- Japan

- /

- Diversified Financial

- /

- TSE:8424

Fuyo General Lease (TSE:8424): How Does Valuation Stack Up After Earnings Forecast Cut Linked to European Renewables Risk?

Reviewed by Simply Wall St

Fuyo General Lease (TSE:8424) has revised its full-year consolidated earnings forecast, citing potential losses linked to uncollectible or delayed receivables from European renewable energy projects. This move signals increased credit risk in its expanding renewables portfolio.

See our latest analysis for Fuyo General Lease.

Today's negative news triggered a sharp selloff, sending Fuyo General Lease’s share price down over 7% in a single session. Even with this setback, investors who have held the stock over the long haul have seen robust rewards, with a 21% one-year total shareholder return and a remarkable 150% total return over five years. Recent momentum had been steady; however, this latest development may challenge sentiment in the short term.

If turbulence in the renewables sector has you scouting for fresh ideas, now could be an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With the stock taking a hit despite solid long-term returns, the question now is whether today’s dip reflects real value or if the market has already accounted for future growth. Could this be a buying opportunity, or is everything priced in?

Price-to-Earnings of 7.7x: Is it justified?

Fuyo General Lease is trading at a price-to-earnings ratio of 7.7x, which makes the stock look inexpensive compared to both its industry and peer group benchmarks. With the last closing price at ¥4,136, the company comes across as a value pick in the sector.

The price-to-earnings (P/E) ratio represents how much investors are willing to pay for each yen of current earnings. For a diversified financial business like Fuyo, the P/E helps gauge if the market is optimistic about its ability to keep growing profits and maintain stable earnings.

This discount suggests that investors may be underestimating the company’s steady profit growth and high-quality earnings, possibly in response to concerns about profit acceleration and ongoing sector risks. However, such a low P/E is rare compared to the industry’s average multiple of 12.6x and the peer average of 10.8x. The stock is also well below the fair price-to-earnings ratio estimate of 14.8x, hinting that significant upside could materialize if market perceptions shift.

Explore the SWS fair ratio for Fuyo General Lease

Result: Price-to-Earnings of 7.7x (UNDERVALUED)

However, ongoing uncertainty around European receivables and any further setbacks in renewables could hinder Fuyo General Lease’s valuation from catching up quickly.

Find out about the key risks to this Fuyo General Lease narrative.

Another View: Discounted Cash Flow Paints a Different Picture

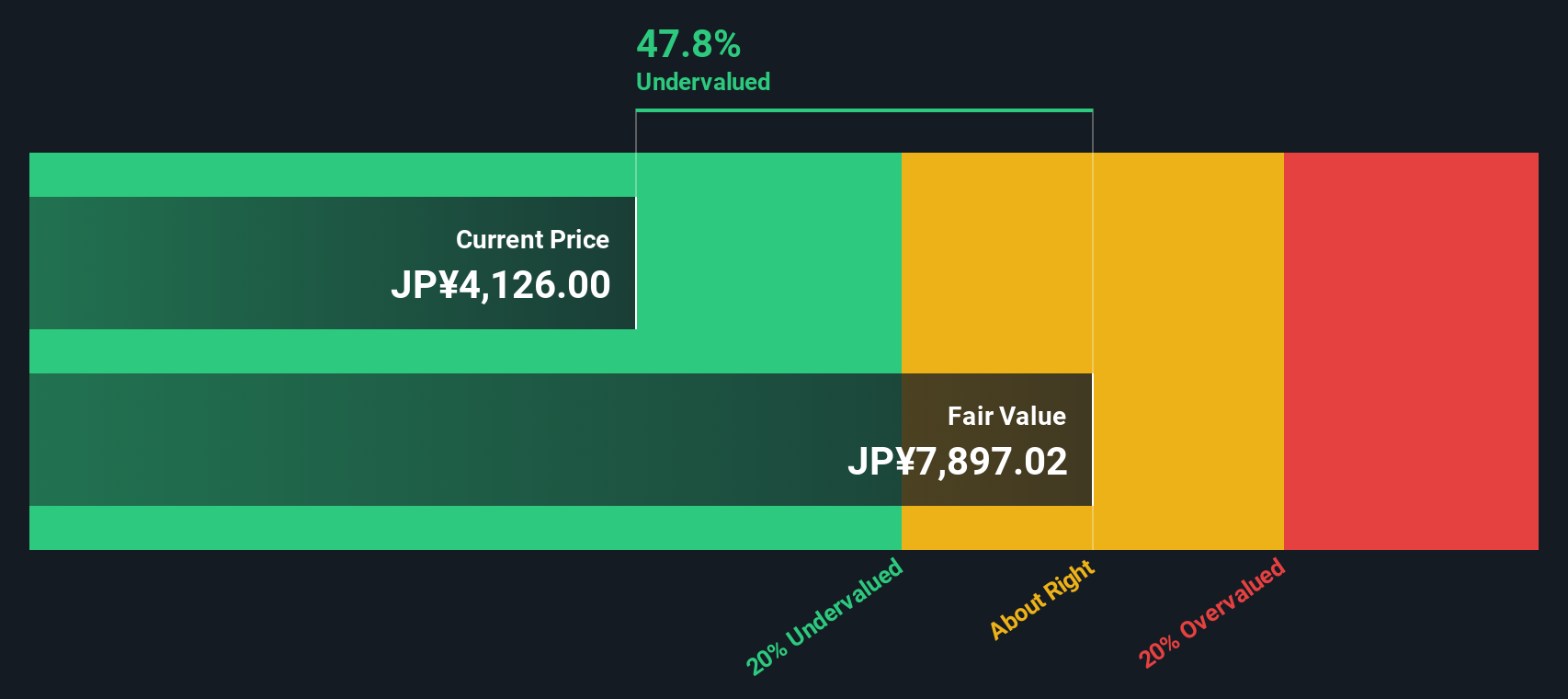

While the price-to-earnings ratio suggests Fuyo General Lease is a bargain, our DCF model values the shares at ¥7,900.87, which is nearly double the current market price. This sizable gap points to a potentially overlooked value. Could the broader market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Fuyo General Lease for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Fuyo General Lease Narrative

If you see things differently or want to dig deeper into the numbers, crafting your own perspective and analysis is quick and straightforward. Do it your way.

A great starting point for your Fuyo General Lease research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your opportunities to a single stock. Gain that edge and uncover standout investments that could transform your portfolio using our easy screening tools.

- Secure higher income streams when you tap into these 17 dividend stocks with yields > 3% boasting yields above 3%, ideal for building a steady flow of returns.

- Capture tomorrow’s market winners by exploring these 880 undervalued stocks based on cash flows and potential growth opportunities hiding in plain sight.

- Ride the next wave of technology growth by targeting these 27 AI penny stocks setting trends in automation, machine learning, and digital transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8424

Fuyo General Lease

Engages in the leasing and instalment sales business in Japan and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives