- Japan

- /

- Food and Staples Retail

- /

- TSE:9974

Belc CO., LTD. (TSE:9974) Shares Slammed 32% But Getting In Cheap Might Be Difficult Regardless

Belc CO., LTD. (TSE:9974) shareholders that were waiting for something to happen have been dealt a blow with a 32% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 23% in that time.

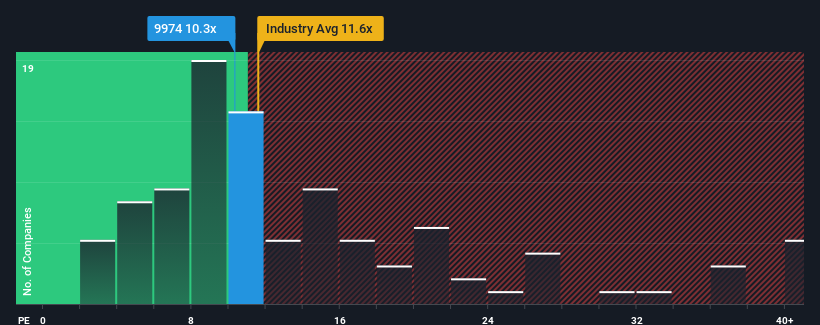

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Belc's P/E ratio of 10.3x, since the median price-to-earnings (or "P/E") ratio in Japan is also close to 12x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Belc hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Belc

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Belc's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 2.4%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 19% in total. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 8.2% each year over the next three years. With the market predicted to deliver 9.6% growth per year, the company is positioned for a comparable earnings result.

With this information, we can see why Belc is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Following Belc's share price tumble, its P/E is now hanging on to the median market P/E. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Belc's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Plus, you should also learn about this 1 warning sign we've spotted with Belc.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Belc might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9974

Solid track record with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026