- Norway

- /

- Hospitality

- /

- OB:G2MNO

Growth Companies With High Insider Ownership In January 2025

Reviewed by Simply Wall St

As the global markets navigate a period of mixed economic signals, including a decline in U.S. consumer confidence and fluctuating stock indices, investors are keenly observing growth opportunities that align with the current financial landscape. In this context, companies with high insider ownership can be particularly appealing as they often reflect strong internal confidence and alignment with shareholder interests, which is crucial during times of market uncertainty.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 23.8% | 37.6% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| EHang Holdings (NasdaqGM:EH) | 31.4% | 79.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

We're going to check out a few of the best picks from our screener tool.

Gentoo Media (OB:G2MNO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gentoo Media Inc. is an iGaming technology company that, along with its subsidiaries, offers solutions, products, and services to iGaming operators in the Nordic countries and internationally, with a market cap of NOK3.31 billion.

Operations: Gentoo Media generates its revenue from providing iGaming technology solutions, products, and services to operators across the Nordic region, other parts of Europe, and globally.

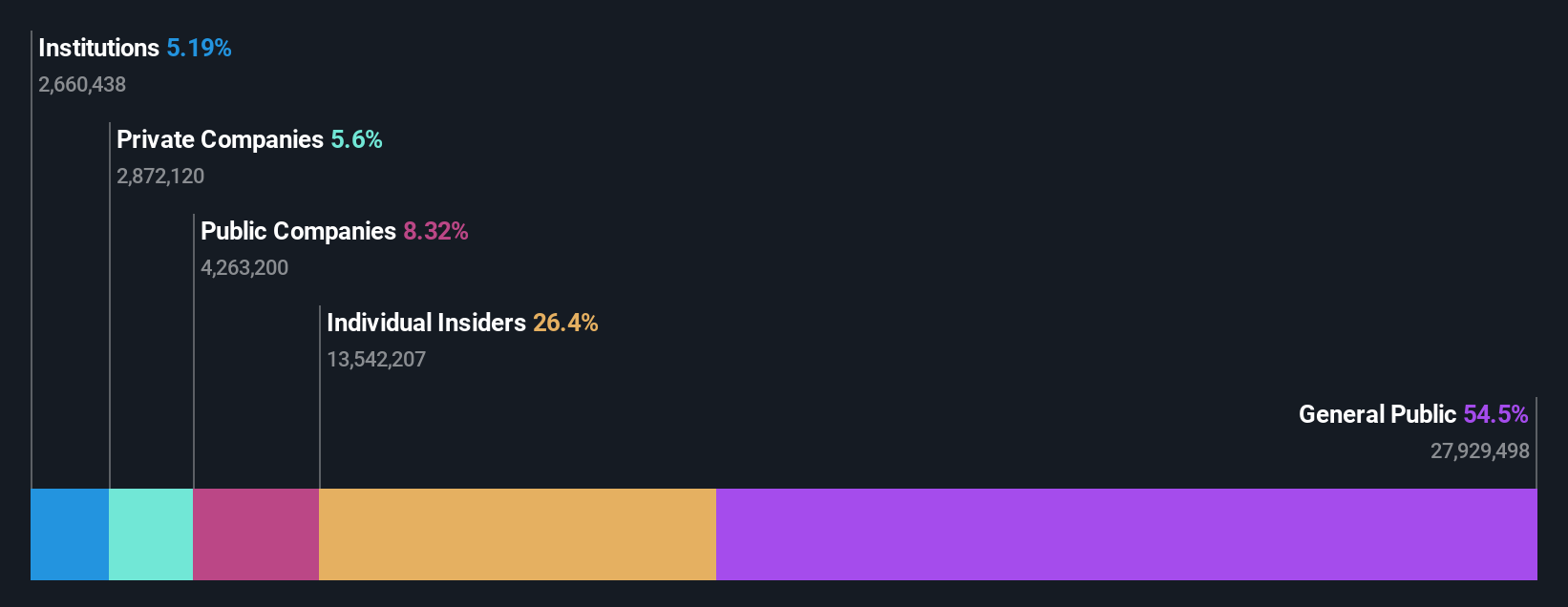

Insider Ownership: 31.2%

Earnings Growth Forecast: 61.6% p.a.

Gentoo Media's earnings are forecast to grow significantly, outpacing the Norwegian market. Despite a recent net loss of EUR 57.79 million for Q3 2024, insiders have increased their holdings substantially over the past three months, indicating confidence in future prospects. The company trades at good value compared to its peers and is expected to achieve very high return on equity in three years. However, interest payments remain poorly covered by earnings and shareholders experienced dilution last year.

- Click here and access our complete growth analysis report to understand the dynamics of Gentoo Media.

- Our valuation report unveils the possibility Gentoo Media's shares may be trading at a discount.

Fujio Food Group (TSE:2752)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujio Food Group Inc. operates restaurants in Japan and internationally, with a market cap of ¥58.92 billion.

Operations: Revenue segments for TSE:2752 are not provided in the text.

Insider Ownership: 26.6%

Earnings Growth Forecast: 80.5% p.a.

Fujio Food Group's earnings are forecast to grow significantly at 80.52% annually, outpacing the Japanese market, with profitability expected within three years. Despite a recent ¥6.06 billion follow-on equity offering that diluted shareholders, no substantial insider trading activity has been reported in the past three months. Revenue growth is moderate at 6.5% annually but surpasses the market average of 4.2%, highlighting potential for sustained expansion amidst strategic capital raising efforts.

- Delve into the full analysis future growth report here for a deeper understanding of Fujio Food Group.

- The valuation report we've compiled suggests that Fujio Food Group's current price could be inflated.

Micronics Japan (TSE:6871)

Simply Wall St Growth Rating: ★★★★★★

Overview: Micronics Japan Co., Ltd. develops, manufactures, and sells testing and measurement equipment for semiconductors and LCD testing systems worldwide, with a market cap of ¥1.46 billion.

Operations: The company's revenue segments consist of the TE Business, generating ¥2.19 billion, and the Probe Card Business, contributing ¥49.56 billion.

Insider Ownership: 15.3%

Earnings Growth Forecast: 27.5% p.a.

Micronics Japan's earnings are expected to grow significantly at 27.5% annually, outpacing the Japanese market's growth rate of 7.8%. The stock is trading at a substantial discount, 66.2% below its estimated fair value, and revenue is forecast to grow robustly at 20.3% per year. Despite recent share price volatility, no substantial insider trading has been reported over the past three months, indicating stable internal confidence in future prospects.

- Dive into the specifics of Micronics Japan here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential undervaluation of Micronics Japan shares in the market.

Taking Advantage

- Dive into all 1503 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:G2MNO

Gentoo Media

An iGaming technology company, together with its subsidiaries, provides solutions, products, and services to iGaming operators in Nordic countries, other European countries, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives