- Japan

- /

- Consumer Services

- /

- TSE:3933

Did You Miss CHIeruLtd's (TYO:3933) Impressive 110% Share Price Gain?

It hasn't been the best quarter for CHIeru Co.,Ltd. (TYO:3933) shareholders, since the share price has fallen 30% in that time. But that doesn't undermine the rather lovely longer-term return, if you measure over the last three years. In three years the stock price has launched 110% higher: a great result. To some, the recent share price pullback wouldn't be surprising after such a good run. The thing to consider is whether the underlying business is doing well enough to support the current price.

See our latest analysis for CHIeruLtd

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the three years of share price growth, CHIeruLtd actually saw its earnings per share (EPS) drop 9.5% per year.

Thus, it seems unlikely that the market is focussed on EPS growth at the moment. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

The modest 0.1% dividend yield is unlikely to be propping up the share price. It may well be that CHIeruLtd revenue growth rate of 23% over three years has convinced shareholders to believe in a brighter future. In that case, the company may be sacrificing current earnings per share to drive growth, and maybe shareholder's faith in better days ahead will be rewarded.

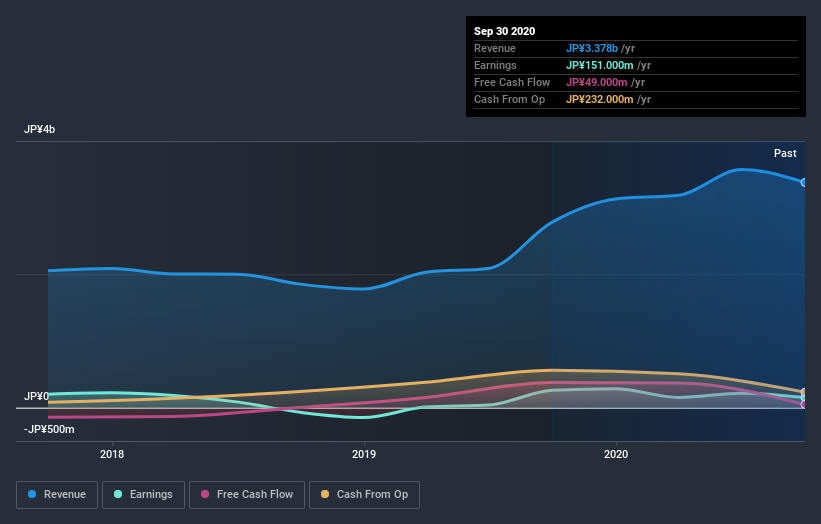

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling CHIeruLtd stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that CHIeruLtd shareholders have gained 12% (in total) over the last year. And yes, that does include the dividend. That falls short of the 28% it has made, for shareholders, each year, over three years. It's always interesting to track share price performance over the longer term. But to understand CHIeruLtd better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for CHIeruLtd (of which 1 shouldn't be ignored!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on JP exchanges.

When trading CHIeruLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:3933

CHIeruLtd

Engages in the production of ICT environments for teaching and learning in schools in Japan and internationally.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives