- Japan

- /

- Consumer Services

- /

- TSE:3041

These 4 Measures Indicate That Beauty Kadan Holdings (TSE:3041) Is Using Debt Safely

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Beauty Kadan Holdings Co., Ltd. (TSE:3041) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Beauty Kadan Holdings

What Is Beauty Kadan Holdings's Net Debt?

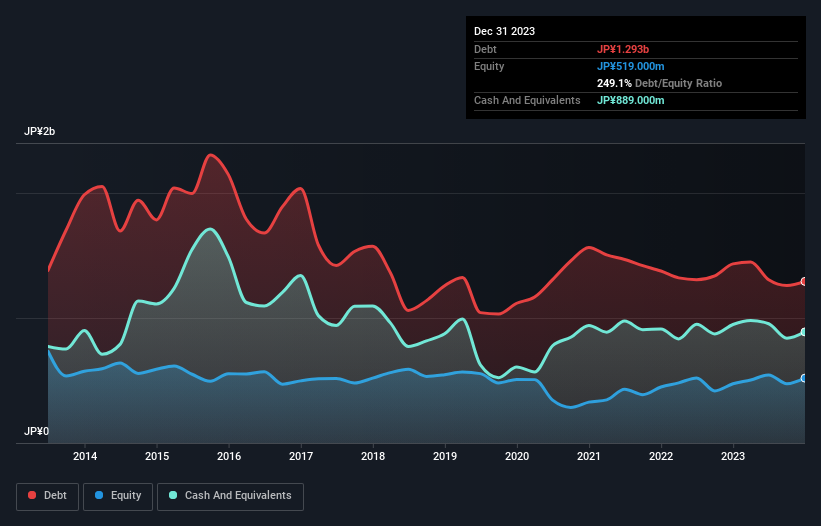

You can click the graphic below for the historical numbers, but it shows that Beauty Kadan Holdings had JP¥1.29b of debt in December 2023, down from JP¥1.43b, one year before. However, it also had JP¥889.0m in cash, and so its net debt is JP¥404.0m.

A Look At Beauty Kadan Holdings' Liabilities

Zooming in on the latest balance sheet data, we can see that Beauty Kadan Holdings had liabilities of JP¥1.23b due within 12 months and liabilities of JP¥867.0m due beyond that. Offsetting these obligations, it had cash of JP¥889.0m as well as receivables valued at JP¥719.0m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by JP¥489.0m.

Since publicly traded Beauty Kadan Holdings shares are worth a total of JP¥3.04b, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

We'd say that Beauty Kadan Holdings's moderate net debt to EBITDA ratio ( being 2.5), indicates prudence when it comes to debt. And its strong interest cover of 13.9 times, makes us even more comfortable. Also relevant is that Beauty Kadan Holdings has grown its EBIT by a very respectable 24% in the last year, thus enhancing its ability to pay down debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Beauty Kadan Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Beauty Kadan Holdings actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

Happily, Beauty Kadan Holdings's impressive interest cover implies it has the upper hand on its debt. But, on a more sombre note, we are a little concerned by its net debt to EBITDA. Zooming out, Beauty Kadan Holdings seems to use debt quite reasonably; and that gets the nod from us. While debt does bring risk, when used wisely it can also bring a higher return on equity. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. We've identified 3 warning signs with Beauty Kadan Holdings (at least 1 which is significant) , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Beauty Kadan Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3041

Beauty Kadan Holdings

Engages in the planning, production, and installation of fresh flower altars in Japan.

Slight with mediocre balance sheet.

Market Insights

Community Narratives