JSS Corporation (TSE:6074) stock is about to trade ex-dividend in 3 days. The ex-dividend date generally occurs two days before the record date, which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. This means that investors who purchase JSS' shares on or after the 28th of March will not receive the dividend, which will be paid on the 30th of June.

The upcoming dividend for JSS will put a total of JP¥10.00 per share in shareholders' pockets. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. We need to see whether the dividend is covered by earnings and if it's growing.

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. JSS paid out just 16% of its profit last year, which we think is conservatively low and leaves plenty of margin for unexpected circumstances. A useful secondary check can be to evaluate whether JSS generated enough free cash flow to afford its dividend. The good news is it paid out just 17% of its free cash flow in the last year.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

See our latest analysis for JSS

Click here to see how much of its profit JSS paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

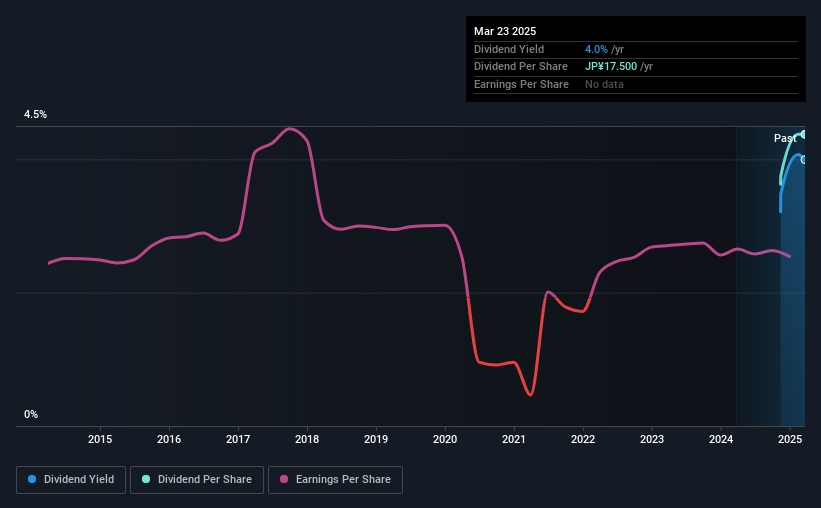

When earnings decline, dividend companies become much harder to analyse and own safely. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Readers will understand then, why we're concerned to see JSS's earnings per share have dropped 10% a year over the past five years. When earnings per share fall, the maximum amount of dividends that can be paid also falls.

This is JSS's first year of paying a regular dividend, which is exciting for shareholders - but it does mean there's no dividend history to examine.

The Bottom Line

Has JSS got what it takes to maintain its dividend payments? JSS has comfortably low cash and profit payout ratios, which may mean the dividend is sustainable even in the face of a sharp decline in earnings per share. Still, we consider declining earnings to be a warning sign. While it does have some good things going for it, we're a bit ambivalent and it would take more to convince us of JSS's dividend merits.

On that note, you'll want to research what risks JSS is facing. Every company has risks, and we've spotted 3 warning signs for JSS (of which 1 is a bit unpleasant!) you should know about.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

If you're looking to trade JSS, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6074

Good value average dividend payer.

Market Insights

Community Narratives