- Japan

- /

- Diversified Financial

- /

- TSE:8596

Subdued Growth No Barrier To Kyushu Leasing Service Co., Ltd. (TSE:8596) With Shares Advancing 27%

Kyushu Leasing Service Co., Ltd. (TSE:8596) shares have continued their recent momentum with a 27% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 57% in the last year.

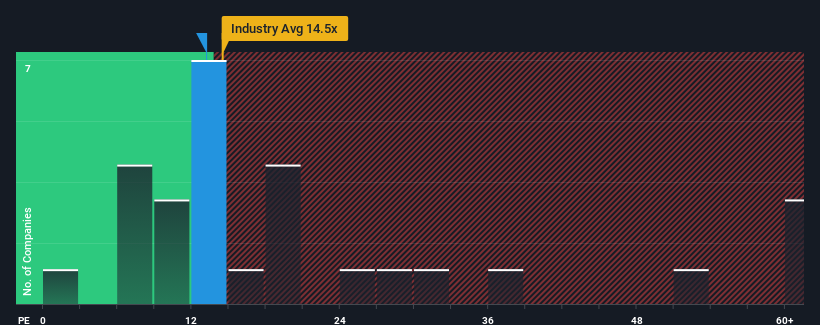

Even after such a large jump in price, it's still not a stretch to say that Kyushu Leasing Service's price-to-earnings (or "P/E") ratio of 13.2x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 14x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

As an illustration, earnings have deteriorated at Kyushu Leasing Service over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Kyushu Leasing Service

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Kyushu Leasing Service's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 59% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 3.4% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 11% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's somewhat alarming that Kyushu Leasing Service's P/E sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Final Word

Its shares have lifted substantially and now Kyushu Leasing Service's P/E is also back up to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Kyushu Leasing Service revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 4 warning signs for Kyushu Leasing Service (1 is concerning!) that you need to take into consideration.

If you're unsure about the strength of Kyushu Leasing Service's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Kyushu Leasing Service might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:8596

Kyushu Leasing Service

Operates as a financial services company in Japan.

Solid track record, good value and pays a dividend.