- China

- /

- Electrical

- /

- SZSE:301291

Guangdong Mingyang ElectricLtd And 2 Other Stocks Considered Below Estimated Value

Reviewed by Simply Wall St

As global markets experience a positive shift, driven by easing core inflation in the U.S. and strong bank earnings, investors are increasingly optimistic about potential rate cuts later in the year. This climate has seen value stocks outperform growth shares, particularly within sectors like energy and financials, as major indices such as the S&P 500 and Dow Jones Industrial Average post significant gains. In this environment, identifying undervalued stocks can be crucial for investors looking to capitalize on market opportunities; companies that demonstrate solid fundamentals yet trade below their intrinsic value may offer promising prospects for growth.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$264.50 | NT$526.86 | 49.8% |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY38.94 | TRY77.88 | 50% |

| Aidma Holdings (TSE:7373) | ¥1816.00 | ¥3611.34 | 49.7% |

| Strike CompanyLimited (TSE:6196) | ¥3600.00 | ¥7194.85 | 50% |

| Tabuk Cement (SASE:3090) | SAR13.46 | SAR26.85 | 49.9% |

| Fevertree Drinks (AIM:FEVR) | £6.595 | £13.12 | 49.7% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1112.30 | ₹2216.95 | 49.8% |

| Fudo Tetra (TSE:1813) | ¥2156.00 | ¥4303.36 | 49.9% |

| Verra Mobility (NasdaqCM:VRRM) | US$26.08 | US$52.02 | 49.9% |

| Shinko Electric Industries (TSE:6967) | ¥5875.00 | ¥11690.72 | 49.7% |

Let's uncover some gems from our specialized screener.

Guangdong Mingyang ElectricLtd (SZSE:301291)

Overview: Guangdong Mingyang Electric Co., Ltd. specializes in the research, development, production, and sale of high/low voltage switchgear, transformers, and power transmission and distribution equipment in China with a market cap of CN¥15.23 billion.

Operations: Revenue Segments (in millions of CN¥): High/Low Voltage Switchgear: 1,200; Transformer: 800; Power Transmission and Distribution Equipment: 3,500. Guangdong Mingyang Electric Co., Ltd. generates its revenue primarily through the sale of high/low voltage switchgear (CN¥1.2 billion), transformers (CN¥800 million), and power transmission and distribution equipment (CN¥3.5 billion) in China.

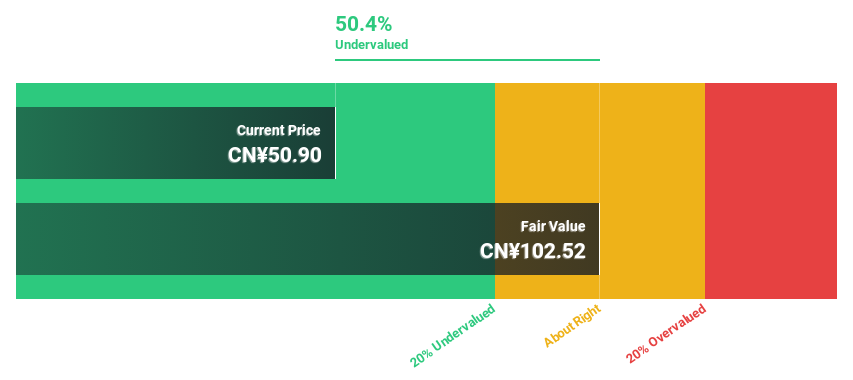

Estimated Discount To Fair Value: 49%

Guangdong Mingyang Electric Ltd. is trading at CN¥51.87, significantly below its estimated fair value of CN¥101.77, suggesting it may be undervalued based on discounted cash flow analysis. The company's revenue is forecast to grow 22.5% annually, outpacing the Chinese market average of 13.4%. Despite high non-cash earnings and a low return on equity forecast of 17.5%, its earnings grew by a robust 49.4% over the past year, with continued strong growth anticipated.

- Insights from our recent growth report point to a promising forecast for Guangdong Mingyang ElectricLtd's business outlook.

- Take a closer look at Guangdong Mingyang ElectricLtd's balance sheet health here in our report.

Round One (TSE:4680)

Overview: Round One Corporation operates indoor leisure complex facilities and has a market cap of ¥338.49 billion.

Operations: The company's revenue is primarily generated from its operations in Japan, contributing ¥100.87 billion, and the United States, adding ¥65.87 billion.

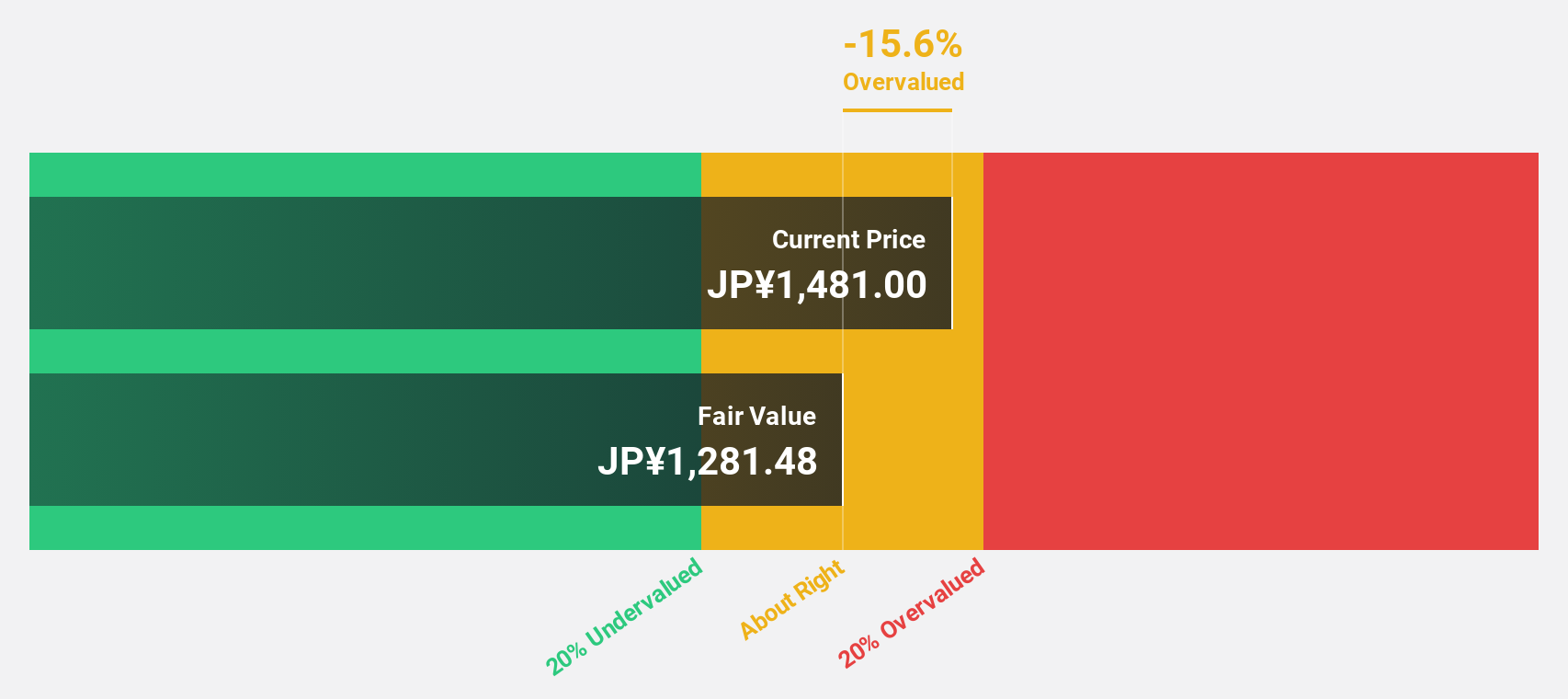

Estimated Discount To Fair Value: 49%

Round One Corporation, trading at ¥1,302, is significantly undervalued with a fair value estimate of ¥2,554.14. Despite high share price volatility recently, it trades 49% below its estimated fair value and shows good relative value compared to peers. Revenue growth is forecast at 7.1% annually, outpacing the Japanese market's 4.3%. Recent sales figures indicate strong performance in both Japan and the USA, while a significant share buyback program supports flexible capital strategy execution.

- Upon reviewing our latest growth report, Round One's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Round One with our detailed financial health report.

Moriya Transportation Engineering and ManufacturingLtd (TSE:6226)

Overview: Moriya Transportation Engineering and Manufacturing Co., Ltd. (TSE:6226) operates in the transportation engineering and manufacturing sector with a market cap of ¥44.33 billion.

Operations: Unfortunately, the provided Business operations text does not contain specific revenue segment information for Moriya Transportation Engineering and Manufacturing Co., Ltd. (TSE:6226), so I'm unable to summarize it into a sentence.

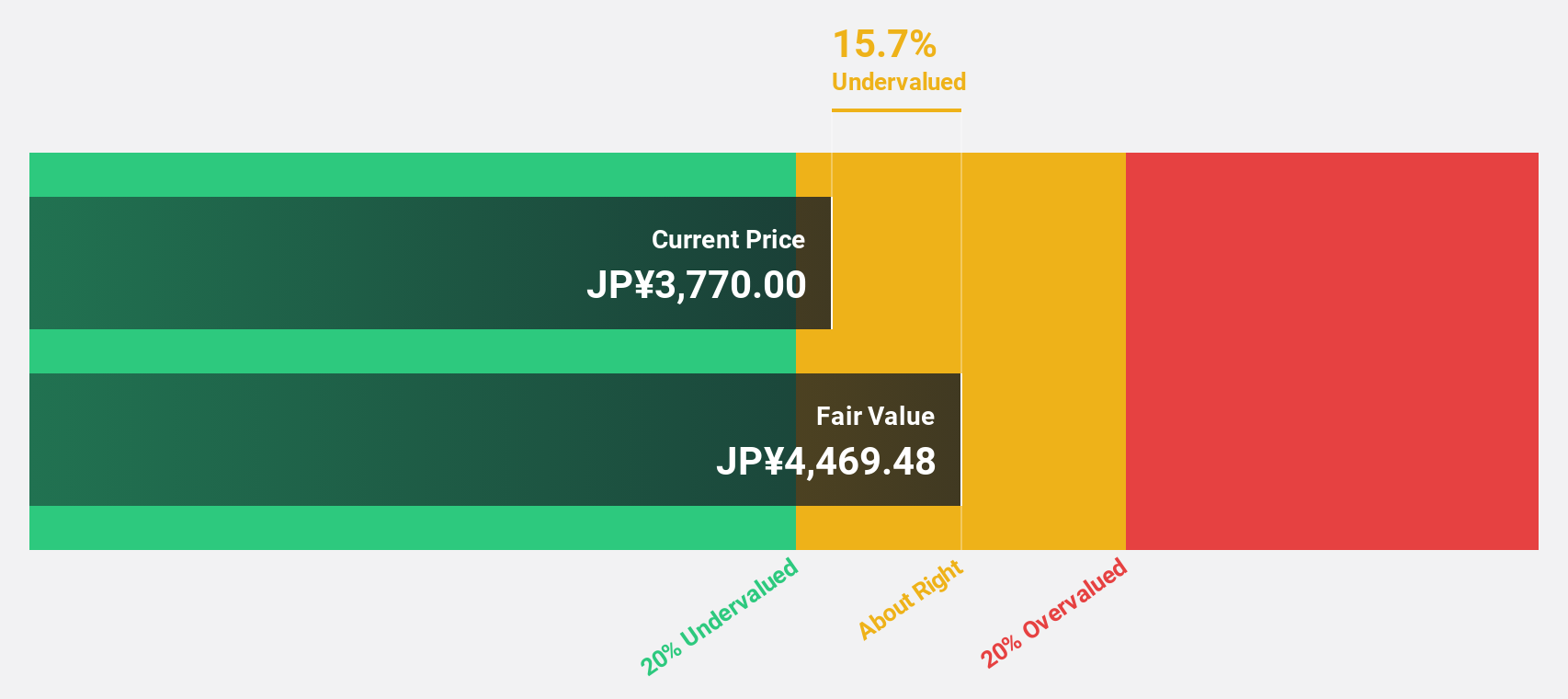

Estimated Discount To Fair Value: 16.8%

Moriya Transportation Engineering and Manufacturing Ltd. is trading at ¥2,579, below its estimated fair value of ¥3,099.71, indicating potential undervaluation. Revenue growth is expected at 10.1% annually, surpassing the Japanese market's 4.3%, while earnings are projected to grow by 12.3% per year. The company recently completed a share buyback program worth ¥116.35 million to enhance shareholder value and adapt to business environment changes amidst recent share price volatility.

- Our growth report here indicates Moriya Transportation Engineering and ManufacturingLtd may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Moriya Transportation Engineering and ManufacturingLtd.

Next Steps

- Click through to start exploring the rest of the 872 Undervalued Stocks Based On Cash Flows now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301291

Guangdong Mingyang ElectricLtd

Engages in the research, development, production, and sale of high/low voltage switchgear, transformer, and power transmission and distribution equipment in China.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives