- Japan

- /

- Consumer Finance

- /

- TSE:7199

Three Stocks Possibly Undervalued By Market Estimates In November 2024

Reviewed by Simply Wall St

In November 2024, global markets are experiencing a surge in optimism following the U.S. election results, with major indices like the S&P 500 reaching record highs amid expectations of economic growth and favorable fiscal policies. As investors navigate this buoyant environment, identifying stocks that may be undervalued by market estimates can offer potential opportunities for those looking to capitalize on discrepancies between current valuations and intrinsic worth.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (NasdaqGS:UMBF) | US$122.86 | US$245.13 | 49.9% |

| Cambi (OB:CAMBI) | NOK15.10 | NOK30.14 | 49.9% |

| Ramssol Group Berhad (KLSE:RAMSSOL) | MYR0.695 | MYR1.39 | 49.8% |

| TBC Bank Group (LSE:TBCG) | £31.35 | £62.68 | 50% |

| Afya (NasdaqGS:AFYA) | US$16.16 | US$32.25 | 49.9% |

| Decisive Dividend (TSXV:DE) | CA$6.05 | CA$12.06 | 49.8% |

| S-Pool (TSE:2471) | ¥343.00 | ¥679.92 | 49.6% |

| XPEL (NasdaqCM:XPEL) | US$45.46 | US$90.91 | 50% |

| Grupo Traxión. de (BMV:TRAXION A) | MX$19.39 | MX$38.77 | 50% |

| BuySell TechnologiesLtd (TSE:7685) | ¥4590.00 | ¥7702.48 | 40.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

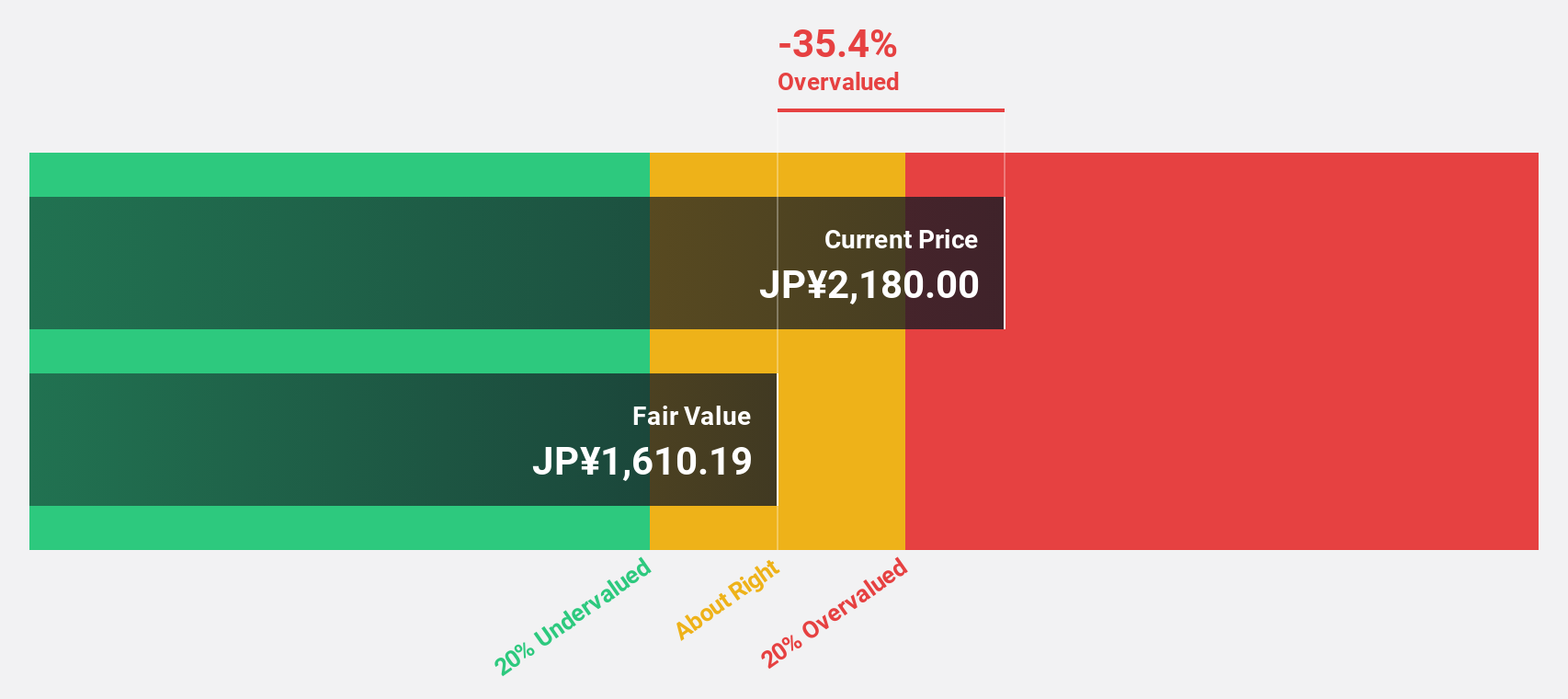

Geo Holdings (TSE:2681)

Overview: Geo Holdings Corporation operates in the amusement businesses in Japan with a market capitalization of ¥57.06 billion.

Operations: The company generates revenue from its Retail Services segment, amounting to ¥417.81 million.

Estimated Discount To Fair Value: 29.2%

Geo Holdings is trading at 29.2% below its estimated fair value of ¥2072.34, indicating it may be undervalued based on cash flows. The company's earnings are forecast to grow significantly at 20.6% per year, outpacing the JP market's growth rate of 8.1%. However, its dividend yield of 2.32% is not well covered by free cash flows, and its return on equity is expected to remain low at 10.8% in three years.

- The analysis detailed in our Geo Holdings growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Geo Holdings.

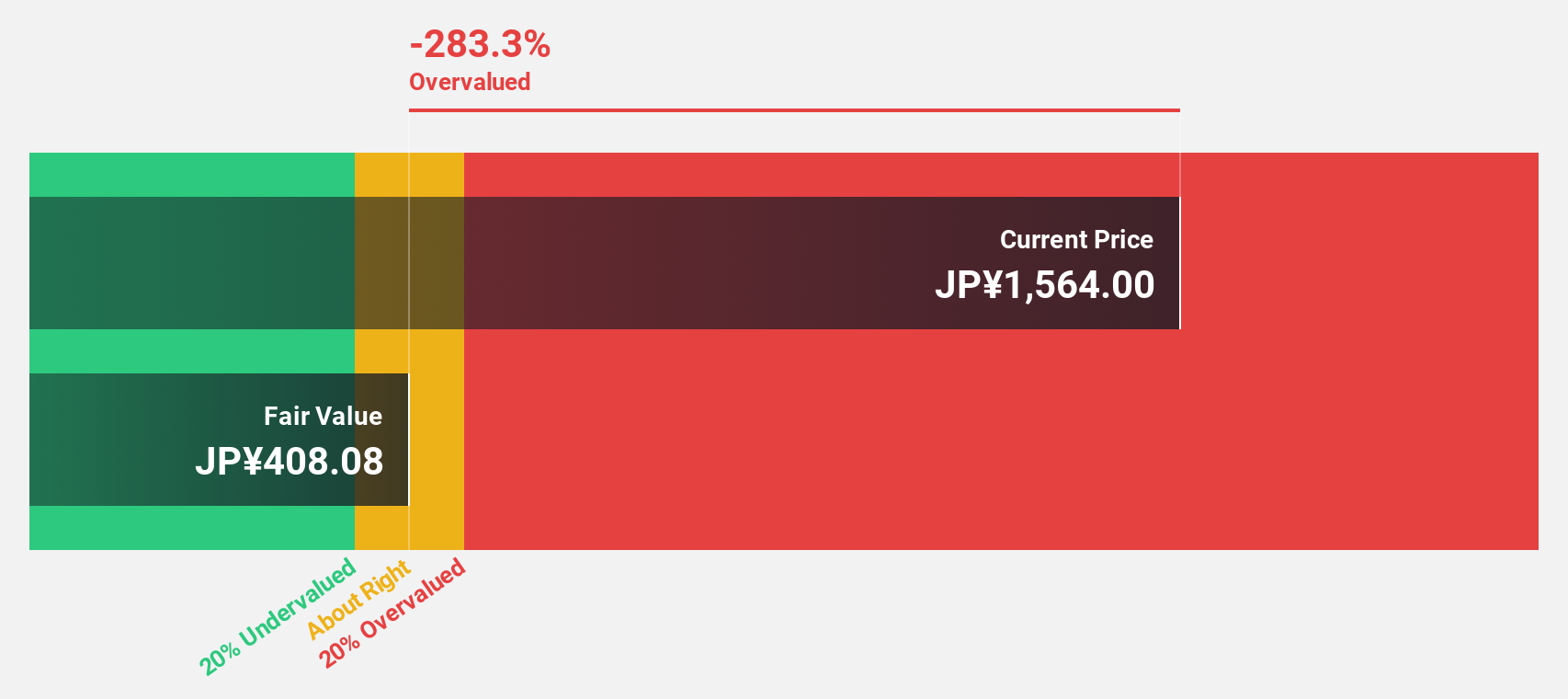

Premium Group (TSE:7199)

Overview: Premium Group Co., Ltd. is a global provider of financing and services, with a market capitalization of ¥88.60 billion.

Operations: Revenue segments for Premium Group Co., Ltd. are not provided in the text.

Estimated Discount To Fair Value: 31.4%

Premium Group, trading at ¥2,414, appears undervalued with a fair value estimate of ¥3,520.39. Earnings grew by 55% last year and are expected to rise 19.26% annually, surpassing the JP market's growth rate of 8.1%. Despite strong revenue growth forecasts of 19%, debt coverage by operating cash flow is weak. Recently announced dividend increases from ¥13 to ¥20 per share reflect positive financial momentum but may strain cash flows further.

- According our earnings growth report, there's an indication that Premium Group might be ready to expand.

- Take a closer look at Premium Group's balance sheet health here in our report.

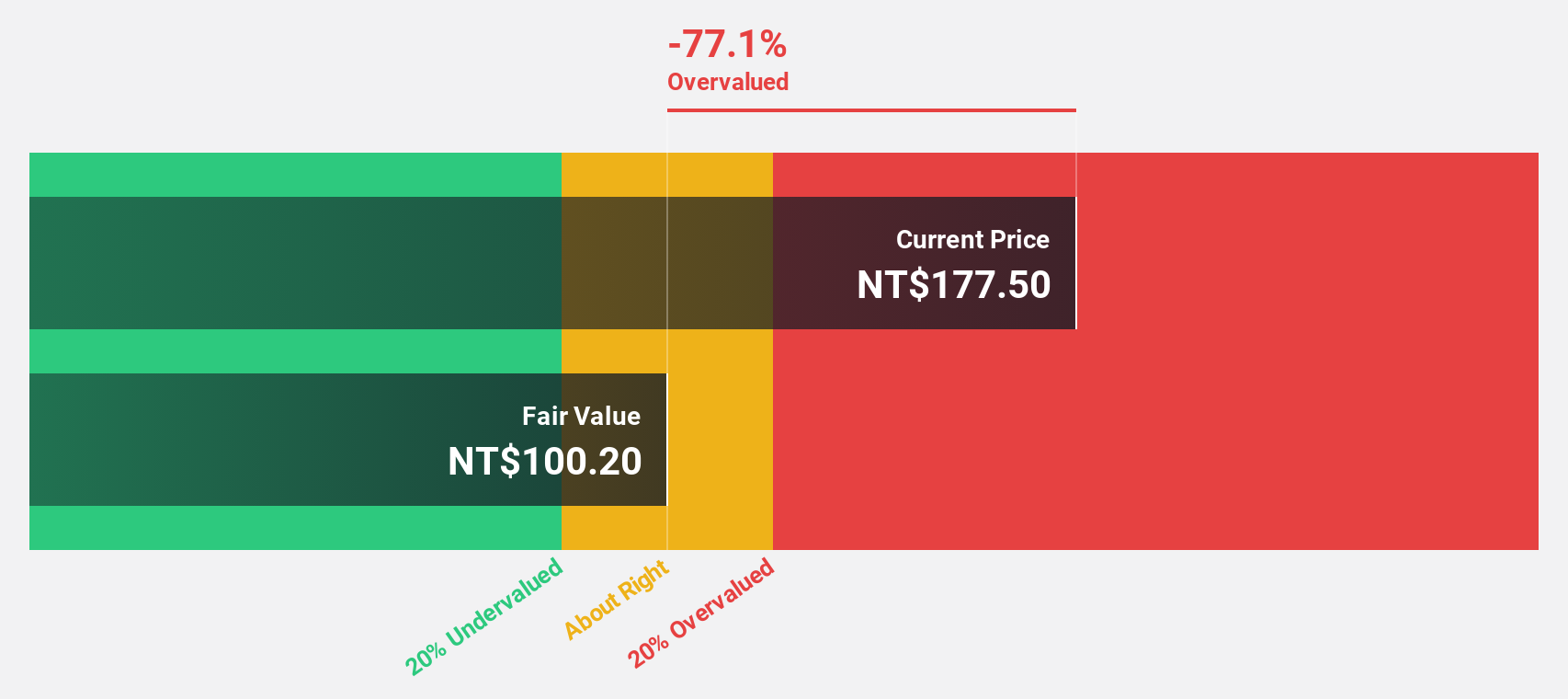

Sunonwealth Electric Machine Industry (TWSE:2421)

Overview: Sunonwealth Electric Machine Industry Co., Ltd. manufactures and sells precision motors and thermal solutions globally, with a market cap of NT$27.89 billion.

Operations: Sunonwealth Electric Machine Industry Co., Ltd.'s revenue primarily comes from the production and sale of precision motors and thermal solutions on a global scale.

Estimated Discount To Fair Value: 25.7%

Sunonwealth Electric Machine Industry is trading at NT$101.5, significantly undervalued compared to its fair value estimate of NT$136.62. Recent earnings reports show a rise in sales but a slight dip in net income year-over-year, which may concern some investors. However, the company's projected annual profit growth of 30.9% outpaces the Taiwan market's average and suggests robust future potential despite recent shareholder dilution and an unstable dividend history.

- Our expertly prepared growth report on Sunonwealth Electric Machine Industry implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Sunonwealth Electric Machine Industry's balance sheet by reading our health report here.

Turning Ideas Into Actions

- Embark on your investment journey to our 900 Undervalued Stocks Based On Cash Flows selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7199

Solid track record with reasonable growth potential.