Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Horiifoodservice Co., Ltd. (TYO:3077) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Horiifoodservice

What Is Horiifoodservice's Net Debt?

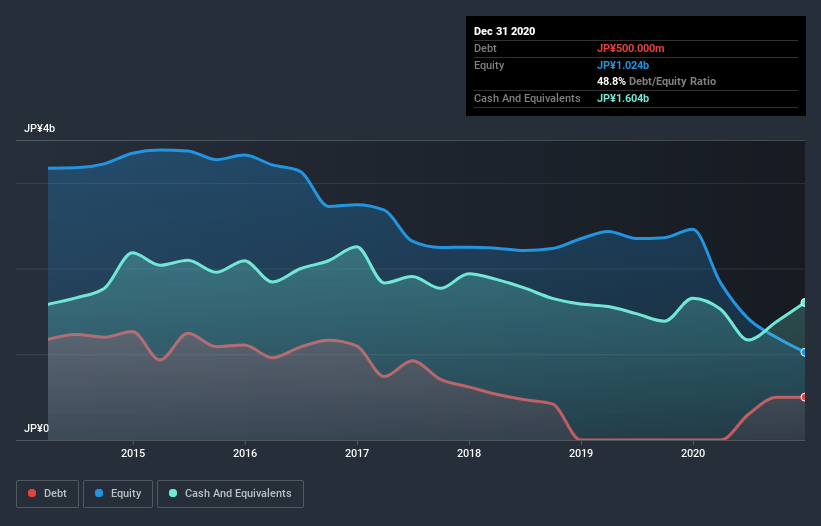

As you can see below, at the end of December 2020, Horiifoodservice had JP¥491.0m of debt, up from none a year ago. Click the image for more detail. But on the other hand it also has JP¥1.60b in cash, leading to a JP¥1.11b net cash position.

How Healthy Is Horiifoodservice's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Horiifoodservice had liabilities of JP¥1.39b due within 12 months and liabilities of JP¥427.0m due beyond that. Offsetting these obligations, it had cash of JP¥1.60b as well as receivables valued at JP¥56.0m due within 12 months. So its liabilities total JP¥158.0m more than the combination of its cash and short-term receivables.

Given Horiifoodservice has a market capitalization of JP¥3.33b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. While it does have liabilities worth noting, Horiifoodservice also has more cash than debt, so we're pretty confident it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Horiifoodservice will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Horiifoodservice made a loss at the EBIT level, and saw its revenue drop to JP¥3.8b, which is a fall of 40%. To be frank that doesn't bode well.

So How Risky Is Horiifoodservice?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And the fact is that over the last twelve months Horiifoodservice lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of JP¥496m and booked a JP¥1.4b accounting loss. With only JP¥1.11b on the balance sheet, it would appear that its going to need to raise capital again soon. Overall, we'd say the stock is a bit risky, and we're usually very cautious until we see positive free cash flow. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Horiifoodservice is showing 2 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade Horiifoodservice, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Horiifoodservice might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:3077

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026