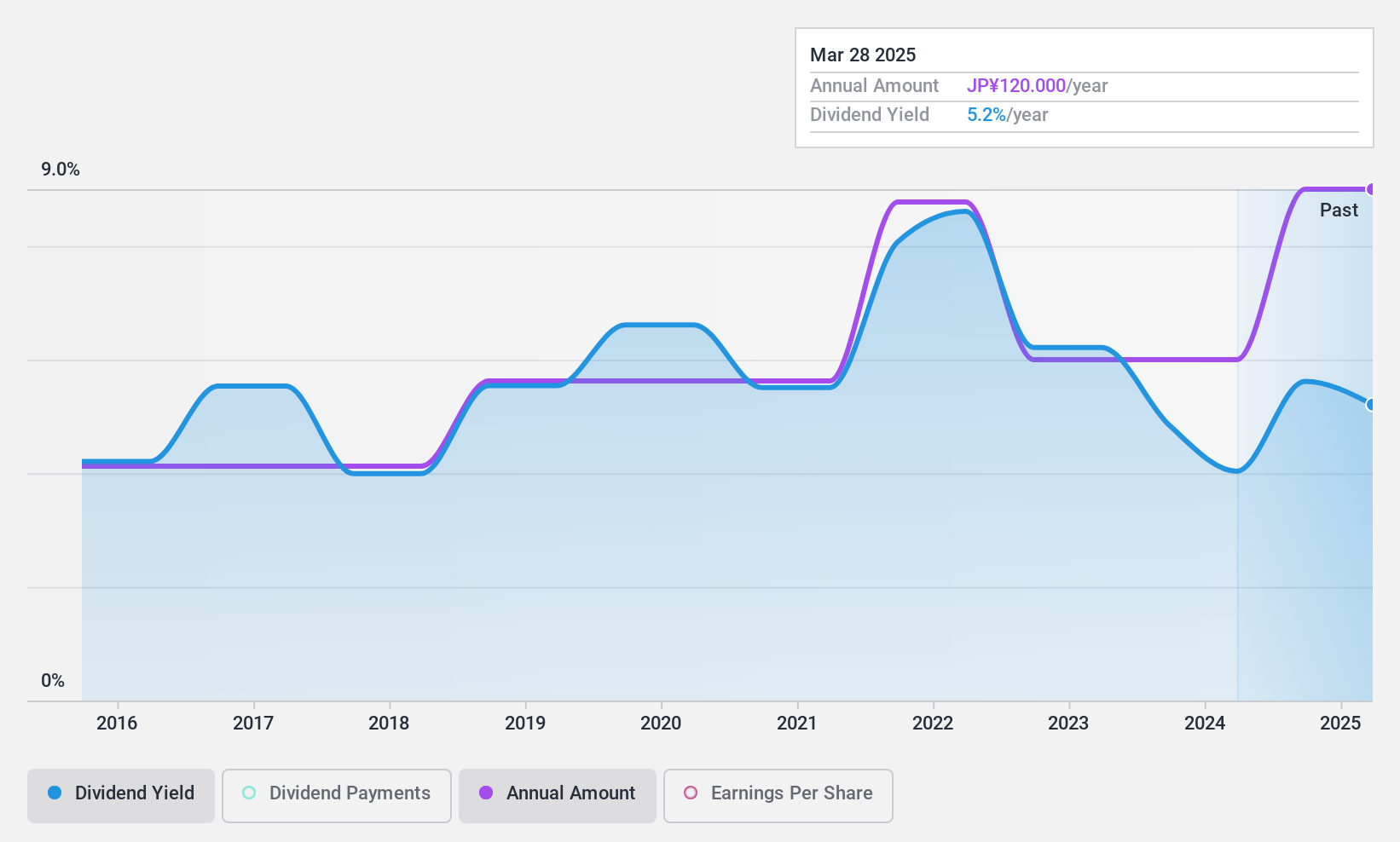

IwaiCosmo Holdings (TSE:8707)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IwaiCosmo Holdings, Inc., along with its subsidiaries, offers financial services leveraging information technology in Japan and has a market capitalization of approximately ¥54.17 billion.

Operations: IwaiCosmo Holdings, Inc.'s revenue is primarily derived from its subsidiary Iwai Cosmo Securities Ltd., contributing ¥25.23 billion, followed by Iwai Cosmo Holdings Ltd. with ¥2.88 billion.

Dividend Yield: 5.2%

IwaiCosmo Holdings offers a dividend yield of 5.2%, placing it in the top 25% of Japanese dividend payers, yet its high cash payout ratio of 270.5% signals inadequate cash flow coverage. Despite trading at good value, with shares priced 14.4% below estimated fair value, dividends have been volatile and unreliable over the past decade. While earnings grew by ¥45 billion last year and are expected to rise modestly, dividend sustainability remains a concern due to inconsistent coverage by free cash flows.

- Dive into the specifics of IwaiCosmo Holdings here with our thorough dividend report.

- Our valuation report unveils the possibility IwaiCosmo Holdings' shares may be trading at a discount.

Turning Ideas Into Actions

- Click this link to deep-dive into the 1963 companies within our Top Dividend Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8707

IwaiCosmo Holdings

Provides financial services using information technology in Japan.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives