- Japan

- /

- Consumer Services

- /

- TSE:7366

3 Asian Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

Amidst heightened global trade tensions and economic uncertainty, Asian markets are navigating a complex landscape influenced by recent tariff announcements and their potential impact on growth. In this environment, identifying growth companies with strong insider ownership can be particularly appealing, as such stocks often reflect confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 24.7% |

| AcrelLtd (SZSE:300286) | 40% | 32% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.7% | 24.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 39.9% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| UTour Group (SZSE:002707) | 23.5% | 32.7% |

| Synspective (TSE:290A) | 13.2% | 44.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 74.7% |

Let's take a closer look at a couple of our picks from the screened companies.

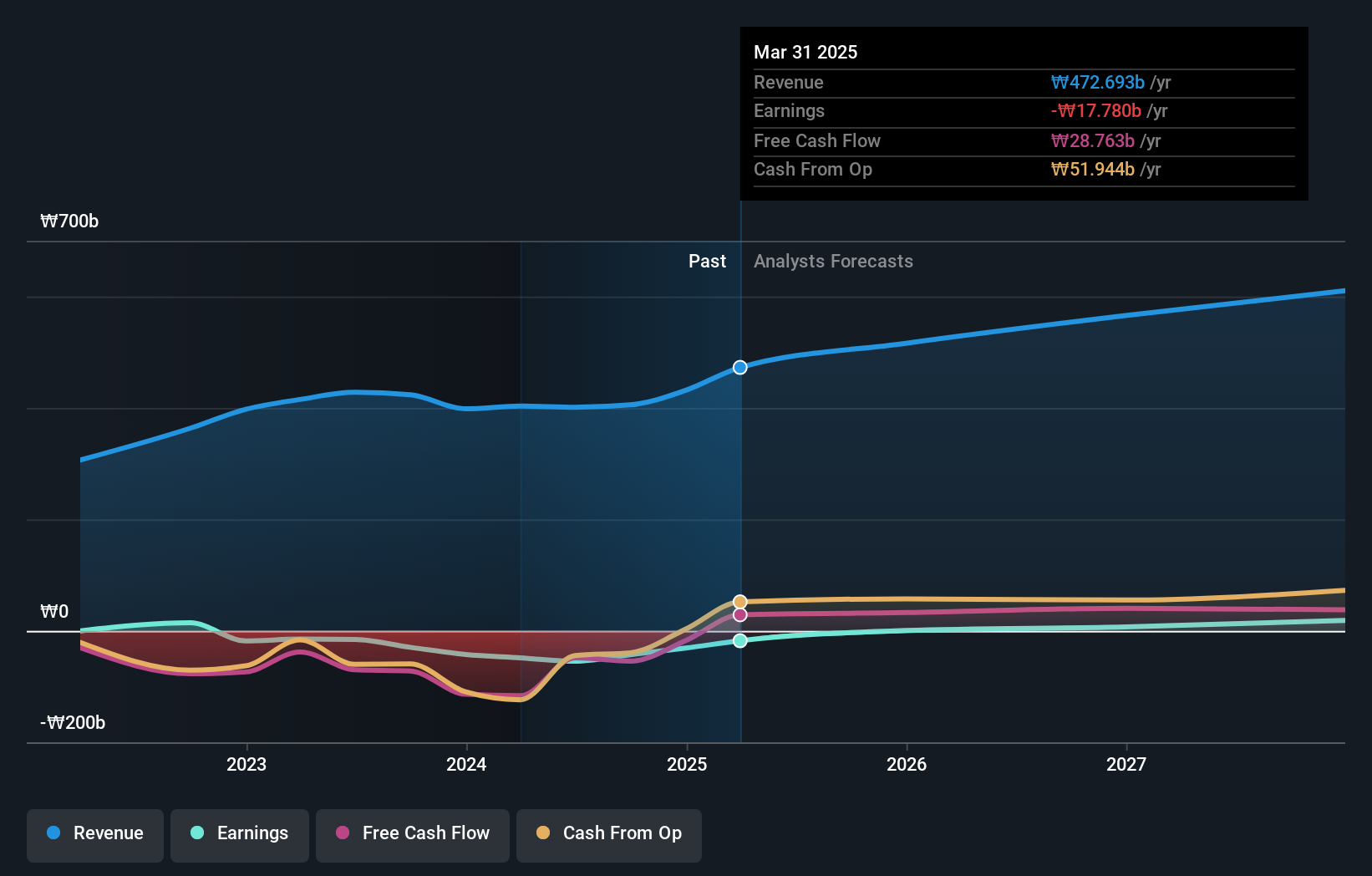

SOCAR (KOSE:A403550)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SOCAR Inc. operates as a mobility company in South Korea with a market cap of ₩466.68 billion.

Operations: The company's revenue segments include Car Sharing at ₩396.77 billion, Micro Mobility at ₩30.53 billion, and Platform Parking Service at ₩8.90 billion.

Insider Ownership: 14.9%

SOCAR's revenue is forecast to grow at 14% annually, outpacing the Korean market average of 7.2%. Analysts expect the stock price to rise by 64.2%, with shares trading at a significant discount of 63.4% below estimated fair value. Despite a net loss reduction from KRW 42 billion to KRW 31 billion in 2024, SOCAR is expected to become profitable in three years, although its future return on equity remains low at an anticipated 4.7%.

- Click here and access our complete growth analysis report to understand the dynamics of SOCAR.

- Our valuation report unveils the possibility SOCAR's shares may be trading at a discount.

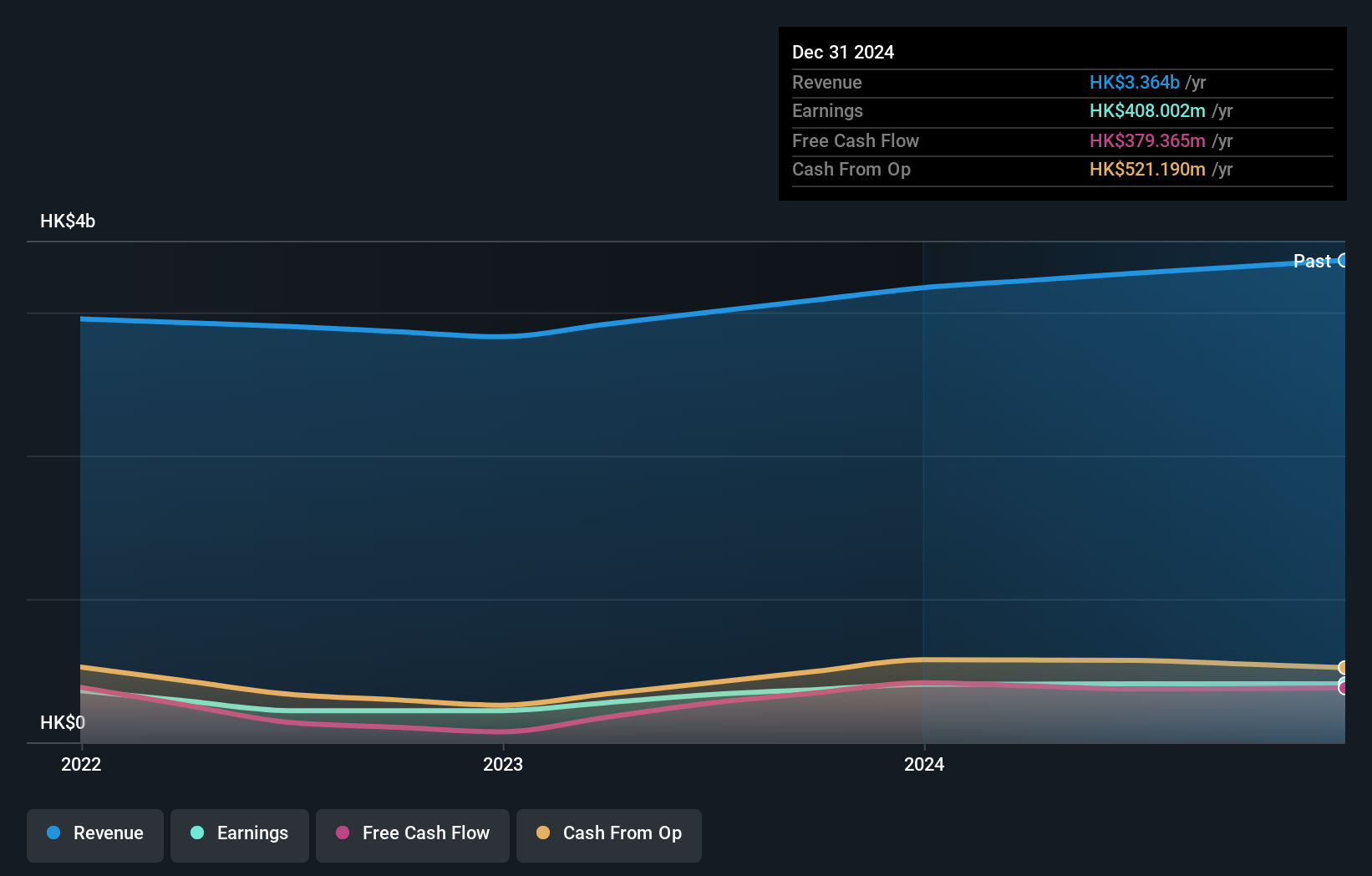

Modern Dental Group (SEHK:3600)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Modern Dental Group Limited is an investment holding company involved in the production, distribution, and trading of dental prosthetic devices across Europe, Greater China, North America, Australia, and other international markets with a market cap of HK$3.73 billion.

Operations: The company's revenue segments include Fixed Prosthetic Devices at HK$2.05 billion and Removable Prosthetic Devices at HK$799.01 million.

Insider Ownership: 17.6%

Modern Dental Group, with substantial insider ownership through Triera Holdings Limited, forecasts earnings growth of 20.6% annually, surpassing the Hong Kong market average. Despite a low future return on equity of 17%, it trades at a significant discount to its estimated fair value. Recent leadership changes see Mr. K.F. Chan transitioning to an advisory role, ensuring strategic continuity within the family-led company structure. The proposed dividend increase reflects efforts to enhance shareholder value amidst stable revenue growth projections.

- Navigate through the intricacies of Modern Dental Group with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Modern Dental Group shares in the market.

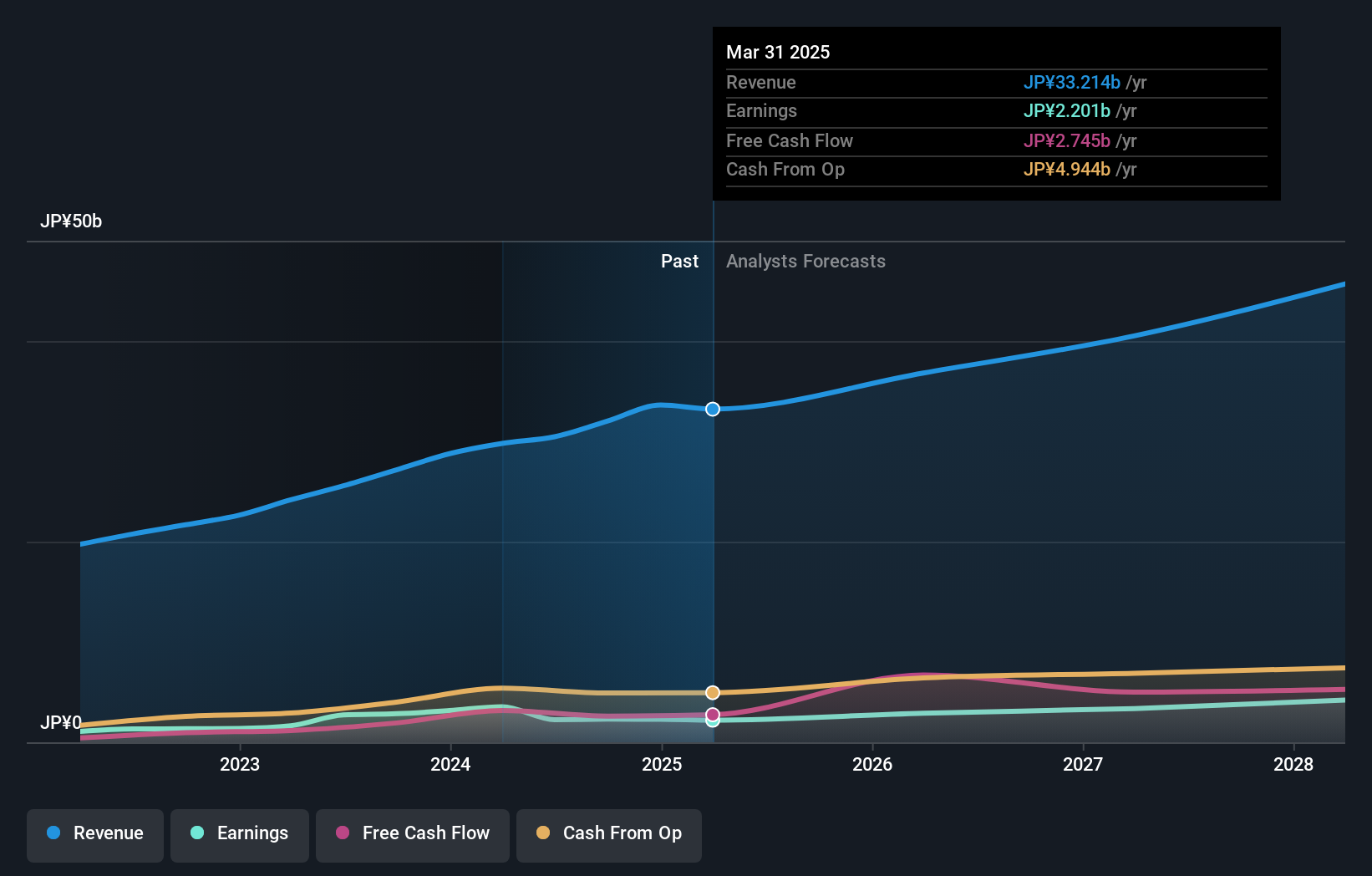

LITALICO (TSE:7366)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LITALICO Inc. operates schools for learning and preschool in Japan with a market cap of ¥38.74 billion.

Operations: The company's revenue is primarily derived from its Employment Support Business, which generates ¥12.05 billion, followed by the Child Welfare Business at ¥9.16 billion and the Platform Business contributing ¥4.30 billion.

Insider Ownership: 36.8%

LITALICO, with significant insider ownership, is poised for robust growth with earnings projected to increase 20.16% annually, outpacing the Japanese market. Despite a volatile share price and lower profit margins than last year, it trades at a substantial discount to its estimated fair value. The recent dividend hike from ¥8.00 to ¥9.00 per share underscores its commitment to shareholder returns while continuing domestic and international expansion amidst high debt levels.

- Delve into the full analysis future growth report here for a deeper understanding of LITALICO.

- In light of our recent valuation report, it seems possible that LITALICO is trading behind its estimated value.

Seize The Opportunity

- Delve into our full catalog of 657 Fast Growing Asian Companies With High Insider Ownership here.

- Contemplating Other Strategies? This technology could replace computers: discover the 21 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7366

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives