- Japan

- /

- Real Estate

- /

- TSE:8876

High Insider Ownership Growth Companies On The Japanese Exchange In June 2024

Reviewed by Simply Wall St

Amid a backdrop of mixed economic signals and a tentative rally in the yen, Japan's stock markets have shown varied performance, with the Nikkei 225 making modest gains while the broader TOPIX index retreated slightly. In such an environment, growth companies with high insider ownership on the Japanese Exchange could potentially offer unique investment opportunities as these insiders often have a deep commitment to their companies' long-term success.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| SHIFT (TSE:3697) | 35.4% | 27% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

| Hottolink (TSE:3680) | 27% | 57.3% |

| Medley (TSE:4480) | 34% | 28.7% |

| Micronics Japan (TSE:6871) | 15.3% | 39.7% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 44.6% |

| ExaWizards (TSE:4259) | 24.8% | 80.2% |

| Money Forward (TSE:3994) | 21.4% | 63.6% |

| Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

| Soracom (TSE:147A) | 17.2% | 54.1% |

Let's explore several standout options from the results in the screener.

PeptiDream (TSE:4587)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PeptiDream Inc. is a biopharmaceutical company focused on the discovery and development of constrained peptides, small molecules, and peptide-drug conjugate therapeutics, with a market capitalization of approximately ¥272.18 billion.

Operations: The company generates revenue primarily through the development and commercialization of constrained peptides, small molecules, and peptide-drug conjugate therapeutics.

Insider Ownership: 26.1%

PeptiDream, a Japanese biotech firm, is experiencing significant earnings growth with forecasts indicating a 23.37% increase annually. Despite a high Return on Equity forecast at 20.3%, its profit margins have declined from last year's 25.9% to 8.7%. Recent strategic developments include an expanded collaboration with Novartis, potentially boosting future revenues through upfront payments and milestone-based earnings totaling billions of yen. Additionally, PeptiDream is advancing in clinical research, notably in cancer diagnostics which could enhance its market position and accelerate development timelines.

- Unlock comprehensive insights into our analysis of PeptiDream stock in this growth report.

- According our valuation report, there's an indication that PeptiDream's share price might be on the expensive side.

Round One (TSE:4680)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Round One Corporation operates indoor leisure complex facilities, with a market capitalization of ¥208.77 billion.

Operations: The business generates revenue primarily from its indoor leisure complex facilities.

Insider Ownership: 35.2%

Round One Corporation, a Japanese company with high insider ownership, has demonstrated robust growth in earnings, increasing by 60.9% over the past year. Its Return on Equity is anticipated to be strong at 20% in three years. While its revenue growth of 6.4% per year outpaces the Japanese market average of 4.1%, it remains below a high-growth benchmark of 20%. The firm trades at a significant discount, valued at 71.1% below estimated fair value and offers a stable dividend yield of 2.07%. Recent sales results show substantial activity in both Japan and the USA markets, indicating sustained operational momentum.

- Get an in-depth perspective on Round One's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Round One's shares may be trading at a discount.

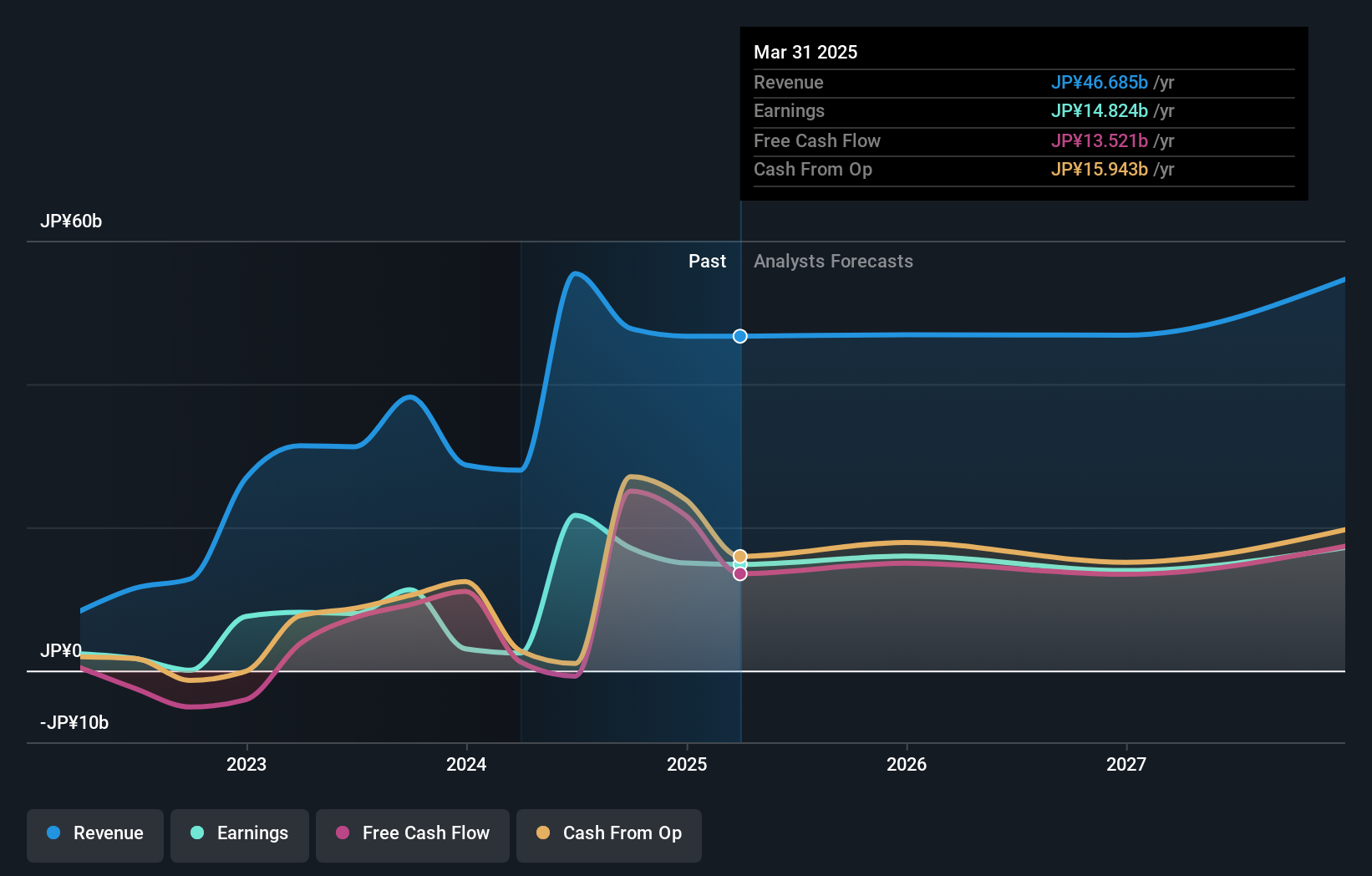

Relo Group (TSE:8876)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Relo Group, Inc. operates primarily in the property management sector in Japan, with a market capitalization of approximately ¥254.48 billion.

Operations: The company generates revenue primarily through its relocation business (¥92.67 billion), followed by welfare programs (¥25.32 billion) and tourism services (¥14.16 billion).

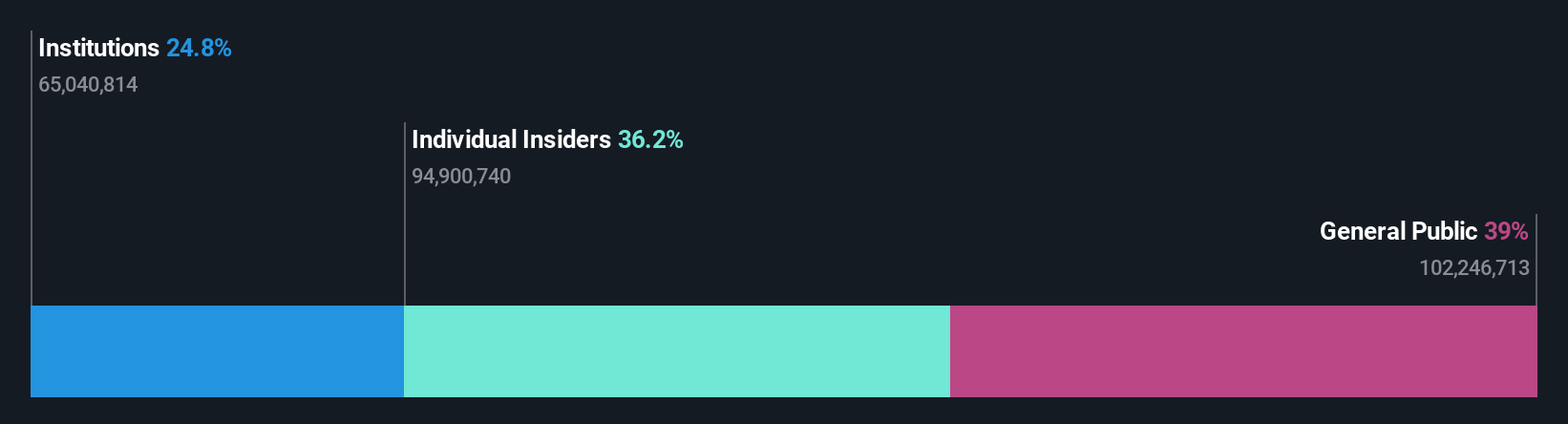

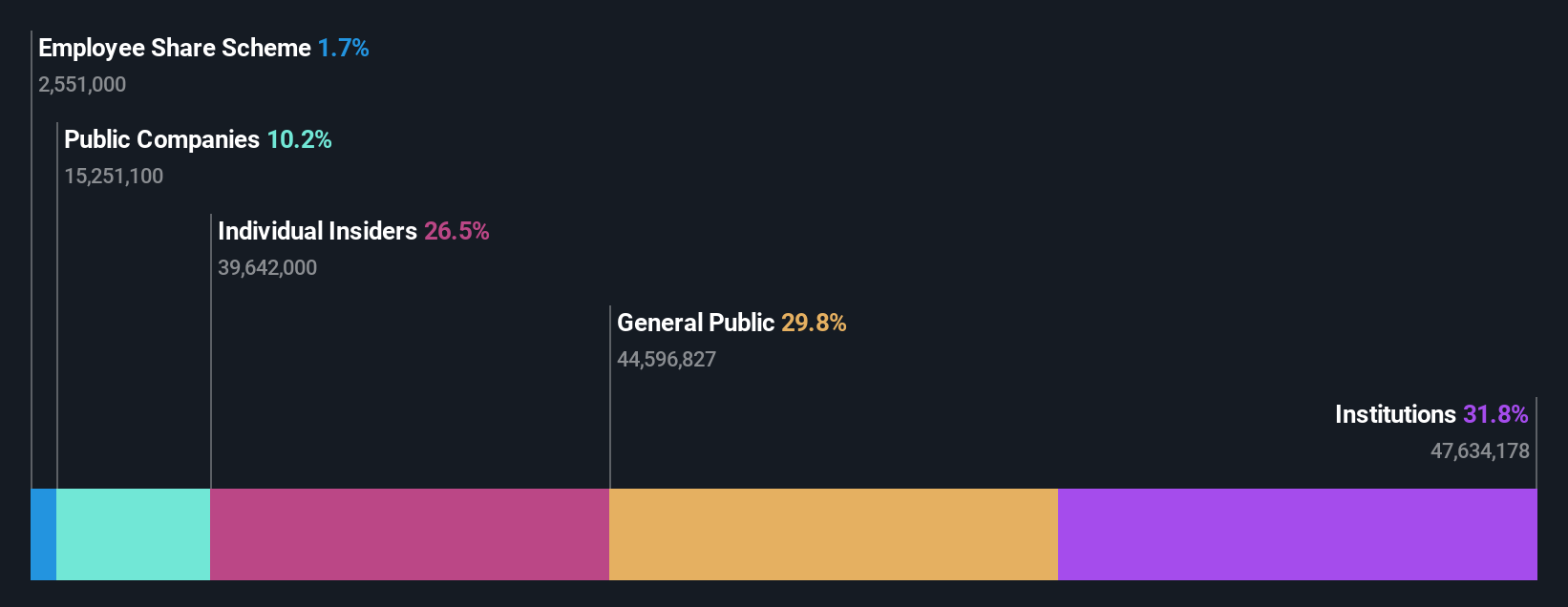

Insider Ownership: 27.5%

Relo Group, set to become profitable within three years, is poised for above-market growth with revenues increasing at 7% annually compared to the Japanese market's 4.1%. Despite a volatile share price recently, it trades at a substantial discount to its fair value. However, its dividend coverage by earnings is weak. Recent corporate governance enhancements aim to strengthen oversight and attract skilled directors, signaling a proactive approach in management and operations optimization.

- Click here to discover the nuances of Relo Group with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Relo Group is trading behind its estimated value.

Make It Happen

- Gain an insight into the universe of 104 Fast Growing Japanese Companies With High Insider Ownership by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8876

Relo Group

Engages in the provision of property management services in Japan.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives