- Japan

- /

- Food and Staples Retail

- /

- TSE:9956

Exploring November 2024's Undiscovered Gems on None Exchange

Reviewed by Simply Wall St

As global markets navigate the complexities of shifting U.S. policies under the Trump 2.0 administration and fluctuating inflation rates, small-cap stocks have shown varied performance, with indices like the Russell 2000 reflecting these dynamics through recent declines. Amid this backdrop, discovering potential opportunities in lesser-known stocks can be particularly rewarding for investors seeking growth beyond the usual market leaders. Identifying such "undiscovered gems" involves looking for companies with solid fundamentals that may benefit from current economic trends or policy changes impacting their sectors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tait Marketing & Distribution | NA | 7.36% | 18.40% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Savior Lifetec | NA | -7.74% | -0.77% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Vivo Energy Mauritius | NA | 13.58% | 14.34% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Asia United Bank (PSE:AUB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Asia United Bank Corporation, along with its subsidiaries, offers a range of banking and financial services to individual consumers, MSMEs, and corporations in the Philippines with a market capitalization of approximately ₱43.68 billion.

Operations: Asia United Bank generates revenue primarily from interest income on loans and advances, as well as service charges and fees. The bank's cost structure includes interest expenses on deposits and borrowings, alongside operational costs. It has a market capitalization of approximately ₱43.68 billion.

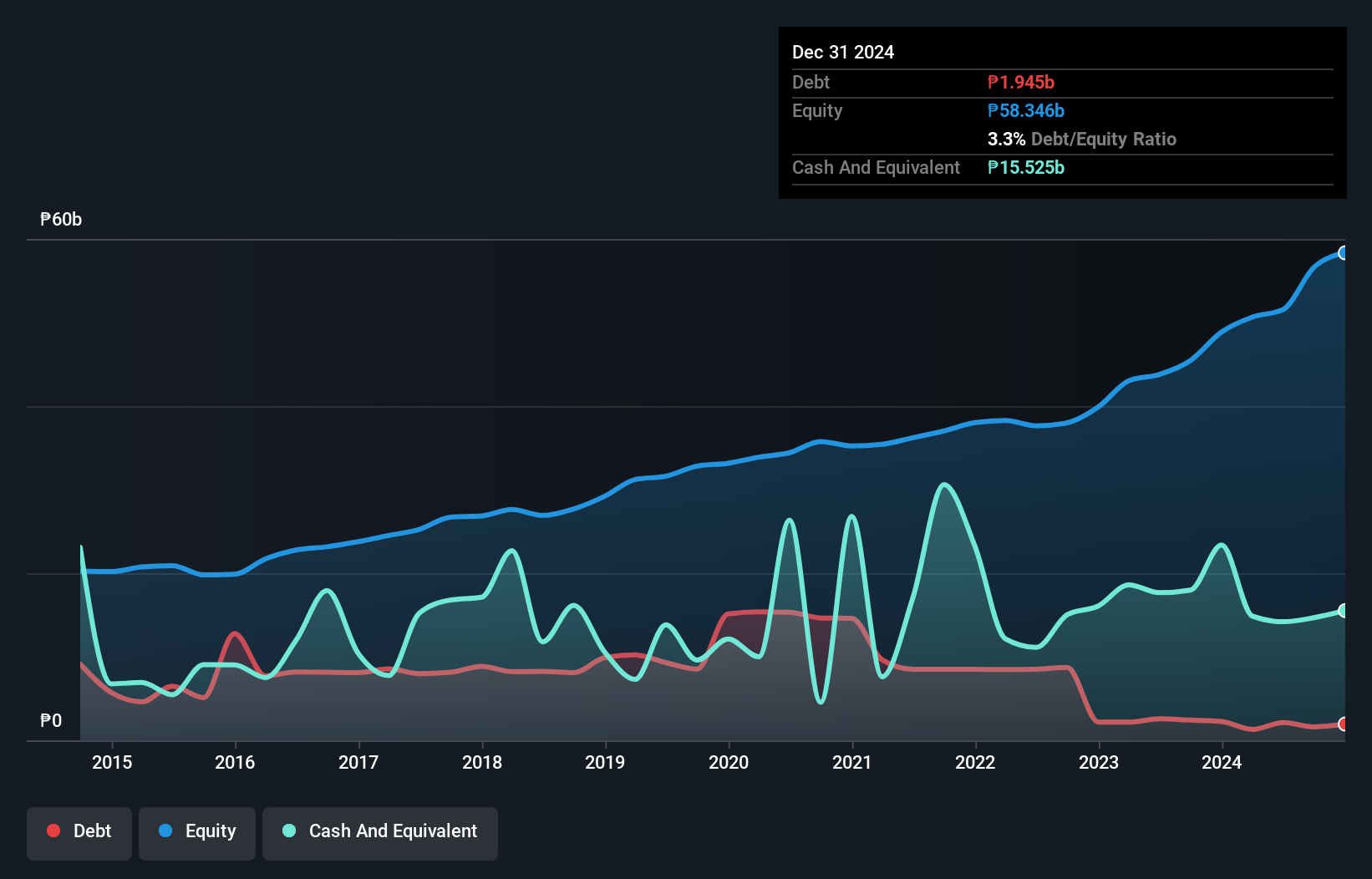

Asia United Bank, a smaller player in the banking sector, showcases a robust profile with total assets of ₱352 billion and equity at ₱56.6 billion. The bank's earnings surged by 38.8% over the past year, outpacing industry growth of 17.5%. It boasts high-quality earnings and primarily low-risk funding sources, with customer deposits making up 95% of liabilities. AUB maintains a sufficient allowance for bad loans at 108%, though it grapples with non-performing loans at 2%. Recent earnings announcements highlight net income growth to ₱3.35 billion for Q3 from ₱1.95 billion last year, reflecting strong financial health amidst its peers.

- Click to explore a detailed breakdown of our findings in Asia United Bank's health report.

Explore historical data to track Asia United Bank's performance over time in our Past section.

Pryce (PSE:PPC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Pryce Corporation, along with its subsidiaries, is involved in the import and distribution of liquefied petroleum gas (LPG) under the PryceGas brand in the Philippines, with a market capitalization of approximately ₱19.07 billion.

Operations: Pryce Corporation's primary revenue stream is from liquefied petroleum and industrial gases, generating approximately ₱19.88 billion, while real estate and pharmaceutical products contribute ₱342.85 million and ₱46.57 million, respectively.

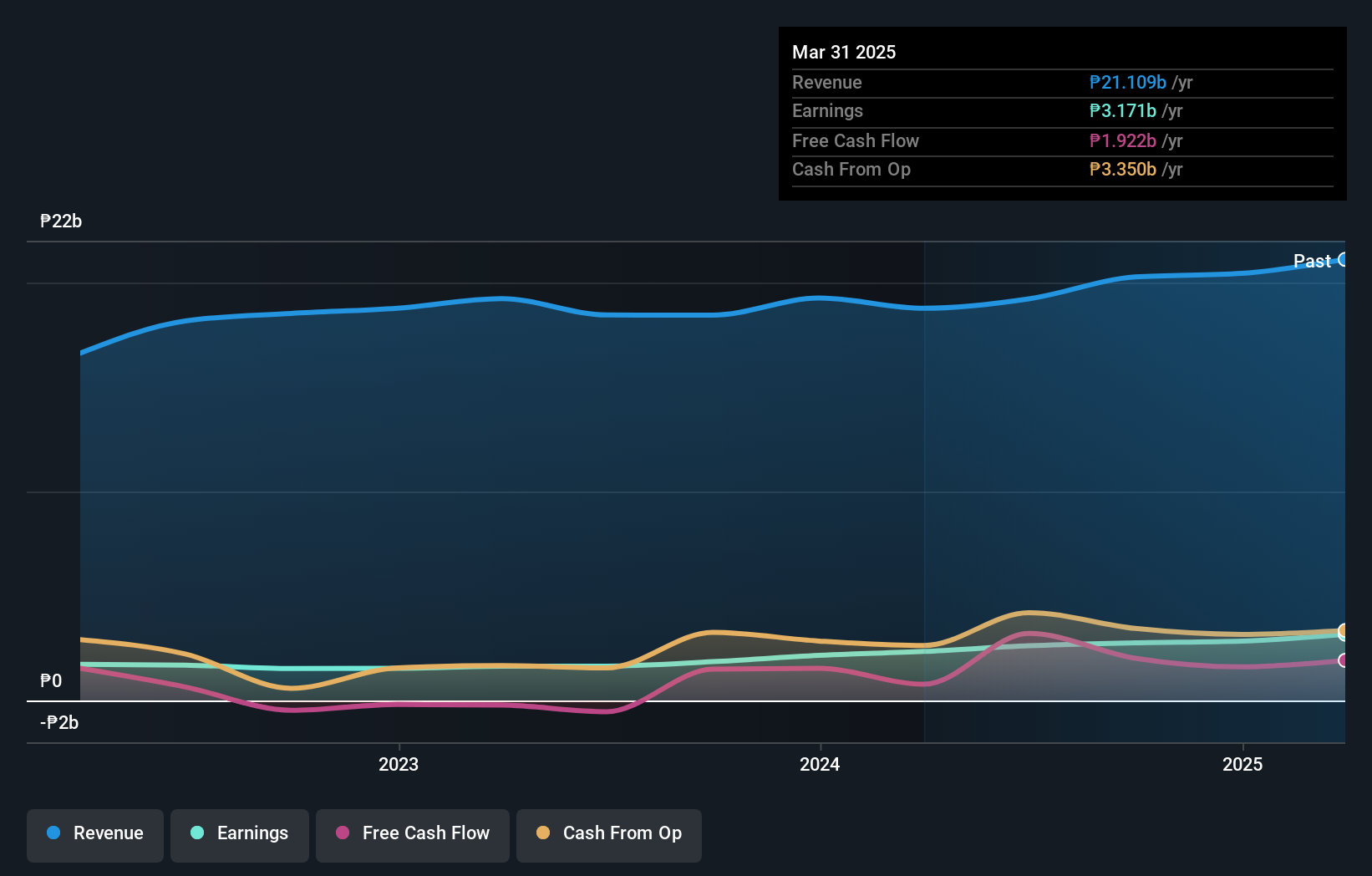

Pryce Corporation, a nimble player in the energy sector, has shown impressive financial strides recently. Its earnings surged by 48% over the past year, outpacing the broader oil and gas industry, which saw a -10% shift. The company reported third-quarter sales of PHP 5.46 billion compared to PHP 4.41 billion last year, with net income rising to PHP 831 million from PHP 692 million previously. Its debt-to-equity ratio increased to 18% over five years but remains manageable as interest payments are covered well by EBIT at nearly 29 times coverage. With high-quality earnings and free cash flow positivity, Pryce appears undervalued by about 26%.

- Get an in-depth perspective on Pryce's performance by reading our health report here.

Examine Pryce's past performance report to understand how it has performed in the past.

Valor Holdings (TSE:9956)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Valor Holdings Co., Ltd. operates supermarkets and home centers in Japan, with a market cap of ¥111.07 billion.

Operations: Valor Holdings generates revenue primarily through its supermarket and home center operations in Japan. The company's financial performance is highlighted by a net profit margin trend that reflects its operational efficiency.

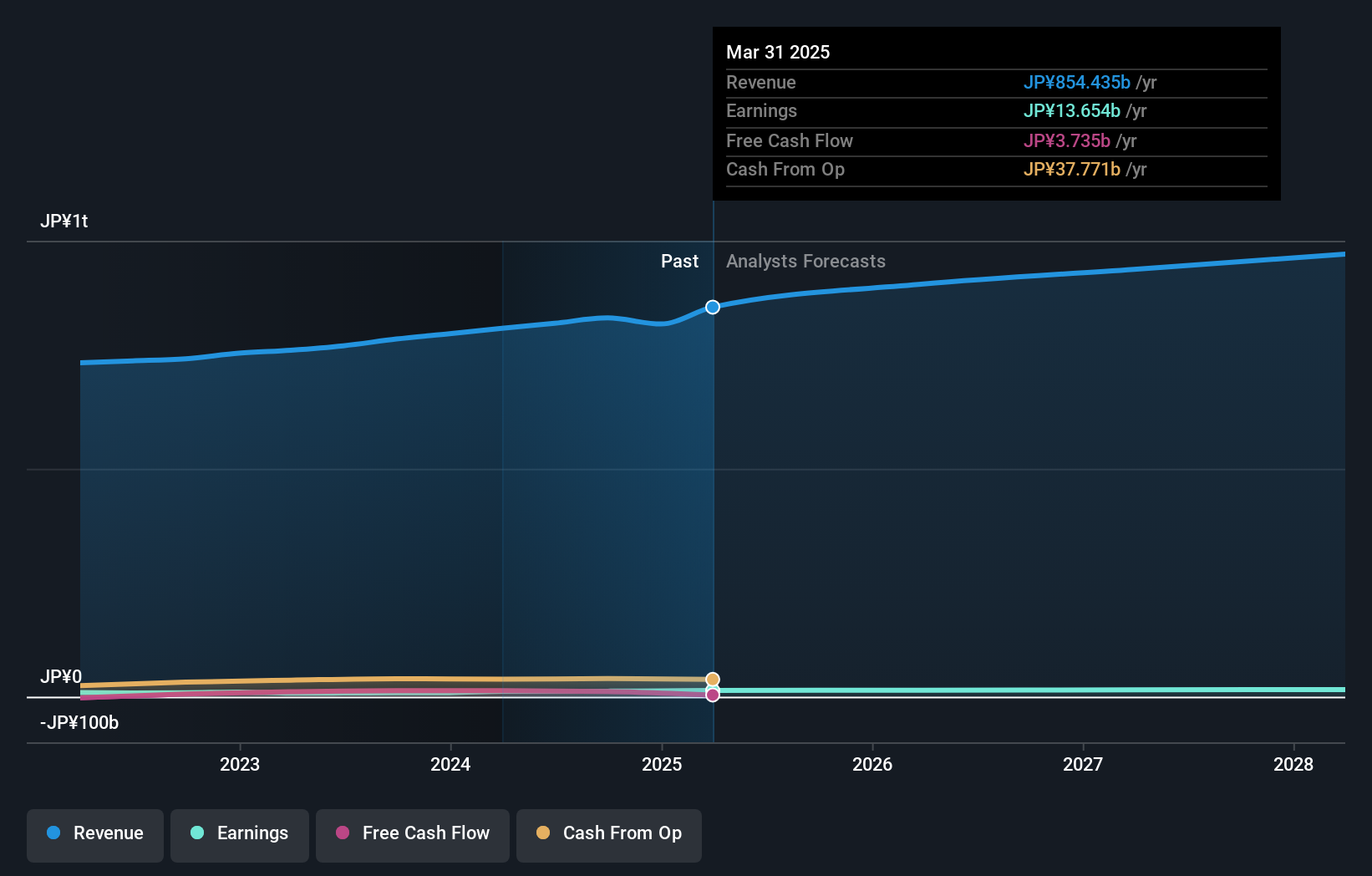

Valor Holdings has been making waves with its impressive earnings growth of 41.9% over the past year, outpacing the Consumer Retailing industry's 15.8%. The debt to equity ratio has improved, dropping from 76.7% to 60.8% in five years, although a net debt to equity ratio of 46.6% remains high. However, interest payments are comfortably covered by EBIT at a robust 61x coverage level. Trading at a price-to-earnings ratio of just 9.3x against the JP market's average of 13.5x suggests good relative value for investors seeking opportunities in this space.

- Delve into the full analysis health report here for a deeper understanding of Valor Holdings.

Evaluate Valor Holdings' historical performance by accessing our past performance report.

Key Takeaways

- Discover the full array of 4649 Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9956

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives