- Japan

- /

- Hospitality

- /

- TSE:4343

3 Stocks Estimated To Be Trading Below Their Intrinsic Value In December 2024

Reviewed by Simply Wall St

As global markets grapple with cautious commentary from the Federal Reserve and political uncertainties, investors are closely watching for signs of stability amid fluctuating indices. With U.S. stocks experiencing a broad-based decline and concerns about future interest rate cuts, identifying stocks trading below their intrinsic value becomes increasingly appealing for those seeking potential opportunities in a volatile environment. In such conditions, a good stock is often characterized by strong fundamentals that may not be fully reflected in its current market price, offering potential value to discerning investors.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Argan (NYSE:AGX) | US$140.28 | US$279.10 | 49.7% |

| HangzhouS MedTech (SHSE:688581) | CN¥62.17 | CN¥124.03 | 49.9% |

| Shenzhen Lifotronic Technology (SHSE:688389) | CN¥15.43 | CN¥30.82 | 49.9% |

| Lindab International (OM:LIAB) | SEK226.40 | SEK451.11 | 49.8% |

| GlobalData (AIM:DATA) | £1.87 | £3.74 | 50% |

| Absolent Air Care Group (OM:ABSO) | SEK255.00 | SEK509.90 | 50% |

| HealthEquity (NasdaqGS:HQY) | US$95.09 | US$189.22 | 49.7% |

| GRCS (TSE:9250) | ¥1413.00 | ¥2824.56 | 50% |

| Surgical Science Sweden (OM:SUS) | SEK159.10 | SEK317.61 | 49.9% |

| RENK Group (DB:R3NK) | €18.342 | €36.50 | 49.7% |

Let's dive into some prime choices out of the screener.

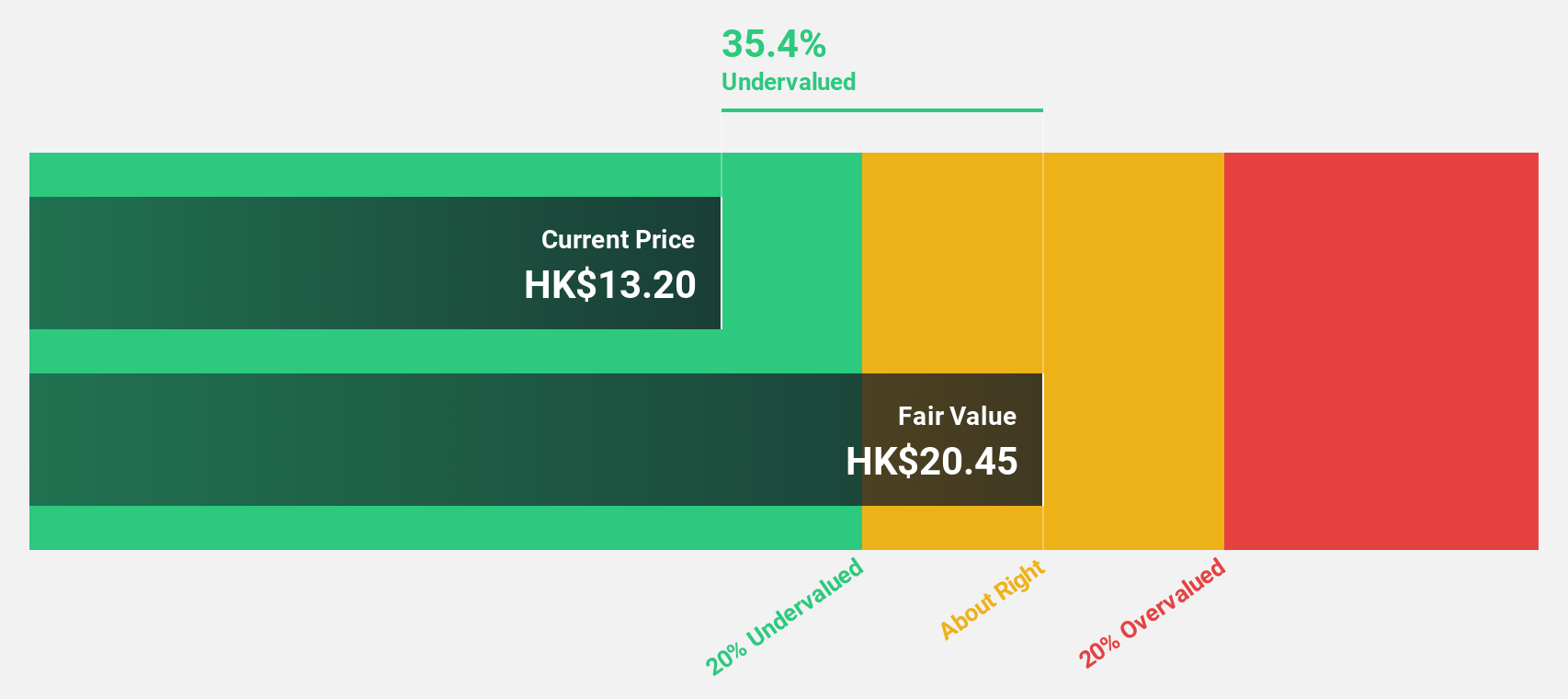

Beijing Chunlizhengda Medical Instruments (SEHK:1858)

Overview: Beijing Chunlizhengda Medical Instruments Co., Ltd. is a company that specializes in the production and sale of orthopedic implants and related medical instruments, with a market cap of HK$4.88 billion.

Operations: The company generates revenue from the manufacture and trading of surgical implants, instruments, and related products amounting to CN¥924.65 million.

Estimated Discount To Fair Value: 38.8%

Beijing Chunlizhengda Medical Instruments is trading at HK$8.28, significantly below its estimated fair value of HK$13.53, indicating potential undervaluation based on cash flows. Despite a challenging year with revenue and net income declines to CNY 508.28 million and CNY 61.15 million respectively for the first nine months of 2024, earnings are forecasted to grow significantly at 29.6% annually, outpacing the Hong Kong market's growth rate of 11.5%.

- Our expertly prepared growth report on Beijing Chunlizhengda Medical Instruments implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Beijing Chunlizhengda Medical Instruments' balance sheet health report.

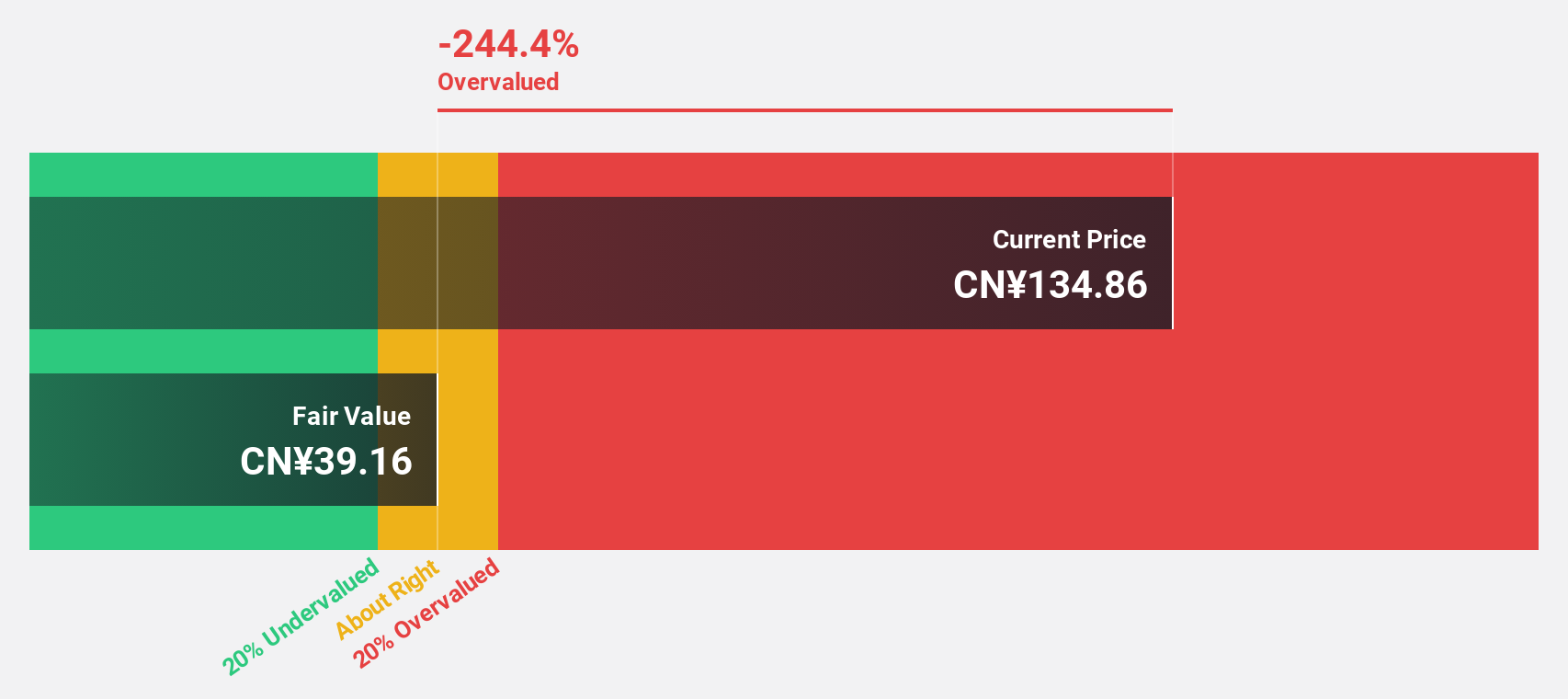

3Peak (SHSE:688536)

Overview: 3Peak Incorporated focuses on the research, development, and sale of analog integrated circuit products both in China and internationally, with a market capitalization of CN¥12.87 billion.

Operations: The company generates revenue from the Integrated Circuit Industry, amounting to CN¥1.13 billion.

Estimated Discount To Fair Value: 38.6%

3Peak is trading at CN¥101.61, below its estimated fair value of CN¥165.62, suggesting undervaluation based on cash flows. Despite a net loss of CN¥98.73 million for the first nine months of 2024, revenue increased to CN¥848.22 million from the previous year’s CN¥813.19 million, and earnings are forecasted to grow significantly at 77.43% annually as it becomes profitable within three years, outpacing the broader market's growth expectations.

- Insights from our recent growth report point to a promising forecast for 3Peak's business outlook.

- Take a closer look at 3Peak's balance sheet health here in our report.

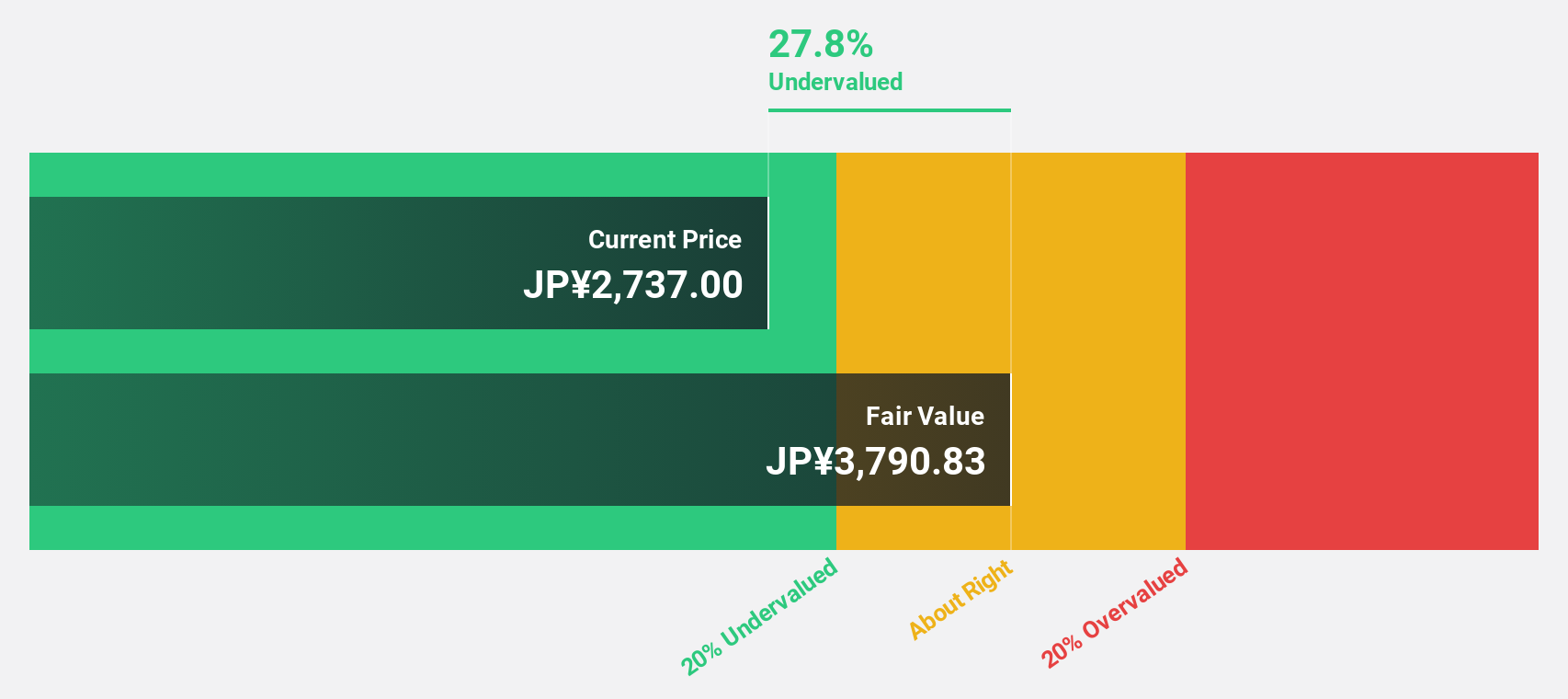

AEON FantasyLTD (TSE:4343)

Overview: AEON Fantasy Co., LTD. operates amusement facilities in Japan and has a market cap of ¥59.21 billion.

Operations: The company generates revenue from its amusement facility operations in Japan.

Estimated Discount To Fair Value: 17.1%

AEON Fantasy LTD is trading at ¥3035, below its estimated fair value of ¥3661.8, reflecting potential undervaluation based on cash flows. The company has recently become profitable and is expected to achieve significant annual earnings growth of 29.35%, surpassing the JP market's growth rate. However, it faces challenges with high debt levels and a volatile share price over the past three months, while revenue growth lags behind the market average.

- The analysis detailed in our AEON FantasyLTD growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of AEON FantasyLTD stock in this financial health report.

Key Takeaways

- Embark on your investment journey to our 872 Undervalued Stocks Based On Cash Flows selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4343

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives