- Japan

- /

- Construction

- /

- TSE:1965

GuangZhou LingWe Technology And 2 Other Undiscovered Gems With Strong Potential

Reviewed by Simply Wall St

As global markets show signs of resilience with U.S. indexes approaching record highs and smaller-cap stocks outperforming their larger counterparts, investors are increasingly focused on uncovering opportunities within the small-cap sector. In this environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding, as these companies may benefit from the current economic trends and investor sentiment shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| Mobile Telecommunications | NA | 4.98% | 0.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

GuangZhou LingWe Technology (SZSE:301373)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangzhou Lingwe Technology Co., Ltd. specializes in the research, development, production, sale, and technical servicing of nano-silica products both in China and internationally with a market capitalization of CN¥2.96 billion.

Operations: LingWe Technology generates revenue through the sale and technical servicing of nano-silica products. The company's focus on research and development supports its product offerings in both domestic and international markets.

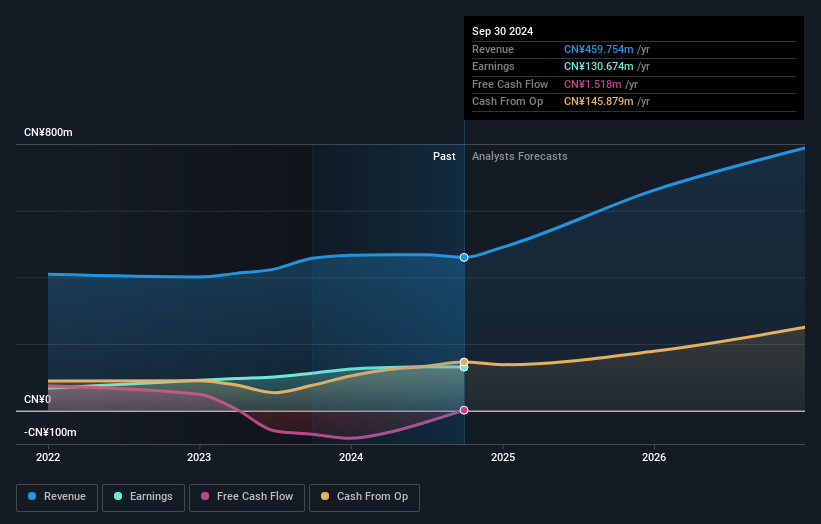

GuangZhou LingWe Technology, a nimble player in the tech sector, showcases robust financial health with earnings growth of 16% over the past year, outpacing the broader chemicals industry. The company operates debt-free, a significant shift from five years ago when its debt-to-equity ratio was 0.4%. Its price-to-earnings ratio stands at 23x, below the CN market average of 35x. Recent earnings reports reveal net income climbing to CNY 95 million for nine months ending September 2024, up from CNY 90 million last year. Future revenue is expected to grow by nearly 25% annually.

Techno Ryowa (TSE:1965)

Simply Wall St Value Rating: ★★★★★☆

Overview: Techno Ryowa Ltd. focuses on the design, construction, and maintenance of environmental control systems primarily in Japan, with a market capitalization of ¥49.21 billion.

Operations: Techno Ryowa Ltd. generates revenue primarily from its Air Conditioning Sanitary Equipment Construction Business and General Building Equipment Work, contributing ¥48.01 billion and ¥25.11 billion respectively. The Electrical Equipment Construction Business adds ¥2.62 billion, while the Cooling and Heating Equipment Sales Segment accounts for ¥1.20 billion in revenue.

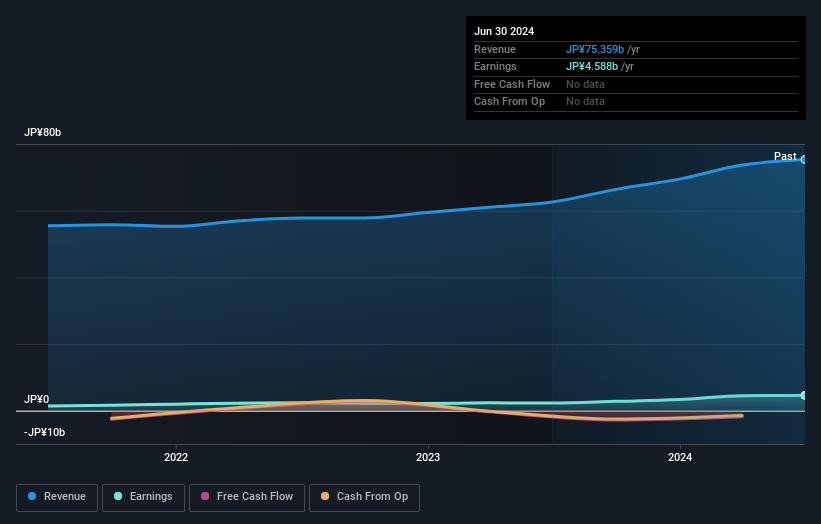

Techno Ryowa, a nimble player in the construction sector, has been making waves with its impressive earnings growth of 77.5% over the past year, outpacing the industry average of 19.2%. This growth is underscored by a favorable price-to-earnings ratio of 10.2x, which stands below Japan's market average of 13.3x, suggesting potential value for investors. Despite recent share price volatility, Techno Ryowa's financial health appears robust with a debt-to-equity ratio dropping from 0.5 to 0.2 over five years and more cash than total debt on hand—an encouraging sign for future stability and expansion prospects following its addition to the S&P Global BMI Index in September 2024.

Heiwa (TSE:6412)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Heiwa Corporation is a Japanese company that develops, manufactures, and sells pachinko and pachislot machines, with a market cap of approximately ¥207.61 billion.

Operations: Heiwa generates revenue primarily from its Pachislot and Pachinko Machine Business, contributing ¥43.30 billion, and its Golf Business, which adds ¥98.16 billion. The company's net profit margin shows a noteworthy trend at 10% over the recent period.

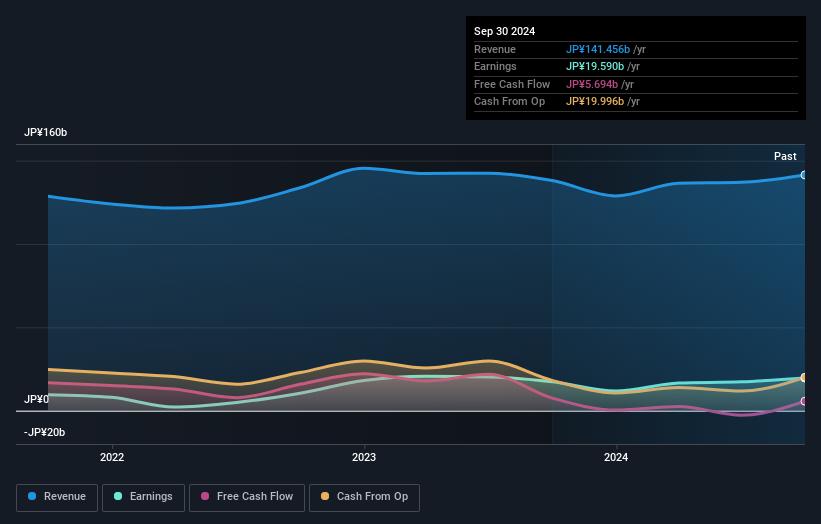

Heiwa, a smaller player in its sector, offers a compelling story with its price-to-earnings ratio at 10.7x, undercutting the JP market average of 13.3x. Over the last five years, Heiwa has successfully reduced its debt to equity from 50.1% to 45.7%, signaling prudent financial management and maintaining a satisfactory net debt to equity ratio of 22.2%. Despite not outpacing industry growth rates recently, Heiwa's earnings have consistently increased by an impressive annual rate of 21.8% over five years and it boasts high-quality earnings alongside well-covered interest payments with EBIT covering interest expenses by a robust margin of nearly 69 times.

- Delve into the full analysis health report here for a deeper understanding of Heiwa.

Gain insights into Heiwa's past trends and performance with our Past report.

Taking Advantage

- Unlock our comprehensive list of 4634 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Techno Ryowa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1965

Techno Ryowa

Engages in the design, construction, and maintenance of environmental control systems primarily in Japan.

Solid track record with excellent balance sheet.