- Japan

- /

- Electrical

- /

- TSE:5659

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors are witnessing a mixed performance across various sectors, with financials and energy benefiting from deregulation hopes while healthcare faces challenges. Amidst this backdrop of fluctuating market dynamics and interest rate speculations, dividend stocks emerge as an attractive option for those seeking steady income streams. A good dividend stock typically offers a reliable payout history and potential for growth, making it an appealing choice in today's unpredictable economic climate.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.12% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.63% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.18% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.79% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.80% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.51% | ★★★★★★ |

Click here to see the full list of 1969 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

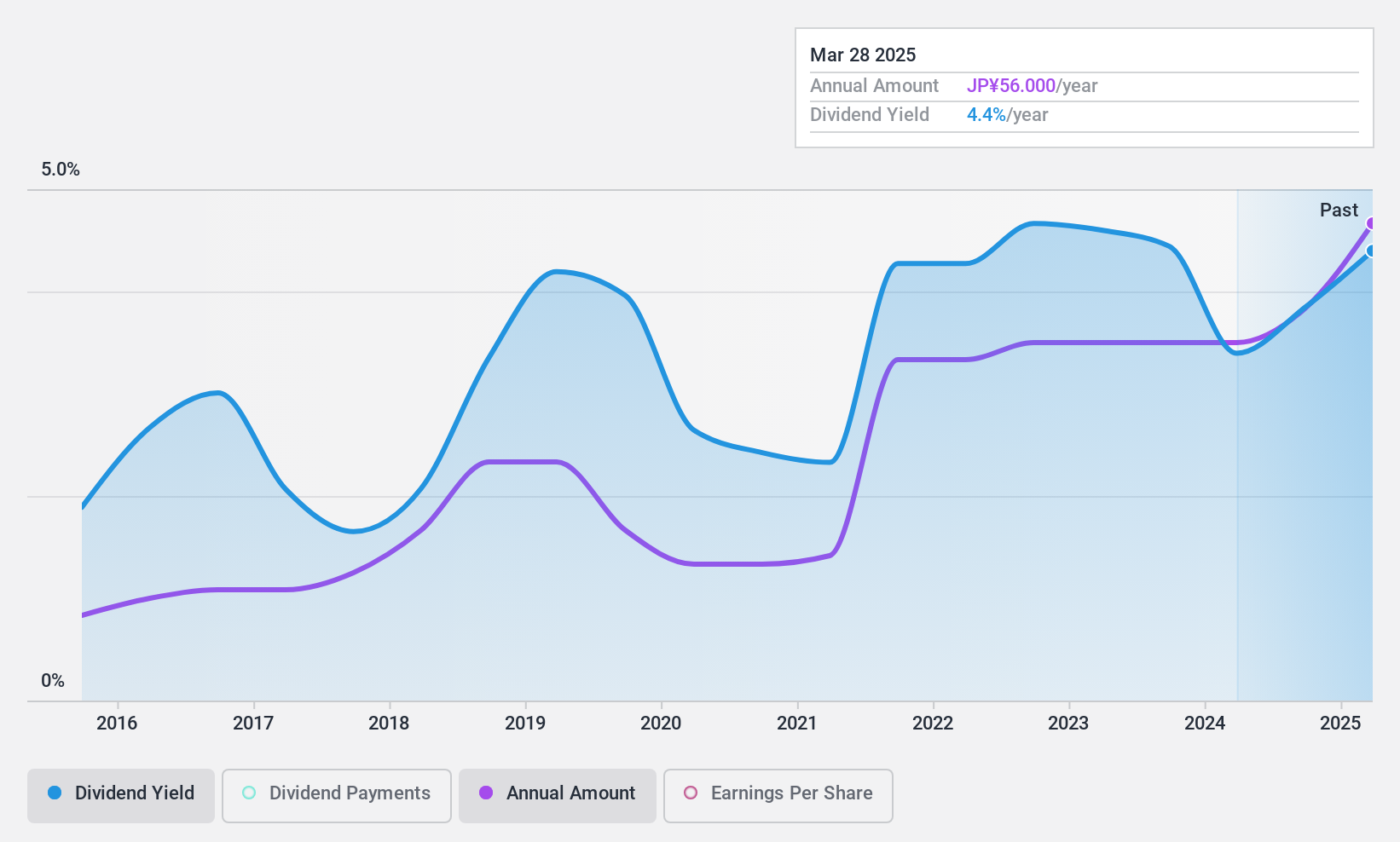

Nippon SeisenLtd (TSE:5659)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Seisen Co., Ltd. manufactures and sells stainless steel wires both in Japan and internationally, with a market cap of ¥39.66 billion.

Operations: Nippon Seisen Co., Ltd.'s revenue primarily comes from its manufacturing and sales of stainless steel wires in both domestic and international markets.

Dividend Yield: 4.3%

Nippon Seisen Ltd. recently announced a significant reduction in its dividend to ¥28.00 per share from ¥105.00 a year ago, reflecting volatility in its dividend payments over the past decade. Despite earnings growth of 12.9% annually over five years and trading below estimated fair value, the high payout ratio of 194.5% suggests dividends are not well covered by earnings, raising concerns about sustainability despite being among the top 25% yielders in Japan.

- Take a closer look at Nippon SeisenLtd's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Nippon SeisenLtd is trading beyond its estimated value.

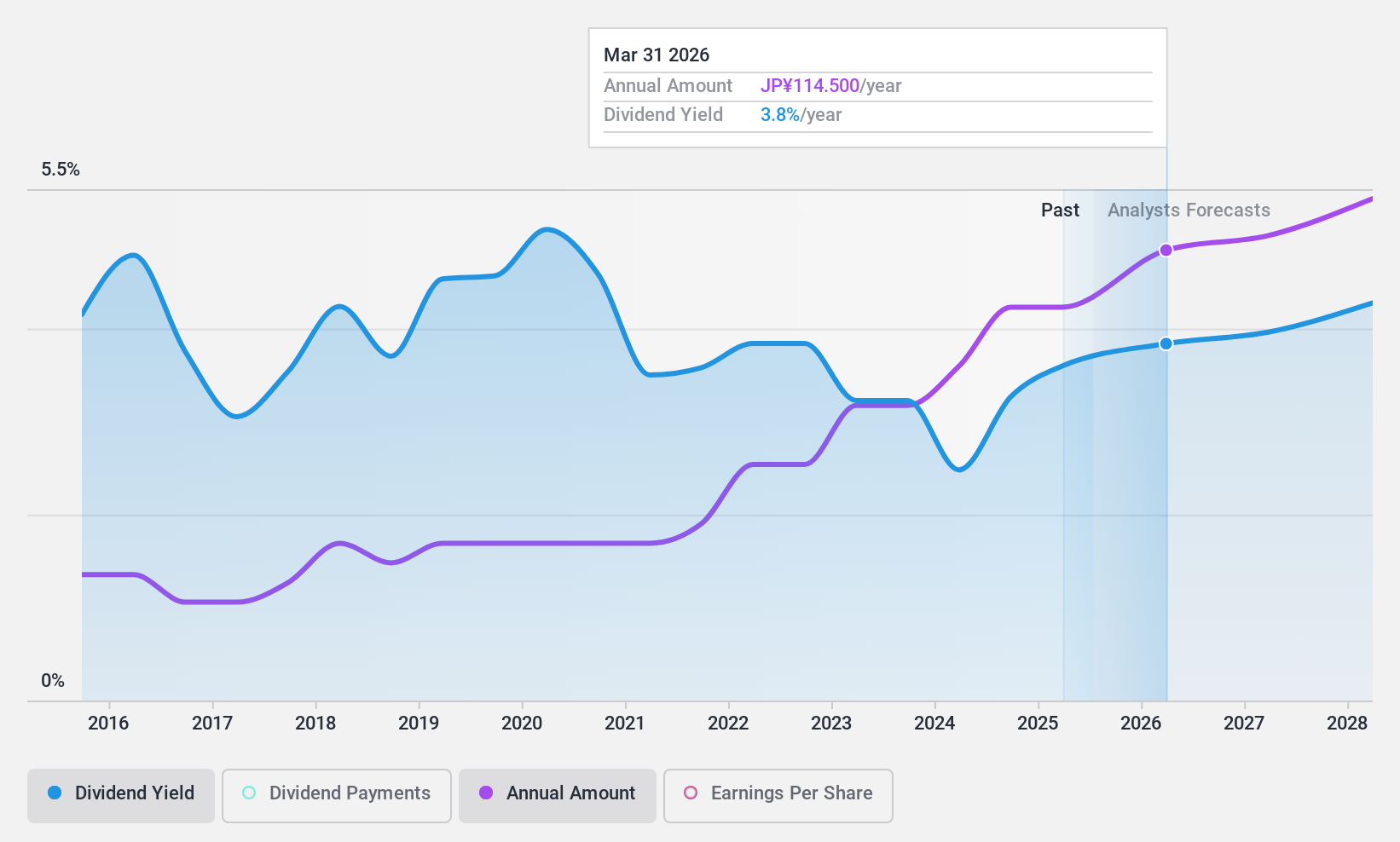

Mitsui (TSE:8031)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitsui & Co., Ltd. is a global trading and investment company with a market capitalization of approximately ¥9.57 trillion.

Operations: Mitsui & Co., Ltd. generates revenue through several key segments, including Energy (¥3.61 billion), Chemicals (¥2.91 billion), Lifestyle (¥3.25 billion), Iron & Steel Products (¥667.31 million), Mineral & Metal Resources (¥2.09 billion), Machinery & Infrastructure (¥1.46 billion), and Innovation & Corporate Development (¥285.17 million).

Dividend Yield: 3.1%

Mitsui & Co., Ltd. has announced an interim dividend of ¥50 per share, supported by a low payout ratio of 27.1%, indicating dividends are well covered by earnings and cash flows. Despite a volatile dividend history over the past decade, recent increases suggest growth potential. However, its dividend yield is lower than Japan's top 25% payers. The company raised its profit guidance for fiscal year-end March 2025 to ¥920 billion, reflecting positive financial prospects amidst strategic share buybacks and debt levels.

- Click here and access our complete dividend analysis report to understand the dynamics of Mitsui.

- The valuation report we've compiled suggests that Mitsui's current price could be quite moderate.

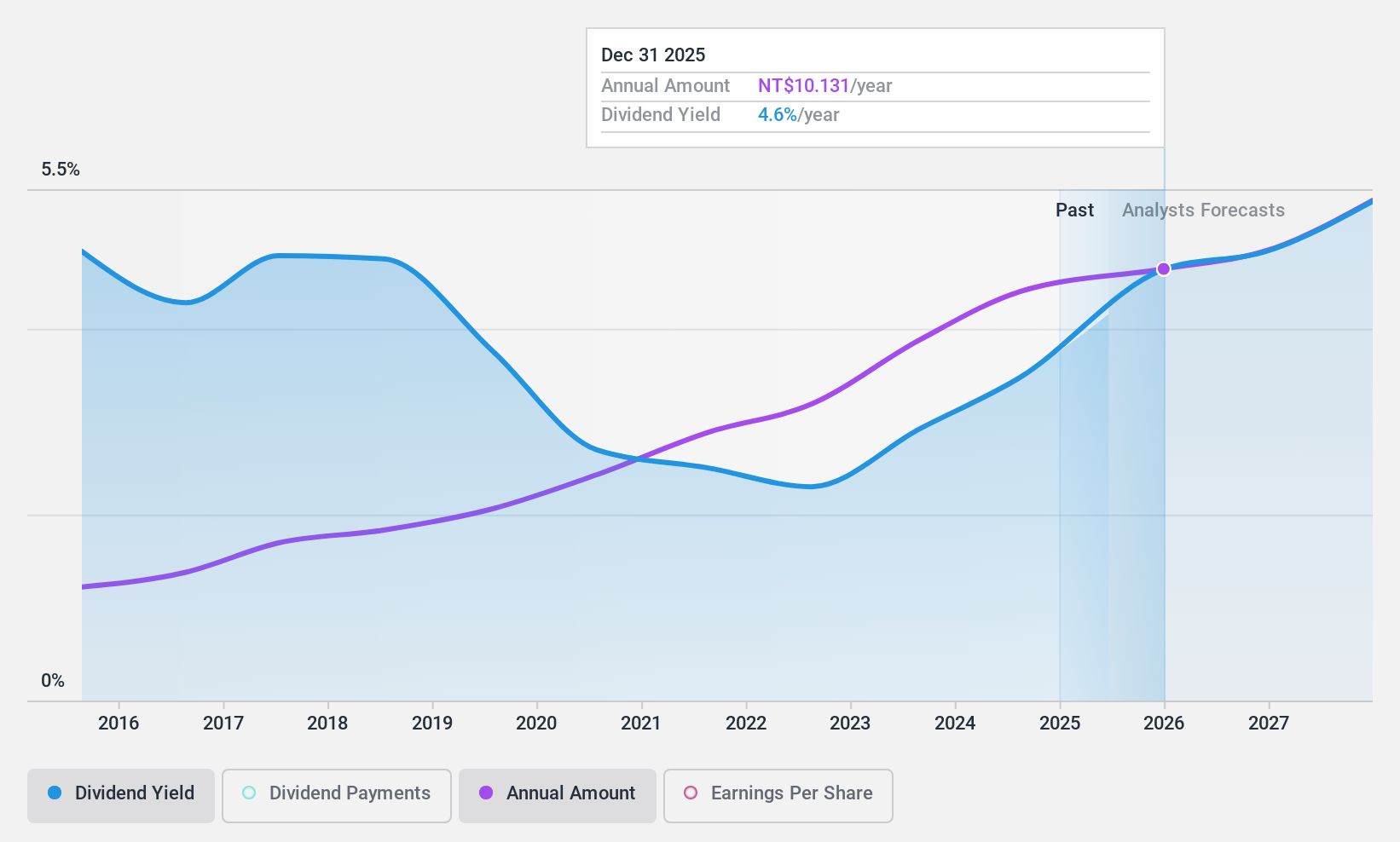

SINBON Electronics (TWSE:3023)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SINBON Electronics Co., Ltd. manufactures and sells computer peripherals, connectors, wires, and other parts across Mainland China, Hong Kong, the United States, Taiwan, and internationally with a market cap of NT$62.54 billion.

Operations: SINBON Electronics Co., Ltd.'s revenue is primarily derived from Industrial Applications (NT$10.25 billion), Green Energy (NT$9.99 billion), Communication (NT$7.57 billion), Automotive and Aerospace (NT$5.21 billion), and Healthcare (NT$2.92 billion) segments.

Dividend Yield: 3.7%

SINBON Electronics offers a stable dividend history with growth over the past decade, though its 3.68% yield is below Taiwan's top quartile. The payout ratio of 67.8% suggests dividends are covered by earnings but not by free cash flow, indicating potential sustainability concerns. Recent earnings show steady growth, with Q3 net income rising to TWD 949.09 million from TWD 878.3 million year-on-year, supporting its dividend strategy amidst ongoing product innovation and market expansion efforts in Europe.

- Dive into the specifics of SINBON Electronics here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that SINBON Electronics is priced lower than what may be justified by its financials.

Taking Advantage

- Delve into our full catalog of 1969 Top Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon SeisenLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5659

Nippon SeisenLtd

Manufactures and sells stainless steel wires in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives