As global markets navigate a landscape marked by cautious Federal Reserve commentary and looming political uncertainties, investors are seeking stability amid fluctuating indices. With U.S. stocks experiencing broad-based declines and rate cut expectations tempered, the appeal of dividend stocks grows as they offer potential income streams in uncertain times. In this environment, a good dividend stock is often characterized by its ability to provide consistent payouts while maintaining financial resilience despite market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.93% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.52% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.24% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.02% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.72% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

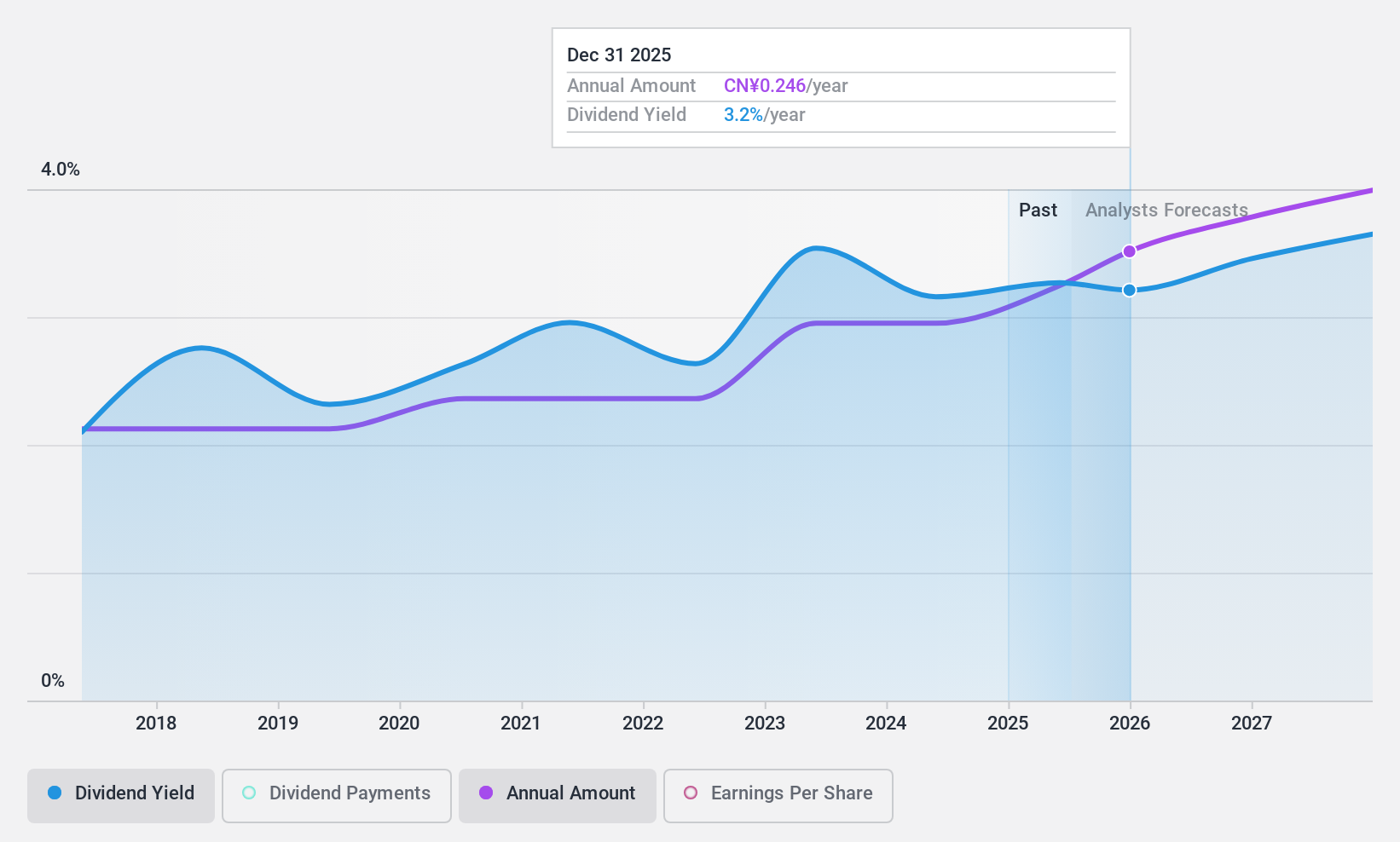

Jiangsu Changshu Rural Commercial Bank (SHSE:601128)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangsu Changshu Rural Commercial Bank Co., Ltd. operates as a rural commercial bank providing financial services and products, with a market cap of CN¥22.67 billion.

Operations: Jiangsu Changshu Rural Commercial Bank Co., Ltd. generates revenue through various financial services and products tailored for rural commercial banking.

Dividend Yield: 3%

Jiangsu Changshu Rural Commercial Bank offers a compelling dividend yield of 3.02%, ranking in the top 25% of CN market payers. With a low payout ratio of 18.4%, dividends are well covered by earnings, ensuring sustainability and reliability despite being paid for only eight years. Recent financials show robust growth, with net income rising to CNY 2.98 billion for the first nine months of 2024 from CNY 2.52 billion last year, supporting future dividend potential.

- Click to explore a detailed breakdown of our findings in Jiangsu Changshu Rural Commercial Bank's dividend report.

- According our valuation report, there's an indication that Jiangsu Changshu Rural Commercial Bank's share price might be on the expensive side.

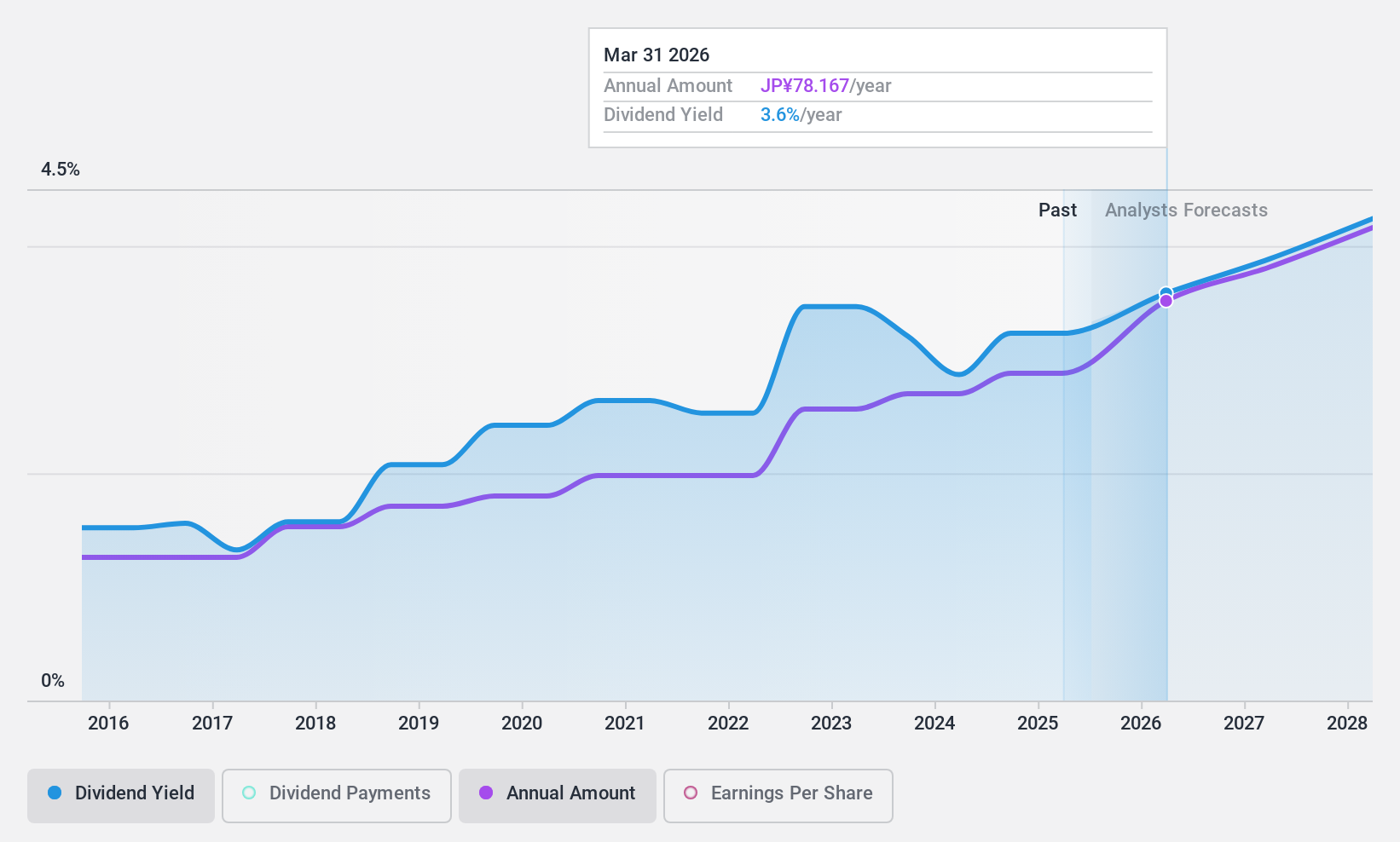

Air Water (TSE:4088)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Air Water Inc. is a diversified Japanese company involved in the manufacturing and sale of industrial gas, chemical, medical, energy, agriculture and food products, logistics, seawater-related products, among other businesses with a market cap of ¥429.63 billion.

Operations: Air Water Inc.'s revenue segments include Digital & Industry at ¥349.40 billion, Health and Safety at ¥238.29 billion, Agriculture & Foods at ¥172.38 billion, and Energy Solution at ¥74.18 billion.

Dividend Yield: 3.4%

Air Water offers a stable and reliable dividend profile, with payments consistently growing over the past decade. The dividend payout is sustainable, supported by a low earnings payout ratio of 31.9% and cash coverage at 51.7%. Although its yield of 3.41% is below the top JP market payers, it remains attractive due to steady increases and robust financial health despite high debt levels. Trading below analyst targets suggests potential for capital appreciation alongside dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Air Water.

- Our expertly prepared valuation report Air Water implies its share price may be lower than expected.

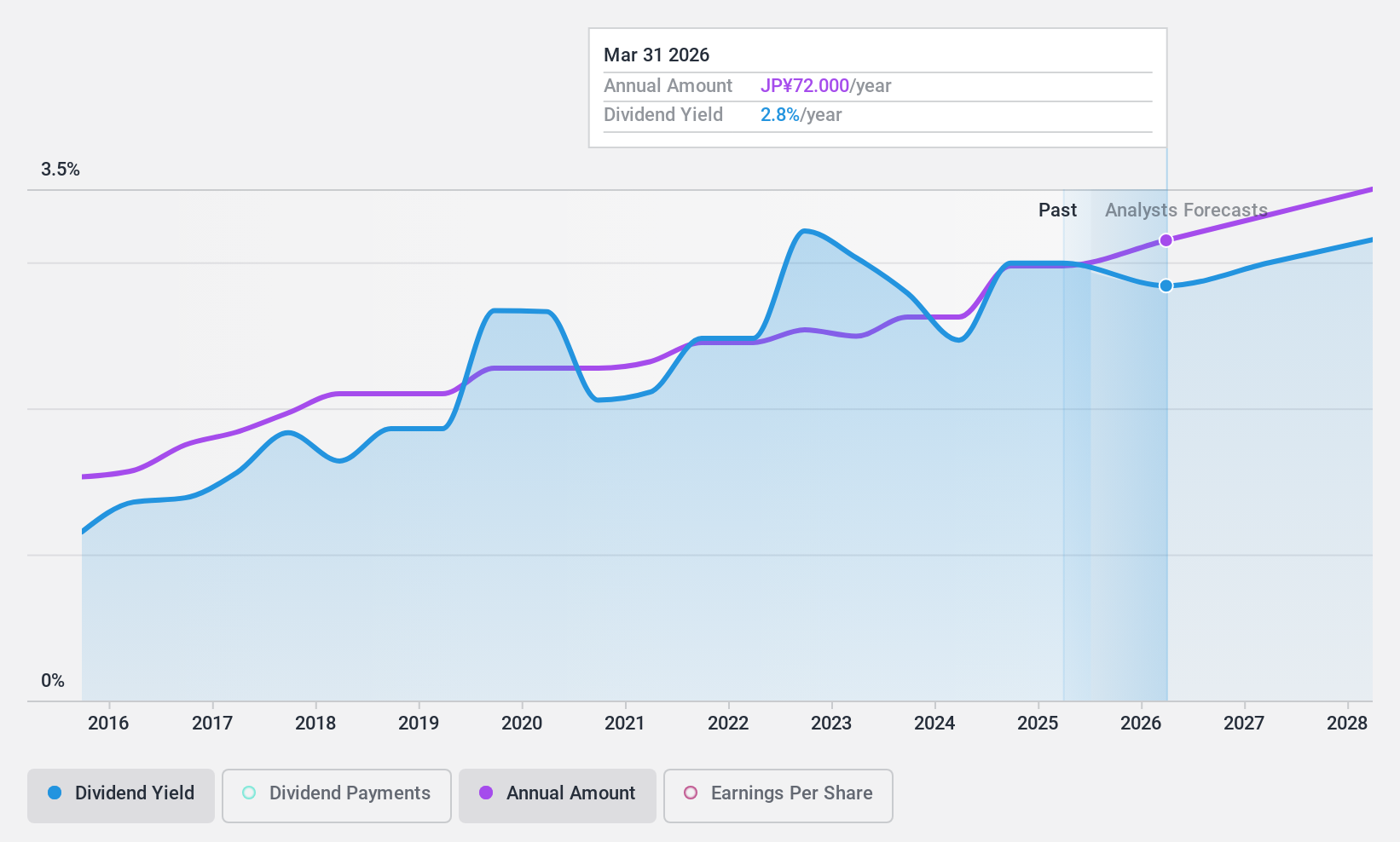

Valor Holdings (TSE:9956)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Valor Holdings Co., Ltd. operates supermarkets and home centers in Japan, with a market cap of ¥114.13 billion.

Operations: Valor Holdings Co., Ltd. generates revenue from several key segments, including the Supermarket Business at ¥474.33 billion, Home Center Business at ¥128.72 billion, Drug Store Business at ¥174.80 billion, Distribution Related Business at ¥56.23 billion, and Sports Club Business at ¥11.43 billion.

Dividend Yield: 3.1%

Valor Holdings has demonstrated a stable and reliable dividend history over the past decade, with recent increases reflecting its commitment to shareholders. The dividends are well-covered by earnings and cash flows, supported by a low payout ratio of 29.3%. Despite a yield of 3.14% being below top-tier market payers, the company’s strong earnings growth and undervaluation relative to fair value enhance its appeal for dividend investors, although high debt levels warrant consideration.

- Navigate through the intricacies of Valor Holdings with our comprehensive dividend report here.

- According our valuation report, there's an indication that Valor Holdings' share price might be on the cheaper side.

Turning Ideas Into Actions

- Investigate our full lineup of 1951 Top Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601128

Jiangsu Changshu Rural Commercial Bank

Jiangsu Changshu Rural Commercial Bank Co., Ltd.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives