- Japan

- /

- Capital Markets

- /

- TSE:8595

Commercial Bank of Dubai PSC And 2 Other Top Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets experience broad-based gains, with U.S. indexes approaching record highs and positive sentiment driven by strong labor market reports, investors are keenly observing opportunities for stable returns amidst economic fluctuations. In this environment, dividend stocks can offer a reliable income stream and potential for capital appreciation, making them an attractive option for those seeking to balance growth with income in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.31% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.60% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.40% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.89% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.45% | ★★★★★★ |

Click here to see the full list of 1963 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Commercial Bank of Dubai PSC (DFM:CBD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Commercial Bank of Dubai PSC offers commercial and retail banking services in the United Arab Emirates, with a market capitalization of AED21.76 billion.

Operations: The revenue segments for Commercial Bank of Dubai PSC include Personal Banking at AED1.96 billion, Institutional Banking at AED1.11 billion, and Corporate Banking at AED575.40 million.

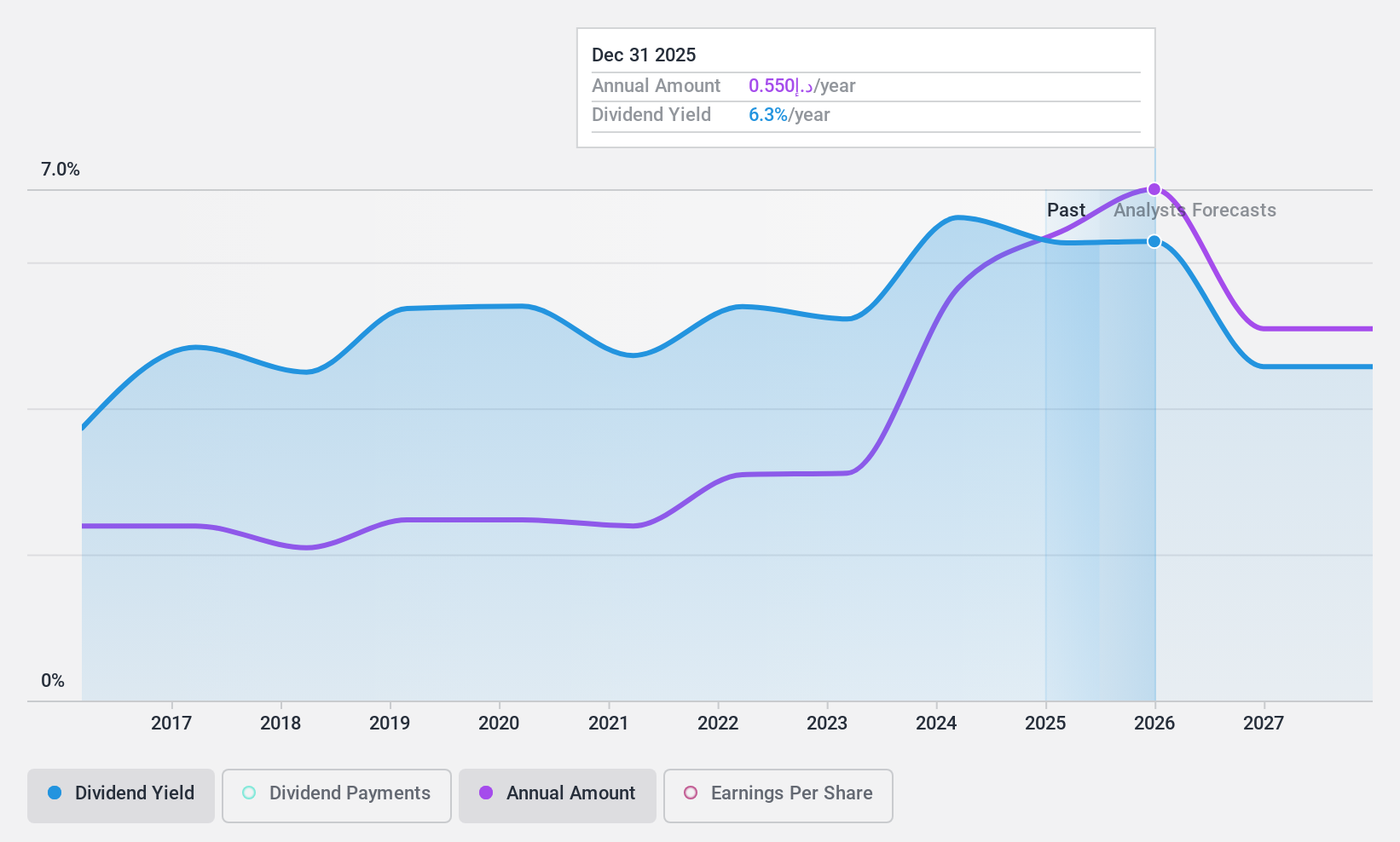

Dividend Yield: 6.1%

Commercial Bank of Dubai PSC offers a stable dividend profile, with payments well-covered by earnings at a 47.1% payout ratio and forecasted to remain sustainable. The bank's dividends have been reliable and growing over the past decade, although its current yield of 6.09% is slightly below the top quartile in the AE market. Recent earnings reports show growth in net income and interest income, indicating strong financial performance despite high non-performing loans at 5.9%.

- Click here to discover the nuances of Commercial Bank of Dubai PSC with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Commercial Bank of Dubai PSC is trading beyond its estimated value.

FIYTA Precision Technology (SZSE:000026)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: FIYTA Precision Technology Co., Ltd. operates in the research, design, manufacture, sale, and service of watches under various brands in China and has a market capitalization of approximately CN¥4.18 billion.

Operations: FIYTA Precision Technology Co., Ltd. generates revenue from the development, design, manufacture, sale, retail, and service of watches under brands including FIYTA, MOONYANG, JONAS&VERUS, Emile Chooriet, Beijing, and Jeep in China.

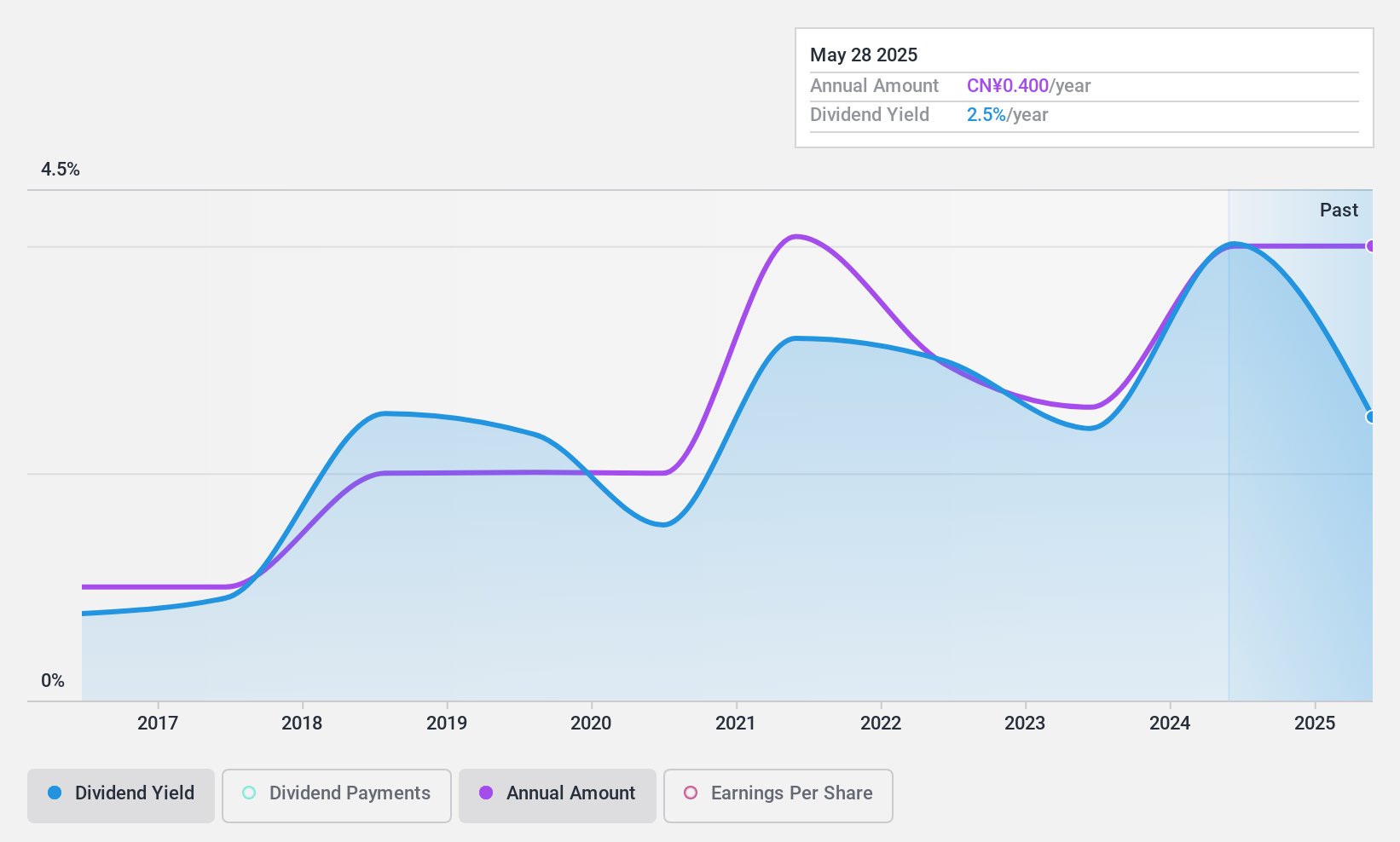

Dividend Yield: 3.7%

FIYTA Precision Technology's dividend is appealing, with a 3.73% yield placing it in the top 25% of CN market payers and well-covered by both earnings (payout ratio: 61.9%) and cash flow (cash payout ratio: 43%). However, its dividend history is marked by volatility, despite growth over the past decade. Recent earnings show a decline in revenue to CNY 3.04 billion and net income to CNY 197.62 million for nine months ending September 2024, suggesting financial challenges.

- Unlock comprehensive insights into our analysis of FIYTA Precision Technology stock in this dividend report.

- Our valuation report unveils the possibility FIYTA Precision Technology's shares may be trading at a discount.

JAFCO Group (TSE:8595)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JAFCO Group Co., Ltd., formerly known as JAFCO Co., Ltd., operates as a venture capital and private equity firm, with a market cap of approximately ¥116.31 billion.

Operations: JAFCO Group Co., Ltd. generates revenue through its operations as a venture capital and private equity firm.

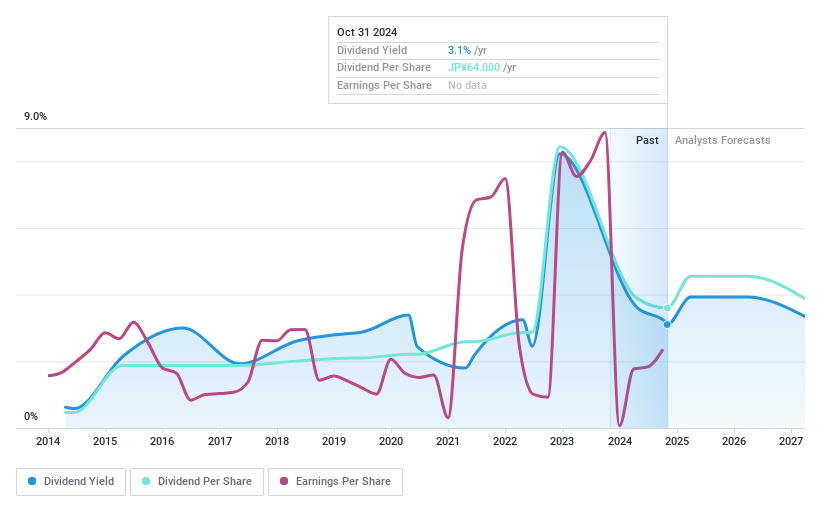

Dividend Yield: 3%

JAFCO Group's dividend of ¥32 per share aligns with its policy to pay dividends based on shareholders' equity or net income, ensuring coverage by earnings (payout ratio: 38.1%) and cash flows (cash payout ratio: 22%). Despite a low yield compared to top JP market payers, the dividend is sustainable due to conservative payout ratios. However, the company's dividend history shows volatility over the past decade, affecting reliability for consistent income seekers.

- Delve into the full analysis dividend report here for a deeper understanding of JAFCO Group.

- According our valuation report, there's an indication that JAFCO Group's share price might be on the cheaper side.

Next Steps

- Gain an insight into the universe of 1963 Top Dividend Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8595

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives