- Japan

- /

- Specialty Stores

- /

- TSE:9856

3 Reliable Dividend Stocks With At Least 3.6% Yield

Reviewed by Simply Wall St

In the wake of a "red sweep" in the U.S. elections, global markets have experienced a rally, with major benchmarks reaching record highs as investors anticipate favorable economic policies. Amidst this optimism, dividend stocks continue to attract attention for their potential to provide steady income streams in an environment of fluctuating interest rates and evolving fiscal policies. A good dividend stock typically offers a reliable yield and demonstrates resilience in varying market conditions, making it an attractive option for income-focused investors seeking stability amidst economic shifts.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.69% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.54% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.40% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.45% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.89% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.53% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

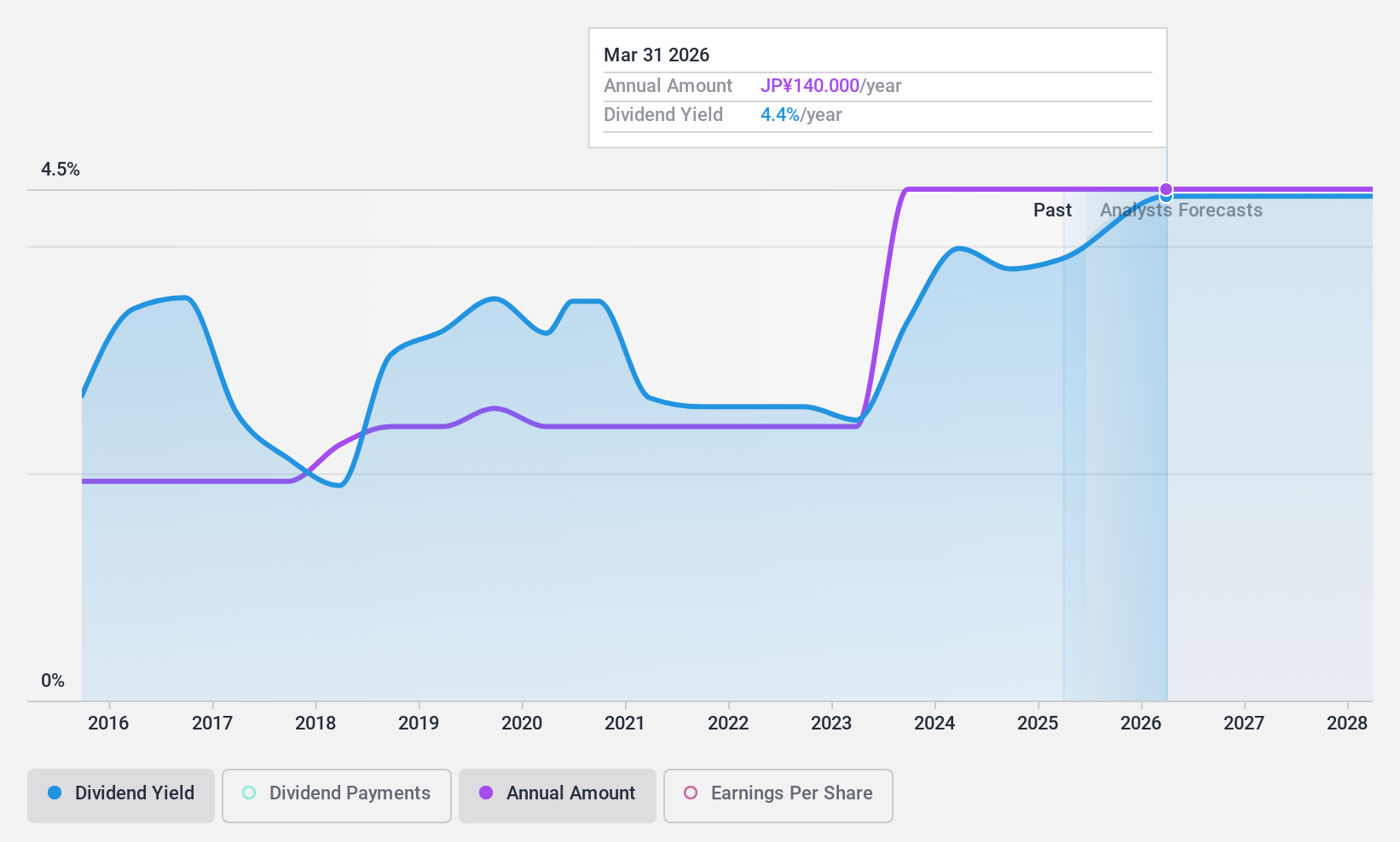

Shibaura MachineLtd (TSE:6104)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shibaura Machine Co., Ltd. manufactures and sells a range of machines both in Japan and internationally, with a market capitalization of ¥91.56 billion.

Operations: Shibaura Machine Co., Ltd.'s revenue is primarily derived from its Molding Machines segment at ¥132.39 billion, followed by Machine Tools at ¥25.34 billion and Control Machine at ¥11.06 billion.

Dividend Yield: 3.7%

Shibaura Machine Ltd. offers a stable dividend yield of 3.66%, although slightly below the top 25% of JP market payers. Its dividends are well-covered by earnings (18.6% payout ratio) and cash flows (55% cash payout ratio), indicating sustainability. Despite recent earnings growth, future declines are forecasted at 19.1% annually over three years, potentially impacting dividend prospects. The company recently completed a share buyback worth ¥2 billion, enhancing shareholder value amidst these challenges.

- Click here and access our complete dividend analysis report to understand the dynamics of Shibaura MachineLtd.

- The analysis detailed in our Shibaura MachineLtd valuation report hints at an deflated share price compared to its estimated value.

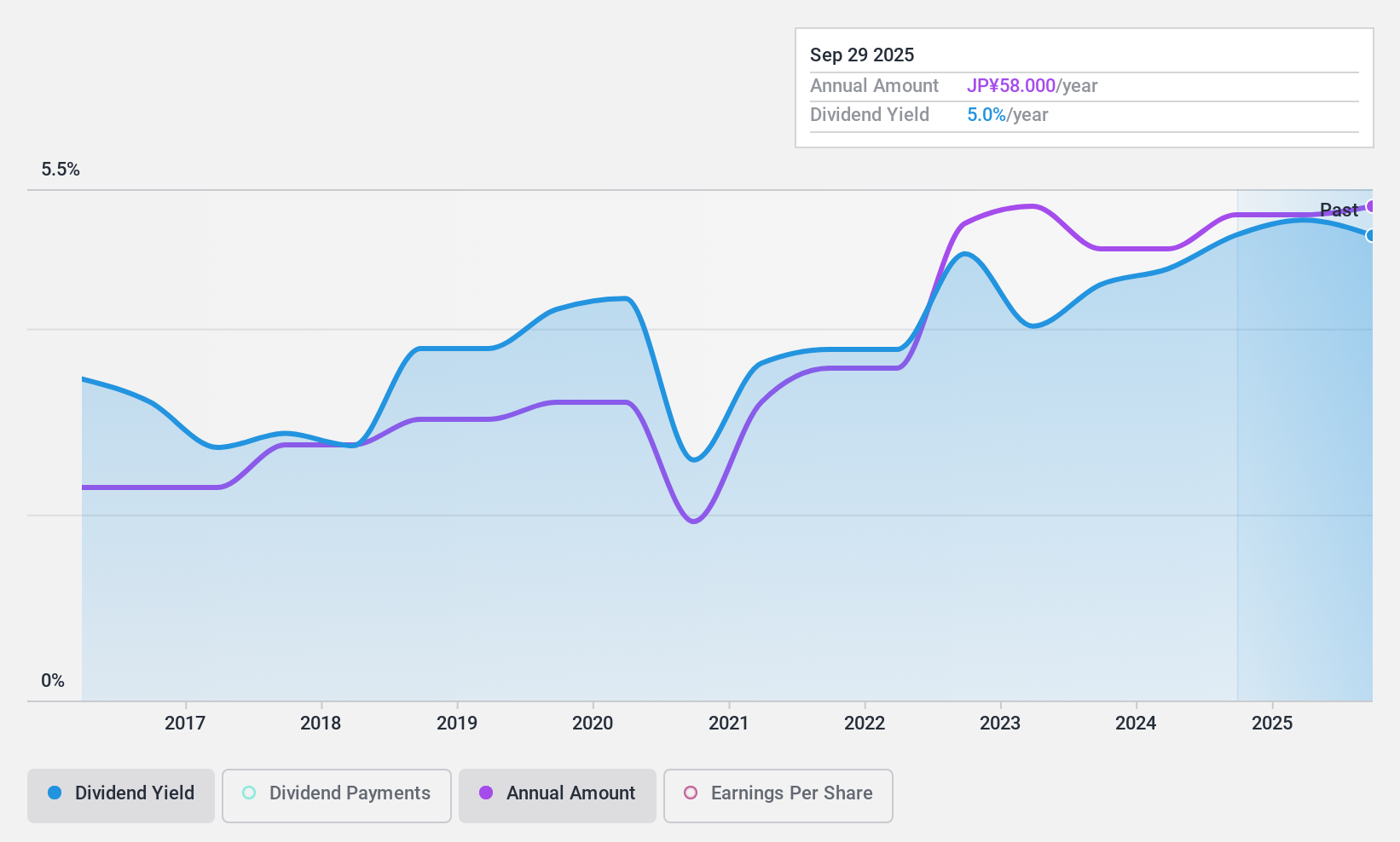

Ku HoldingsLtd (TSE:9856)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ku Holdings Ltd (TSE:9856) is involved in the import and sale of new and used cars in Japan, with a market capitalization of ¥35.83 billion.

Operations: Ku Holdings Ltd generates revenue from the import and sale of both new and used vehicles within Japan.

Dividend Yield: 5.2%

Ku Holdings Ltd. features a dividend yield of 5.18%, placing it among the top 25% of dividend payers in Japan. Despite historical volatility, its dividends are well-supported by earnings and cash flows, with payout ratios at 20.5% and 57.8%, respectively, suggesting sustainability. Recent inclusion in the S&P Global BMI Index may bolster investor confidence, although past inconsistencies highlight potential risks for those prioritizing stable income streams from dividends.

- Click to explore a detailed breakdown of our findings in Ku HoldingsLtd's dividend report.

- In light of our recent valuation report, it seems possible that Ku HoldingsLtd is trading behind its estimated value.

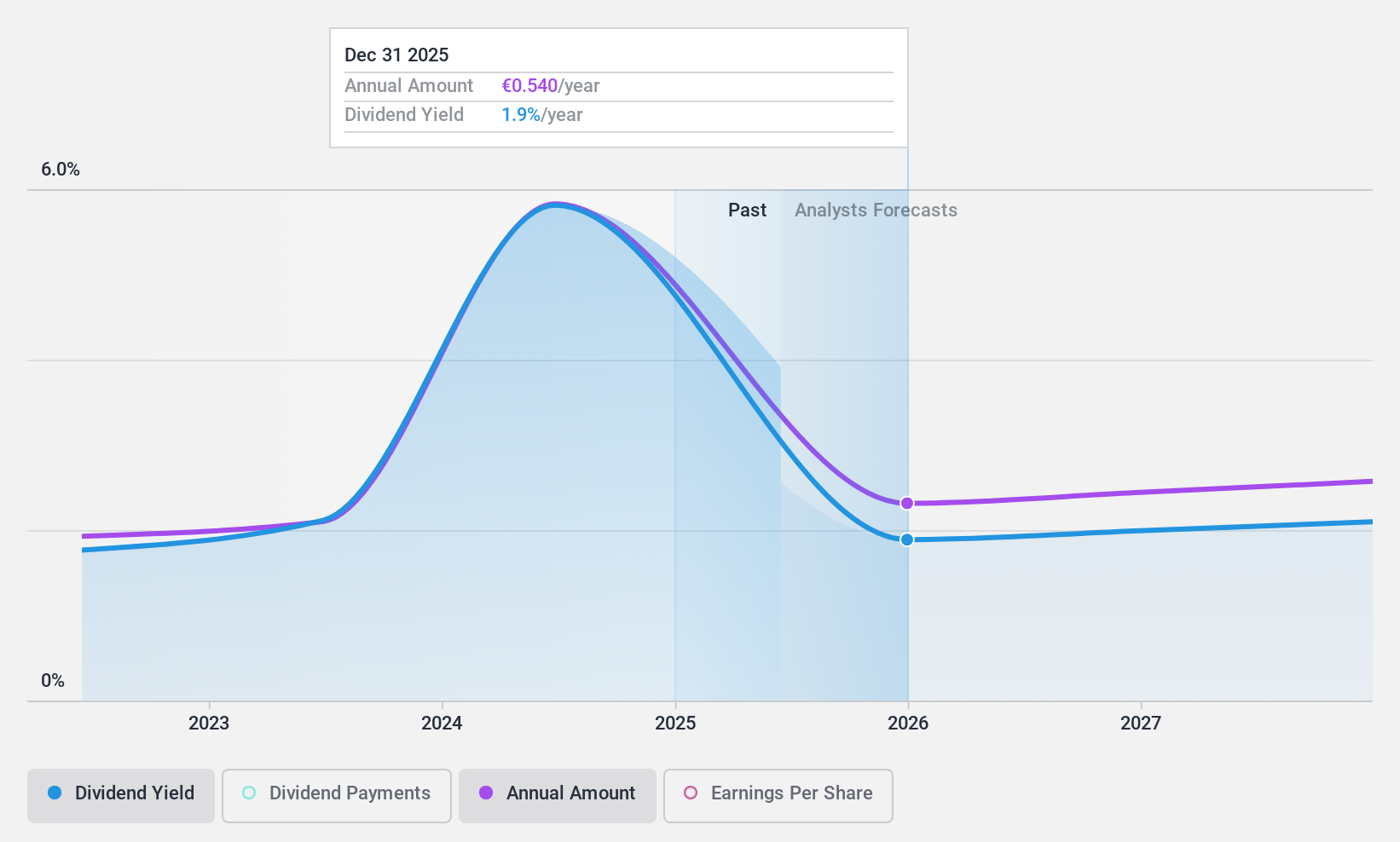

PharmaSGP Holding (XTRA:PSG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PharmaSGP Holding SE manufactures and sells over-the-counter drugs and other healthcare products in Germany, with a market cap of €302.15 million.

Operations: PharmaSGP Holding SE generates its revenue primarily from the Pharmaceuticals segment, which amounted to €109.76 million.

Dividend Yield: 5.4%

PharmaSGP Holding's dividend yield of 5.4% ranks it in the top 25% of German dividend payers, with dividends covered by earnings and cash flows at payout ratios of 89.6% and 77.8%, respectively, indicating sustainability despite a high debt level. While dividends have grown over three years, their short history may concern some investors seeking long-term stability. Recent earnings show growth with net income rising to €8.68 million for the half year ended June 2024 from €6.86 million previously.

- Unlock comprehensive insights into our analysis of PharmaSGP Holding stock in this dividend report.

- Our expertly prepared valuation report PharmaSGP Holding implies its share price may be lower than expected.

Key Takeaways

- Access the full spectrum of 1951 Top Dividend Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ku HoldingsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9856

Ku HoldingsLtd

Engages in the import and sale of new and used cars in Japan.

Flawless balance sheet established dividend payer.