- Japan

- /

- Hospitality

- /

- TSE:9936

Assessing Ohsho Food Service (TSE:9936) Valuation After Notable Recent Share Price Swings

Reviewed by Simply Wall St

Price-to-Earnings of 23.3x: Is it justified?

Ohsho Food Service is currently trading at a price-to-earnings (P/E) ratio of 23.3x, just below the Japanese hospitality industry average of 23.7x. This places the company's valuation in line with peers and suggests investors are valuing its earnings similarly to other companies in the sector.

The price-to-earnings (P/E) ratio compares a company’s current share price to its per-share earnings. In the restaurant and hospitality industry, this metric helps assess how the market is pricing future growth and profitability relative to rivals. A P/E close to the industry average generally indicates the market expects the company to deliver a similar earnings trajectory to its competitors.

Ohsho Food Service’s current P/E ratio appears justified, reflecting current earnings momentum and future growth expectations that broadly match those of its industry peers.

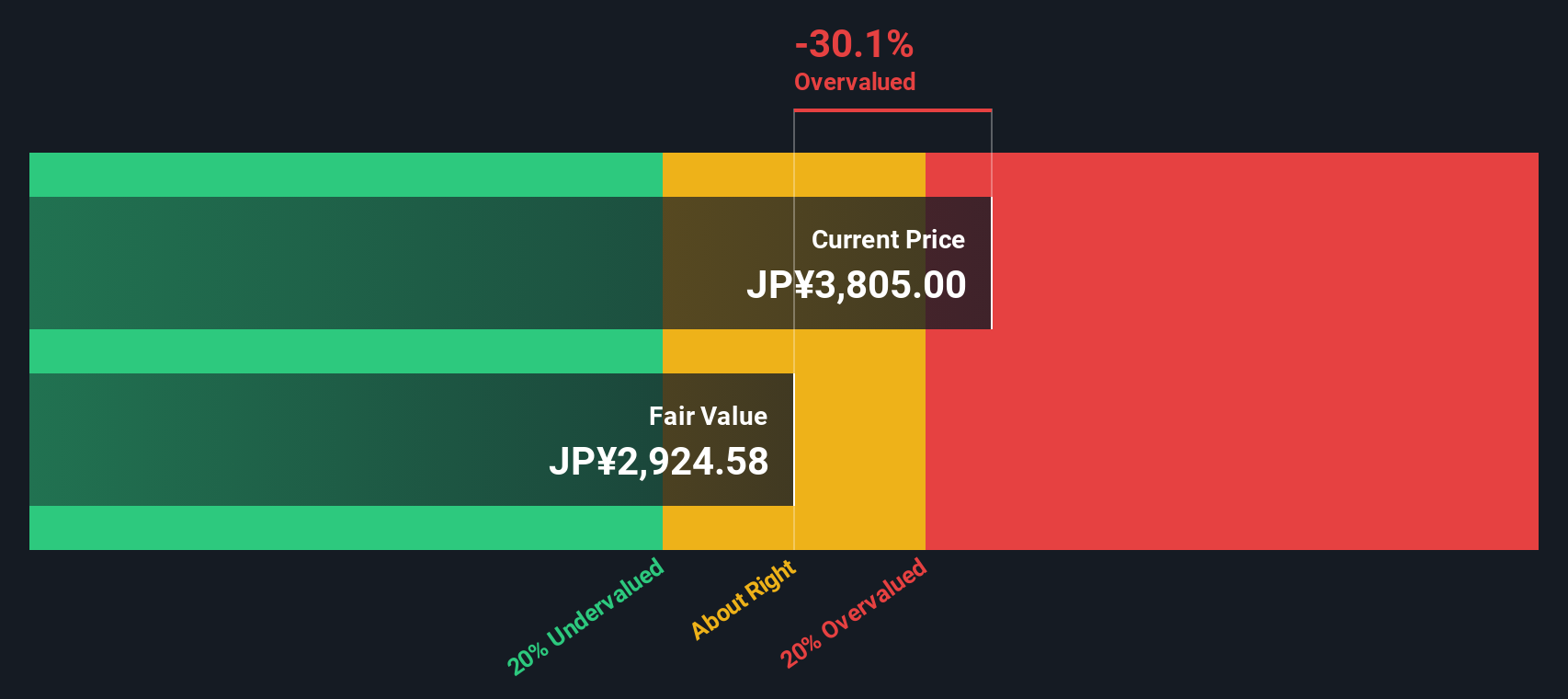

Result: Fair Value of ¥2,921.23 (OVERVALUED)

See our latest analysis for Ohsho Food Service.However, if trends persist, slowing revenue and net income growth could become concerns. This introduces the possibility of investor sentiment shifting away from optimism.

Find out about the key risks to this Ohsho Food Service narrative.Another View: SWS DCF Model Offers a Different Perspective

Taking a step back from valuation ratios, the SWS DCF model instead looks at expected future cash flows to assess value. This approach suggests the shares may actually be overvalued at current prices, offering a contrasting outlook. Which method reflects reality best?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Ohsho Food Service Narrative

If you see things differently or want to dive deeper into the numbers, you can shape your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Ohsho Food Service.

Ready for More Investment Opportunities?

Take charge of your portfolio. Don’t let the next big idea pass you by; these tailored stock picks could bring real growth, income, or innovation into your investments.

- Unlock yield potential by targeting companies rated for robust income, all highlighted in our dividend stocks with yields > 3%.

- Ride the wave of artificial intelligence innovation with businesses shaping tomorrow’s world, spotlighted in our AI penny stocks.

- Capitalize on value by zeroing in on stocks priced for upside in our handpicked list of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9936

Ohsho Food Service

Operates and franchises a chain of Chinese restaurants under the Gyoza no OHSHO brand name in Japan.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives