- Japan

- /

- Hospitality

- /

- TSE:3350

Metaplanet (TSE:3350) Valuation Check as New MARS and Mercury Preferred Shares Target Bigger Bitcoin Treasury

Reviewed by Simply Wall St

Metaplanet (TSE:3350) just moved ahead in Japan’s crypto-financing race, detailing plans for new MARS and Mercury preferred-share structures to fund additional Bitcoin purchases, while a key rival sidelines similar offerings for at least a year.

See our latest analysis for Metaplanet.

The latest MARS and Mercury plans come after a volatile stretch, with the share price down 11.25 percent over the last day but still showing a positive year to date share price return of 16.92 percent and a three year total shareholder return of 703.85 percent. This suggests momentum is cooling in the short term but remains powerful over a longer horizon.

If Metaplanet’s bold Bitcoin treasury bet has caught your eye, this could be a moment to explore other high conviction ideas through fast growing stocks with high insider ownership.

With momentum cooling and Bitcoin exposure set to deepen, investors now face a key question: is Metaplanet’s valuation still catching up with its bold strategy, or has the market already priced in the next leg of growth?

Price-to-Earnings of 23.6x: Is it justified?

On a trailing basis, Metaplanet trades on a price-to-earnings ratio of 23.6x, which indicates that investors are paying a premium for each unit of current earnings.

The price-to-earnings multiple links today’s share price to the company’s accounting profits and is a common way to gauge how much growth and profitability investors are pricing in for hospitality and service businesses like Metaplanet.

Relative to peers overall, the stock appears expensive, given its 23.6x P/E is higher than the peer average of 15.9x. This suggests the market is willing to assign a richer multiple to its earnings. However, compared with the broader Japanese hospitality industry, the picture changes. Metaplanet’s 23.6x multiple is effectively in line with the 23.7x sector average, and it even looks inexpensive relative to an estimated fair P/E of 46.1x.

Explore the SWS fair ratio for Metaplanet

Result: Price-to-Earnings of 23.6x (ABOUT RIGHT)

However, investors should still weigh volatility in Bitcoin prices and execution risks in Metaplanet’s expanding Web3 and hospitality ambitions, which could unsettle sentiment.

Find out about the key risks to this Metaplanet narrative.

Another Angle on Value

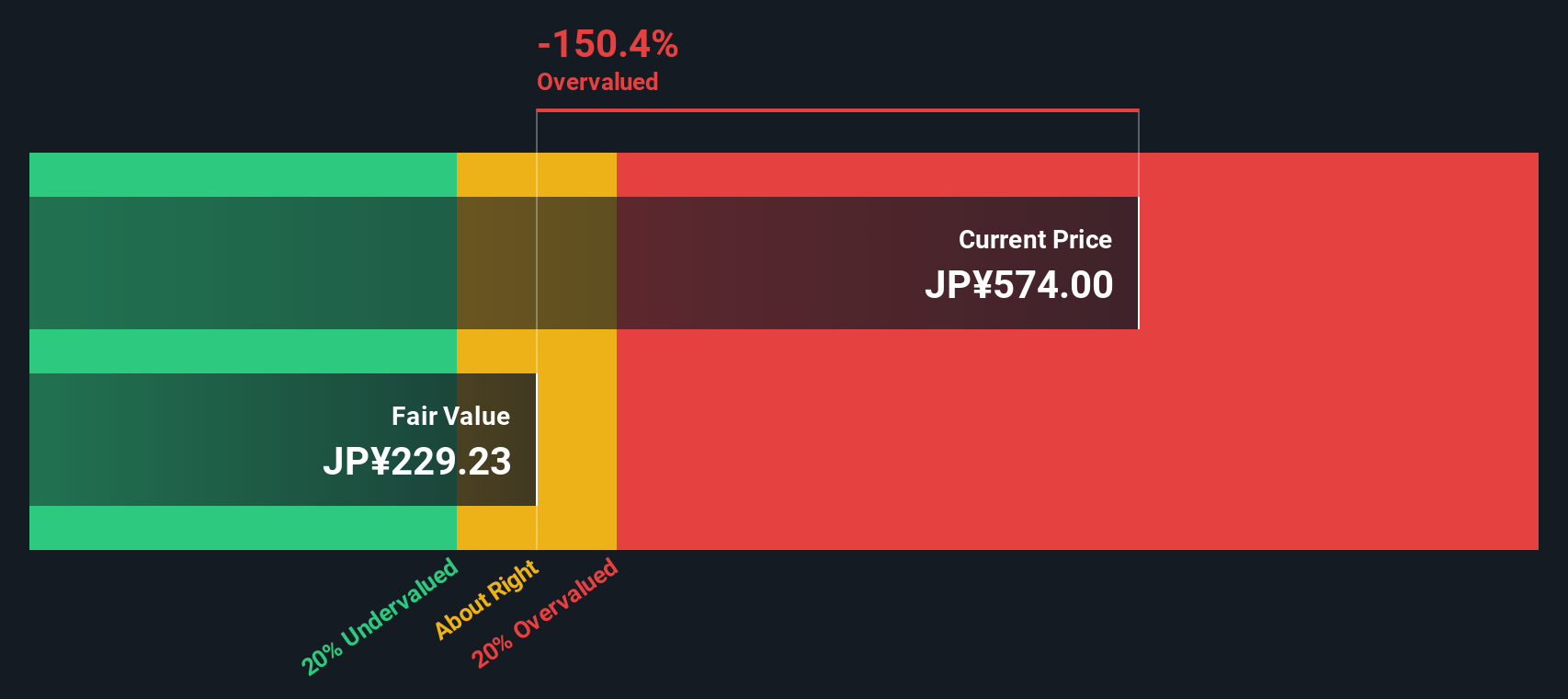

While the 23.6x earnings multiple looks roughly in line with the hospitality sector, our DCF model paints a far harsher picture, suggesting fair value closer to ¥36. That gap implies the share price bakes in a lot of future success, leaving little room for missteps. Or does it?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Metaplanet for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Metaplanet Narrative

If you see the numbers differently or want to dig into the details yourself, you can build a full narrative from scratch in just a few minutes: Do it your way.

A great starting point for your Metaplanet research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas before you act?

Before you make your next move, lock in an edge by scanning hand picked opportunities other investors might overlook, and position yourself ahead of the crowd.

- Explore potential mispricings by targeting companies that appear attractively valued on future cash flows using these 907 undervalued stocks based on cash flows tailored for value focused investors.

- Follow secular trends in automation and machine learning by identifying breakthrough innovators through these 26 AI penny stocks.

- Navigate volatility in digital assets by focusing on listed businesses involved in decentralized finance via these 81 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3350

Metaplanet

Engages in hotel management operation and development in Japan.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026