Stock Analysis

- Japan

- /

- Hospitality

- /

- TSE:4680

High Insider Ownership Up To 35% In These 3 Japanese Growth Stocks

Reviewed by Simply Wall St

Amid a challenging week for Japan's stock markets, with the Nikkei 225 Index and TOPIX Index both registering sharp declines, investors may find solace in companies where insiders hold significant stakes. High insider ownership can be a sign of confidence in the company's future growth prospects, particularly in turbulent times.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Hottolink (TSE:3680) | 27% | 59.7% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 43.3% |

| Micronics Japan (TSE:6871) | 15.3% | 39.8% |

| Medley (TSE:4480) | 34% | 28.7% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

| SHIFT (TSE:3697) | 35.4% | 32.8% |

| Money Forward (TSE:3994) | 21.4% | 66.9% |

| ExaWizards (TSE:4259) | 21.9% | 91.1% |

| Astroscale Holdings (TSE:186A) | 20.9% | 90% |

| freee K.K (TSE:4478) | 23.9% | 72.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Lifedrink Company (TSE:2585)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lifedrink Company, Inc. is a Japanese beverage manufacturer with a market capitalization of ¥92.58 billion.

Operations: The revenue segments information for this entity is not provided in the text.

Insider Ownership: 14.6%

Lifedrink Company is trading slightly below its fair value and showcases a promising forecast with earnings expected to grow by 9.45% annually. Despite a high debt level and a volatile share price recently, the company benefits from high-quality earnings largely derived from non-cash sources. Notably, its revenue growth at 6.3% per year surpasses the Japanese market average, although it doesn’t reach the high growth benchmark of 20% per year. Return on equity is also anticipated to be robust at 23.1%.

- Take a closer look at Lifedrink Company's potential here in our earnings growth report.

- The analysis detailed in our Lifedrink Company valuation report hints at an inflated share price compared to its estimated value.

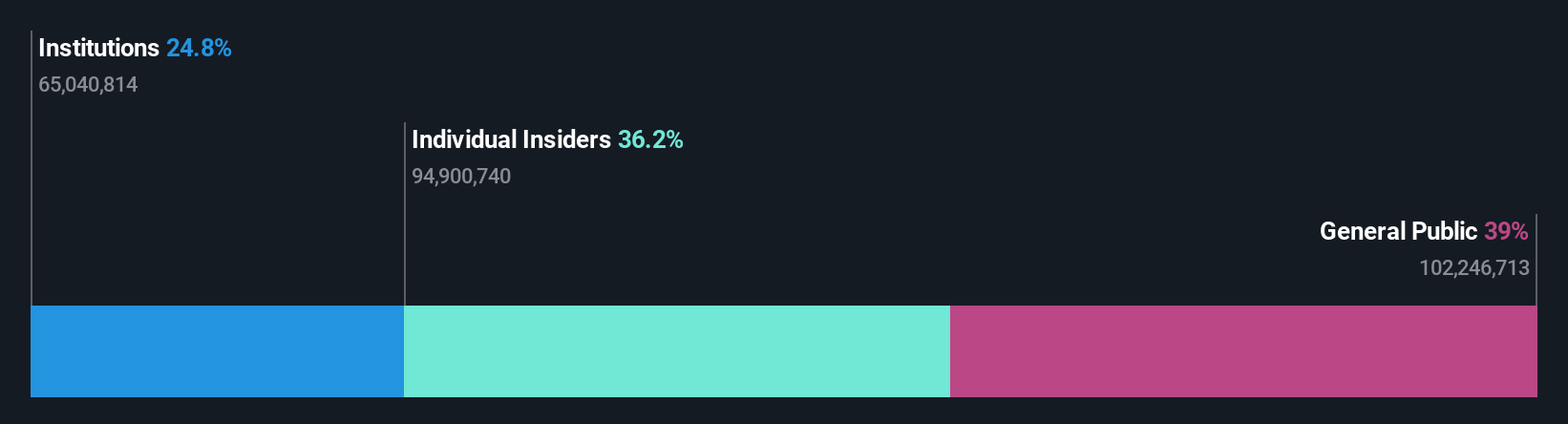

Simplex Holdings (TSE:4373)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Simplex Holdings, Inc., a global company, offers strategic consulting, design and development, and operation and maintenance services to financial institutions, corporations, and public sectors with a market capitalization of ¥129.42 billion.

Operations: The firm generates revenue by providing strategic consulting, design and development, and operational support services across various sectors globally.

Insider Ownership: 28.8%

Simplex Holdings, Inc. has demonstrated robust earnings growth of 26.6% annually over the past five years and is poised for further expansion with forecasted earnings growth of 20.1% per year, outpacing the Japanese market's 8.9%. Despite its volatile share price recently and an unstable dividend track record, the company benefits from revenue forecasts growing at 12.8% annually—also above market trends. Trading at a significant discount, Simplex offers potential upside according to analyst targets suggesting a near 48.8% increase in stock price.

- Delve into the full analysis future growth report here for a deeper understanding of Simplex Holdings.

- Upon reviewing our latest valuation report, Simplex Holdings' share price might be too pessimistic.

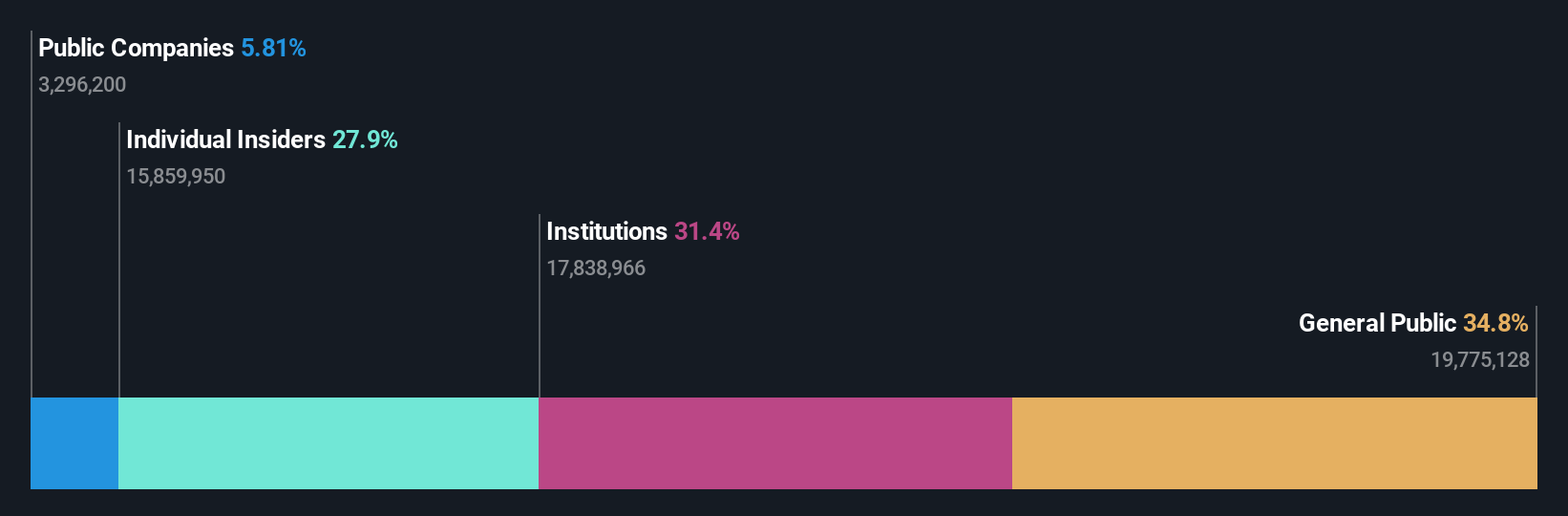

Round One (TSE:4680)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Round One Corporation operates indoor leisure complex facilities and has a market capitalization of approximately ¥241.30 billion.

Operations: The company generates revenue primarily from its leisure complexes in Japan and the USA, with segment revenues of ¥97.99 billion and ¥59.58 billion respectively.

Insider Ownership: 35.2%

Round One Corporation, with its high insider ownership, offers a mixed investment outlook. Despite trading at 60.2% below its estimated fair value and showing promising revenue growth forecasts of 7.1% annually—surpassing Japan's market average of 4.3%—the company faces challenges with a highly volatile share price and modest earnings growth projections of around 11% per year. Recent sales figures underscore robust activity in both the Japanese and U.S. markets, indicating potential for sustained operational expansion.

- Get an in-depth perspective on Round One's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Round One shares in the market.

Make It Happen

- Unlock our comprehensive list of 101 Fast Growing Japanese Companies With High Insider Ownership by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4680

Outstanding track record, undervalued and pays a dividend.