- Japan

- /

- Capital Markets

- /

- TSE:8473

Is SBI’s ¥50 Billion Buyback And New Stock Options Plan Altering The Investment Case For SBI Holdings (TSE:8473)?

Reviewed by Sasha Jovanovic

- In November 2025, SBI Holdings, Inc. (TSE:8473) announced a ¥50,000 million share repurchase program of 10,000,000 shares (3.09% of outstanding shares as of October 31, 2025), running until March 31, 2026, while its board also approved issuing paid stock options to directors of the company and its subsidiaries.

- Together, the buyback aimed at enhancing capital efficiency and the new stock options framework indicate a concerted effort to refine SBI Holdings’ capital structure and align management incentives with shareholder interests.

- We’ll now examine how this sizable share repurchase plan may influence SBI Holdings’ existing investment narrative and capital-efficiency outlook.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

SBI Holdings Investment Narrative Recap

To own SBI Holdings, you need to be comfortable with a diversified financial group that combines traditional financial services with higher risk fintech and digital asset exposure. The newly announced ¥50,000 million share repurchase does not materially alter the near term earnings outlook or the key risk that returns from PE and crypto related investments may prove volatile and hard to repeat.

The board’s decision to issue paid stock options to directors of SBI Holdings and its subsidiaries sits alongside the buyback in reshaping the equity base. While the options could dilute earnings per share when exercised, the buyback may partially offset this, making it important to watch how overall share count evolves against the catalysts investors are focusing on.

Yet investors should also factor in how dependent recent profits have been on revaluations of private equity and crypto related holdings, since...

Read the full narrative on SBI Holdings (it's free!)

SBI Holdings’ narrative projects ¥1696.9 billion revenue and ¥181.7 billion earnings by 2028.

Uncover how SBI Holdings' forecasts yield a ¥6538 fair value, a 103% upside to its current price.

Exploring Other Perspectives

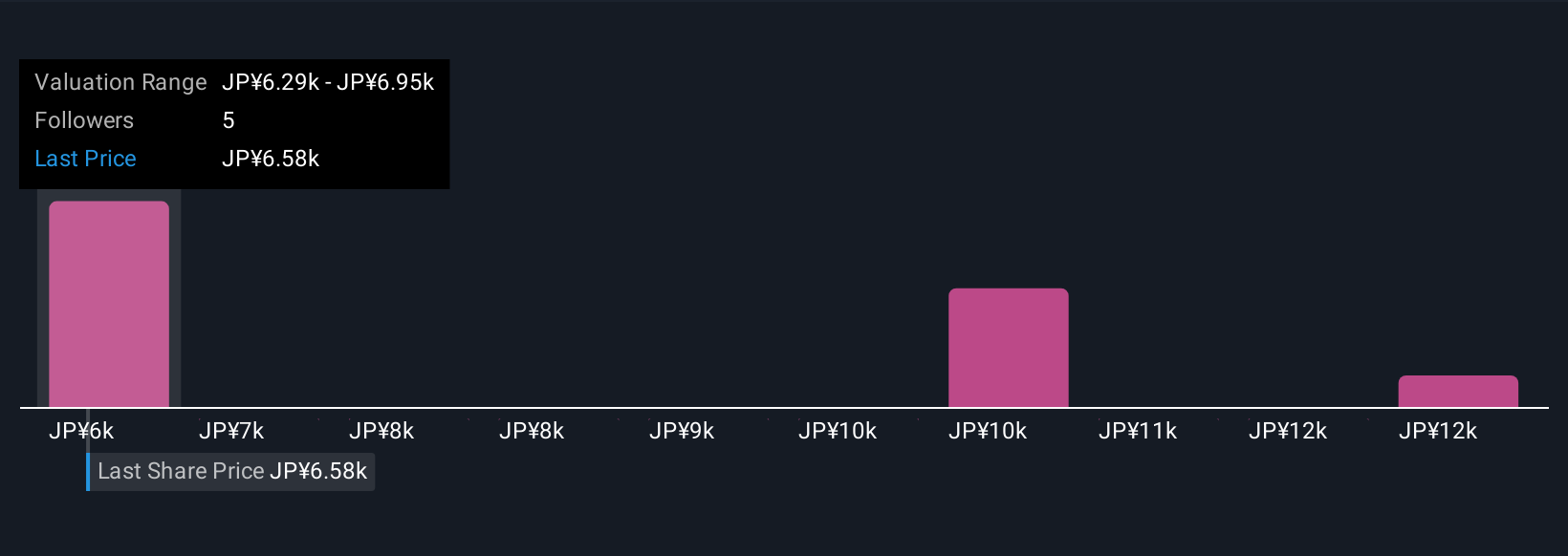

Four members of the Simply Wall St Community currently see SBI’s fair value between ¥5,728.95 and ¥12,832.27, showing wide disagreement on upside. You can weigh those views against the risk that earnings could be pressured if returns from PE and crypto related investments become less supportive over time.

Explore 4 other fair value estimates on SBI Holdings - why the stock might be worth just ¥5729!

Build Your Own SBI Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SBI Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free SBI Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SBI Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8473

SBI Holdings

Engages in the online securities and investment businesses in Japan and Saudi Arabia.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026