- Japan

- /

- Oil and Gas

- /

- TSE:5019

Discover 3 Dividend Stocks Yielding Between 3% And 6.4%

Reviewed by Simply Wall St

In a week marked by a flurry of earnings reports and economic data, global markets have experienced notable fluctuations, with major indexes like the Nasdaq Composite and S&P MidCap 400 reaching highs before retreating. Amid this backdrop of uncertainty, investors often turn to dividend stocks as a potential source of steady income. In today's market environment, characterized by cautious optimism and mixed signals from both economic indicators and corporate earnings, selecting dividend stocks yielding between 3% and 6.4% can provide an appealing balance between risk and reward for those seeking reliable returns in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.86% | ★★★★★★ |

| Globeride (TSE:7990) | 4.12% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.97% | ★★★★★★ |

| Innotech (TSE:9880) | 4.86% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.22% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.57% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.10% | ★★★★★★ |

Click here to see the full list of 2037 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

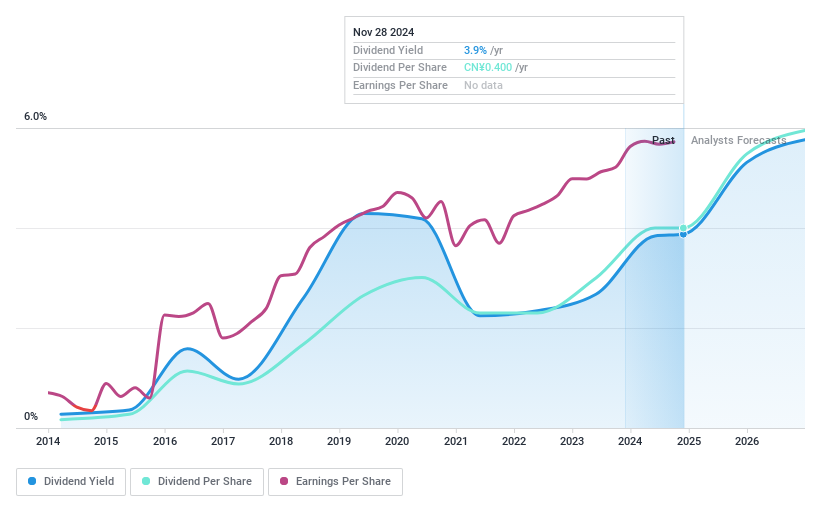

Sinoma International EngineeringLtd (SHSE:600970)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sinoma International Engineering Co., Ltd operates in engineering, equipment manufacturing and supply both in China and internationally, with a market cap of CN¥27.93 billion.

Operations: Sinoma International Engineering Co., Ltd generates revenue primarily from its Heavy Construction segment, amounting to CN¥46.02 billion.

Dividend Yield: 3.8%

Sinoma International Engineering Ltd. reported a slight increase in sales and net income for the nine months ending September 2024, with earnings per share improving marginally. Despite being valued below its estimated fair value and offering a top-tier dividend yield of 3.78% in the Chinese market, its dividend history is marked by volatility and unreliability over the past decade. However, dividends are well-covered by earnings and cash flows, suggesting sustainability despite past inconsistencies.

- Dive into the specifics of Sinoma International EngineeringLtd here with our thorough dividend report.

- According our valuation report, there's an indication that Sinoma International EngineeringLtd's share price might be on the cheaper side.

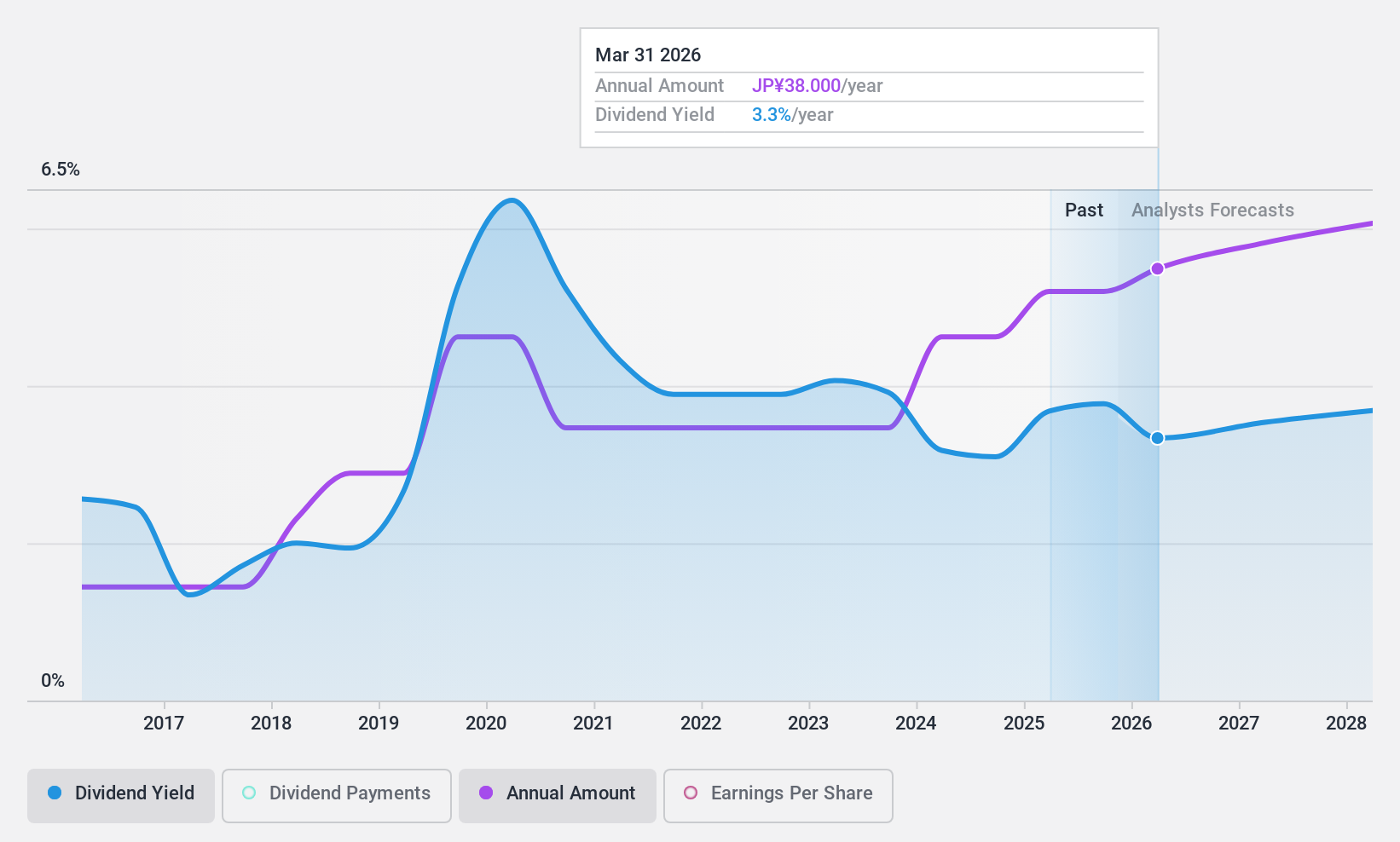

Idemitsu KosanLtd (TSE:5019)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Idemitsu Kosan Co., Ltd. operates in the petroleum, basic chemicals, functional materials, power and renewable energy, and resources sectors both in Japan and internationally, with a market cap of ¥1.38 trillion.

Operations: Idemitsu Kosan Co., Ltd.'s revenue is primarily derived from its petroleum segment at ¥7.56 billion, followed by basic chemicals at ¥677.84 million, highly functional materials at ¥545.62 million, resources at ¥325.94 million, and electricity and renewable energy at ¥141.51 million.

Dividend Yield: 3.1%

Idemitsu Kosan Ltd. offers a reliable dividend yield of 3.07%, supported by low payout ratios from both earnings (16.1%) and cash flows (14.1%), indicating strong coverage and sustainability. The company's dividends have been stable over the past decade, though its yield is lower than top-tier payers in Japan. Recent developments include strategic moves in sustainable aviation fuel production and carbon capture projects, reflecting a commitment to innovation amidst industry challenges such as high debt levels.

- Click here and access our complete dividend analysis report to understand the dynamics of Idemitsu KosanLtd.

- Our valuation report unveils the possibility Idemitsu KosanLtd's shares may be trading at a discount.

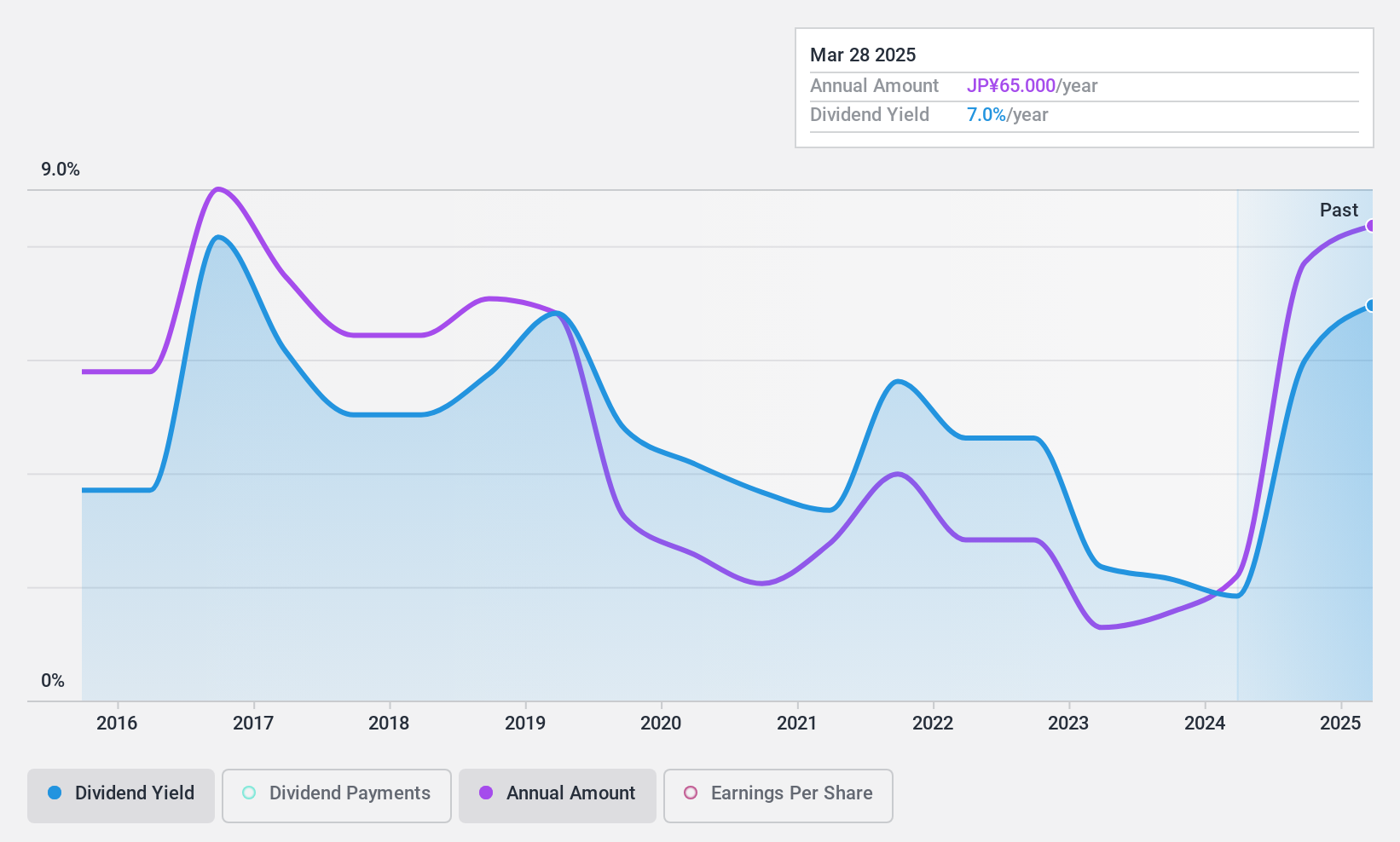

Marusan Securities (TSE:8613)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Marusan Securities Co., Ltd. operates in the financial products trading sector in Japan and has a market cap of ¥61.84 billion.

Operations: Marusan Securities Co., Ltd. generates revenue through its operations in the financial products trading business within Japan.

Dividend Yield: 6.4%

Marusan Securities provides a high dividend yield of 6.4%, placing it among the top 25% in Japan, with dividends well-covered by earnings and cash flows (payout ratios of 42.2% and 56.7% respectively). However, its dividend history is marked by volatility and lack of growth over the past decade, making reliability a concern for investors seeking stable income streams. Recent earnings announcements may offer insights into future performance stability.

- Unlock comprehensive insights into our analysis of Marusan Securities stock in this dividend report.

- In light of our recent valuation report, it seems possible that Marusan Securities is trading beyond its estimated value.

Make It Happen

- Delve into our full catalog of 2037 Top Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5019

Idemitsu KosanLtd

Engages in the petroleum, basic chemicals, functional materials, power and renewable energy, and resources businesses in Japan and internationally.

Excellent balance sheet established dividend payer.