February 2025's Top Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating interest rates and AI competition fears, investors are closely watching for opportunities amidst the volatility. In this environment, growth companies with high insider ownership can offer appealing prospects due to their potential alignment of interests between company insiders and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 20.5% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.9% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Pharma Mar (BME:PHM) | 11.9% | 44.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 86% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

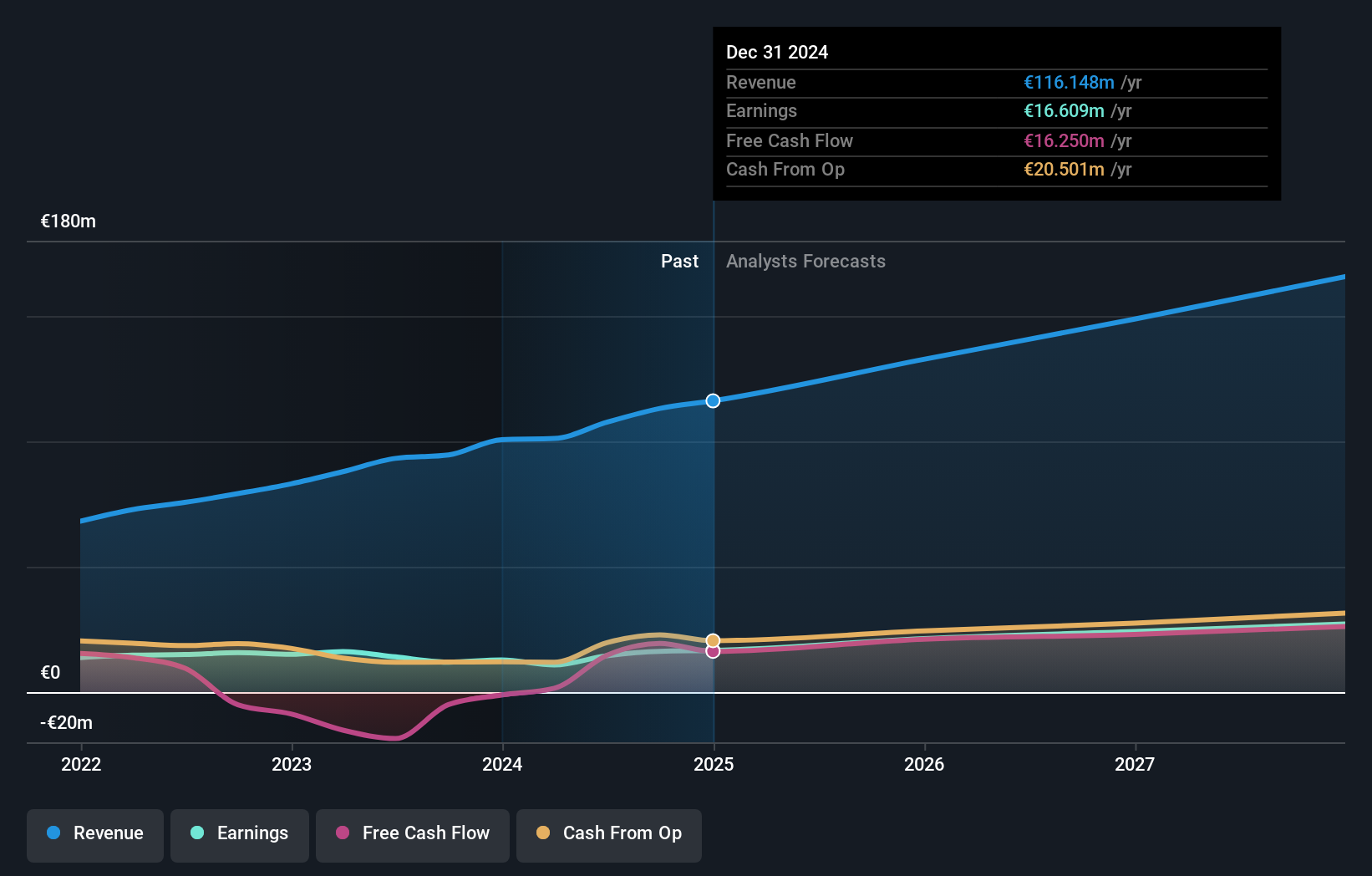

Pharmanutra (BIT:PHN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pharmanutra S.p.A. is a pharmaceutical and nutraceutical company that researches, designs, develops, and markets nutritional supplements and medical devices across Italy, Europe, the Middle East, South America, the Far East, and internationally with a market cap of €489.04 million.

Operations: The company's revenue segments include €5.49 million from Akern, €68.35 million from operations in Italy, and €38.40 million from international markets outside Italy.

Insider Ownership: 10.7%

Earnings Growth Forecast: 18.5% p.a.

Pharmanutra's recent performance highlights its growth potential, with earnings for the nine months ending September 2024 showing a net income increase to €13.17 million from €9.73 million year-on-year. Analysts project an annual earnings growth of 18.48%, outpacing the Italian market's 6.8%. Despite no substantial insider trading in the past three months, analysts agree on a potential stock price rise of 65.7%, reflecting confidence in its growth trajectory amidst high insider ownership.

- Get an in-depth perspective on Pharmanutra's performance by reading our analyst estimates report here.

- The analysis detailed in our Pharmanutra valuation report hints at an inflated share price compared to its estimated value.

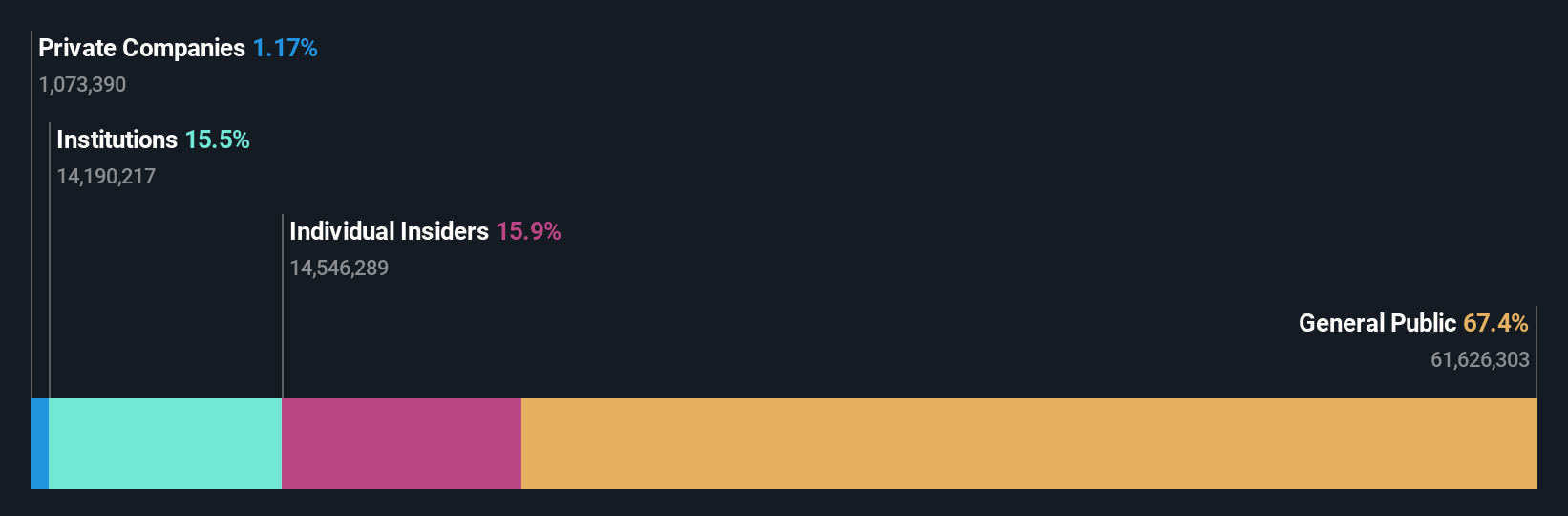

Ercros (BME:ECR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ercros, S.A. is a Spanish company that manufactures and sells basic chemicals, intermediate chemicals, and pharmaceuticals with a market cap of €323.23 million.

Operations: The company's revenue is derived from three main segments: Pharmaceuticals (€63.57 million), Chlorine Derivatives (€375.76 million), and Intermediate Chemicals (€193.57 million).

Insider Ownership: 15.7%

Earnings Growth Forecast: 48.5% p.a.

Ercros, S.A. demonstrates growth potential with forecasted earnings growth of 48.5% annually, significantly outpacing the Spanish market's 8.6%. Despite a recent net loss of €7.8 million for the nine months ending September 2024, analysts still see value as it trades at 13.6% below fair value estimates. Revenue is set to grow at 10.4% per year, faster than the Spanish average of 5.3%, though insider trading activity remains minimal recently.

- Dive into the specifics of Ercros here with our thorough growth forecast report.

- Our valuation report here indicates Ercros may be overvalued.

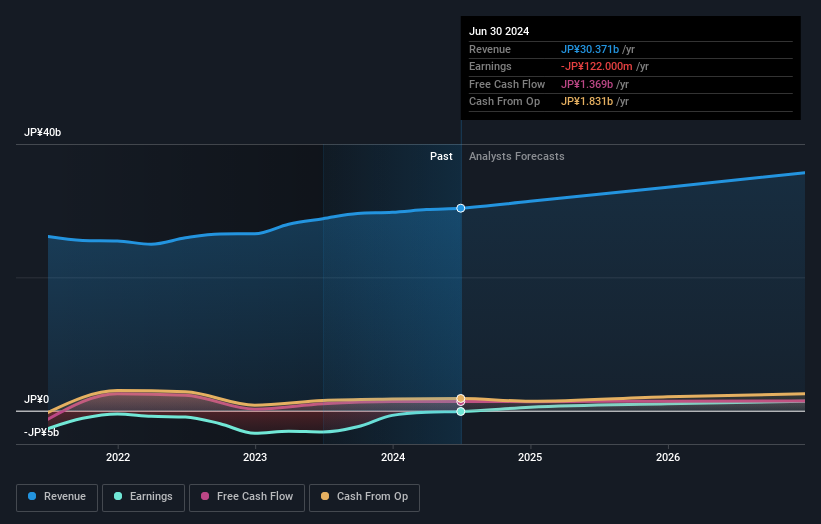

Fujio Food Group (TSE:2752)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujio Food Group Inc. operates a variety of restaurants and restaurant franchise chains both in Japan and internationally, with a market cap of ¥54.94 billion.

Operations: The company's revenue is derived from its Directly Managed Business, which contributes ¥29.24 billion, and the FC Business, which adds ¥1.63 billion.

Insider Ownership: 26.6%

Earnings Growth Forecast: 80.5% p.a.

Fujio Food Group is poised for significant growth, with earnings projected to increase by 80.52% annually and revenue expected to grow at 6.5% per year, surpassing the Japanese market's average of 4.2%. The company plans a follow-on equity offering of ¥6.06 billion, potentially diluting insider ownership but also providing capital for expansion. While insider trading activity data is unavailable, Fujio aims for profitability within three years, indicating strong growth potential despite slower revenue acceleration compared to peers.

- Delve into the full analysis future growth report here for a deeper understanding of Fujio Food Group.

- According our valuation report, there's an indication that Fujio Food Group's share price might be on the expensive side.

Where To Now?

- Delve into our full catalog of 1476 Fast Growing Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Ercros might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ECR

Ercros

Manufactures and sells basic chemicals, intermediate chemicals, and pharmaceuticals in Spain.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives