As global markets experience mixed performances, with major U.S. indices like the S&P 500 and Nasdaq Composite reaching record highs amid a rally in growth stocks, investors are keenly watching economic indicators and central bank policies for clues on future market directions. In this context of varied sector performance and geopolitical developments, dividend stocks remain an attractive option for those seeking steady income streams; they often provide stability during times of market volatility by offering regular payouts that can help cushion against price fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.08% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.73% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.97% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.12% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.09% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.32% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.81% | ★★★★★★ |

Click here to see the full list of 1931 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

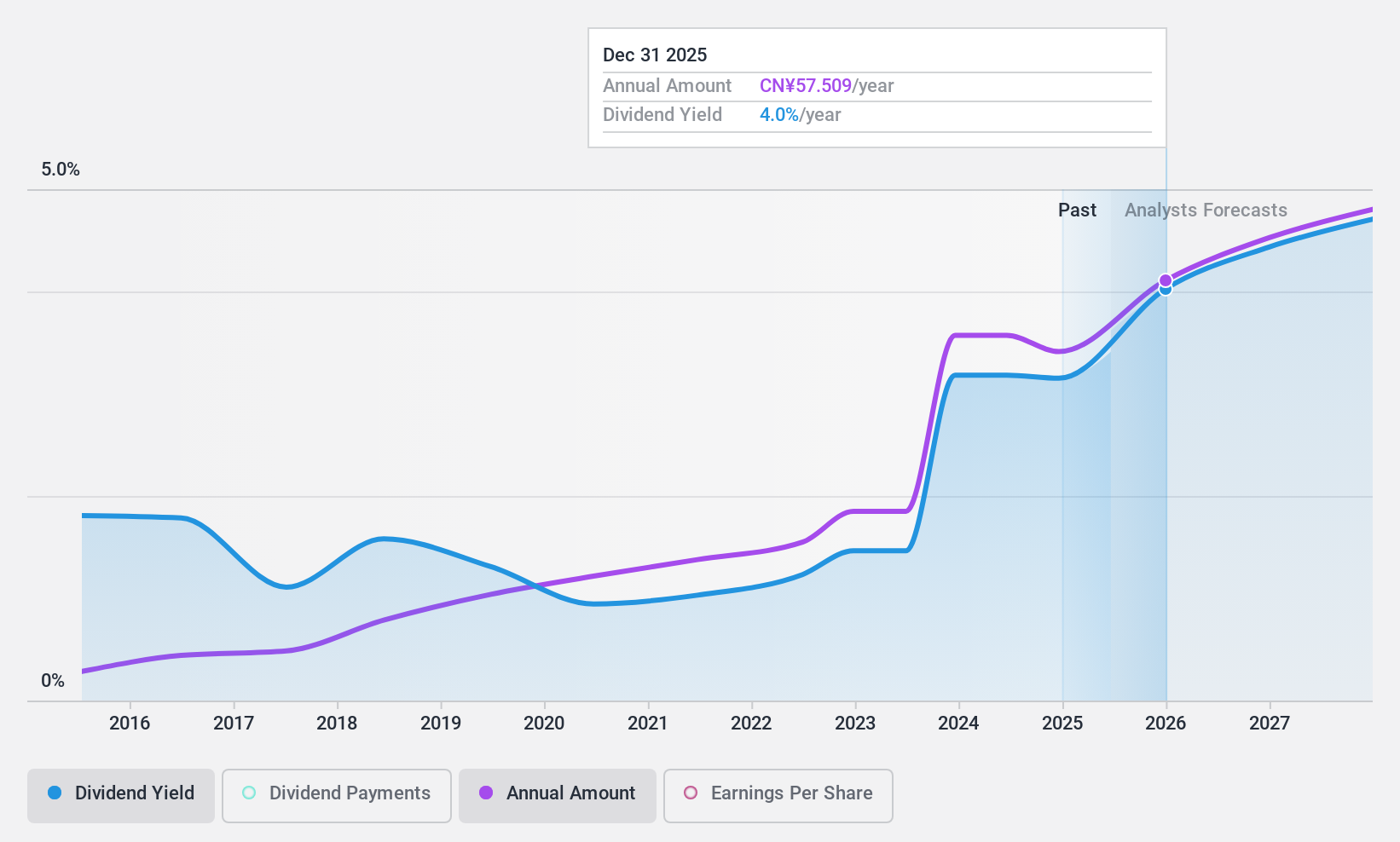

Kweichow Moutai (SHSE:600519)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kweichow Moutai Co., Ltd. is a company that produces and sells liquor products both in China and internationally, with a market cap of CN¥1.97 trillion.

Operations: Kweichow Moutai Co., Ltd. generates revenue primarily from its liquor segment, amounting to CN¥165.20 billion.

Dividend Yield: 3.2%

Kweichow Moutai's dividend yield of 3.19% ranks in the top 25% of CN market dividend payers, but it faces challenges as dividends are not well covered by free cash flows, with a high cash payout ratio of 109.3%. Despite stable and growing dividends over the past decade, sustainability concerns persist due to inadequate coverage by earnings and cash flows. Recent earnings growth and a share repurchase program may impact future dividend strategies.

- Click here and access our complete dividend analysis report to understand the dynamics of Kweichow Moutai.

- The valuation report we've compiled suggests that Kweichow Moutai's current price could be quite moderate.

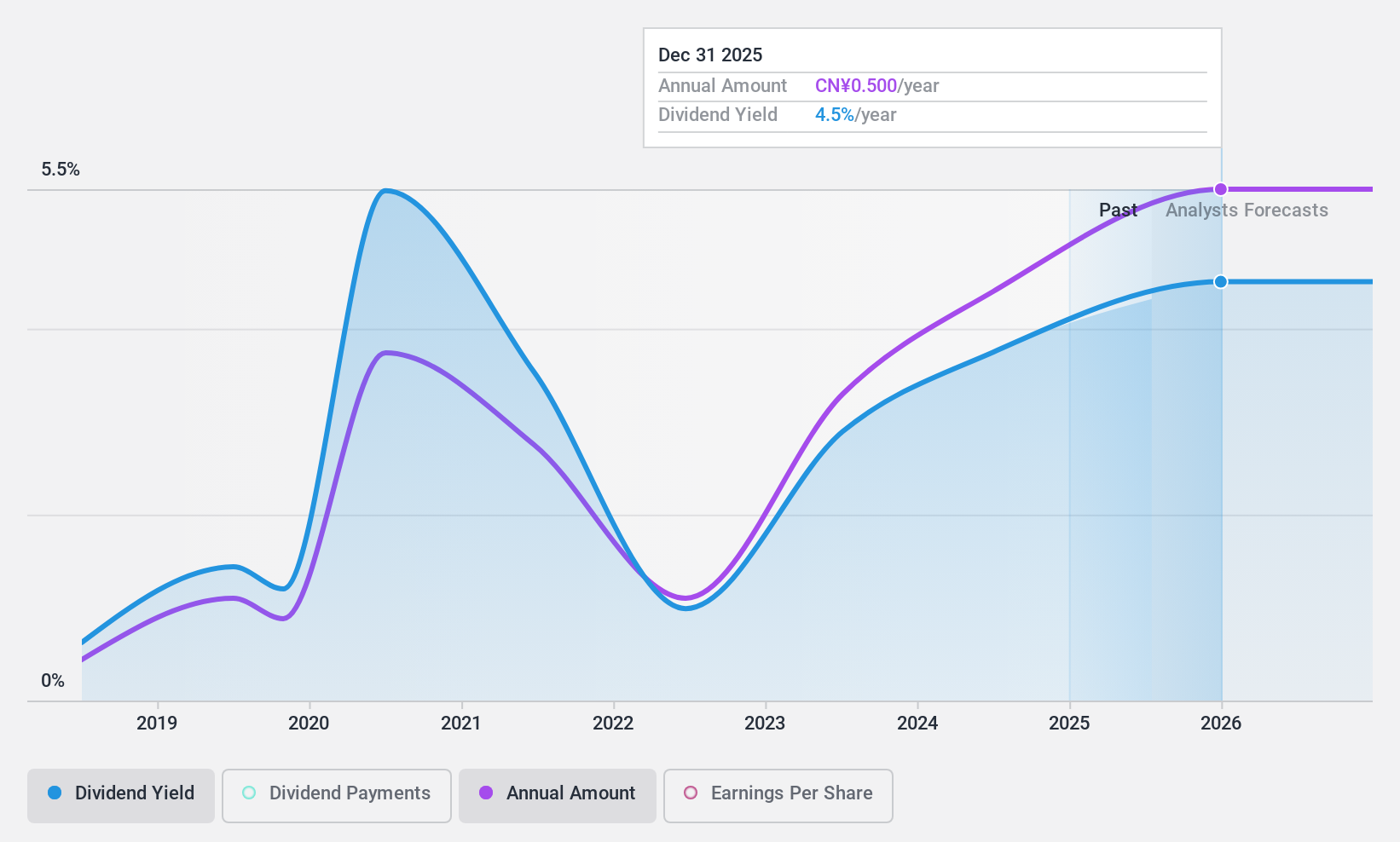

Jinduicheng Molybdenum (SHSE:601958)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jinduicheng Molybdenum Co., Ltd. is a company that produces and sells molybdenum products globally, with a market capitalization of CN¥35.04 billion.

Operations: Jinduicheng Molybdenum Co., Ltd. generates its revenue through the production and sale of molybdenum products on a global scale.

Dividend Yield: 3.7%

Jinduicheng Molybdenum's dividend yield of 3.68% is among the top 25% in the CN market, supported by a low payout ratio of 43.7%, indicating dividends are well covered by earnings and cash flows. However, its dividend history is volatile and unreliable, with significant annual drops exceeding 20%. Despite recent revenue growth to CNY 10.10 billion for nine months ending September 2024, net income slightly declined, highlighting potential challenges in maintaining stable dividends.

- Take a closer look at Jinduicheng Molybdenum's potential here in our dividend report.

- Our valuation report here indicates Jinduicheng Molybdenum may be undervalued.

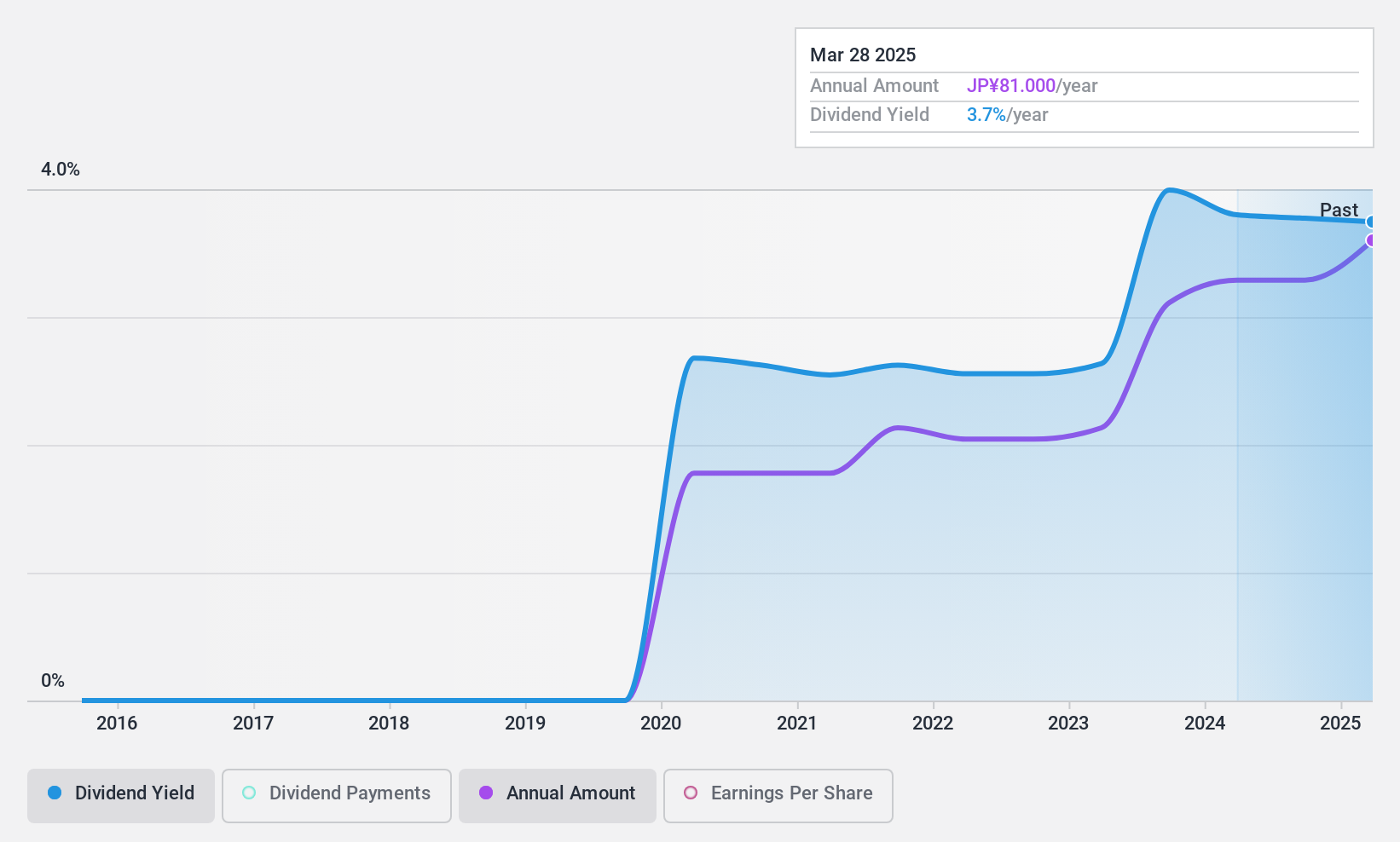

StepLtd (TSE:9795)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Step Co.,Ltd. operates cram schools in Japan and has a market cap of ¥33.66 billion.

Operations: Step Co.,Ltd. generates its revenue from two main segments: the High School Section, contributing ¥3.12 billion, and the Elementary and Junior High School Section, contributing ¥11.98 billion.

Dividend Yield: 3.8%

Step Ltd.'s dividend yield of 3.82% ranks in the top 25% of the JP market, with dividends well-covered by earnings and cash flows due to low payout ratios (49.5% and 41.8%, respectively). While dividends have grown steadily over five years, recent guidance indicates a decrease for fiscal year-end September 2024 but an increase for fiscal year-end September 2025. The company projects JPY 2,541 million profit for FY ending September 2025 amidst ongoing share buybacks.

- Navigate through the intricacies of StepLtd with our comprehensive dividend report here.

- According our valuation report, there's an indication that StepLtd's share price might be on the cheaper side.

Make It Happen

- Get an in-depth perspective on all 1931 Top Dividend Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kweichow Moutai might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600519

Kweichow Moutai

Produces and sells liquor products in China and internationally.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives