- Japan

- /

- Construction

- /

- TSE:1885

3 Dividend Stocks To Consider With Yields Up To 3.8%

Reviewed by Simply Wall St

As global markets respond to the U.S. election results and central bank policies, investors are witnessing significant rallies in major indices like the S&P 500 and Nasdaq Composite, driven by expectations of growth-friendly fiscal measures. In such a dynamic environment, dividend stocks with attractive yields can offer a blend of income stability and potential capital appreciation, making them an appealing consideration for investors looking to navigate these evolving market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.03% | ★★★★★★ |

| Globeride (TSE:7990) | 4.06% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.10% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.41% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.66% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Innotech (TSE:9880) | 5.06% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.36% | ★★★★☆☆ |

Click here to see the full list of 1930 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

TOA (TSE:1885)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TOA Corporation, with a market cap of ¥77.30 billion, offers construction and engineering services in Japan.

Operations: TOA Corporation's revenue segments include construction and engineering services in Japan.

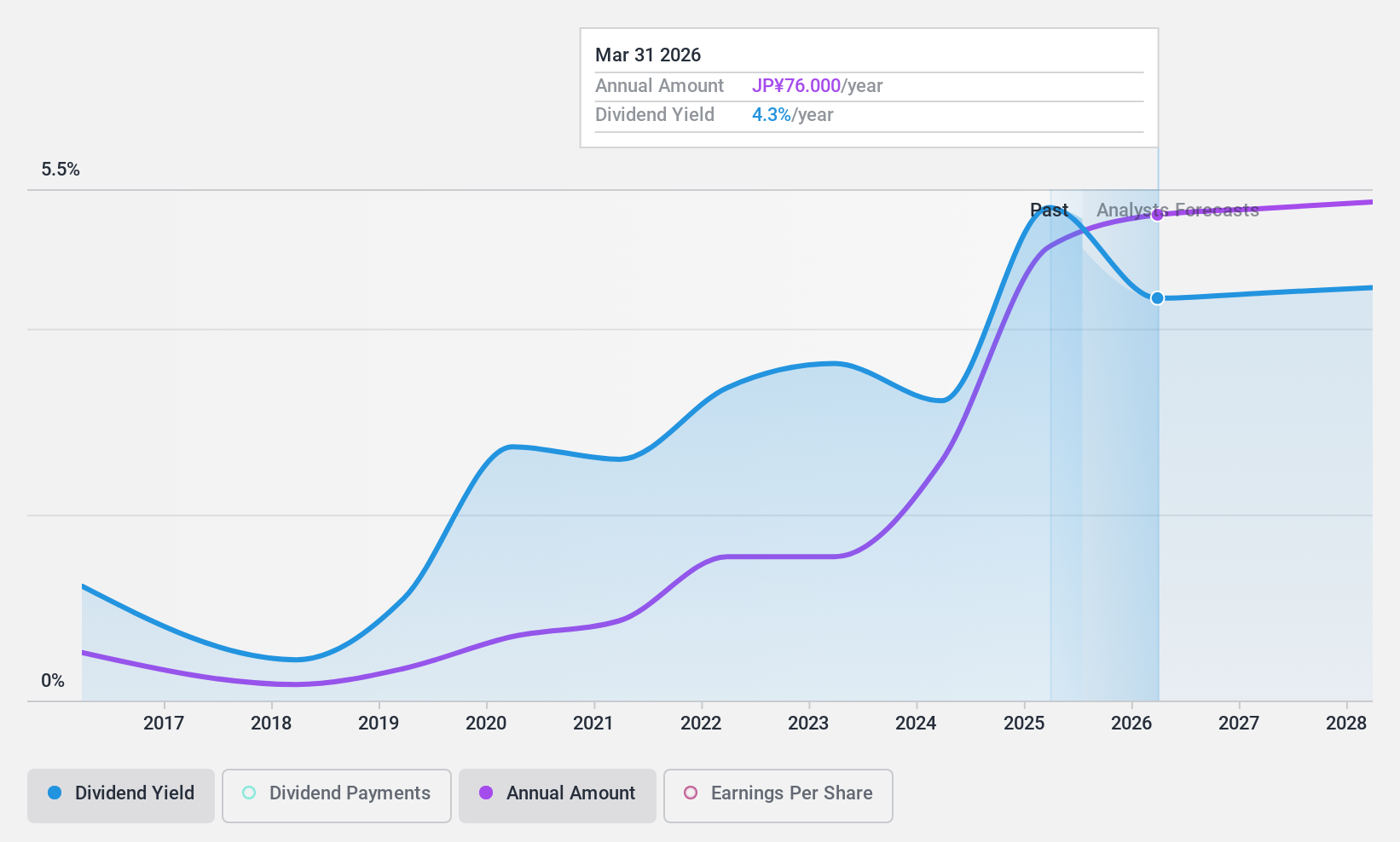

Dividend Yield: 3.6%

TOA Corporation's dividend yield is slightly below the top 25% of payers in Japan, but its dividends are well-covered by earnings and cash flows, with payout ratios of 35.8% and 8.9%, respectively. Despite a volatile dividend track record over the past decade, recent growth in earnings by 27.8% and good relative value compared to peers suggest potential for future stability. However, investors should note the historical instability in dividend payments when considering TOA for income portfolios.

- Get an in-depth perspective on TOA's performance by reading our dividend report here.

- The valuation report we've compiled suggests that TOA's current price could be quite moderate.

KYB (TSE:7242)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: KYB Corporation is a global manufacturer and seller of automotive, hydraulic, and aircraft components with a market cap of ¥118.07 billion.

Operations: KYB Corporation's revenue segments include automotive components at ¥277,000 million, hydraulic components at ¥150,000 million, and aircraft components at ¥30,000 million.

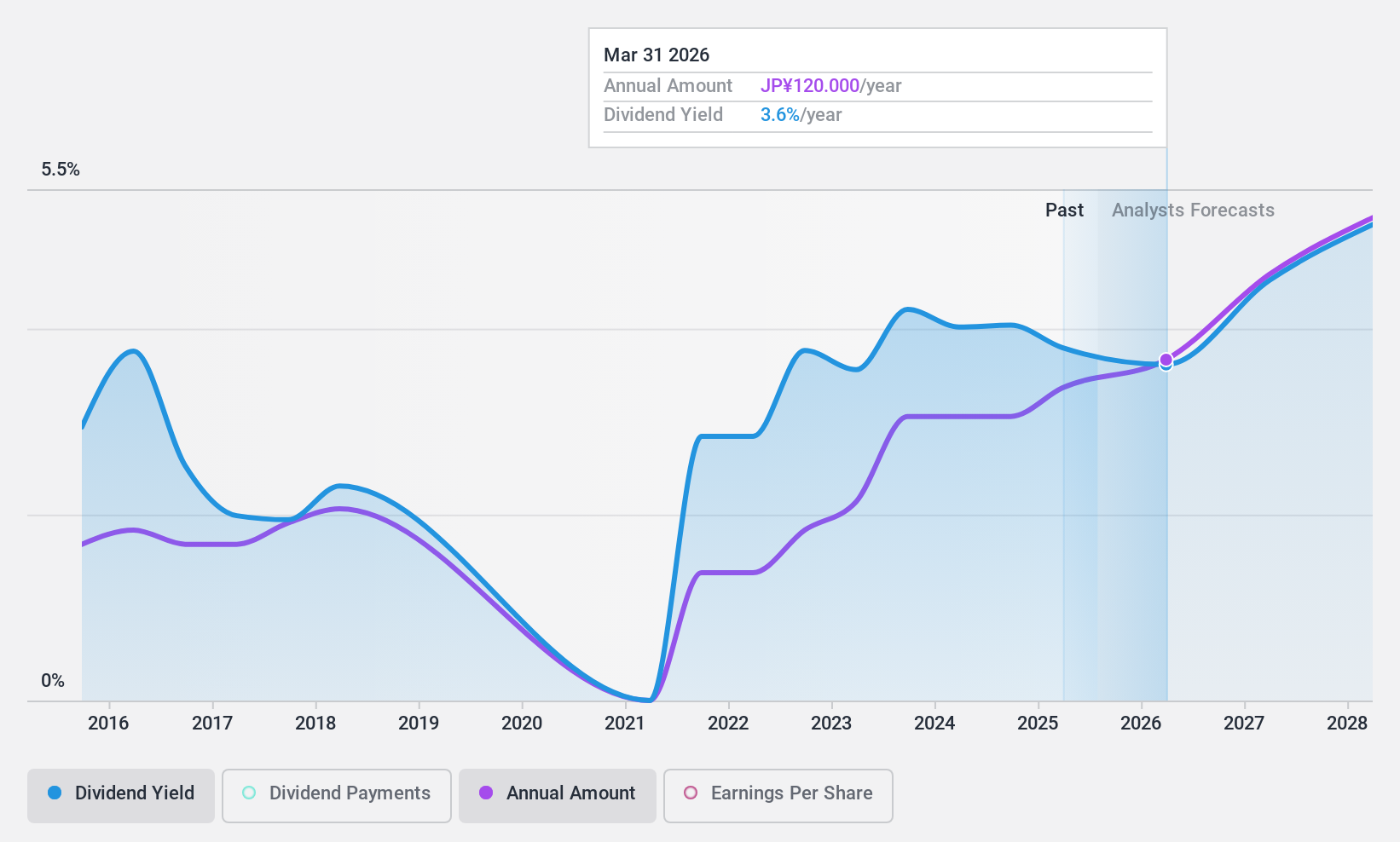

Dividend Yield: 3.8%

KYB Corporation's dividend yield ranks in the top 25% of Japanese payers, supported by a payout ratio of 36.6%, indicating strong earnings coverage. However, the dividend history is marked by volatility and unreliability over the past decade. The recent share repurchase program worth ¥20 billion aims to enhance shareholder returns amid a changing business environment. Despite unstable dividends, KYB offers good value with a price-to-earnings ratio below the market average and potential growth prospects.

- Delve into the full analysis dividend report here for a deeper understanding of KYB.

- The valuation report we've compiled suggests that KYB's current price could be inflated.

Nishimoto (TSE:9260)

Simply Wall St Dividend Rating: ★★★☆☆☆

Overview: Nishimoto Co., Ltd. and its subsidiaries are involved in the global wholesale and distribution of Asian food products and ingredients, with a market cap of ¥57.86 billion.

Operations: Nishimoto Co., Ltd. generates revenue primarily from its Asian Food Global Business segment, which accounts for ¥258.68 billion, and its Agriculture Segment, which contributes ¥58.09 billion.

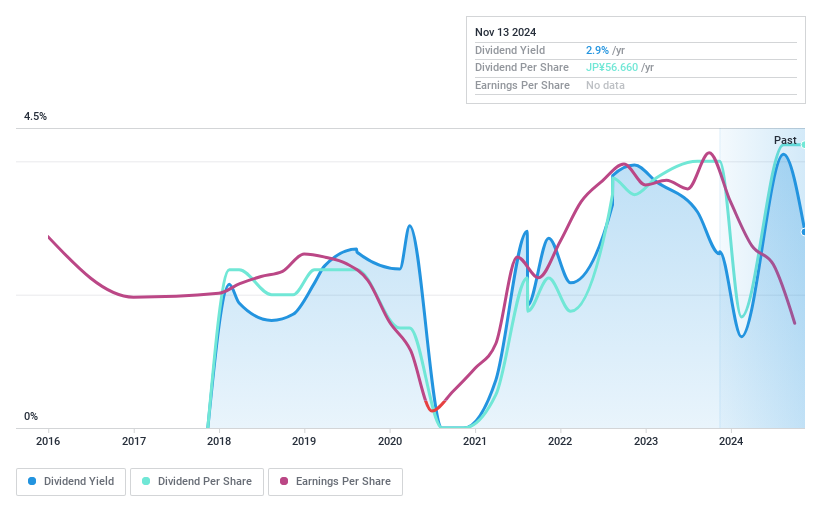

Dividend Yield: 3.4%

Nishimoto's dividend, while covered by earnings (payout ratio 46.7%) and cash flows (cash payout ratio 79.2%), suffers from volatility and an unstable track record over its seven-year history. The dividend yield of 3.43% is below the top tier in Japan, with recent profit margins declining to 1.3%. A management buyout offer valued at ¥23.1 billion could impact future payouts, as it may influence company strategy and financial priorities.

- Click to explore a detailed breakdown of our findings in Nishimoto's dividend report.

- According our valuation report, there's an indication that Nishimoto's share price might be on the expensive side.

Make It Happen

- Gain an insight into the universe of 1930 Top Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TOA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1885

Undervalued with solid track record and pays a dividend.