- Japan

- /

- Capital Markets

- /

- TSE:8604

Nomura Holdings (TSE:8604) Increases Dividend to JPY 23, Eyes Avendus Capital M&A for Growth

Reviewed by Simply Wall St

Nomura Holdings (TSE:8604) has demonstrated impressive financial performance, with a notable earnings growth of 106.7% over the past year and a recent dividend increase to JPY 23 per share, reflecting its commitment to shareholder returns. However, the company faces challenges such as forecasted revenue and earnings declines, and its strategic participation in M&A discussions for Avendus Capital highlights its efforts to expand market presence amidst these hurdles. Readers can expect a deeper dive into Nomura's strategic initiatives, financial health, and the potential impact of market dynamics in the discussion that follows.

Unlock comprehensive insights into our analysis of Nomura Holdings stock here.

Competitive Advantages That Elevate Nomura Holdings

With earnings growth of 106.7% over the past year, Nomura Holdings has outpaced the Capital Markets industry average of 35.2%, showcasing its financial performance. The company's net profit margin improved to 15.4% from 9.3% last year, reflecting high-quality earnings. This financial health is further bolstered by a strong cash position relative to debt, ensuring stability. The management team, with an average tenure of 3.5 years, contributes significantly to strategic goals, leveraging their experience to navigate complex market dynamics. Additionally, the recent dividend increase to JPY 23 per share from JPY 8 underscores a commitment to shareholder returns, supported by a sustainable payout ratio of 41.2%.

Learn about Nomura Holdings's dividend strategy and how it impacts shareholder returns and financial stability.Challenges Constraining Nomura Holdings's Potential

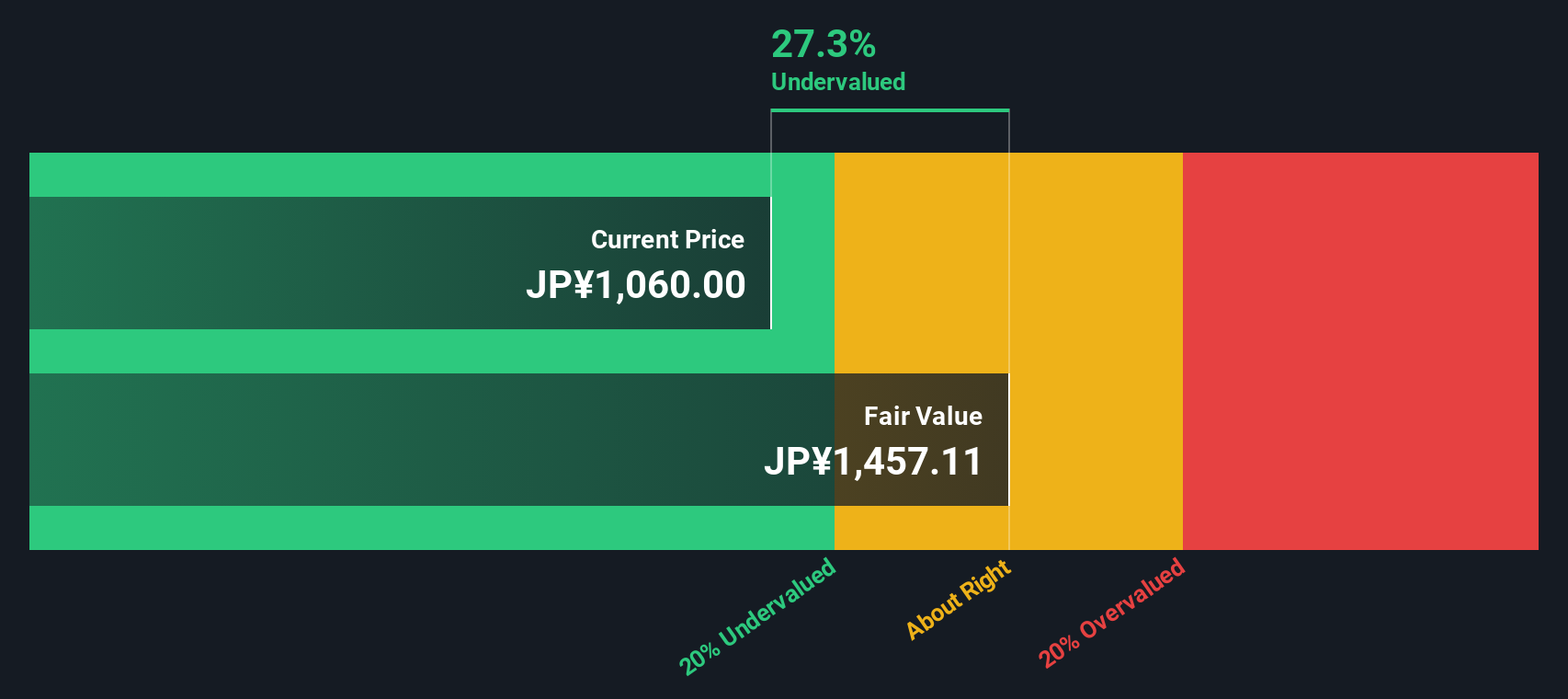

Despite its strong earnings, the company faces challenges with expected revenue and earnings declines over the next three years, at rates of 1% and 0.4% annually. The Return on Equity stands at 8.4%, below the industry benchmark of 20%, indicating room for improvement. The dividend yield of 2.96% is lower than the top 25% of dividend payers in the JP market, and its volatility over the past decade raises concerns about consistency. Moreover, the company is trading at a significant discount to its estimated fair value, with a Price-To-Earnings Ratio of 8.4x, suggesting potential undervaluation amidst these financial challenges.

To dive deeper into how Nomura Holdings's valuation metrics are shaping its market position, check out our detailed analysis of Nomura Holdings's Valuation.Future Prospects for Nomura Holdings in the Market

Opportunities for growth are evident as Nomura Holdings trades at a 43.9% discount to its estimated fair value, presenting potential upside if earnings and revenue stabilize. The firm's strategic moves, such as participating in M&A discussions for Avendus Capital, highlight its intent to expand its market presence. Additionally, hosting events like the Nomura Korea Consumer Corporate Day in Singapore and Hong Kong reflects efforts to strengthen strategic alliances and tap into new markets, which could enhance its competitive position.

See what the latest analyst reports say about Nomura Holdings's future prospects and potential market movements.Key Risks and Challenges That Could Impact Nomura Holdings's Success

While aiming for growth, Nomura faces threats from forecasted earnings declines, which could affect investor sentiment and share price stability. The recent volatility in its share price over the past three months poses a risk to investors. Furthermore, the competitive environment requires differentiation, as noted in the latest earnings call, where market competition and regulatory hurdles were discussed as significant challenges. These external factors necessitate strategic vigilance to maintain market share and ensure long-term success.

To gain deeper insights into Nomura Holdings's historical performance, explore our detailed analysis of past performance.Conclusion

Nomura Holdings has demonstrated impressive earnings growth and improved profit margins, signaling strong financial health and effective management strategies. However, the anticipated declines in revenue and earnings, coupled with a Return on Equity below industry standards, highlight areas needing strategic focus. The company's current trading price, significantly lower than its estimated fair value with a Price-To-Earnings Ratio of 8.4x, suggests a potential opportunity for investors if the firm can stabilize its financial trajectory. Nomura's strategic initiatives, including market expansion efforts and M&A activities, could enhance its competitive position, yet the company must address external challenges and investor concerns to fully capitalize on its market potential and improve shareholder returns.

Summing It All Up

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Nomura Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSE:8604

Nomura Holdings

Provides various financial services to individuals, corporations, financial institutions, governments, and governmental agencies worldwide.

Undervalued with proven track record and pays a dividend.