As global markets react to the recent U.S. election results and a Federal Reserve rate cut, major indices like the S&P 500 have reached record highs, driven by investor optimism over potential economic growth and tax reforms. In this dynamic environment, dividend stocks offering yields of at least 3% can provide a stable income stream while potentially benefiting from favorable market conditions. A good dividend stock typically combines consistent payouts with strong fundamentals, making it an attractive option for investors seeking both income and resilience amidst changing economic landscapes.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.51% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.79% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.69% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.44% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.88% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.13% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.39% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.49% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.90% | ★★★★★★ |

Click here to see the full list of 1956 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

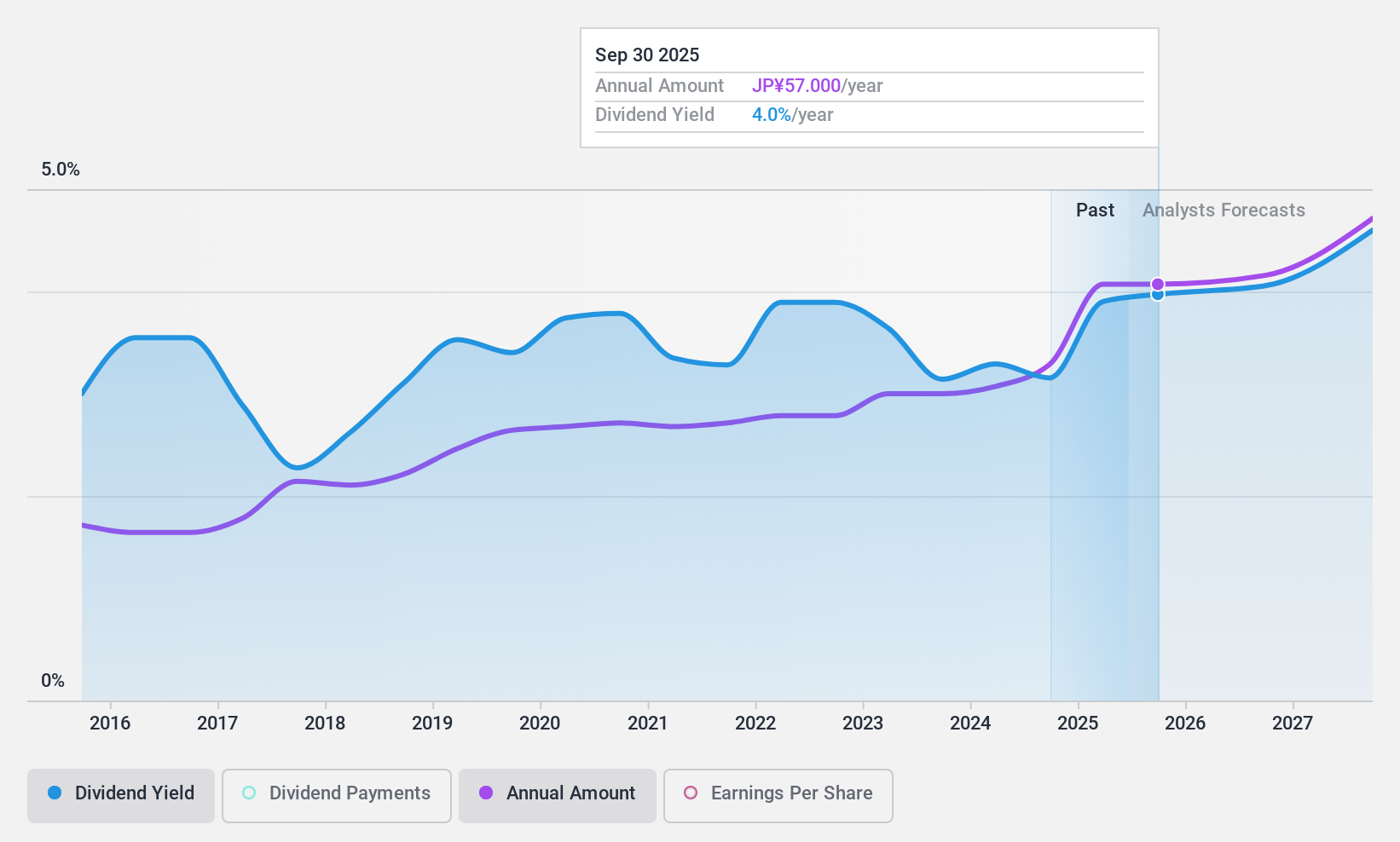

Sanyo Trading (TSE:3176)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sanyo Trading Co., Ltd. operates through its subsidiaries in the rubber, chemical, green technology, industrial products, and life science sectors both in Japan and internationally, with a market cap of ¥43.45 billion.

Operations: Sanyo Trading Co., Ltd.'s revenue is primarily derived from its Chemical Products segment at ¥46.67 billion, Overseas Subsidiary at ¥37.30 billion, and Mechanical Materials at ¥54.19 billion.

Dividend Yield: 3%

Sanyo Trading's dividend payments are well-supported, with a low payout ratio of 21.8% and a cash payout ratio of 27.9%, ensuring sustainability through earnings and cash flows. Over the past decade, dividends have been stable and reliable, though its yield of 3.01% is below Japan's top quartile threshold of 3.79%. The stock trades at good value relative to peers, significantly below its fair value estimate, with earnings growth projected at 7.51% annually.

- Click here to discover the nuances of Sanyo Trading with our detailed analytical dividend report.

- Our expertly prepared valuation report Sanyo Trading implies its share price may be lower than expected.

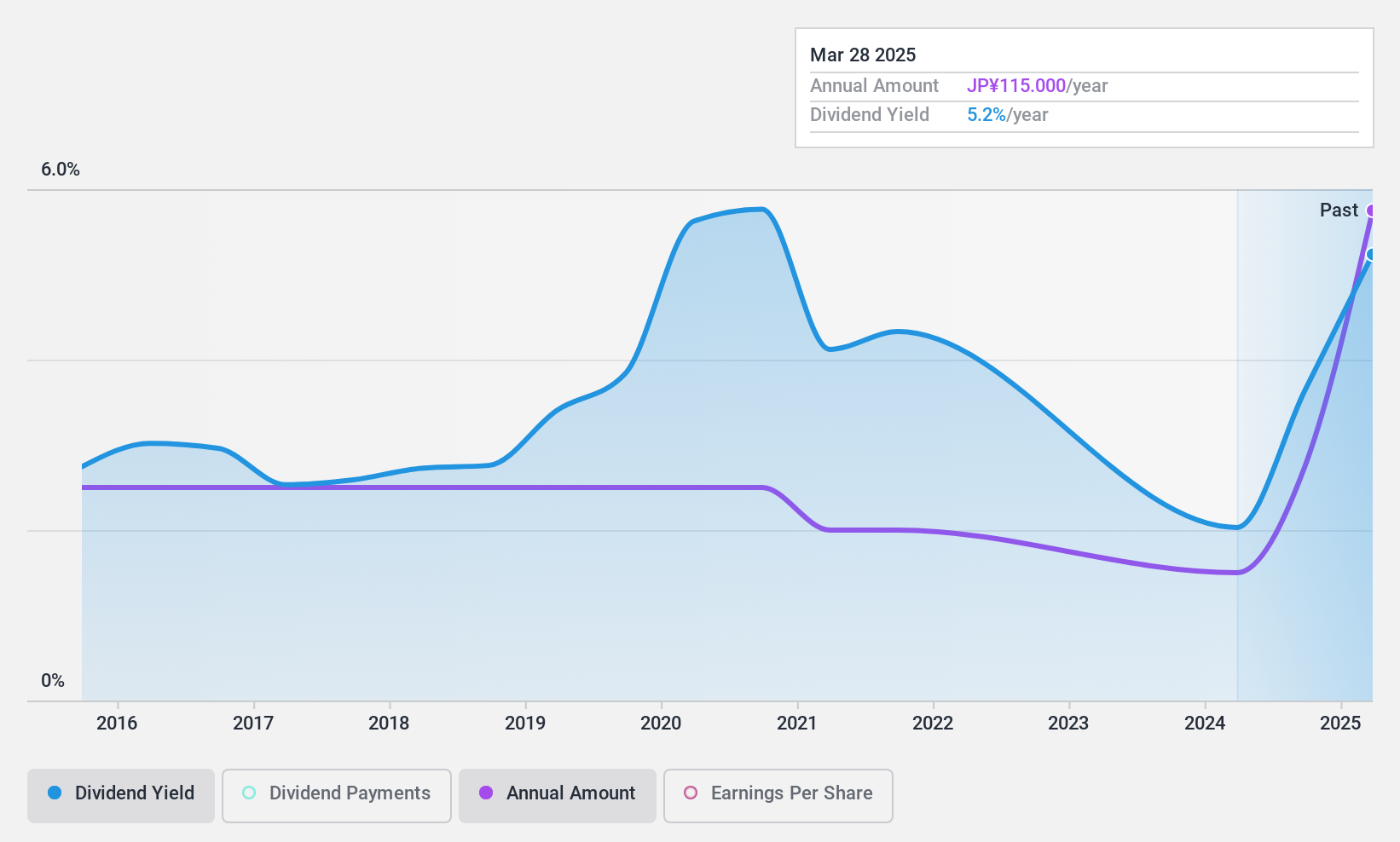

Nihon Yamamura Glass (TSE:5210)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nihon Yamamura Glass Co., Ltd. produces and sells glass bottles and plastic closures both in Japan and internationally, with a market cap of ¥16.55 billion.

Operations: Nihon Yamamura Glass Co., Ltd. generates revenue from the production and sale of glass bottles and plastic closures in both domestic and international markets.

Dividend Yield: 3.3%

Nihon Yamamura Glass's dividend payments are well-covered, with a payout ratio of 10.2% and a cash payout ratio of 17.6%, indicating sustainability through earnings and cash flows. However, dividends have been volatile over the past decade, lacking reliability. Despite this, dividends have shown growth in the same period. The yield stands at 3.33%, below Japan's top quartile benchmark of 3.79%. The stock trades significantly below its estimated fair value, offering potential value to investors.

- Delve into the full analysis dividend report here for a deeper understanding of Nihon Yamamura Glass.

- Upon reviewing our latest valuation report, Nihon Yamamura Glass' share price might be too pessimistic.

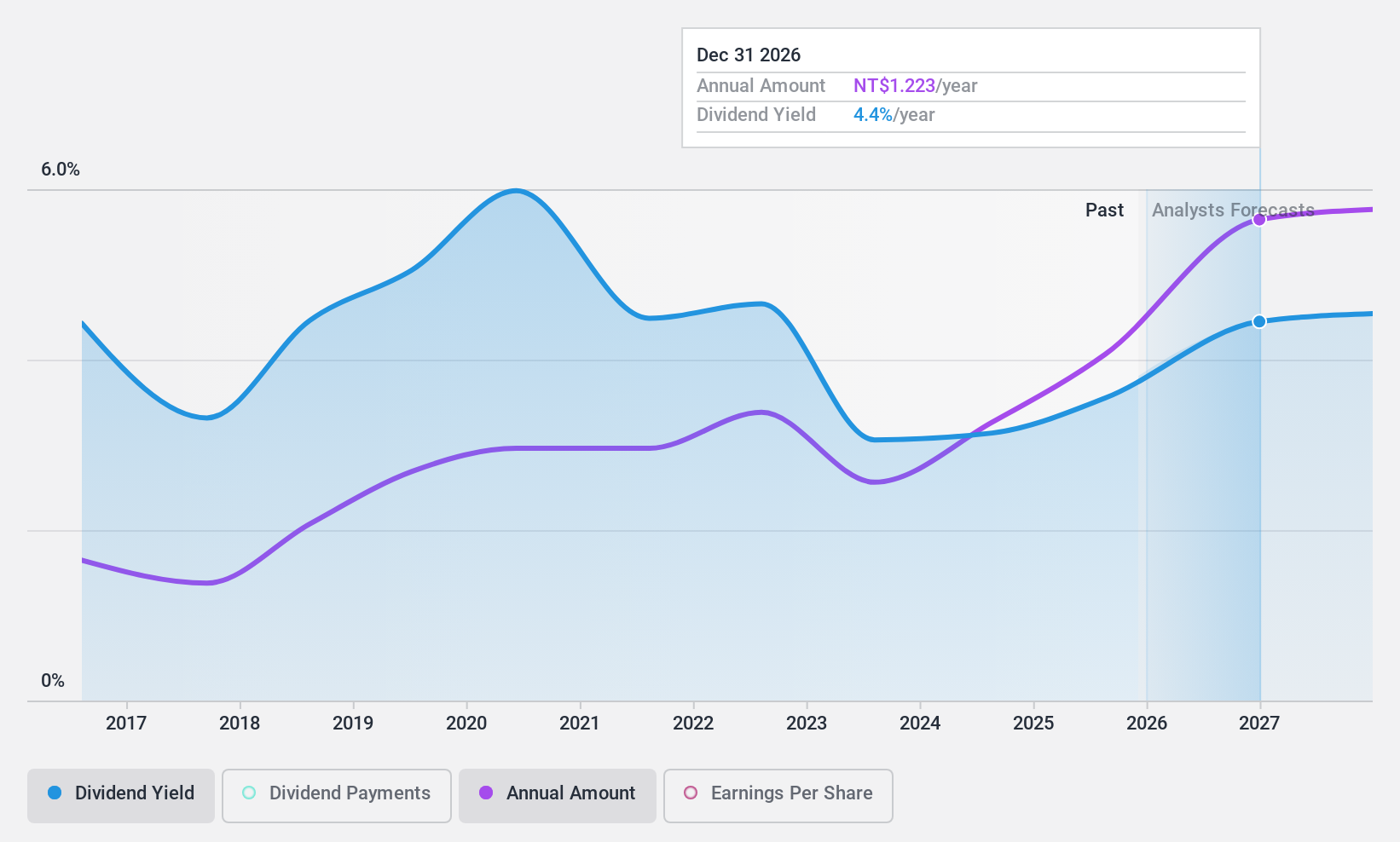

SinoPac Financial Holdings (TWSE:2890)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SinoPac Financial Holdings Company Limited operates globally through its subsidiaries, offering services in banking, securities, investment, leasing, and venture capital with a market cap of NT$288.20 billion.

Operations: SinoPac Financial Holdings generates revenue primarily from its Banking Business, which accounts for NT$41.52 billion, and its Securities Business, contributing NT$14.75 billion.

Dividend Yield: 3.1%

SinoPac Financial Holdings' dividend payments are supported by a low payout ratio of 42.5%, suggesting sustainability through earnings, with forecasts indicating similar coverage in three years (48.1%). However, the dividends have been volatile and unreliable over the past decade despite growth during this period. The current yield of 3.08% is below Taiwan's top quartile benchmark of 4.52%. The stock trades at a discount to its estimated fair value, potentially offering value to investors.

- Dive into the specifics of SinoPac Financial Holdings here with our thorough dividend report.

- According our valuation report, there's an indication that SinoPac Financial Holdings' share price might be on the cheaper side.

Summing It All Up

- Explore the 1956 names from our Top Dividend Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nihon Yamamura Glass might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5210

Nihon Yamamura Glass

Produces and sells glass bottles and plastic closures in Japan and internationally.

Flawless balance sheet, good value and pays a dividend.