- Japan

- /

- Food and Staples Retail

- /

- TSE:3182

Tsuburaya Fields Holdings And 2 Other Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

In the wake of recent global market shifts, small-cap stocks have garnered increased attention, especially as the Russell 2000 Index led gains with an impressive surge. Amid this backdrop, identifying promising stocks involves looking for companies that can capitalize on economic changes and policy developments to drive growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ramco Industries | 3.16% | 9.84% | -14.15% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Berger Paints Bangladesh | 3.40% | 10.41% | 7.51% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| Shree Pushkar Chemicals & Fertilisers | 22.85% | 17.68% | 3.50% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

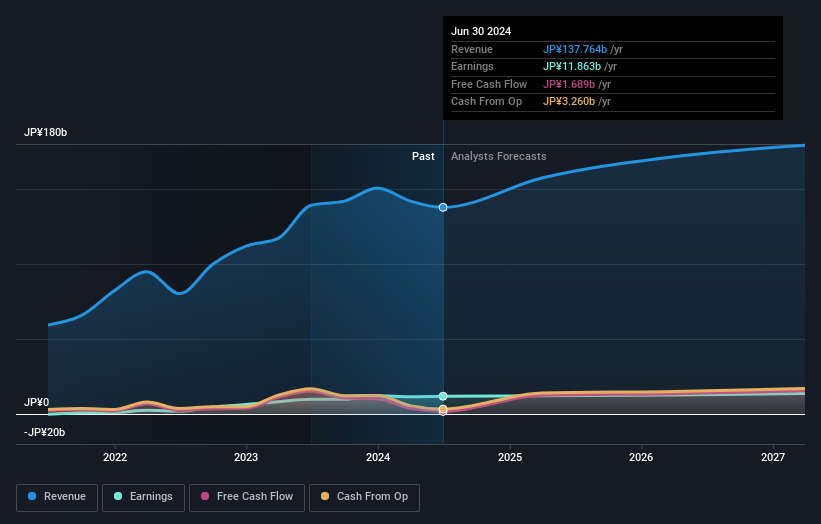

Tsuburaya Fields Holdings (TSE:2767)

Simply Wall St Value Rating: ★★★★★★

Overview: Tsuburaya Fields Holdings Inc. operates in content-related businesses in Japan with a market capitalization of ¥115.93 billion.

Operations: The company's primary revenue streams are the PS Business Segment, generating ¥120.91 billion, and the Content & Digital Business Segment, contributing ¥15.80 billion.

Tsuburaya Fields Holdings, a notable player in its industry, has shown impressive earnings growth of 20.9% over the past year, outpacing the Leisure industry's 11.8%. The company seems to offer good value as it trades at 67.4% below estimated fair value and boasts a high level of non-cash earnings. Debt management appears prudent with a reduction in the debt-to-equity ratio from 40.4% to 24.5% over five years, and interest payments are well covered by EBIT at an impressive 614 times coverage. Despite recent share price volatility, these financial strengths suggest potential for future stability and growth.

- Get an in-depth perspective on Tsuburaya Fields Holdings' performance by reading our health report here.

Gain insights into Tsuburaya Fields Holdings' past trends and performance with our Past report.

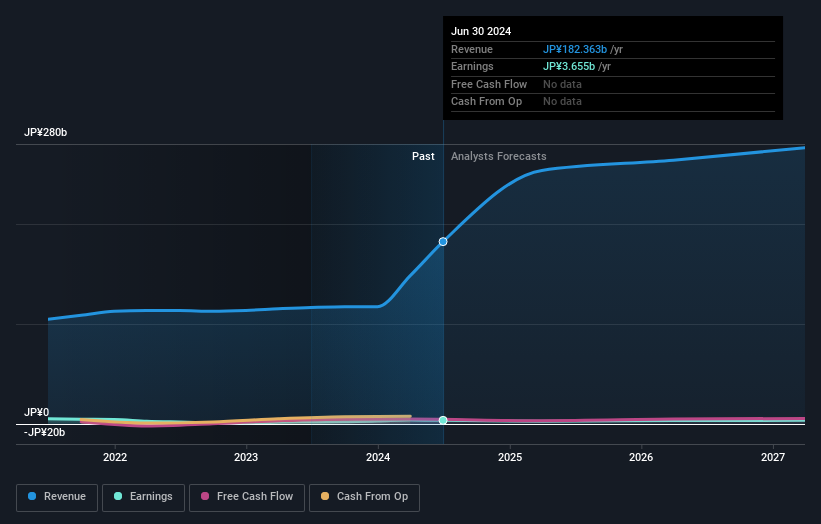

Oisix ra daichi (TSE:3182)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Oisix ra daichi Inc. is a company that specializes in the online and catalogue sale of organic vegetables, agricultural products, additive-free processed foods, and other food products to general consumers in Japan, with a market cap of ¥41.92 billion.

Operations: Oisix ra daichi generates revenue through the sale of organic vegetables, agricultural products, and additive-free processed foods to consumers in Japan. The company has a market cap of ¥41.92 billion.

Oisix ra daichi, a smaller player in the consumer retailing space, has shown impressive growth with earnings surging by 79% over the past year, significantly outpacing the industry average of 15%. Despite a hefty debt to equity ratio increase from 0.5% to 102% over five years, its net debt to equity remains satisfactory at nearly 28%. The company's profitability is underscored by an EBIT that covers interest payments 17 times over. Recently completing a share buyback program repurchasing about 5% of shares for ¥2.30 billion, Oisix trades attractively at around 56% below estimated fair value.

- Delve into the full analysis health report here for a deeper understanding of Oisix ra daichi.

Review our historical performance report to gain insights into Oisix ra daichi's's past performance.

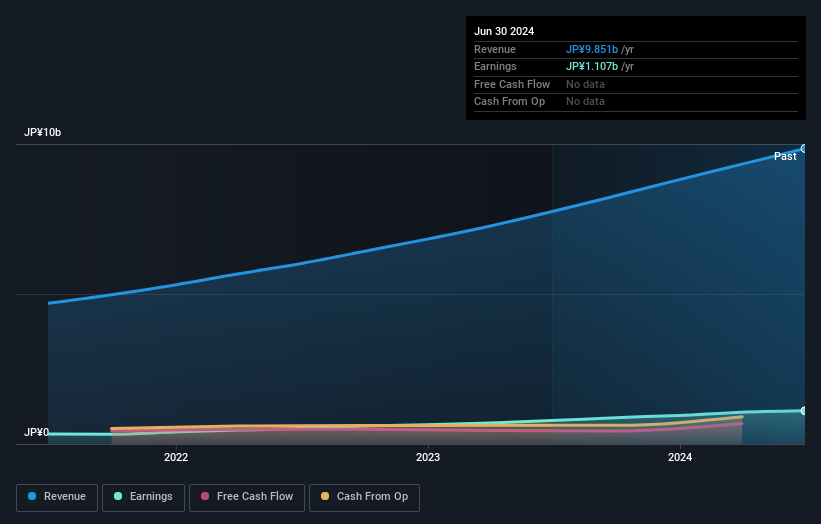

AzoomLtd (TSE:3496)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Azoom Co., Ltd operates in Japan, offering a range of real estate services, with a market capitalization of ¥39.71 billion.

Operations: Azoom Co., Ltd generates revenue primarily from its Idle Asset Utilization Business, contributing ¥9.66 billion, and a smaller portion from the Visualization Business at ¥203.52 million.

AzoomLtd, a nimble player in its sector, has shown impressive earnings growth of 41.7% over the past year, outpacing the Real Estate industry's 18.8%. The company enjoys high-quality earnings and is free cash flow positive, with levered free cash flow reaching US$684 million as of March 2024. Despite having more cash than total debt, Azoom's share price has been highly volatile recently. Its performance seems bolstered by strategic capital expenditure management and a robust financial position that supports future growth potential without immediate concerns about its cash runway.

- Take a closer look at AzoomLtd's potential here in our health report.

Examine AzoomLtd's past performance report to understand how it has performed in the past.

Next Steps

- Discover the full array of 4659 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3182

Oisix ra daichi

Engages in the online and catalogue sale of organic vegetables, agricultural products, additive free processed foods, and other food products and ingredients to general consumers in Japan.

Proven track record with adequate balance sheet.