- Japan

- /

- Capital Markets

- /

- TSE:4436

Not Many Are Piling Into MINKABU THE INFONOID, Inc. (TSE:4436) Stock Yet As It Plummets 29%

Unfortunately for some shareholders, the MINKABU THE INFONOID, Inc. (TSE:4436) share price has dived 29% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 74% share price decline.

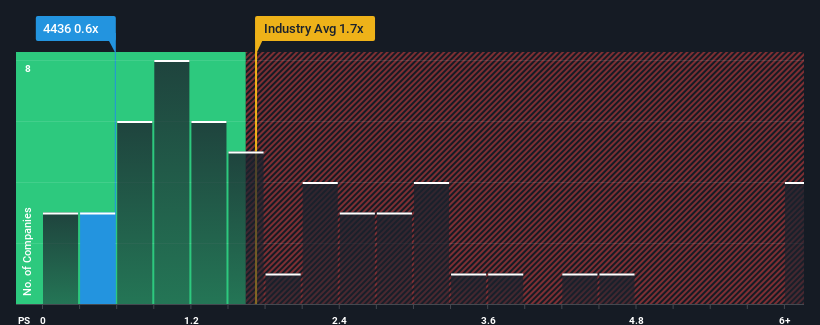

After such a large drop in price, given about half the companies operating in Japan's Capital Markets industry have price-to-sales ratios (or "P/S") above 1.7x, you may consider MINKABU THE INFONOID as an attractive investment with its 0.6x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for MINKABU THE INFONOID

How Has MINKABU THE INFONOID Performed Recently?

MINKABU THE INFONOID could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on MINKABU THE INFONOID will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For MINKABU THE INFONOID?

The only time you'd be truly comfortable seeing a P/S as low as MINKABU THE INFONOID's is when the company's growth is on track to lag the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Although pleasingly revenue has lifted 95% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Turning to the outlook, the next three years should generate growth of 0.03% each year as estimated by the two analysts watching the company. With the industry predicted to deliver 1.8% growth each year, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that MINKABU THE INFONOID's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

MINKABU THE INFONOID's P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It looks to us like the P/S figures for MINKABU THE INFONOID remain low despite growth that is expected to be in line with other companies in the industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

And what about other risks? Every company has them, and we've spotted 4 warning signs for MINKABU THE INFONOID (of which 3 are a bit unpleasant!) you should know about.

If these risks are making you reconsider your opinion on MINKABU THE INFONOID, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4436

MINKABU THE INFONOID

Provides financial information services in Japan and internationally.

Slight with moderate growth potential.

Market Insights

Community Narratives