- Japan

- /

- Diversified Financial

- /

- TSE:8593

Is It Too Late To Consider Mitsubishi HC Capital After Its Strong Multi Year Share Price Rally?

Reviewed by Bailey Pemberton

- If you are wondering whether Mitsubishi HC Capital is still good value after its strong run, you are not alone. That is exactly what we are going to unpack here.

- The share price has continued to grind higher, with gains of 2.0% over the last week, 3.6% over the past month, and 19.7% year to date, adding to a 25.7% 1 year return and 120.0% over 3 years and 219.1% over 5 years.

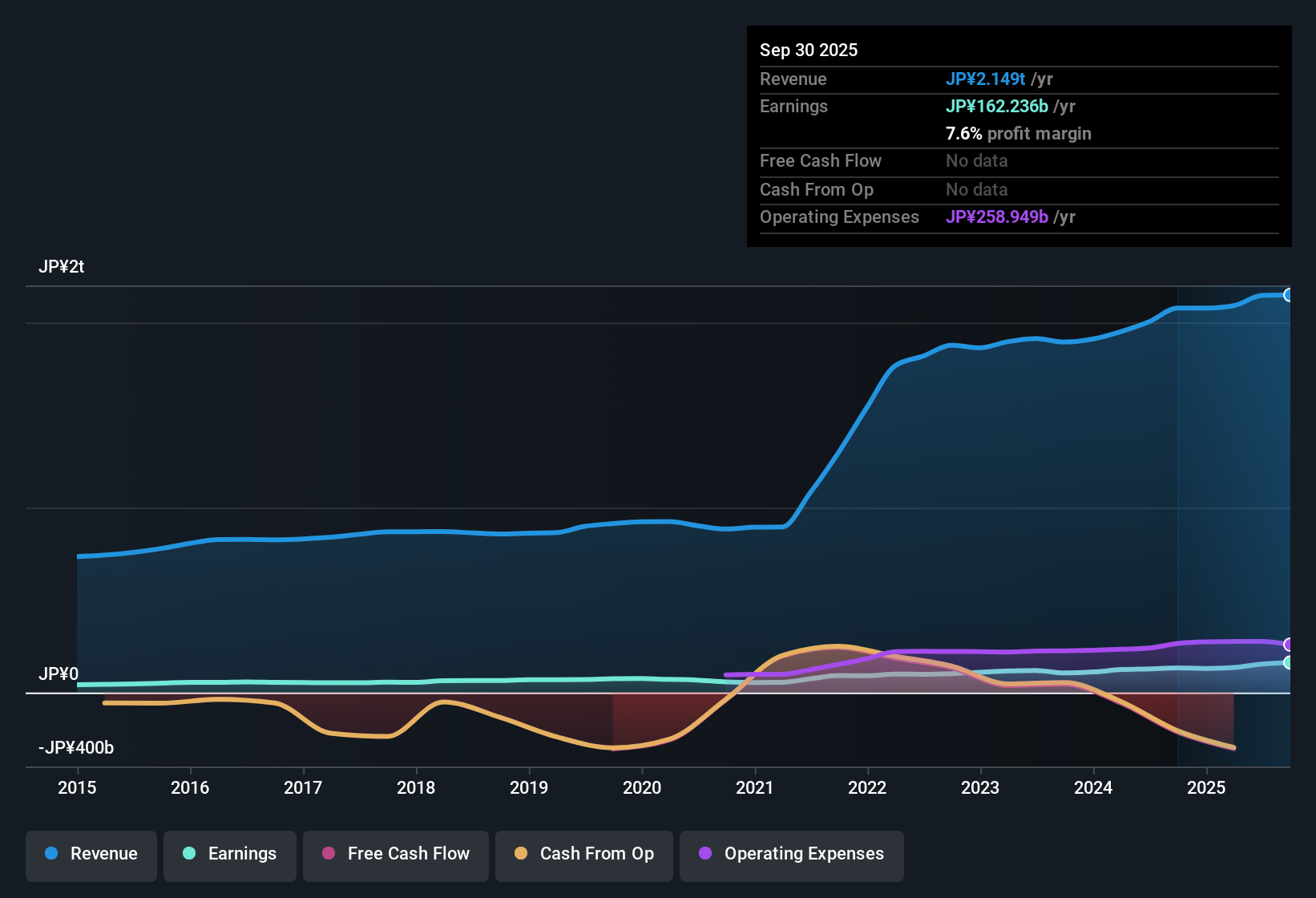

- Investor interest has been supported by steady expansion in its leasing and structured finance businesses, alongside a broader push into sustainable and infrastructure related financing that positions the company as a key player in Japan's transition economy. At the same time, ongoing consolidation in Japan's financial sector and a gradual shift away from ultra low interest rates have contributed to a change in how the market prices diversified financials like Mitsubishi HC Capital.

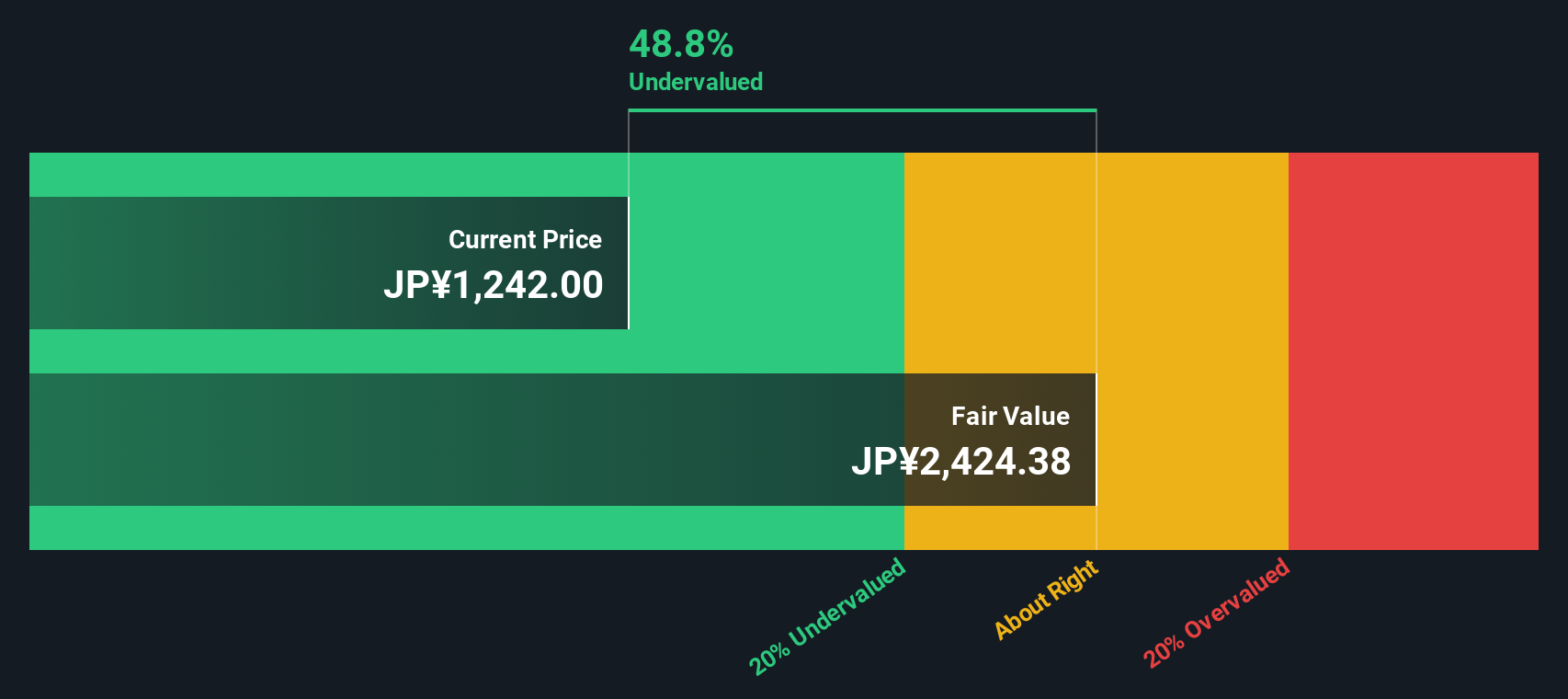

- Even after this rally, Mitsubishi HC Capital scores a solid 5/6 on our valuation checks, suggesting it still screens as undervalued on most metrics. Next, we will walk through the main valuation approaches investors typically use and introduce a more comprehensive way to think about fair value that we will come back to at the end.

Approach 1: Mitsubishi HC Capital Excess Returns Analysis

The Excess Returns model looks at how much profit Mitsubishi HC Capital can earn on shareholders equity above its required cost of capital, then converts that stream of excess profits into an intrinsic value per share.

For Mitsubishi HC Capital, the starting point is a Book Value of ¥1,276.33 per share and a Stable EPS of ¥127.57 per share, based on weighted future Return on Equity estimates from 4 analysts. The implied Average Return on Equity is 8.98%, comfortably above a Cost of Equity of ¥77.58 per share, which produces an Excess Return of ¥49.99 per share.

Analysts also expect Book Value to grow over time, with a Stable Book Value of ¥1,419.84 per share, again based on forward estimates from 4 analysts. When these excess returns and growth expectations are capitalised, the model points to an intrinsic fair value around ¥2,448 per share. This implies the stock is roughly 49.0% undervalued versus its current trading price.

This framework suggests Mitsubishi HC Capital is generating value above its cost of equity and may continue to do so, which could leave meaningful upside potential for long term investors.

Result: UNDERVALUED

Our Excess Returns analysis suggests Mitsubishi HC Capital is undervalued by 49.0%. Track this in your watchlist or portfolio, or discover 935 more undervalued stocks based on cash flows.

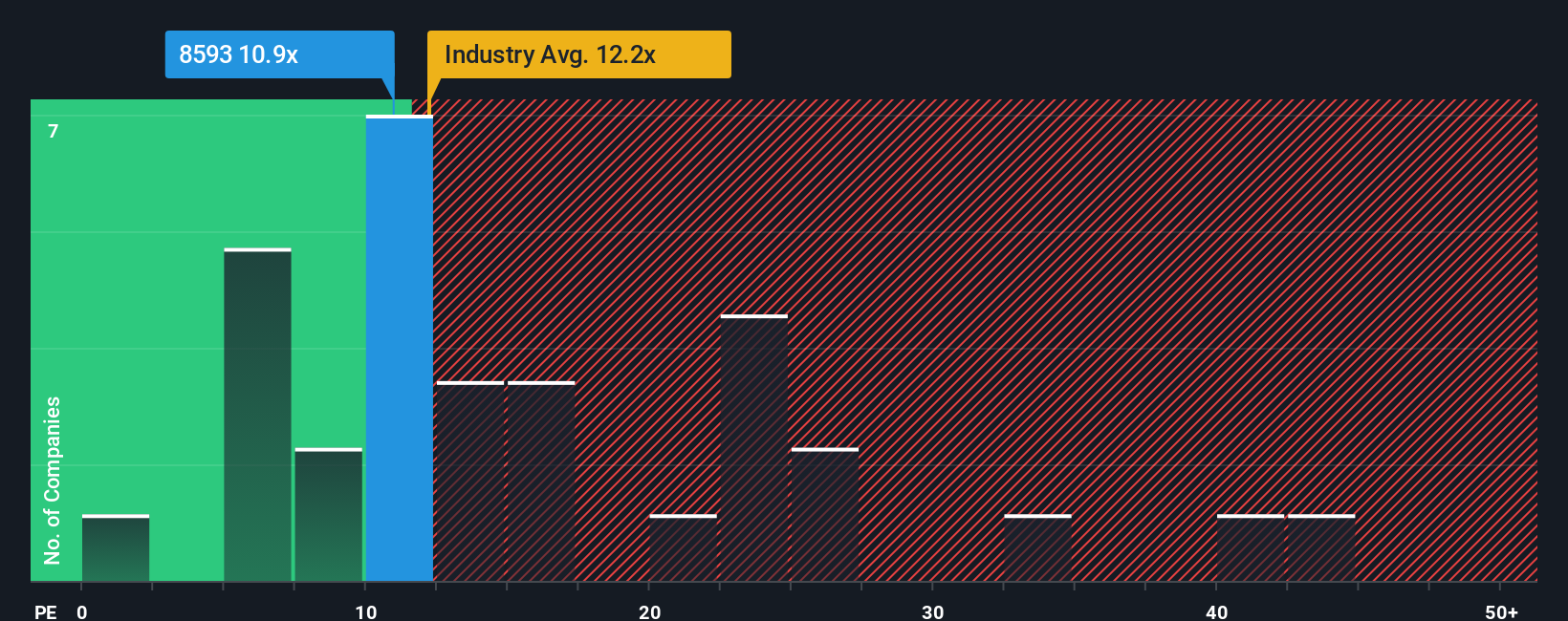

Approach 2: Mitsubishi HC Capital Price vs Earnings

For profitable companies like Mitsubishi HC Capital, the price to earnings, or PE, ratio is a practical way to compare what investors are paying for each unit of earnings today versus other opportunities. A higher PE can be justified when a company is expected to grow faster or is perceived as lower risk, while slower growth or higher risk typically warrants a lower, more conservative multiple.

Mitsubishi HC Capital currently trades on a PE of 11.1x, which is below both the Diversified Financial industry average of around 12.4x and the broader peer group average of 18.7x. Simply Wall St also calculates a proprietary Fair Ratio of 15.1x, which estimates what PE the stock should trade on after adjusting for its earnings growth outlook, profitability, risk profile, industry and market cap. This Fair Ratio provides a more tailored benchmark than simple peer or industry comparisons, because it explicitly incorporates company specific strengths and risks rather than assuming all diversified financials deserve the same multiple.

Comparing the current PE of 11.1x to the Fair Ratio of 15.1x suggests the market is still pricing Mitsubishi HC Capital at a discount to its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mitsubishi HC Capital Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about a company, captured as assumptions about its future revenue, earnings, margins and fair value, rather than just accepting one static set of numbers. Narratives link Mitsubishi HC Capital’s business story, such as its role in Japan’s transition economy and expansion into sustainable finance, to a financial forecast and then to a clear fair value estimate. On Simply Wall St’s Community page, used by millions of investors, Narratives are an easy, accessible tool that help you compare your Fair Value to the current market price. They also update dynamically when new information like earnings releases or major news arrives, so your view evolves as the facts change. For example, one investor’s Narrative for Mitsubishi HC Capital might assume slower growth and a lower fair value, while another might focus on expectations for infrastructure demand and arrive at a very different fair value, leading to very different decisions on whether to add, hold, or trim the stock.

Do you think there's more to the story for Mitsubishi HC Capital? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8593

Mitsubishi HC Capital

Engages in the lease, installment sale, and other financing activities in Japan, North America, the United Kingdom, rest of Europe, the Middle and Near East, Asia, Oceania, and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026