- Japan

- /

- Hospitality

- /

- TSE:3926

OpenDoor Inc. (TSE:3926) May Have Run Too Fast Too Soon With Recent 28% Price Plummet

OpenDoor Inc. (TSE:3926) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 41% share price drop.

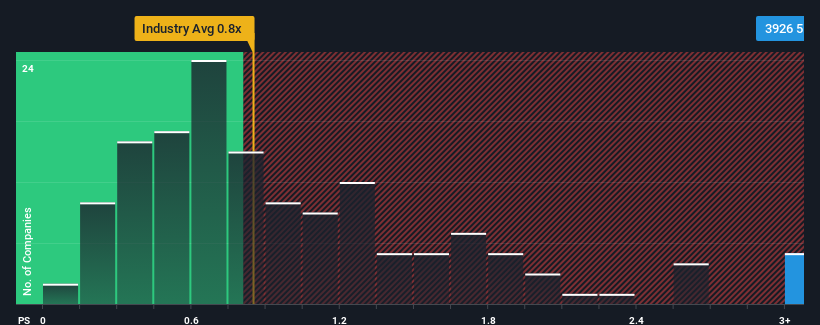

Even after such a large drop in price, you could still be forgiven for thinking OpenDoor is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.8x, considering almost half the companies in Japan's Hospitality industry have P/S ratios below 0.8x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for OpenDoor

What Does OpenDoor's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, OpenDoor's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on OpenDoor .Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as OpenDoor's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 3.6% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 118% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the only analyst covering the company suggest revenue growth is heading into negative territory, declining 0.05% over the next year. With the industry predicted to deliver 9.5% growth, that's a disappointing outcome.

With this information, we find it concerning that OpenDoor is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Key Takeaway

OpenDoor's shares may have suffered, but its P/S remains high. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of OpenDoor's analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. At these price levels, investors should remain cautious, particularly if things don't improve.

And what about other risks? Every company has them, and we've spotted 2 warning signs for OpenDoor you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3926

Flawless balance sheet minimal.

Similar Companies

Market Insights

Community Narratives