- Japan

- /

- Capital Markets

- /

- TSE:8707

None Unveiling 3 Hidden Small Caps with Strong Fundamentals

Reviewed by Simply Wall St

As global markets continue to rally, with major indices like the S&P 500 reaching new highs amid optimism over trade policies and AI advancements, small-cap stocks are experiencing a more subdued performance compared to their larger counterparts. Despite this, the economic landscape presents opportunities for discerning investors who focus on strong fundamentals in smaller companies. In such a climate, identifying stocks with robust financial health and growth potential can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Yantai Ishikawa Sealing Technology | NA | 0.96% | -9.28% | ★★★★★★ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret | 18.55% | 49.85% | 71.73% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Maezawa Kasei Industries | 0.81% | 2.30% | 18.80% | ★★★★★★ |

| Shandong Boyuan Pharmaceutical & Chemical | NA | 28.20% | 32.92% | ★★★★★★ |

| Center International GroupLtd | 27.06% | 1.89% | -39.77% | ★★★★★★ |

| Master Trust | 33.35% | 28.01% | 41.50% | ★★★★★☆ |

| Poly Plastic Masterbatch (SuZhou)Ltd | 2.80% | 17.08% | -4.11% | ★★★★★☆ |

| Zhejiang E-P Equipment | 15.30% | 21.69% | 32.47% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Shanghai INT Medical Instruments (SEHK:1501)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai INT Medical Instruments Co., Ltd. specializes in the development and manufacturing of medical devices, particularly focusing on cardiovascular interventional products, with a market capitalization of HK$4.93 billion.

Operations: Shanghai INT Medical Instruments generates revenue primarily from its cardiovascular interventional business, amounting to CN¥718.71 million. The company exhibits a market capitalization of HK$4.93 billion.

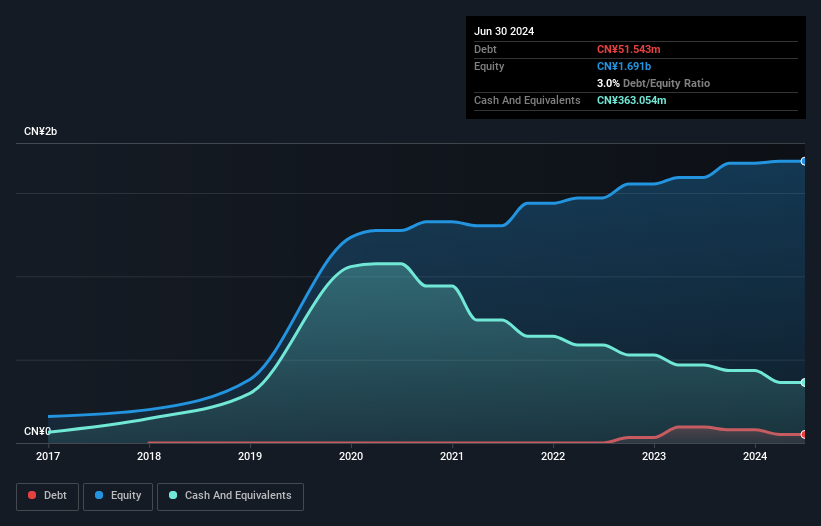

Shanghai INT Medical Instruments, a smaller player in the medical equipment sector, has shown resilience with earnings growth of 5.3% over the past year, outpacing the industry's -4.3%. Despite a modest increase in its debt to equity ratio from 0% to 3% over five years, it seems well-positioned financially with more cash than total debt and sufficient interest coverage. Recent levered free cash flow figures indicate a turnaround from negative values to US$26.93 million by mid-2024, suggesting improved operational efficiency and potential for future expansion within its market niche.

Kagome (TSE:2811)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kagome Co., Ltd. is engaged in the manufacturing, purchasing, and selling of food products both in Japan and internationally, with a market cap of ¥266.21 billion.

Operations: Kagome generates revenue primarily from the manufacturing and sale of food products both domestically and internationally. The company focuses on optimizing its cost structure to enhance profitability. Its financial performance is highlighted by a net profit margin trend that reflects its strategic initiatives in managing expenses effectively.

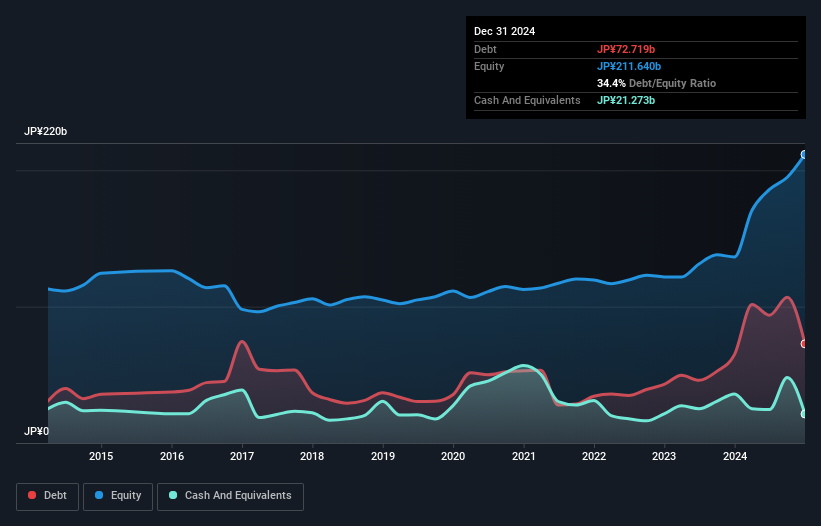

Kagome, a modestly-sized player in the food industry, has shown impressive earnings growth of 99.7% over the past year, outpacing the industry's 20.1%. The company's net debt to equity ratio stands at a satisfactory 30.2%, with interest payments well-covered by EBIT at 15.9 times coverage. Trading at nearly half its estimated fair value, Kagome appears undervalued compared to peers and industry benchmarks. Recent announcements include a special dividend of JPY 10 per share and an increase in regular dividends to JPY 42 per share for fiscal year-end December 2024, reflecting confidence in ongoing profitability and financial health.

- Click here and access our complete health analysis report to understand the dynamics of Kagome.

Gain insights into Kagome's historical performance by reviewing our past performance report.

IwaiCosmo Holdings (TSE:8707)

Simply Wall St Value Rating: ★★★★★☆

Overview: IwaiCosmo Holdings, Inc., along with its subsidiaries, offers financial services leveraging information technology in Japan and has a market capitalization of approximately ¥52.24 billion.

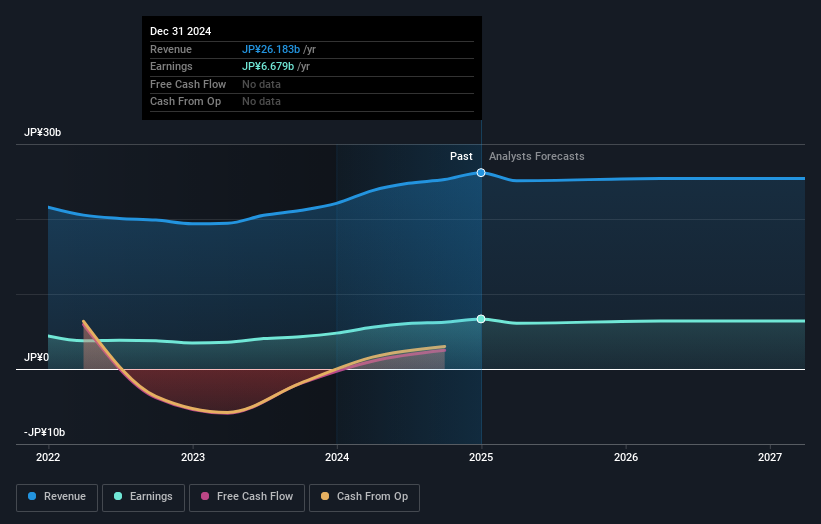

Operations: IwaiCosmo Holdings generates revenue primarily through Iwai Cosmo Securities Ltd., contributing ¥25.23 billion, and Iwai Cosmo Holdings Ltd., adding ¥2.88 billion. The company's net profit margin is a key financial indicator to consider for assessing profitability trends.

IwaiCosmo Holdings, a financial entity with a knack for flying under the radar, shows promising attributes. Its earnings surged 45% last year, outpacing the Capital Markets industry's 28% growth rate. The company has successfully trimmed its debt to equity ratio from 26% to 16% over five years, indicating prudent financial management. Trading at about 3.5% below estimated fair value suggests potential upside in valuation compared to peers. With high-quality earnings and more cash than total debt, IwaiCosmo seems well-positioned in its industry landscape despite insufficient data on interest coverage by EBIT.

- Delve into the full analysis health report here for a deeper understanding of IwaiCosmo Holdings.

Explore historical data to track IwaiCosmo Holdings' performance over time in our Past section.

Key Takeaways

- Click here to access our complete index of 4668 Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8707

IwaiCosmo Holdings

Provides financial services using information technology in Japan.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion